Virginia State Tax Refund Delayed In 2025? Here’s Quick Guide

Table of Contents

Virginia State Tax Refund: A Complete Expert Guide

A Virginia state tax refund represents the repayment of excess state income taxes paid by a taxpayer to the Virginia Department of Taxation. This refund occurs when your total payments—through wage withholding, estimated tax payments, or refundable tax credits—exceed your actual tax liability for the year.

Virginia State Tax Refund Process

Virginia imposes a state income tax on residents and nonresidents earning income sourced within the state. Throughout the tax year, taxpayers typically fulfill their tax obligations via withholding (deducted from paychecks by employers) or through quarterly estimated tax payments if they are self-employed or have other income sources not subject to withholding.

If, at the end of the tax year, your total tax payments surpass your actual tax liability computed on your annual return, the Virginia Department of Taxation will issue a refund for the overpaid amount.

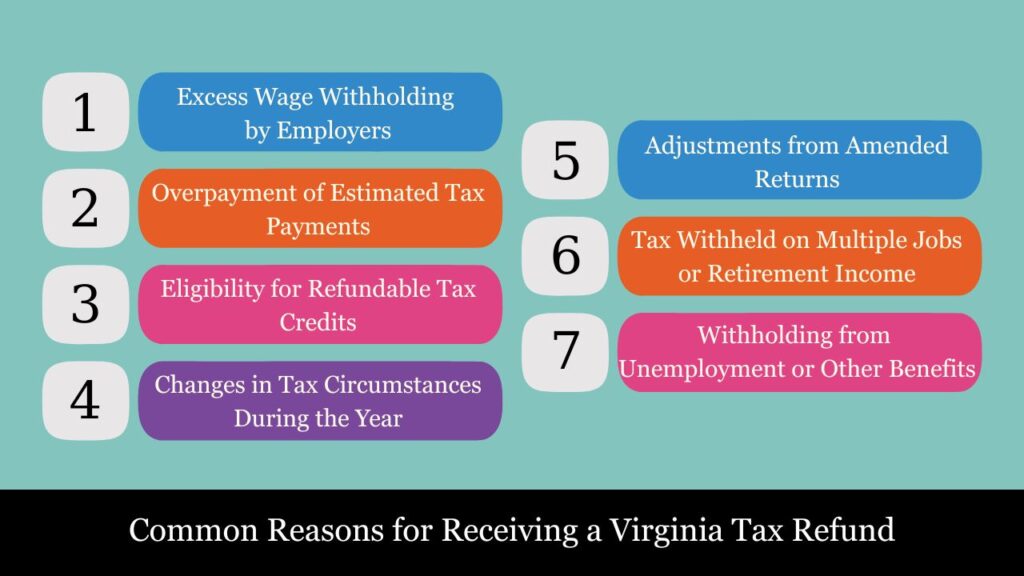

Common Reasons for Receiving a Virginia Tax Refund

Receiving a Virginia state tax refund typically means that you have paid more in state taxes during the year than you ultimately owed. This overpayment can arise from several common situations:

1. Excess Wage Withholding by Employers

One of the most frequent causes of a Virginia tax refund is overwithholding from your paycheck. Employers determine the amount of state tax to withhold from your paycheck using the details you supply on Form VA-4, the Virginia Employee’s Withholding Exemption Certificate. If you claim too few allowances or do not adjust your withholding to reflect changes in your personal or financial situation—such as marriage, additional jobs, or dependents—your employer may withhold more state tax than necessary. When you file your tax return, this excess withholding results in a refund.

2. Overpayment of Estimated Tax Payments

Self-employed individuals, freelancers, investors, or taxpayers with income not subject to withholding must make quarterly estimated tax payments to Virginia. If these payments are higher than your actual tax liability for the year, a refund will be due. Overestimating your income or tax rate often leads to overpayment through estimated taxes.

3. Eligibility for Refundable Tax Credits

Virginia offers several refundable tax credits that reduce your overall tax liability. Refundable credits can reduce your tax liability and may also result in a refund if the credit amount is greater than the total tax you owe. Examples include the Virginia Earned Income Tax Credit (EITC), which is designed to support low-to-moderate income working individuals and families, and the Child and Dependent Care Credit. These credits can significantly boost the amount of your refund when applied to your return.

4. Changes in Tax Circumstances During the Year

Life events such as marriage, divorce, having children, buying a home, or changes in employment status can affect your tax situation. If withholding or estimated payments were based on outdated information, you might have paid too much tax during part of the year, leading to a refund upon filing.

5. Adjustments from Amended Returns

If you discover errors or omissions after submitting your initial Virginia tax return, filing an amended return (Form 760X) can correct your tax liability. In cases where the amendment shows you paid more tax than necessary, the Virginia Department of Taxation will issue a refund for the overpaid amount.

6. Tax Withheld on Multiple Jobs or Retirement Income

Taxpayers with income from multiple jobs or retirement sources may have multiple employers or payers withholding Virginia state tax. The combined withholding may exceed the total tax owed, especially if each employer withholds without coordination. This scenario often results in a refund after filing.

7. Withholding from Unemployment or Other Benefits

Certain unemployment compensation or other benefits might have Virginia tax withheld voluntarily or otherwise. If the total withholding surpasses your tax liability calculated on your return, it creates a refund situation.

By understanding these common reasons, taxpayers can better plan their withholding and estimated payments to avoid overpaying taxes, ensuring their finances remain optimized throughout the year.

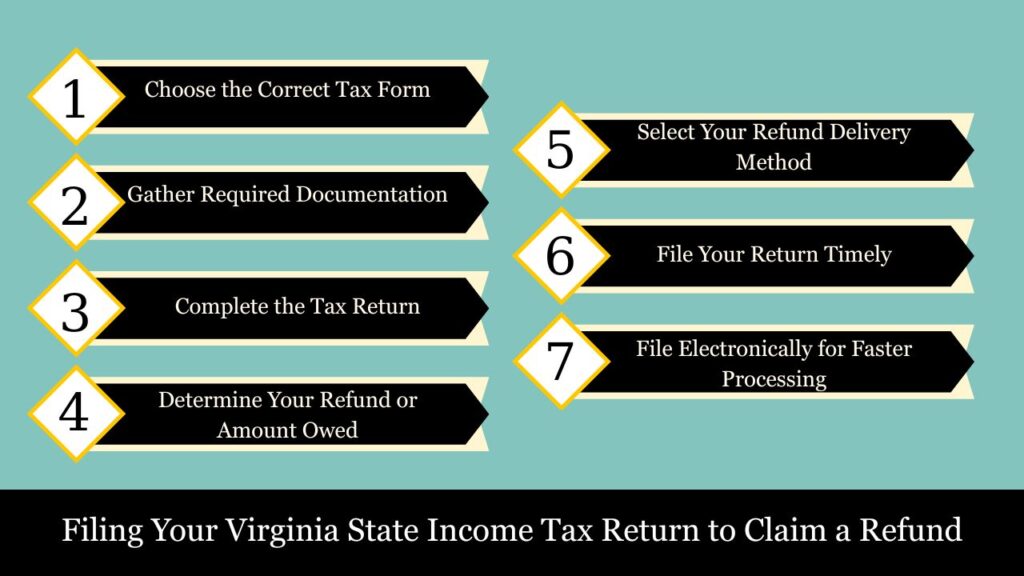

Filing Your Virginia State Income Tax Return to Claim a Refund

Claiming a Virginia state tax refund begins with accurately filing your Virginia income tax return. The return serves as your official report of income, deductions, credits, and payments made throughout the tax year. The Virginia Department of Taxation uses this information to determine if you have overpaid your state taxes and are therefore entitled to a refund.

1. Choose the Correct Tax Form

Virginia offers different tax forms based on residency status and income type:

- Form 760 (Virginia Resident Income Tax Return):

This form is used by full-year residents who earn income from all sources—both inside and outside Virginia. It requires detailed reporting of all income, including wages, interest, dividends, capital gains, and other income sources. - Form 760PY (Part-Year Resident or Nonresident Return):

If you lived in Virginia for only part of the year or earned income from Virginia sources while residing in another state, this form is applicable. It requires you to allocate income between Virginia and other states and calculate tax accordingly. - Form 760ES (Estimated Tax Payment Voucher):

For taxpayers who must make quarterly estimated tax payments to avoid penalties or to cover income not subject to withholding, Form 760ES is used to submit these payments. It is not used to file the final return but is critical for managing tax liability throughout the year.

2. Gather Required Documentation

Gather all essential documents in advance to ensure your tax return is accurate and complete:

- W-2 Forms: Wage and tax statements from employers showing income and Virginia tax withheld.

- 1099 Forms: Income from self-employment, investments, retirement, or other sources.

- Records of Estimated Payments: Proof of quarterly estimated tax payments made.

- Supporting Documents for Credits and Deductions: Receipts or statements for tax credits like the Virginia Earned Income Tax Credit or deductions such as mortgage interest.

3. Complete the Tax Return

- Report Income: Enter all income items as required. Nonresidents and part-year residents should accurately apportion income earned within Virginia to ensure proper tax reporting.

- Claim Deductions and Exemptions: Apply standard or itemized deductions, personal exemptions, and any other allowable adjustments.

- Calculate Tax Liability: Use Virginia’s tax tables or tax rate schedules to determine your tax due based on taxable income.

- Report Payments: Enter the full amount of Virginia tax withheld and any estimated tax payments submitted throughout the year.

- Claim Applicable Credits: Apply any Virginia tax credits you qualify for, which directly reduce your tax liability.

4. Determine Your Refund or Amount Owed

Subtract the total payments and credits from your calculated tax liability. If payments and credits exceed the tax due, you have a refund. If less, you owe additional tax.

5. Select Your Refund Delivery Method

- Direct Deposit: Enter your bank routing and account numbers to receive your refund electronically. This method is faster and more secure.

- Paper Check: If you prefer or do not provide banking information, your refund will be mailed as a paper check to the address on file.

6. File Your Return Timely

- The Virginia income tax return is generally due by May 1 following the end of the tax year (for calendar-year taxpayers).

- Filing on time ensures prompt processing of your refund and avoids late filing penalties.

- Extensions may be requested if additional time is needed, but any tax owed must still be paid by the original deadline to avoid interest and penalties.

7. File Electronically for Faster Processing

Virginia encourages taxpayers to file electronically through authorized e-file providers. E-filing reduces errors, speeds up processing, and allows quicker access to your refund status. Paper filing is still available but tends to have longer processing times.

Summary

Filing your Virginia state income tax return accurately and on time is essential to claim any refund due. Selecting the correct form, providing complete documentation, reporting income and credits properly, and choosing direct deposit for your refund can make the process smoother and faster. Staying informed and organized helps you get your Virginia tax refund without unnecessary delays.

Tax Implications of a Virginia State Tax Refund

When you receive a state tax refund, such as from Virginia, it may affect your federal income tax return in the following way:

Is Your Virginia State Tax Refund Taxable on Your Federal Return?

- This depends on whether you claimed itemized deductions on your federal tax return for the previous year.

- If you took the standard deduction on your previous federal tax return, your Virginia state refund is typically not taxable since you didn’t benefit from deducting state income taxes.

- If you itemized deductions on your federal tax return and deducted state income taxes paid, the Virginia refund might be considered taxable income in the year you receive it, because the refund reduces the amount of state taxes you previously deducted.

Why Does This Happen?

When you itemize deductions, state income taxes paid reduce your federal taxable income, providing a tax benefit. Receiving a refund of those state taxes later means you ultimately paid less than the amount you originally deducted. Therefore, the refund may partially or fully increase your federal taxable income to prevent “double dipping” on deductions.

How to Determine the Taxable Amount?

To determine how much of your Virginia refund is taxable, use the IRS Tax Benefit Rule and the worksheet in IRS Publication 525 (Taxable and Nontaxable Income) or the State and Local Income Tax Refund Worksheet in the federal Form 1040 Schedule A instructions.

The key factors include:

- How much state and local taxes you deducted last year.

- Whether the refund reduces your total itemized deductions to an amount less than the standard deduction.

- The amount of the refund received.

Simple Example Calculation

Scenario:

- You chose to itemize deductions on your federal return for the 2023 tax year.

- You deducted $5,000 of Virginia state income taxes paid.

- In 2024, you receive a Virginia state tax refund of $1,200.

Steps:

- Determine if deducting the $5,000 in state taxes last year reduced your taxable income compared to taking the standard deduction.

- If yes, then some or all of the $1,200 refund is taxable in 2024.

- Use the IRS worksheet to calculate the taxable portion (often it’s the full refund if the deduction was fully beneficial).

Reporting the Refund

- Report the taxable portion of your Virginia state tax refund as “Other Income” on your federal Form 1040, typically on Schedule 1 (Additional Income and Adjustments to Income).

- If the refund isn’t considered taxable income, you don’t need to report it on your federal return.

Important Notes

- If you did not deduct state income taxes (for example, you took the standard deduction), the refund is not taxable.

- If you filed a joint federal return but only one spouse received the refund, consult IRS guidelines on how to report it.

- If your prior year refund was from state taxes withheld on income reported in multiple states, calculations might be more complex.

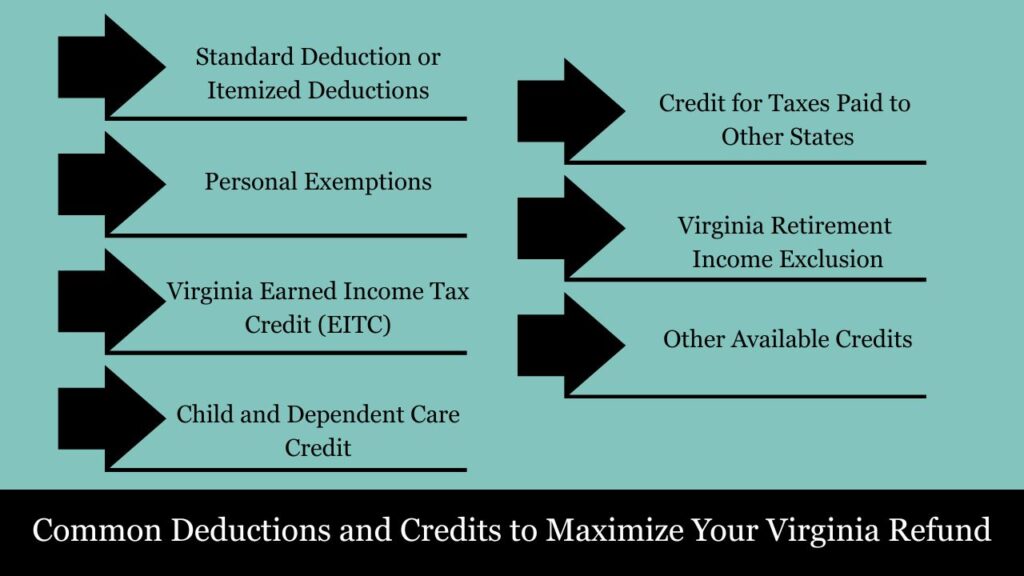

Common Deductions and Credits to Maximize Your Virginia Refund

1. Standard Deduction or Itemized Deductions

- Virginia allows a standard deduction based on filing status (e.g., $4,500 for single filers in 2024).

- You may itemize deductions such as mortgage interest, charitable contributions, medical expenses exceeding 10% of AGI, and state/local taxes paid.

- Choose whichever option gives you the larger deduction.

2. Personal Exemptions

- Virginia offers personal exemptions for taxpayers and dependents, reducing taxable income.

3. Virginia Earned Income Tax Credit (EITC)

- A refundable credit determined by your earned income and the number of qualifying family members.

- The Virginia EITC is a percentage of the federal EITC.

4. Child and Dependent Care Credit

- Provides credit for childcare or dependent care expenses if required to work or look for work.

5. Credit for Taxes Paid to Other States

- This credit offsets income taxes paid to another state on income also taxed by Virginia, helping to avoid double taxation.

6. Virginia Retirement Income Exclusion

- Eligible taxpayers may exclude a portion of their retirement income (pensions, annuities, etc.) from taxable income.

7. Other Available Credits

- Credits for historic preservation, solar energy systems, and education-related expenses may also reduce your tax liability.

Expiration of the Virginia State Tax Refund Claim

When you overpay your Virginia state income taxes and are eligible for a refund, it’s important to claim that refund within the timeframe allowed by law. Virginia has specific rules governing how long you have to file a refund claim before it expires.

Time Limit to Claim a Refund

- General Rule:

You must file your Virginia state tax return (or an amended return) to claim a refund within three years from the original due date of the return. For instance, if you follow a calendar year, your tax return is typically due by May 1 of the next year. This means you generally have until May 1, three years later, to claim a refund for that tax year. - What Happens If You Miss the Deadline?

If you don’t submit a refund claim within the three-year window, Virginia law treats the refund as forfeited. The overpaid amount then becomes the property of the state, and you lose the right to recover it.

Special Situations

- Amended Returns:

If you discover errors or missed deductions after filing your original return, you can file an amended return (Form 760X) to claim an additional refund, but this must also be done within the three-year timeframe. - Extensions or Other Exceptions:

Certain circumstances, such as fraud or failure to file a return, may extend or alter the refund claim period. However, these exceptions are rare and typically require legal or tax professional assistance.

Why Is This Important?

- Protect Your Refund:

Being aware of the refund expiration deadline helps ensure you file your return on time and claim any overpayments before you lose the right to a refund. - Avoid Financial Loss:

Missing the deadline means permanently losing funds you rightfully overpaid, which could have been used for other financial needs.

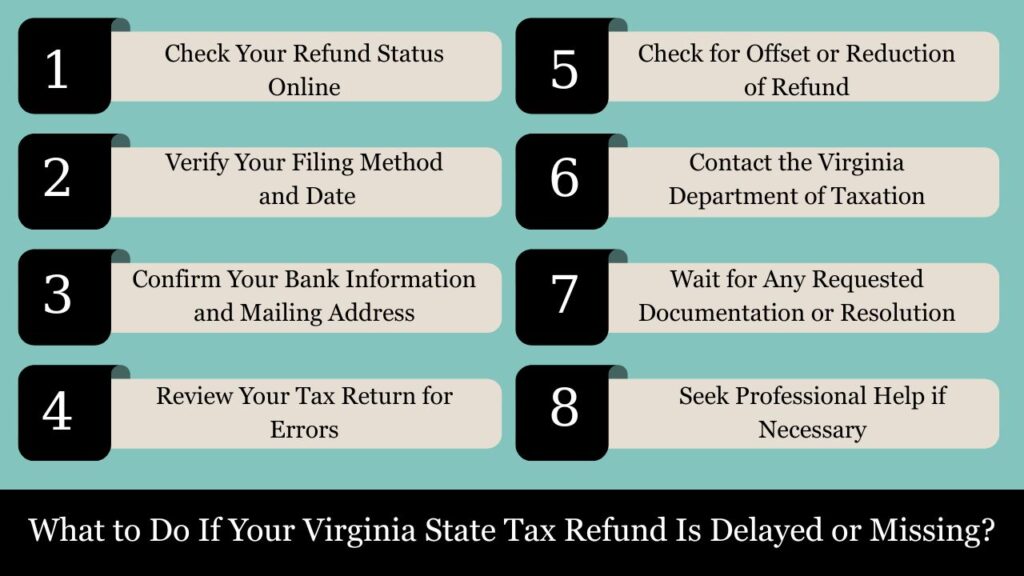

What to Do If Your Virginia State Tax Refund Is Delayed or Missing?

Waiting for a tax refund can be stressful, especially when it’s delayed or you’re unsure if it’s been issued. If you have not received your Virginia state tax refund within the expected timeframe, here are steps you can take to investigate and resolve the issue:

1. Check Your Refund Status Online

- Go to the Virginia Department of Taxation’s official website and access the “Where’s My Refund?” tool.

- You will need:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- The exact amount of the refund claimed.

- The tax year of the refund.

- This tool provides up-to-date information on whether your return is received, being processed, or if your refund has been issued.

2. Verify Your Filing Method and Date

- Confirm whether you filed your return electronically or by mail.

- E-filed returns are processed faster (typically 7–14 business days) compared to paper returns (which can take 4–6 weeks or more).

- If you mailed your return recently, delays could be due to mail processing times.

3. Confirm Your Bank Information and Mailing Address

- If you selected direct deposit, double-check that your bank routing and account numbers were entered correctly.

- For paper checks, ensure your mailing address on the return is accurate and up to date.

- Incorrect or outdated information can cause delays or misdirected refunds.

4. Review Your Tax Return for Errors

- Errors such as missing signatures, incorrect Social Security numbers, or calculation mistakes can cause processing delays.

- If the Virginia Department of Taxation finds errors, they may contact you by mail requesting additional information or corrections.

5. Check for Offset or Reduction of Refund

- If you have outstanding debts, your refund may be reduced or applied toward those obligations:

- Past-due child support.

- Unpaid state taxes or fees.

- Defaulted student loans.

- The Virginia Department of Taxation may apply your refund toward these debts before issuing any remaining balance.

6. Contact the Virginia Department of Taxation

- If you have checked all the above and still have not received your refund within a reasonable period, contact the Department directly:

- Call their customer service line during business hours.

- Use their online contact forms or email for inquiries.

- Be prepared with your Social Security number, filing details, refund amount, and date of filing to facilitate quicker assistance.

7. Wait for Any Requested Documentation or Resolution

- If the Department requests additional documentation or clarification, respond promptly to avoid further delays.

- Retain all submitted documents and communications for your personal records and future reference.

8. Seek Professional Help if Necessary

- If you encounter unresolved issues or suspect identity theft or fraud, consider consulting a tax professional or accountant.

- They can assist with more complex situations or help communicate with tax authorities on your behalf.

How and When Will You Receive Your Virginia State Tax Refund?

Methods of Refund

- Direct Deposit: The fastest and safest way to receive a refund is through direct deposit to your bank account. This option avoids mailing delays and reduces the risk of lost checks.

- Paper Check: Refunds can also be mailed as physical checks. These take longer to arrive and may be subject to postal delays.

Timeline for Receiving Refunds

- E-Filed Returns: Typically, refunds are processed and issued within 7 to 14 business days after receipt.

- Paper Returns: Returns filed by mail can take 4 to 6 weeks or longer due to manual processing.

- Amended Returns: Processing amended returns may take 8 to 12 weeks.

Tips to Avoid Overpaying Virginia State Taxes and Maximize Your Refund

- Review Your Withholding: Use the Virginia withholding calculator or consult your employer to adjust your withholding allowances to better match your expected tax liability.

- Make Accurate Estimated Payments: If you have non-wage income, ensure your quarterly estimated payments are as close as possible to your actual tax liability to avoid overpayment or underpayment penalties.

- Claim All Eligible Credits and Deductions: Familiarize yourself with available Virginia tax credits and deductions to reduce your tax liability and increase your refund.

- File Early and Electronically: Filing early and via e-file can help you receive your refund sooner and reduce errors.

Conclusion

A Virginia state tax refund is essentially your own money returned when you have overpaid your state taxes during the year. Filing an accurate, timely tax return and understanding the refund process helps ensure you receive any due refunds promptly. Keep good records, track your refund online, and address any issues quickly to avoid delays.

Frequently Asked Questions (FAQs)

What is a Virginia state tax refund?

A Virginia state tax refund is the amount returned to you when you have paid more state income tax during the year—via withholding or estimated payments—than your actual tax liability.

How do I claim a Virginia tax refund?

You claim your refund by filing a completed Virginia income tax return (Form 760 for residents or Form 760PY for part-year/nonresidents). The refund amount will be calculated based on your payments and tax due.

When will I receive my Virginia tax refund?

If you file electronically, refunds typically process within 7 to 14 business days. Paper returns take longer, usually 4 to 6 weeks or more.

Is my Virginia state tax refund taxable on my federal return?

It depends. If you itemized deductions and claimed state taxes last year, your refund might be taxable on your federal return. On the other hand, if you claimed the standard deduction, the refund is usually not treated as taxable income

What if my refund is delayed or missing?

First, check your refund status online. Verify your filing date, mailing address, and direct deposit info. If necessary, reach out to the Virginia Department of Taxation for help or clarification.

How long do I have to claim a Virginia tax refund?

You generally have 3 years from the original due date of your tax return (usually May 1) to claim a refund. Beyond that deadline, the refund is considered expired and reverts to the state.

Can my refund be reduced or withheld?

Yes. Your refund may be offset to cover past-due debts such as child support, unpaid state taxes, or defaulted student loans.

What payment methods are available for receiving my refund?

You can receive your refund via direct deposit into your bank account or as a paper check mailed to your address.

Can I amend my Virginia tax return to get an additional refund?

Yes. If you discover errors or missed deductions, you can file an amended return (Form 760X) within the refund claim period to request a corrected refund.