State and Local Tax Deductions 2025 Version: Easy and Accurate

Table of Contents

State And Local Tax Deductions (SALT) Made Simple

The State and Local Tax deductions enables taxpayers to reduce their federal taxable income by claiming certain state and local taxes they’ve paid, potentially lowering their overall federal income tax bill. However, this benefit is limited and nuanced, particularly after the 2017 Tax Cuts and Jobs Act (TCJA), which placed strict caps on how much could be deducted.

What Is the SALT Deduction?

The SALT deduction is a federal itemized deduction available on Schedule A of Form 1040. Taxpayers can subtract the amount paid in qualifying state and local taxes from their federal taxable income.

It is intended to avoid double taxation—ensuring that income already taxed at the state/local level is not taxed again in full by the federal government.

Which Taxes Can Be Deducted Under the SALT Deduction?

Certain taxes levied by U.S. state and local governments can be itemized and deducted on Schedule A of IRS Form 1040 under the State and Local Tax (SALT) deduction, helping to reduce your federal taxable incom. However, to qualify, these taxes must meet IRS criteria for being non-business, personal-level taxes that are not optional or related to specific services.

Let’s look at each type of deductible tax under SALT, including important conditions and examples:

1. State and Local Income Taxes

You may deduct the total of all state and local income taxes paid during the year, which can include:

- Withholding from your paycheck (reported on your W-2)

- Estimated tax payments made directly to the state or local government

- Prior year’s taxes paid in the current year (e.g., payment made in April 2025 for your 2024 state return)

Note: This includes state-level taxes (like New York, California, or Illinois income tax) and local income taxes (like New York City or Philadelphia wage taxes).

Deductible:

- Income tax on wages

- State or local income taxes applied to earnings such as interest, dividends, capital gains, and other taxable income sources

Not Deductible:

- Penalties or interest paid for late filing

- Fees for filing or processing your return

2. State and Local General Sales Taxes (As an Alternative)

If you live in a state without an income tax (e.g., Florida, Texas, Washington), or if your sales tax paid exceeds your income tax, you can choose to deduct state and local general sales taxes instead of income tax—but not both.

You may deduct:

- Actual sales tax paid (if you have receipts), or

- A calculated amount using the IRS optional sales tax tables, which are adjusted based on your income level and household size

You can also add certain big-ticket purchases (like a car, boat, RV, or major home renovation materials) to the table amount if the tax was separately stated.

Example: If you purchased a car and paid $2,000 in sales tax, you may include that amount in addition to the base sales tax figure from the IRS table.

3. Real Estate Taxes (Property Taxes)

Real estate taxes on non-business personal-use property, such as your primary home, vacation home, or undeveloped land, are generally deductible, provided:

- It is imposed uniformly by the local government

- It is used to fund general government services (schools, police, fire protection, etc.)

Deductible:

- Yearly property tax levied on your residence by your local county or municipal government.

Not Deductible:

- Charges for local improvements (e.g., sidewalk repair, sewer line installation)

- Utility service fees (e.g., garbage collection, water)

- Homeowners’ association (HOA) dues

4. Personal Property Taxes

You may deduct certain state and local personal property taxes, such as:

- Annual vehicle registration fees (if based on value)

- Boat or airplane registration fees (if assessed annually and based on value)

Key Rule: The tax must be:

- Ad valorem (i.e., based on the value of the property)

- Imposed on a yearly basis

Example:

You own a car in Colorado and pay an annual vehicle registration fee that includes a property tax based on the car’s market value — this portion is deductible.

You cannot deduct flat registration fees or per-weight-based fees that are not tied to the asset’s value.

Do You Know? Not All State and Local Taxes Are Deductible

Here are examples of non-deductible taxes and fees under SALT rules:

- Utility fees (electricity, gas, water, trash collection)

- Fines and penalties

- Business license fees (unless claimed as a business expense)

- Transfer taxes (e.g., on the sale of real estate)

- Fees for driver’s licenses or marriage certificates

The SALT Deduction Cap (2025)

The State and Local Tax (SALT) deduction cap is a federal limitation placed on how much individuals can deduct on their federal income tax return for state and local taxes paid during the tax year.

What Is the SALT Deduction Cap?

As of tax year 2025, taxpayers who itemize deductions on Schedule A (Form 1040) may only deduct up to $10,000 of combined:

- Either state and local income taxes or general sales taxes, depending on which provides a greater benefit

plus - Real estate (property) taxes

plus - Personal property taxes (e.g., vehicle registration based on value)

Married individuals filing separately are limited to $5,000.

This cap applies regardless of how high your actual state and local tax payments are.

Origin of the Cap

The SALT deduction cap was introduced by the Tax Cuts and Jobs Act (TCJA) of 2017 as a way to limit deductions for higher-income earners and offset the cost of tax rate reductions. The cap was originally effective from 2018 through 2025, and unless extended or revised by Congress, it is scheduled to expire after December 31, 2025, restoring the pre-2018 unlimited deduction for qualified state and local taxes.

What Counts Toward the $10,000 Cap?

Here’s what’s included in the cap:

| Tax Type | Counts Toward Cap? | Notes |

| State income taxes | Yes | Withholding, estimated payments, or prior year balances |

| Local income/wage taxes | Yes | NYC income tax, Philadelphia wage tax, etc. |

| General sales taxes | Yes | Choose either sales tax or income tax |

| Real estate/property taxes | Yes | On primary/secondary personal-use homes |

| Personal property taxes | Yes | but only if the tax is calculated based on the item’s assessed value (ad valorem) |

And here’s what’s excluded:

| Tax Type | Excluded from Cap | Why |

| State taxes on business income | No | Deductible on Schedule C, E, or F |

| Property tax on rental homes | No | Deductible as business expense |

| Sales tax on business purchases | No | Deductible on business returns |

Example

Let’s say you paid the following in 2025:

- $7,500 in state income tax

- $6,000 in local property tax

- $800 in car registration tax (based on value)

Your total eligible SALT deductions = $14,300, but you can only deduct $10,000 due to the cap.

$4,300 is non-deductible at the federal level, even though you paid it.

SALT Deductions Compliance Rules (2025)

The State and Local Tax (SALT) deduction allows taxpayers who itemize deductions on their federal return to deduct certain state and local taxes paid. However, due to the $10,000 cap and IRS scrutiny, it’s essential to follow strict compliance rules to ensure your deductions are valid, properly documented, and audit-proof.

1. Eligible Taxes Must Be Actually Paid

Only taxes paid during the tax year can be claimed as a SALT deduction. This includes:

- Withholding from W-2 or estimated tax payments

- Property taxes paid directly to local authorities

- Income taxes paid with state/local extensions or prior-year balances paid during the year

Taxes that have been incurred but not yet paid cannot be deducted by cash-basis taxpayers.

2. Payments Must Be Imposed by Government Entities

Only taxes that are legally imposed by state, local, or tribal governments qualify. Voluntary payments, fees, or payments made to non-governmental bodies do not qualify.

Examples that qualify:

- State income tax

- County real estate tax

- City personal property tax

Examples that don’t qualify:

- HOA fees

- Utility bills

- Fines or penalties

3. Cap Enforcement: $10,000 per Return

The IRS strictly enforces the $10,000 cap ($5,000 if married filing separately). This cap applies to the total combined deduction for:

- State and local income or sales taxes (you can choose one)

- Real property taxes

- Personal property taxes (e.g., vehicle registration based on value)

You cannot circumvent the cap by prepaying future-year taxes or splitting deductions between spouses on separate returns.

4. Non-Deductible SALT Workarounds Are Disallowed

The IRS has disallowed certain SALT cap workarounds created by states after 2018, including:

- Charitable contribution schemes where a taxpayer donates to a state-run fund and receives a tax credit in return. These are treated as quid pro quo, not true charitable contributions.

- Double deduction claims (e.g., claiming a property tax and sales tax for the same item)

However, Pass-Through Entity (PTE) tax workarounds have been approved for businesses.

5. Keep Supporting Documentation

To ensure SALT deductions withstand IRS scrutiny, retain clear documentation:

- State tax return copies

- W-2s and 1099s showing state/local withholding

- Cancelled checks or electronic receipts for real estate tax payments

- Tax bills showing value-based assessments for personal property taxes

6. Only Personal-Use Property Taxes Are Included

Only property taxes on personal-use real estate (e.g., primary and secondary homes) are included in the SALT deduction. Property taxes on:

- Rental properties

- Business-use property

…must be deducted on Schedule E or Schedule C, not Schedule A, and are not subject to the $10,000 cap.

7. No Prepayments for Future-Year Taxes

You may not deduct future property tax payments made early (e.g., in December for a bill due in January) unless the tax has been assessed before year-end.

IRS rules under Notice 2018-54 clarify that only assessed and paid taxes qualify for that year’s deduction.

8. Allocation of Real Estate Tax Payments

If your real estate tax bill includes non-tax assessments (e.g., trash collection, street lighting), you must separately identify and deduct only the tax portion.

Only the ad valorem (value-based) portion is deductible.

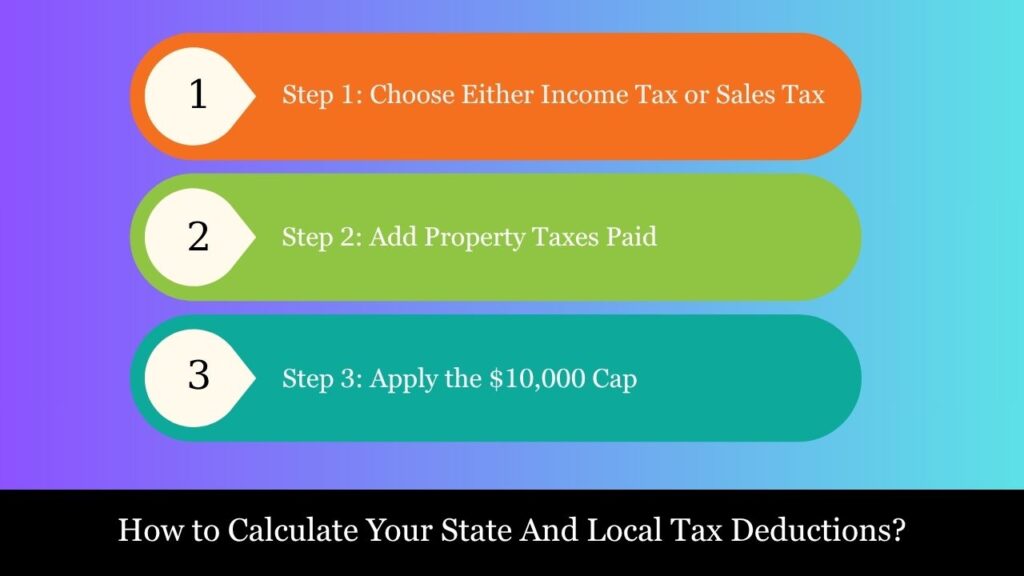

How to Calculate Your State And Local Tax Deductions?

The State and Local Tax (SALT) deduction lets you reduce your federal taxable income by the amount of certain state and local taxes you’ve actually paid—but only up to $10,000 ($5,000 if married filing separately). Here’s a step-by-step guide to calculating your allowable deduction:

Step 1: Choose Either Income Tax or Sales Tax

You must choose one, not both:

- State and Local Income Tax

– Includes: Withholding (shown on W-2), estimated payments, and taxes paid with extensions or for prior years.

OR - State and Local General Sales Tax

– You can use actual receipts or the IRS Optional Sales Tax Tables based on income, location, and family size.

– Add large purchases (like vehicles, boats, or home renovation materials) on top of the table amount.

Tip: High earners with low or no income tax (e.g., Florida or Texas residents) may benefit more from deducting sales tax.

Step 2: Add Property Taxes Paid

You can include:

- Real estate taxes paid on your primary home and other personal-use properties.

- Personal property taxes, such as vehicle registration fees that are determined by the property’s value.

Exclude any non-ad valorem charges (e.g., trash pickup or sewer fees) that appear on your bill.

Step 3: Apply the $10,000 Cap

Once you’ve added up:

- Either state/local income tax or sales tax

plus - Real estate and personal property taxes

…compare the total to the $10,000 cap:

- If your total is less than $10,000, you can deduct the full amount.

- If it’s more than $10,000, you can only deduct up to $10,000 on Schedule A (Form 1040).

Married Filing Separately: The limit is $5,000 per spouse.

Sample SALT Deduction Calculation (2025)

| Tax Type | Amount Paid |

| State income tax withheld (W-2) | $4,000 |

| Estimated state taxes paid | $1,500 |

| Local income tax | $500 |

| Real estate tax (primary residence) | $6,000 |

| Vehicle registration (value-based) | $800 |

| Total Paid | $12,800 |

| Deductible (Capped) | $10,000 |

In this example, even though $12,800 was paid, the taxpayer can only deduct $10,000 due to the SALT cap.

Things To Be Taken Care Of While State And Local tax Deductions

- Do not include business or rental property taxes—they are deducted separately on Schedules C or E.

- Do not deduct taxes not yet assessed or paid—only paid taxes for the current tax year count.

- Maintain proper documentation for all amounts claimed.

SALT Deduction vs. Standard Deduction

When filing your federal income tax return, you must choose between itemizing deductions (including the SALT deduction) or taking the standard deduction. You cannot do both. Understanding the trade-offs between these two options is essential to optimize your tax savings.

Key Differences Between SALT Deduction and Standard Deduction

| Aspect | SALT Deduction (Itemized Deduction) | Standard Deduction |

| Definition | The SALT (State and Local Tax) deduction allows taxpayers to deduct certain state and local taxes paid during the year if they choose to itemize deductions on their return. | A set amount that lowers the portion of your income subject to federal tax. It’s automatically available without listing expenses. |

| Purpose | Designed to provide relief from double taxation by allowing deductions of state and local taxes, such as income or property taxes, on the federal tax return. | Simplifies tax filing by offering a standardized deduction amount without documentation or itemization. |

| How Claimed | Claimed on Schedule A of IRS Form 1040 as part of itemized deductions. | Claimed directly on the IRS Form 1040 without needing Schedule A. |

| Deduction Limit (Cap) | The SALT deduction is capped at $10,000 per tax return ($5,000 if Married Filing Separately), regardless of the actual taxes paid. | There is no cap, but amounts vary by filing status. |

| Filing Complexity | Requires maintaining receipts, tax bills, property tax statements, and using Schedule A to total itemized deductions. | Very simple — no itemization required. You automatically receive the full deduction for your filing status. |

| Flexibility | Part of a broader set of itemized deductions. You may also deduct mortgage interest, charitable donations, and medical expenses. | Not flexible — it’s a flat deduction amount based on your filing status only. |

| Eligibility Criteria | Only available if you choose to itemize deductions and have qualifying state and local tax payments. | Available to all taxpayers regardless of income, expenses, or state of residence. |

| Ideal For | Taxpayers in high-tax states (e.g., New York, California, New Jersey) or those with significant deductible expenses like mortgage interest. | Most filers — especially those with few deductions or whose total itemized deductions are less than the standard. |

| Taxpayer Benefit | Can be valuable for high earners and homeowners who pay high property or income taxes — but limited by the $10,000 cap. | Provides increased tax savings and ease of filing for most taxpayers. |

| Other Deductions | Part of your total itemized deductions. If SALT + other deductions don’t exceed the standard deduction, itemizing is not advantageous. | Replaces itemized deductions — you cannot claim SALT or any itemized deductions if you take the standard deduction. |

| SALT Deduction Sunset | The current $10,000 cap expires after 2025, unless extended or changed by Congress. | Adjusted annually for inflation and built into the tax code permanently (unless legislation changes it). |

Example Scenario

Scenario 1:

- State income tax paid: $6,000

- Property tax paid: $5,000

- Total SALT = $11,000 → limited to $10,000 cap

- Other deductions: $3,000 mortgage interest

- Total itemized = $13,000

Standard deduction for single filer in 2025 = $14,600

Better to take the standard deduction

Recent Legal and Political Update on SALT Deduction – July 2025

1. SALT Deduction Cap Status (2025)

- The $10,000 SALT deduction cap—introduced under the Tax Cuts and Jobs Act (TCJA) of 2017—remains in effect through 2025.

- The cap limits itemized deductions for:

- State income taxes

- Real estate/property taxes

- Local taxes

- The cap applies per return, meaning:

- Married filing jointly = $10,000 total cap

- Single or married filing separately = $5,000

2. Legal Challenge Status

- Multiple lawsuits (mostly from high-tax states like New York, New Jersey, Connecticut) have challenged the SALT cap, arguing it is unconstitutional.

- Courts (including the Supreme Court in 2023) have upheld the SALT cap as constitutional, reinforcing Congress’s authority to limit deductions.

3. Legislative Activity – Federal Level (2025)

- As the TCJA provisions are set to expire after 2025, the SALT deduction cap will automatically expire unless extended or modified.

- Current Congressional debate (2025):

- Democrats from high-tax states are demanding full repeal or a significantly higher cap (e.g., $80,000 limit temporarily enacted for 2021 under ARPA).

- Republicans generally oppose lifting the cap, citing it disproportionately benefits higher-income taxpayers.

- No bipartisan consensus has been reached as of July 2025.

4. SALT Cap Reform Proposals (2025 Legislative Highlights)

| Bill/Proposal | Summary | Status |

| SALT Fairness Act | Repeals the $10,000 SALT cap | Reintroduced in House; stalled in Senate |

| Middle-Class Tax Relief Act | Raises the SALT cap to $20,000 for joint filers | In committee review |

| Budget Reconciliation (Expected Late 2025) | May include a temporary SALT cap increase or partial repeal | Under negotiation |

Note: Any SALT-related reforms will likely be bundled into broader 2025 year-end tax reform as Congress negotiates TCJA extensions.

5. State-Level Workarounds (2025)

To bypass the federal cap, many states have implemented Pass-Through Entity (PTE) taxes, allowing businesses like partnerships and S corporations to pay state tax at the entity level and deduct it fully federally.

- As of July 2025, 41+ states offer elective PTE tax regimes.

- Recent updates:

- Florida (effective Jan 1, 2025): Implemented new PTE tax structure

- California: Adjusted PTE credits to avoid double taxation

- New York: Expanded base to include guaranteed payments

6. Political Climate Going into 2026 Elections

- SALT deduction is becoming a key political wedge issue ahead of the 2026 midterms and TCJA expiration.

- Democrats: Advocating for full repeal or higher caps, especially for blue states.

- Republicans: Emphasize tax reform that limits itemized deductions and favors standard deduction use.

- Bipartisan SALT Caucus: A bipartisan group of lawmakers advocating for changes to the SALT deduction limit.

7. What to Expect Next?

- Expect intensive year-end negotiations in Q4 2025 as part of broader tax package reforms.

- If no action is taken:

- SALT deduction cap expires Dec 31, 2025

- Returns to pre-2018 rules (no cap; subject to Pease limitation for high-income earners)

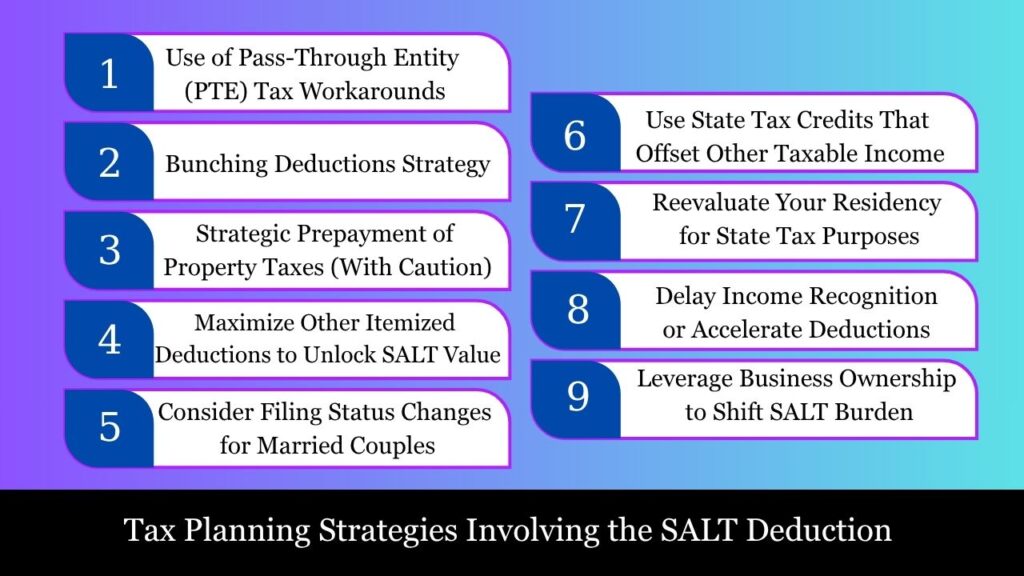

Tax Planning Strategies Involving the SALT Deduction (July 2025)

1. Use of Pass-Through Entity (PTE) Tax Workarounds

Overview:

- The $10,000 SALT deduction limit affects individual taxpayers but does not apply to business entities.

- Many states allow pass-through entities (PTEs) (e.g., partnerships, S corporations, LLCs) to electively pay state income tax at the entity level, making it fully deductible on the business’s federal return.

Planning Strategy:

- If you’re an owner of a pass-through business in a participating state (e.g., NY, CA, FL, IL):

- Elect into the PTE tax regime.

- Deduct state taxes paid by the entity on the business’s federal tax return, bypassing the SALT cap at the individual level.

- Claim a state tax credit on your individual return to avoid double taxation.

Best For:

- High-income individuals who receive significant pass-through income

- Professionals (e.g., law firms, medical practices, real estate partnerships)

2. Bunching Deductions Strategy

Overview:

- If your itemized deductions are close to the standard deduction threshold, you may not get the benefit of SALT payments every year.

- In 2025, the standard deduction is:

- $29,200 (MFJ)

- $14,600 (Single)

Planning Strategy:

- “Bunch” deductible expenses like property taxes and charitable contributions into one year, itemize that year.

- Take the standard deduction in the following year.

Example:

- Pay January 2026 property taxes early in December 2025.

- Combine with charitable gifts and mortgage interest in 2025.

- Itemize in 2025, take the standard deduction in 2026.

3. Strategic Prepayment of Property Taxes (With Caution)

Overview:

- In some cases, prepaying property taxes before year-end can increase your SALT deduction.

Planning Strategy:

- If your municipality has assessed 2026 property taxes by December 2025, consider prepaying.

- Note: You cannot deduct prepayments for taxes not yet assessed, per IRS rules (Notice 2018-54).

Risk:

- Prepayment must be legally enforceable in that tax year. Otherwise, the deduction could be disallowed.

4. Maximize Other Itemized Deductions to Unlock SALT Value

Overview:

- The SALT deduction only matters if you itemize. So boost total deductions above the standard deduction threshold.

Planning Strategy:

- Combine SALT deductions with:

- Charitable contributions

- Mortgage interest

- Medical expenses (>7.5% of AGI)

- Use a Donor-Advised Fund (DAF) to front-load multiple years’ charitable giving.

5. Consider Filing Status Changes for Married Couples

Overview:

- SALT cap is $10,000 for joint filers, but also $5,000 per person for married filing separately (MFS), which offers no benefit unless managed carefully.

Planning Strategy:

- In rare cases, married filing separately (MFS) could reduce total federal taxes if:

- One spouse has significantly lower income and high itemized deductions.

- Other tax attributes (credits, thresholds) still favor MFS.

Note: Filing separately usually limits other deductions/credits, so weigh carefully with a tax advisor.

6. Use State Tax Credits That Offset Other Taxable Income

Overview:

- Many states offer tax credits (e.g., school tuition credits, conservation easement donations) that can reduce state liability rather than increasing itemized deductions.

Planning Strategy:

- Use state credits in place of paying additional deductible state taxes.

- This reduces actual state tax paid without increasing federal taxable income.

Tip: Combine this with PTE election to reduce state tax at both the entity and personal level.

7. Reevaluate Your Residency for State Tax Purposes

Overview:

- For high-income earners in high-tax states (e.g., NY, CA, NJ), consider moving to a low- or no-income tax state (e.g., FL, TX, NV).

Planning Strategy:

- Change your primary residence and meet legal residency requirements in a state with lower or no income tax.

- Ensure sufficient evidence (e.g., home ownership, driver’s license, voter registration, days spent).

Caution: States like NY aggressively audit residency claims. Maintain complete documentation.

8. Delay Income Recognition or Accelerate Deductions (2025 Planning)

Overview:

- The SALT deduction limit is set to expire after 2025 unless Congress acts to extend, modify, or replace it.

Planning Strategy:

- If your 2026 tax year may allow a full deduction, consider:

- Delaying income into 2026

- Deferring SALT payments to 2026 (if deductible)

BUT: Watch for possible retroactive legislation or extension of the cap beyond 2025.

9. Leverage Business Ownership to Shift SALT Burden

Overview:

- Owning a business (especially a pass-through entity) creates planning flexibility not available to W-2 employees.

Planning Strategy:

- Use entity-level tax planning:

- Shift income into your LLC or S-corp

- Elect PTE tax treatment

- Allocate income between states (if multi-state operations)

Conclusion

The State and Local Tax (SALT) deduction can significantly reduce a taxpayer’s federal income tax liability—particularly for those who itemize deductions and live in high-tax states. However, the $10,000 cap continues to limit its usefulness for many, making careful planning essential. Always consult a tax advisor to determine the most tax-efficient strategy based on your specific circumstances.

Frequently Asked Questions (FAQs)

What is the SALT deduction?

The SALT deduction allows taxpayers who itemize deductions to deduct certain state and local taxes paid, such as:

–State income or general sales tax

–Real estate (property) tax

–Personal property tax (e.g., vehicle taxes in some states)

What is the current cap on SALT deductions?

As of tax year 2025, the SALT deduction is capped at $10,000 ($5,000 if married filing separately), regardless of the amount actually paid.

When does the SALT cap expire?

The $10,000 cap was enacted under the Tax Cuts and Jobs Act (TCJA) and is set to expire after December 31, 2025, unless extended or modified by Congress.

Can I deduct both income and sales tax under SALT?

No. You must choose either:

–State and local income taxes, or

–State and local general sales taxes (often beneficial for retirees or residents of states without income tax)

You can still deduct real estate taxes separately (subject to the $10,000 total cap).

What taxes are not deductible under SALT?

The following are not deductible:

-Federal income taxes

-Employee-side payroll taxes (Social Security, Medicare)

-Gasoline or excise taxes

-HOA fees or assessments

-Fines or penalties to the state/local government

Can I prepay property taxes to increase my deduction?

Only if:

-The property taxes are assessed and legally due in the current year (2025).

-Your local taxing authority has formally issued the bill.

The IRS does not allow deductions for prepayment

How do Pass-Through Entity (PTE) tax elections help with SALT?

If you own an LLC, partnership, or S corporation, many states allow the business to pay state tax at the entity level, which is fully deductible federally.

This bypasses the SALT cap for individual owners, who receive a state tax credit on their personal return.

Does the SALT cap apply to trusts and estates?

Yes. For non-grantor trusts and estates, the $10,000 SALT cap also applies. Special planning (e.g., splitting trusts) may help in some cases, but the IRS has challenged abusive structures.