Publicly Traded Partnership: Best Review In 2025

Table of Contents

Publicly Traded Partnerships: What Every Investor Should Know?

A Publicly Traded Partnerships (PTP) is a business entity that is organized as a partnership but whose interests (units) are traded on public exchanges, much like stocks of corporations. These entities are generally taxed as partnerships for federal income tax purposes, even though their units are available to retail investors on platforms like the NYSE or NASDAQ.

Legal Definition (IRS Perspective)

From the viewpoint of the Internal Revenue Service (IRS), a Publicly Traded Partnership (PTP) is governed primarily by Internal Revenue Code (IRC) Section 7704. According to this provision, a PTP is defined as a business entity that is classified as a partnership for federal income tax purposes, but whose partnership interests are either:

- Traded on an established securities market (such as the New York Stock Exchange or NASDAQ), or

- Available for trading on secondary markets or comparable venues such as electronic platforms or OTC exchanges.

While partnerships are generally not subject to entity-level federal income tax, IRC §7704 imposes a default rule that a PTP is taxed as a C corporation, unless it meets a specific income-based exception.

Exception to Corporate Taxation: The “Qualifying Income” Test

To maintain partnership tax treatment and avoid corporate-level taxation, the PTP must satisfy the “90% qualifying income” rule under IRC §7704(c). This means that at least 90% of the gross income earned during the tax year must consist of qualifying income, which includes:

- Interest and dividends

- Rents from real property

- Capital gains generated by selling or trading a capital property

- Revenue stemming from the discovery, development, or exploitation of natural resources .

- Taxable income from transactions involving select commodities or futures

- Income from transportation or storage of natural resources (e.g., oil, gas)

If a PTP fails to meet the 90% test, it loses pass-through treatment and is subject to entity-level corporate tax, like a regular corporation.

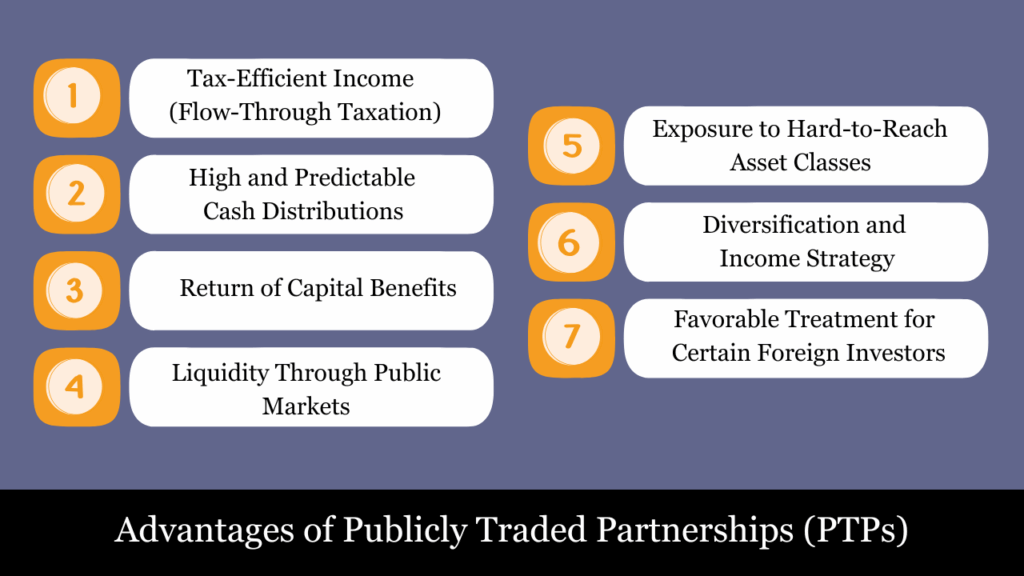

Advantages of Publicly Traded Partnerships (PTPs)

Publicly Traded Partnerships (PTPs) offer a unique hybrid of partnership-level tax benefits and corporate-level liquidity. Investors looking for steady cash flows, tax advantages, and exposure to industries like energy and infrastructure often find PTPs attractive. Below is a comprehensive look at the key benefits:

1. Tax-Efficient Income (Flow-Through Taxation)

One major advantage of publicly traded partnerships is the avoidance of entity-level taxation:

- C corporations are taxed at the corporate level, whereas PTPs pass income through to investors tax-free at the entity level.

- Instead, all income, deductions, and credits pass through directly to the investors (limited partners), avoiding double taxation.

- Investors report their share of income on their individual tax returns via Schedule K-1, potentially resulting in lower effective tax rates depending on the character of the income.

2. High and Predictable Cash Distributions

PTPs are known for providing consistent and often high quarterly distributions:

- Many PTPs, especially those in the energy sector, operate stable, cash-generating businesses such as pipelines or storage facilities with long-term contracts.

- A large portion of the cash distributed may be treated as return of capital, not immediately taxable, which helps defer taxes until the units are sold.

3. Return of Capital Benefits

Unlike dividends from a corporation, most PTP distributions are classified as return of capital (ROC):

- ROC reduces the investor’s cost basis in their units, thus deferring tax liability.

- This tax deferral can be a powerful wealth-building strategy, especially when holding units long term.

- The deferred tax is realized only upon sale or disposition of units.

4. Liquidity Through Public Markets

By trading on platforms such as NYSE and NASDAQ, PTPs provide:

- Ease of buying and selling, similar to stocks.

- Market-based price transparency and access to broader investor participation.

- Lower investment barriers compared to traditional private partnerships or limited offerings.

5. Exposure to Hard-to-Reach Asset Classes

Many PTPs operate in specialized sectors such as:

- Infrastructure supporting energy distribution, including oil and gas pipelines

- Mineral extraction and natural resources

- Commodities processing and storage

These industries offer defensive characteristics and inflation-resistant revenue, making PTPs a strategic hedge in a diversified portfolio.

6. Diversification and Income Strategy

PTPs can serve as an income-generating alternative to bonds or REITs:

- Useful for retirees or income-focused investors.

- Provide sector-specific diversification not easily accessible through traditional equities.

7. Favorable Treatment for Certain Foreign Investors

Some treaties allow non-U.S. persons to benefit from reduced withholding rates or favorable tax treatment for PTP income, depending on jurisdiction and entity structure.

How Do Publicly Traded Partnerships (PTPs) Work

Publicly Traded Partnerships (PTPs) operate much like traditional partnerships, but with a key distinction—they are open to public investment and their ownership interests (units) are traded on established securities exchanges or equivalent platforms. PTPs blend characteristics of both corporations and partnerships, offering liquidity to investors and flow-through taxation to the business.

1. Formation and Structure

A PTP is typically formed under state partnership laws, such as a limited partnership (LP) or a limited liability company (LLC). It consists of:

- General Partner (GP): Manages day-to-day operations and usually holds a small ownership percentage.

- Limited Partners (LPs): The public investors who buy units (akin to shares) and enjoy limited liability but have no role in management.

Ownership is represented in partnership units, which are listed on platforms like the NYSE or NASDAQ and traded similarly to corporate stocks.

2. Tax Treatment

Unlike C corporations, which are taxed at both the entity and shareholder levels, PTPs generally avoid double taxation. Instead, they:

- Pass through income, deductions, credits, and losses to unit holders (investors).

- Issue Schedule K-1 forms annually to each investor, reporting their share of partnership activity, which is reported on the individual’s tax return.

- Avoid federal income tax at the partnership level only if they meet the “90% qualifying income” test under IRC §7704(c).

3. Distributions to Investors

PTPs often distribute a substantial portion of their cash flows (not necessarily equivalent to taxable income) to investors in the form of quarterly distributions. These distributions are not always immediately taxable—much of it is often considered return of capital, which reduces the investor’s basis in the units.

4. Buying & Selling Units

- Units can be bought and sold like regular stock through brokerage accounts.

- When investors sell units, they recognize capital gain or loss, adjusted for:

- Return of capital distributions

- Allocated income/losses reported on K-1s

- Depreciation recapture or other ordinary income elements

This makes PTP investing more complex at tax time compared to corporate stocks.

5. Common Industries

Most PTPs operate in energy-related sectors, especially:

- Natural gas and crude oil pipeliness

- Processing, storage, and transportation of natural resources

- Exploration and development of minerals

These industries naturally generate qualifying income, making them ideal for maintaining partnership tax treatment.

How to File Taxes for Publicly Traded Partnerships (PTPs)

When you invest in a Publicly Traded Partnership (PTP)—also known as a Master Limited Partnership (MLP)—you don’t receive a traditional Form 1099-DIV like with corporate stocks. Instead, you must report your pro-rata share of the partnership’s income, deductions, and credits using IRS Schedule K-1 (Form 1065).

Here’s how to file taxes properly if you hold units in a PTP:

Step 1: Receive Schedule K-1 (Form 1065)

Each year (typically by mid-March), the PTP sends a Schedule K-1 to its investors. This form outlines:

- Your share of the partnership’s income, losses, and deductions

- Interest income, capital gains, and other credits

- State-level tax information (if applicable)

Note: The K-1 is sent directly by the partnership, not your brokerage firm.

Step 2: Review and Understand the K-1 Contents

Key boxes on the K-1 include:

- Box 1: Ordinary business income/loss

- Box 2: Net rental real estate income/loss

- Box 5: Interest income

- Box 11: Section 1231 gains/losses

- Box 13: Deductions such as depreciation, charitable contributions

- Box 20: Other important information, including Section 199A deductions

Each box may require multiple forms or worksheets to properly report on your tax return.

Step 3: Enter K-1 Information on Your Tax Return

Here’s how to reflect Schedule K-1 details on your Form 1040:

| K-1 Box | Where to Report on 1040 |

| Box 1 (Ordinary business income) | Schedule E, Part II |

| Box 5 (Interest income) | Schedule B |

| Box 9a (Capital gains) | Schedule D and Form 8949 |

| Box 13 (Deductions) | Depends on type (e.g., Schedule A, Form 4952) |

| Box 20 (QBI, Section 754, etc.) | Requires analysis—often affects Form 8995 or Form 8582 |

You’ll also need to:

- Adjust your basis in the PTP units based on income and distributions received.

- Track suspended losses (e.g., passive losses) if you can’t deduct them in the current year.

Step 4: Track Return of Capital (ROC) Distributions

Unlike dividends from C corporations, most PTP distributions are return of capital (ROC) and:

- Not immediately taxable

- Reduce your cost basis in the PTP units

- Result in capital gains when you sell your units

Example: If you bought units for $10,000 and received $2,000 in ROC over time, your adjusted basis becomes $8,000. If you sell for $12,000, you recognize a $4,000 capital gain.

Step 5: Handle State Tax Filing Requirements

Many PTPs operate in multiple states. Your K-1 may indicate:

- Income sourced to specific states (e.g., Texas, Louisiana)

- Whether you may owe nonresident state income tax

- Whether composite filing was done on your behalf

You may need to file nonresident returns in those states, depending on the thresholds.

Step 6: File Additional IRS Forms (If Applicable)

Depending on the K-1 content, you might need to attach these forms:

| Form | Purpose |

| Form 4797 | Section 1231 gains/losses |

| Form 8949 & Schedule D | Capital gains/losses on sale |

| Form 8582 | Passive activity loss limitations |

| Form 8995/8995-A | Qualified Business Income Deduction |

| Form 1116 | Foreign tax credit, if any applies |

What Is a Publicly Traded Partnership K-1

A PTP K-1 is a tax form (Schedule K-1 from Form 1065) issued to investors (unitholders) in a Publicly Traded Partnership (PTP). Unlike regular stocks that issue Form 1099-DIV, PTPs are pass-through entities. That means all income, losses, deductions, and credits are passed directly to the investor, who must report them on their personal tax return.

What Does a PTP K-1 Include?

Your K-1 will include:

- Your share of ordinary business income, interest, dividends, capital gains/losses, and deductions.

- Other data such as AMT adjustments, Section 199A information, and state-specific data.

- It also reports distributions, which usually reduce your cost basis (they’re not taxable unless your basis hits zero).

Key Features

- Box 1: Business income or loss – report on Schedule E.

- Box 5–9a: Interest, dividends, and capital gains – report on Schedules B & D.

- Box 13: Deductions like charitable contributions.

- Box 20: Other items, including QBI (qualified business income) or tax-exempt income.

Example

You receive:

- $2,000 in ordinary business income (Box 1) → report on Schedule E.

- $500 long-term capital gain (Box 9a) → report on Schedule D.

- $1,000 distribution (not taxable now, but reduces basis).

Tax Tips

- Track your basis carefully: Distributions reduce it; income increases it.

- If you sell your PTP units, calculate capital gains and ordinary income separately, per IRS rules (IRC §751).

- Watch out for multi-state tax exposure if the PTP operates in several states.

Most PTP K-1s are available by mid-March, which can delay your tax filing if you wait for them.

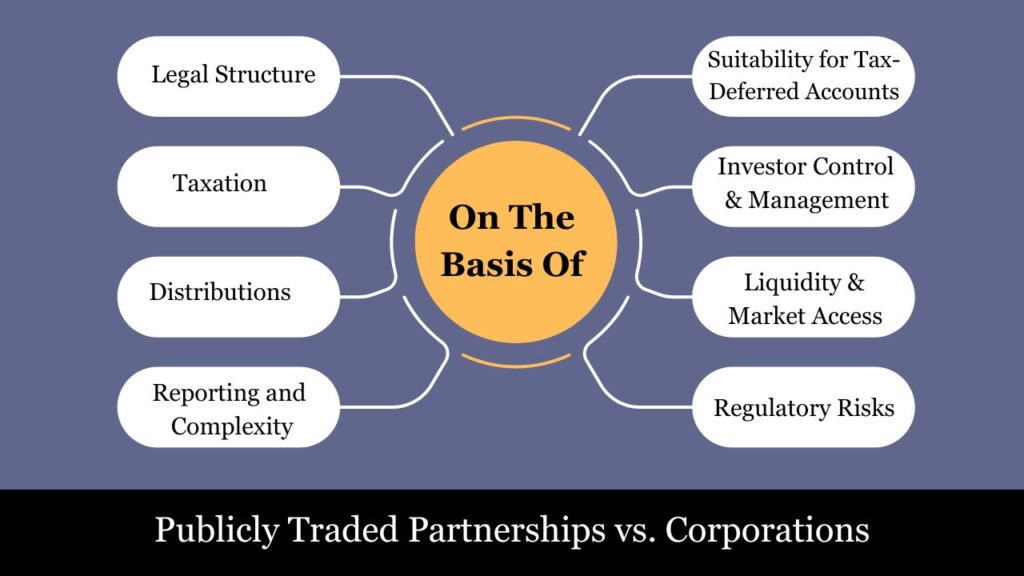

Publicly Traded Partnerships (PTPs) vs. Corporations: A Complete Comparison

Investors often weigh the choice between PTPs and traditional corporations (especially C corporations) based on tax efficiency, reporting complexity, income potential, and legal structure. Below is a deep dive into their key differences:

1. Legal Structure

| PTPs | Corporations |

| Formed as partnerships under state law but publicly traded. | Formed as C corporations under state law and publicly traded on stock exchanges. |

| Governed by a partnership agreement. | Governed by corporate bylaws and articles of incorporation. |

2. Taxation

| PTPs | Corporations (C Corps) |

| Pass-through taxation – income, deductions, credits, and losses flow through to investors (unit holders), who report them on individual tax returns. | C corporations face double taxation: once on corporate income and again when dividends are distributed to shareholders. |

| No federal income tax is imposed at the partnership level. | Subject to a flat 21% federal corporate tax (as of 2025), plus any applicable state corporate taxes. |

| Investors receive Schedule K-1, which reports detailed allocations of income. | Form 1099-DIV is issued for dividend payments, offering an easier reporting method for investors. |

3. Distributions

| PTPs | Corporations |

| Distributions typically reduce an investor’s cost basis (non-taxable until basis is recovered). | Dividends are typically taxable when paid, even if reinvested. |

| Taxable income ≠ cash distributions – can be mismatched. | Dividends reflect after-tax profits; what you see is generally what you report. |

4. Reporting and Complexity

| PTPs | Corporations |

| Tax reporting is more complex – Schedule K-1 can be delayed, and multi-state filings may be needed. | Easier tax reporting – investors simply use 1099-DIV. |

| May require filing in multiple states if the PTP operates in various jurisdictions. | Shareholders rarely need to file in more than their home state. |

5. Suitability for Tax-Deferred Accounts

| PTPs | Corporations |

| Not ideal for IRAs/401(k)s due to Unrelated Business Taxable Income (UBTI) concerns. | Retirement-friendly investment—free from Unrelated Business Taxable Income (UBTI) and extra reporting requirements. |

| UBTI over $1,000 in a retirement account triggers Form 990-T and possible tax. | No UBTI; income and gains are fully tax-deferred inside the account. |

6. Investor Control & Management

| PTPs | Corporations |

| Limited partners (investors) have no control over operations. General partners make all decisions. | The board of directors is chosen by shareholders, who also vote on important corporate decisions. |

| Often focused on energy, pipeline, or natural resource sectors. | Broad industry diversification – from tech to healthcare. |

7. Liquidity & Market Access

| PTPs | Corporations |

| Traded on public exchanges, but some may have lower liquidity. | orporate stocks are highly liquid, with most being key components of major indices like the S&P 500. |

| Commodity price movements and regulatory updates are key drivers of price volatility. | Price affected by earnings, news, macro trends – generally more predictable. |

8. Regulatory Risks

| PTPs | Corporations |

| Subject to ongoing scrutiny – tax laws could revoke favorable pass-through treatment. | More regulatory certainty in tax and reporting obligations. |

- Choose a PTP if you’re comfortable with complex tax filings, want tax-deferred distributions, and are investing in niche sectors like energy or MLPs.

- Choose a corporation if you prefer simplicity, diversification, and are using a tax-deferred account.

Example of a Publicly Traded Partnership (PTP)

Enterprise Products Partners L.P. (NYSE: EPD)

Enterprise Products Partners is one of the largest and most well-known publicly traded partnerships in the United States. It specializes in midstream services within the oil and gas segment of the energy industry.

Key Facts About EPD as a PTP:

- Structure: Limited partnership

- General Partner (GP): Manages the business.

- Limited Partners (LPs): Investors who buy units of the partnership on the stock exchange (like EPD on NYSE).

- Traded Like a Stock: Investors can buy and sell EPD units on the New York Stock Exchange, just like they would shares of a corporation.

- Tax Treatment:

- Instead of dividends, investors receive distributions.

- Investors are issued a Schedule K-1 each year, detailing their share of the partnership’s income, deductions, credits, and more.

- EPD does not pay corporate income tax—the income flows through to unit holders.

- Distributions vs. Dividends:

- Let’s say an investor receives $4.00 per unit in annual distributions from EPD.

- Much of this may be considered return of capital and not immediately taxable, but it reduces the investor’s cost basis in the units.

- Retirement Account Caveat:

- If an investor holds EPD in an IRA and receives more than $1,000 in Unrelated Business Taxable Income (UBTI), they may be required to file Form 990-T and pay tax—even within the retirement account.

Real-World Illustration

Suppose you buy 1,000 units of EPD:

- You receive $4,000 in annual distributions.

- You get a Schedule K-1, which reports:

- $1,000 in ordinary income (taxable now),

- $2,500 in return of capital (not taxable immediately),

- $500 in depreciation-related deductions.

If held in a taxable brokerage account, you’ll report the $1,000 as income, and the rest affects your adjusted basis in the investment.

Conclusion

Publicly Traded Partnerships combine the operational flexibility and tax efficiency of partnerships with the liquidity of publicly traded stock. While they can be tax-advantageous, investors must be prepared for more complex tax reporting and multi-state obligations. They are best suited for experienced investors comfortable with Schedule K-1 reporting and seeking high-yield investments in specialized sectors.

Frequently Asked Questions (FAQs)

What is a Publicly Traded Partnership (PTP)?

A PTP is a limited partnership or limited liability company that trades on public exchanges and passes income, losses, deductions, and credits directly to investors.

How are PTPs taxed?

PTPs are generally not subject to federal income tax at the entity level. Rather than issuing a 1099, the entity provides a Schedule K-1 detailing each investor’s share of earnings for tax reporting.

What form do PTP investors receive at tax time?

Investors receive a Schedule K-1 (Form 1065), detailing their share of the PTP’s income, deductions, and credits.

Are PTP distributions taxable?

Distributions are generally not taxed immediately; they reduce your basis in the investment. Tax is triggered upon sale of the units.

Can I hold PTPs in an IRA or other retirement account?

Permissible, but may lead to the recognition of Unrelated Business Taxable Income. If UBTI exceeds $1,000, the IRA must file Form 990-T and potentially pay tax.

What are the risks of investing in PTPs?

-Complicated tax reporting

-Potential state filing requirements in multiple states

-UBTI exposure in tax-deferred accounts

-Limited liquidity vs. corporations

How are PTPs different from corporations?

Corporations pay corporate tax and issue Form 1099-DIV. PTPs don’t pay corporate tax and issue K-1s, which can offer tax deferral but require more complex tax filing.

Are PTPs suitable for all investors?

PTPs are more suited for tax-savvy investors comfortable with Schedule K-1 reporting and possible multi-state tax obligations.