NJ Mansion Tax: 2025’s Ultimate Review – No Hype!

Table of Contents

NJ Mansion Tax: Must-Read Review of 2025

The NJ Mansion Tax is a one-time real estate transfer tax levied on buyers who purchase high-value residential properties. Specifically, it applies when the purchase price of a residential property reaches or exceeds $1,000,000. This tax is assessed at 1% of the total sale price and is paid by the buyer at the time of closing.

Introduced in 2004 as part of a state initiative to increase revenue, the mansion tax is designed to target luxury home purchases, especially in areas where real estate prices are significantly above the state average—such as parts of Bergen, Essex, Monmouth, and Hudson counties.

Who Is Required to Pay the New Jersey Mansion Tax?

In New Jersey, the responsibility for paying the Mansion Tax rests solely with the buyer of the property—not the seller. This tax is triggered when a residential property is sold for $1,000,000 or more, and it is due at the time of closing as part of the buyer’s settlement costs.

Buyer’s Obligation

Once the threshold is met or exceeded, the buyer is legally obligated to pay a tax equal to 1% of the total consideration (purchase price). This obligation applies regardless of the buyer’s residency status—meaning both New Jersey residents and out-of-state buyers are subject to the tax if purchasing qualifying real estate within the state.

Example: If a New York resident purchases a condominium in Hoboken, NJ for $1.2 million, they must pay $12,000 in Mansion Tax at closing.

Property Types Covered by the New Jersey Mansion Tax (Fully Explained)

The New Jersey Mansion Tax is a targeted real estate transfer tax that applies to specific residential properties sold for $1 million or more. It is important to understand that this tax is not universally applied to all real estate transactions—it is narrowly focused on high-value residential property transfers, with clear guidelines on which types of properties are covered, and which are excluded.

Understanding the applicable property types helps both buyers and real estate professionals accurately anticipate tax obligations at closing.

1. Single-Family Residential Homes

A detached house or single-family dwelling is one of the most common property types subject to the mansion tax. If the purchase price equals or exceeds $1,000,000, the buyer will be liable for the tax, regardless of whether the home is being used as a primary residence, second home, or rental property.

- Example: A buyer purchasing a $1.3 million suburban home in Summit, NJ will pay a mansion tax of $13,000.

2. Two- and Three-Family Homes

These properties are still considered residential under New Jersey law and are therefore subject to the mansion tax if the total sales price meets the threshold. Buyers purchasing duplexes or triplexes—often for investment or multi-generational family living—must be mindful of the tax implications.

- Even if only one unit is owner-occupied and the rest are rented, the entire property is considered residential.

3. Residential Condominiums

Condominium units are fully covered under the mansion tax rules if the individual unit price is $1 million or more. Whether located in high-rise luxury developments, waterfront complexes, or gated communities, condos are treated as standalone residential purchases for tax purposes.

- The tax is calculated per unit, not per building, even if multiple units are bought in the same complex.

4. Cooperative Apartments (Co-Ops)

In a co-op transaction, the buyer purchases shares in a corporation that owns the residential building and receives the exclusive right to occupy a unit. If the value of the co-op unit (i.e., the value of the shares) is $1 million or more, the mansion tax applies.

- Although structured differently from a condo, co-ops are treated as residential real estate for tax purposes in New Jersey.

5. Townhouses and Rowhouses

Attached dwellings such as townhomes, brownstones, and rowhouses are also subject to the mansion tax when their purchase price meets or exceeds $1 million. These units often fall into the luxury housing category in cities like Hoboken, Jersey City, and parts of Bergen County.

- These are typically fee-simple properties, meaning the buyer owns the structure and the land it sits on.

6. Vacant Land Zoned for Residential Use

Although no dwelling exists at the time of sale, vacant land that is officially zoned for residential development can also trigger the mansion tax if sold for $1 million or more. The intent or zoning classification—rather than the presence of a structure—is the determining factor.

- This applies to parcels acquired for building luxury homes or residential subdivisions.

Property Types Not Covered by the NJ Mansion Tax

Several categories of real estate are specifically excluded from mansion tax liability. These include:

1. Commercial and Industrial Properties

- Office buildings, warehouses, retail plazas, and other commercial-use buildings are not subject to the mansion tax, regardless of sale price.

2. Apartment Complexes with Four or More Units

- Properties containing four or more dwelling units, owned and operated as rental housing (e.g., apartment buildings), are treated as commercial real estate and are exempt.

3. Mixed-Use Properties (Primarily Commercial)

- A building that combines residential and commercial space may escape mansion tax if the primary use is commercial (e.g., a storefront with an office or apartment above).

4. Undeveloped Land Zoned Non-Residential

- Vacant land that is zoned for commercial, industrial, or agricultural purposes does not fall under mansion tax rules.

Important Legal Considerations

- The zoning and classification of the property at the time of deed transfer governs whether the mansion tax applies—not the buyer’s future plans for use.

- If a property has both residential and non-residential components, taxability is determined based on the dominant use.

- For properties that straddle categories (e.g., a mixed-use building with a penthouse unit worth $1M), the transaction may still be taxable in part or whole. Legal and tax guidance is advised.

Threshold for Applicability of the New Jersey Mansion Tax

The New Jersey Mansion Tax is not a general tax on all real estate transactions—it applies only when a specific financial threshold is met. The key trigger for this tax is the purchase price of the residential property being equal to or exceeding $1,000,000.

This threshold serves as a legal dividing line between standard residential real estate transactions and those classified as “luxury-level” purchases in the eyes of New Jersey tax law.

What Is the Threshold?

The threshold for applicability of the mansion tax is precisely:

$1,000,000 or more in “consideration” for certain types of real property.

“Consideration” refers to the total amount paid or agreed to be paid for the property, including:

- Purchase price

- Assumption of debt

- Transfer of any property or value as part of the deal

If the full consideration reaches or surpasses $1,000,000, the buyer becomes liable for a 1% tax on the entire amount—not just the amount exceeding the threshold.

Important Clarification: No Partial Exemption

Unlike some tax thresholds that apply only to the excess over a limit, New Jersey’s mansion tax applies to the full purchase price once the $1 million line is crossed.

- Example 1: If a home is sold for $999,999, no mansion tax is due.

- Example 2: If the sale price is $1,000,000, a $10,000 tax (1% of total) is owed.

- Example 3: For a purchase of $1,250,000, the buyer pays $12,500 in mansion tax.

No Proration or Phase-In

The threshold is binary—the tax either applies in full or not at all. There is:

- No proration

- No tiered rate structure

- No progressive calculation

This “cliff” structure makes transactions at or near $1 million particularly sensitive, as even a small increase in negotiated price could impose a large tax liability.

Consideration Includes Non-Cash Elements

In determining whether the threshold has been met, consideration is not limited to cash payments. It includes:

- The value of debt assumed (e.g., mortgage balances)

- The fair market value of anything else of value exchanged

- Additional amounts paid outside of the contract (e.g., for fixtures or rights)

Buyers and attorneys must accurately report all components of consideration on the RTF-1EE affidavit, or risk penalties and delays in recording.

Risk of Underreporting or Structuring

Some buyers may attempt to structure a transaction below the threshold (e.g., offering $999,000 and paying $10,000 under the table). However, New Jersey tax authorities strictly audit such transactions and can impose:

- Additional tax assessments

- Interest and penalties

- Civil fraud charges in egregious cases

Impact on Real Estate Pricing and Negotiation

Because the threshold is fixed, many luxury property buyers and sellers try to negotiate just below the $1 million mark to avoid triggering the tax. However, if the fair market value or disclosed consideration suggests otherwise, the Division of Taxation may still apply the tax.

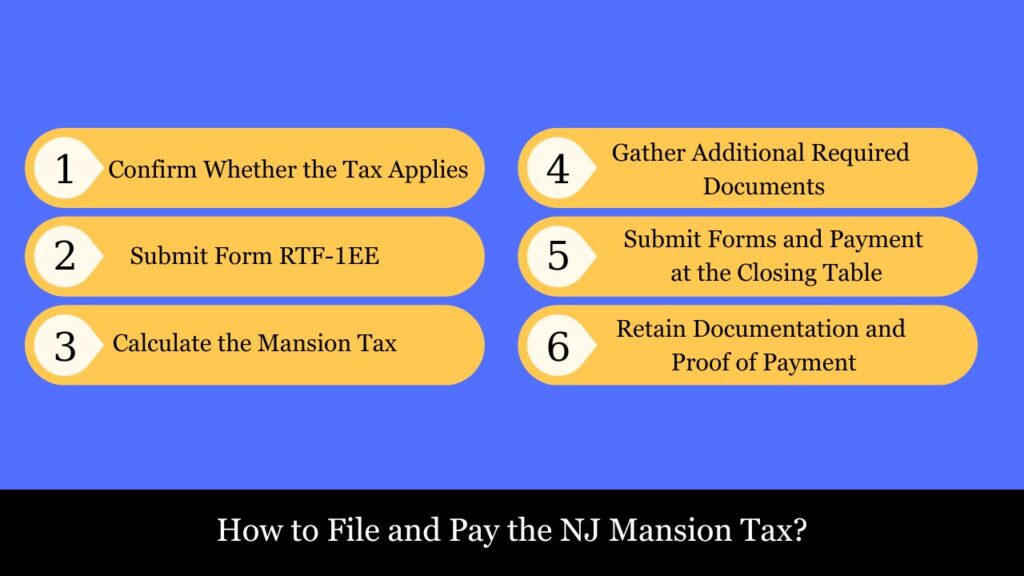

How to File and Pay the NJ Mansion Tax? (Fully Explained)

If you’re purchasing a residential property in New Jersey for $1,000,000 or more, you’re legally required to pay a 1% mansion tax and file the appropriate forms at the time of closing. This tax is administered by the New Jersey Division of Taxation but collected locally via the county clerk’s office where the deed is recorded.

Filing this tax correctly is essential for legal property transfer—failure to do so can delay or even prevent your deed from being recorded.

Process to File and Pay the Mansion Tax

Step 1: Confirm Whether the Tax Applies

Before filing, ensure that:

- The property type is covered (e.g., 1–3 family home, condo, townhouse, co-op).

- The sale price is at or above the $1,000,000 threshold.

- The buyer is not exempt (e.g., not a charitable organization, government agency, or other exempt entity).

Important: The tax applies to the entire purchase price once it meets or exceeds $1,000,000.

Step 2: Submit Form RTF-1EE—Affidavit of Consideration for Buyer—as part of the filing process

The core filing document is the RTF-1EE — a sworn legal affidavit that the buyer completes to:

- Disclose the transaction amount

- Affirm that the mansion tax is due

- Provide property and buyer/seller details

You can download this form from the NJ Division of Taxation or request it from your attorney or title agency.

The RTF-1EE Requires:

- Property description (including block and lot)

- Deed information

- Full legal names of the buyer and seller

- Purchase price or total consideration

- Buyer’s signature and notarization

- Checkboxes for any exemptions (if applicable)

Best Practice: Have the form reviewed by a legal professional to ensure accuracy and avoid rejection at the county clerk’s office.

Step 3: Calculate the Mansion Tax

The mansion tax is assessed at 1% of the total consideration, as calculated below:

Mansion Tax = Purchase Price × 0.01

Examples:

- $1,000,000 purchase → $10,000 tax

- $1,500,000 purchase → $15,000 tax

- $2,250,000 purchase → $22,500 tax

Partial payments are not permitted, and there is no exemption based on residency or financing method.

Step 4: Gather Additional Required Documents

When filing the deed for recording, the following forms are typically submitted together:

- Form RTF-1EE – Affidavit by the buyer

- Form RTF-1 – Affidavit by the seller

- Deed – The new legal document transferring ownership

- Payment – Certified check or wire transfer for the mansion tax (and any other fees)

Where to File: At the county clerk’s office in the county where the property is located (e.g., Hudson, Bergen, Morris County).

Each county may have slightly different filing protocols, so confirm in advance.

Step 5: Submit Forms and Payment at the Closing Table

At the real estate closing:

- The title company or closing attorney typically handles form preparation and payment.

- The mansion tax check is made payable to the County Clerk or per local rules.

- Forms are reviewed and submitted with the deed.

Upon successful recording of the deed, the county clerk remits the mansion tax to the NJ Division of Taxation.

Note: Without full payment and properly completed forms, the deed will not be recorded, which legally halts the transfer.

Step 6: Retain Documentation and Proof of Payment

After the transaction is complete, ensure you receive:

- Recorded deed

- Receipt or proof of mansion tax payment

- Copy of RTF-1EE and other affidavits

These documents serve as legal proof of ownership and are important for future property sales, audits, or tax return filings.

Penalties for Incorrect Filing

Failure to properly file RTF-1EE or pay the required mansion tax may lead to:

- Rejection of deed recording

- Late payment penalties and interest

- State enforcement actions for underreporting or fraud

In addition, knowingly misclassifying a taxable transaction as exempt may lead to civil penalties or criminal charges under New Jersey tax law.

Mansion Tax vs. Realty Transfer Fee (RTF)

When closing a real estate deal in New Jersey, both buyers and sellers may encounter state-imposed taxes. Two of the most commonly confused charges are the Mansion Tax and the Realty Transfer Fee (RTF). While both are related to property transfers, they differ significantly in terms of who pays, when, how much, and which properties are subject to each.

This comparison helps clarify the legal, financial, and procedural distinctions between the two.

Side-by-Side Comparison

| Aspect | Mansion Tax | Realty Transfer Fee (RTF) |

| Who Pays It | Buyer | Seller |

| When It Applies | Purchase price ≥ $1,000,000 | Nearly all real estate sales, regardless of price |

| Rate | Flat 1% of the total consideration | Graduated, starts at $2 per $500 of consideration |

| Payment Timing | At closing, during deed recording | At closing, deducted from seller’s proceeds |

| Purpose | Luxury transaction tax on high-value residential purchases | State/local revenue for recording property transfers |

| Filed With | RTF-1EE (buyer affidavit), submitted at county clerk | RTF-1 (seller affidavit), also submitted at county clerk |

| Who Administers It | New Jersey Division of Taxation (via county clerk) | New Jersey Division of Taxation (via county clerk) |

| Taxable Property Types | Residential (1–3 family homes, condos, co-ops, etc.) | All property types (residential, commercial, vacant land) |

| Exemptions Available? | Limited exemptions (e.g., gov’t buyers, nonprofits) | Yes (e.g., transfers between spouses, low-income exemptions) |

| Refundable? | Rarely | Occasionally, if overpaid or exempt |

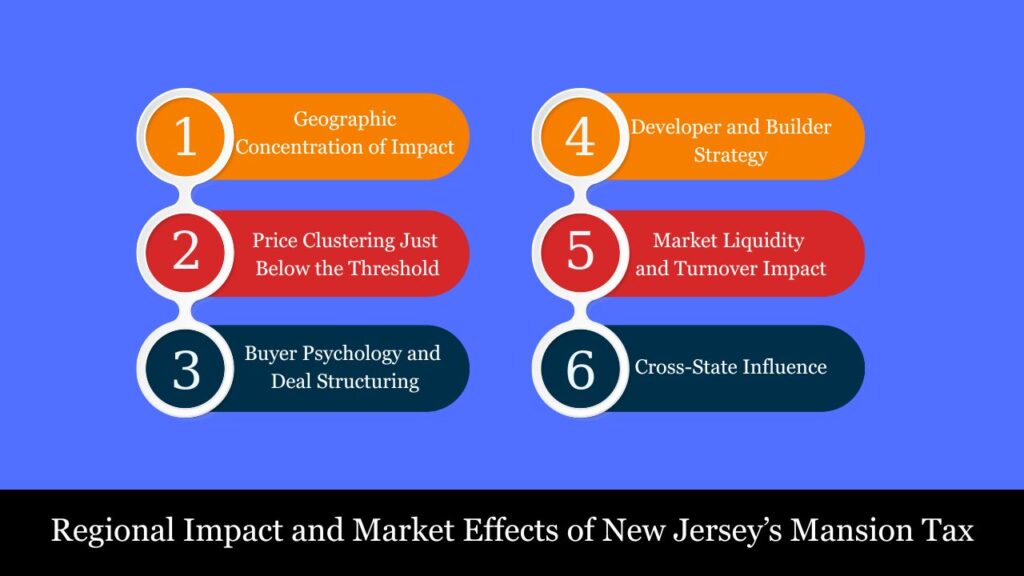

Regional Impact and Market Effects of New Jersey’s Mansion Tax

The New Jersey Mansion Tax imposes a 1% tax on residential property purchases of $1,000,000 or more. Though simple in concept, its real-world effects are highly localized and economically significant, particularly in high-value real estate markets.

This section provides a concise, region-specific, and behaviorally accurate breakdown of how the Mansion Tax shapes buyer and seller decisions, listing patterns, and regional real estate dynamics.

1. Geographic Concentration of Impact

Because the tax applies only when a sale reaches or exceeds $1,000,000, it disproportionately affects specific counties and municipalities where home values routinely approach or exceed this threshold.

High-Impact Regions:

- Bergen County: Alpine, Tenafly, Ridgewood

- Essex County: Short Hills (Millburn), Montclair

- Hudson County: Hoboken, Jersey City waterfront

- Union County: Westfield, Summit

- Morris County: Mendham, Chatham

- Monmouth County: Rumson, Colts Neck

- Somerset County: Bernardsville, Basking Ridge

These areas see routine triggering of the Mansion Tax due to a combination of:

- High median home prices

- Desirable school districts

- Proximity to NYC or major commuter hubs

2. Price Clustering Just Below the Threshold

One of the most visible effects of the Mansion Tax is the strategic listing of homes at $999,999 or slightly below to avoid the 1% surcharge.

Observed Market Behavior:

- Listing agents often encourage sellers to price just under the threshold to increase buyer interest.

- Buyers may request seller concessions or price reductions to bring a $1M+ home under the threshold.

- Properties listed slightly above $1M often take longer to sell due to the psychological resistance associated with the tax.

Example: A home listed at $1,025,000 may sit unsold longer than a similar one priced at $999,000—even if the difference is marginal.

3. Buyer Psychology and Deal Structuring

The Mansion Tax has a real behavioral effect on buyers — especially first-time or move-up buyers entering the luxury bracket.

Common responses from buyers:

- Pause or reconsider offers that cross the $1M mark.

- Request upgrades, credits, or covering of the tax by the seller.

- Work with attorneys to adjust purchase agreements to reduce reportable consideration (e.g., allocating value to furnishings).

4. Developer and Builder Strategy

In regions where $1M is the average luxury entry point, developers of new construction homes often design and price homes specifically to avoid the tax.

Examples:

- New subdivisions may include models priced at $995,000 to remain competitive.

- Luxury townhomes in Hoboken or Edgewater may be designed to fall just under the mansion tax threshold to appeal to young professionals.

5. Market Liquidity and Turnover Impact

The tax also discourages mobility:

- Sellers of appreciated homes may hesitate to upgrade if their next purchase exceeds $1M.

- Empty-nesters in $1.2M+ homes may find it harder to sell due to limited buyer pools above the threshold.

- In some areas, this creates inventory bottlenecks just above $1M and oversupply for homes at $1.05M–$1.1M.

6. Cross-State Influence

The Mansion Tax may incentivize high-income individuals to:

- Buy in New York’s suburbs like Westchester (despite their own tax rules), or

- Relocate to Pennsylvania, where high-end homes often avoid equivalent luxury taxes.

This is especially relevant for dual-state earners and remote workers.

Conclusion

The New Jersey Mansion Tax is a critical closing cost for high-value property purchases. While it affects only properties sold at $1 million or more, buyers should not overlook this potentially large expense. Whether you’re a first-time buyer entering the luxury market or an experienced investor, understanding the mansion tax—and planning accordingly—can help avoid closing surprises and ensure compliance with state law.

Frequently Asked Questions (FAQs)

What is the New Jersey Mansion Tax?

The Mansion Tax is a 1% state tax imposed on residential real estate purchases of $1,000,000 or more. It applies to the entire purchase price, not just the amount above $1 million.

Who pays the Mansion Tax?

The buyer is responsible for paying the Mansion Tax at the time of closing. It is paid when the deed is recorded with the county clerk.

Does the tax apply if the property costs exactly $1,000,000?

Yes. If the purchase price is exactly $1,000,000, the full 1% Mansion Tax applies. The threshold is not “over” $1 million—it includes $1 million exactly.

Can the seller pay the Mansion Tax instead of the buyer?

Legally, the buyer is obligated to pay the tax, but in rare cases, the seller may agree to cover it as a concession during negotiation. However, this must be reflected in the sale contract and closing statement.

Is the Mansion Tax refundable?

Refunds are rare, but may be available if:

-The transaction is canceled prior to deed recording.

-The tax was paid in error.

-An exemption applies and was overlooked.

Refund requests must be submitted to the New Jersey Division of Taxation with proper documentation.

Are any buyers exempt from the Mansion Tax?

Yes, the following buyers may be exempt:

-Government entities (e.g., municipalities, agencies)

-Qualified non-profit organizations (e.g., 501(c)(3))

-Transfers between certain trusts or family members (case-specific)

Does the tax apply to newly built homes or pre-owned homes?

It applies to both new construction and previously owned homes, as long as the total consideration (contract price) is $1,000,000 or more and the property is residential.

Which form must be submitted to report and pay the Mansion Tax?

Buyers must complete and file Form RTF-1EE (Affidavit of Consideration by Buyer), signed and notarized, at the time of recording the deed.

Can the purchase price be reduced to avoid the tax?

Parties may negotiate the contract price, but structuring the deal to avoid the tax (e.g., excluding fixtures or furniture) must be done carefully and legally. Improper structuring could lead to penalties.

Does the Mansion Tax apply to multi-unit buildings?

Yes, if the building has 1–3 residential units, it is subject to the tax if the price is $1 million or more. However, apartment buildings with 4+ units, or buildings used primarily for business, are generally excluded.