Michigan Flow Through Entity Tax: Perfect Review In 2025

Table of Contents

What is the Michigan Flow Through Entity Tax? An Essential Guide

Michigan Flow Through Entity Tax is an elective state-level income tax that allows certain pass-through businesses—such as partnerships, S corporations, and limited liability companies (LLCs)—to pay Michigan income tax at the entity level, rather than having the tax assessed directly on individual owners or shareholders.

This election was introduced in response to the federal $10,000 SALT (State and Local Tax) deduction cap enacted by the Tax Cuts and Jobs Act (TCJA). Michigan’s FTE tax provides a federal workaround by allowing business owners to claim a larger SALT deduction indirectly through the business.

Key Features of Michigan Flow Through Entity Tax

- Elective: Participation is voluntary; eligible entities must elect to pay the FTE tax annually.

- Entity-level tax: Tax is paid by the business itself, not the individual owners or members.

- Federal SALT workaround: Owners benefit from a federal tax deduction for the state tax paid by the entity, potentially reducing their federal income tax.

- Introduced under Public Act 135 of 2021, the FTE tax became available beginning with the 2021 tax year.

Who Can Elect the FTE Tax in Michigan?

The Michigan Flow-Through Entity (FTE) Tax is an optional election available to certain types of business entities that are treated as pass-throughs for federal income tax purposes. This election allows qualifying entities to pay Michigan income tax at the entity level, rather than passing the tax obligation directly to the individual owners or shareholders.

Here’s a detailed look at which entities are eligible—and which are not—to make this election:

Eligible Entities

The following business structures can elect to pay the Michigan FTE tax:

1. S Corporations

Businesses that have made an S corporation election for federal tax purposes under IRC §1362 qualify. These entities pass income and losses through to shareholders, and the FTE election allows the business itself to pay Michigan income tax directly, relieving shareholders from paying it individually on that income.

Requirements:

- Must be federally recognized as an S corp

- Must be doing business in Michigan or subject to Michigan income tax

- Must make the FTE election annually via the Michigan Treasury Online (MTO) portal

2. Partnerships

This includes:

- General partnerships

- Limited partnerships (LPs)

- Limited liability partnerships (LLPs)

These entities typically allocate income, deductions, and credits to partners. Electing the FTE tax allows the partnership to pay Michigan tax directly, with partners receiving a credit on their Michigan individual tax returns.

3. Limited Liability Companies (LLCs) Taxed as Partnerships or S Corporations

LLCs are generally eligible if they are treated as partnerships or S corporations for federal tax purposes. This includes multi-member LLCs that file Form 1065 or have elected to be taxed as S corps via Form 2553.

Note: A single-member LLC (SMLLC) treated as a disregarded entity is not eligible on its own, but may participate if it is owned by an eligible entity (e.g., an S corp).

Ineligible Entities

The following cannot elect the Michigan FTE tax:

- C Corporations (including LLCs taxed as C corps)

- Sole Proprietorships

- Single-member LLCs that are treated as disregarded entities

- Trusts and estates

- Non-profit organizations

These entities are either not taxed as flow-throughs or do not meet the state’s definition of a qualifying flow-through entity for FTE election purposes.

Additional Eligibility Requirements

o complete a valid election for the Michigan FTE tax, the entity must also meet all required registration and filing conditions.:

- Have at least one owner who is subject to Michigan individual income tax or composite return filing

- Make the election by the last day of the tax year (typically December 31)

- File returns and make payments electronically through the Michigan Treasury Online (MTO) system.

Example

Green Leaf LLC, a multi-member LLC taxed as a partnership, earns $500,000 in income. The members are Michigan residents. Green Leaf elects into the Michigan FTE tax and pays 4.25% tax on the entire income. Each member receives a certificate reflecting their share of the tax paid, which they claim as a credit on their Michigan individual tax return.

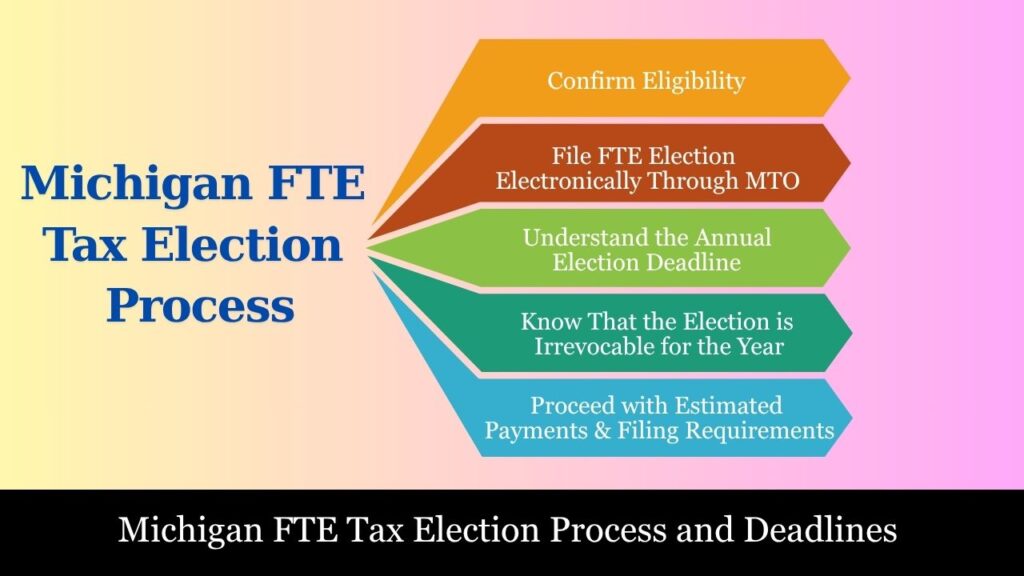

Michigan FTE Tax Election Process and Deadlines – Fully Explained

The election to pay Michigan’s Flow-Through Entity (FTE) tax is voluntary and must be made annually by eligible pass-through entities. The process requires careful attention to eligibility, timing, and filing procedures to ensure the entity can take advantage of the federal SALT deduction workaround without facing penalties or disqualification.

Below is a step-by-step breakdown of how the election process works and when it must be completed:

Step 1: Confirm Eligibility

Before making the election, the entity must ensure it qualifies under Michigan’s FTE tax rules:

- Eligible entities include:

- S corporations

- Partnerships

- LLCs treated as partnerships or S corporations for federal tax purposes

- Ineligible entities:

- C corporations

- Sole proprietorships

- Single-member LLCs (disregarded entities)

- Trusts and estates

If your business does not fall under one of the eligible structures, it cannot elect to participate in the FTE tax.

Step 2: File FTE Election Electronically Through MTO

Entities must submit the FTE tax election electronically using the Michigan Treasury Online (MTO); paper filings are not permitted.

How to Make the Election on MTO:

- Create or log in to your business’s MTO account: https://mto.treasury.michigan.gov

- Locate the “FTE Tax Election” option.

- Choose the applicable tax year for which you wish to make the election.

- Submit the election form with acknowledgment of its binding nature for the year.

Step 3: Understand the Annual Election Deadline

Entities must make the election by the end of the tax year they intend to participate in the FTE tax.

For calendar-year entities:

- The election must be made by December 31 of the applicable tax year.

For fiscal-year filers:

- The election is due by the last day of the fiscal tax year (e.g., June 30 for a July 1 – June 30 filer).

Important: There is no extension available to make the FTE tax election. If the election is not made by the deadline, the entity will not be eligible to participate in the program for that year.

Step 4: Know That the Election is Irrevocable for the Year

Once submitted, the FTE election is:

- Binding for the entire tax year

- Irrevocable—the entity cannot cancel or undo the election after the deadline has passed

Therefore, the decision to elect the FTE tax should be made after consulting with a tax advisor and evaluating the federal and state-level implications for all members or shareholders.

Step 5: Proceed with Estimated Payments and Filing Requirements

After a successful election:

- The entity must begin making quarterly estimated payments (based on anticipated Michigan-sourced income)

- File Form 5774 – FTE Tax Return by March 31 of the following year

- Provide members with FTE tax credit certificates for their individual use

Michigan FTE Tax: Complete Calculation Guide

The Michigan FTE Tax is calculated by applying a flat 4.25% tax rate to the Michigan-sourced taxable income of an eligible electing pass-through entity (such as a partnership or S corporation). However, arriving at that final taxable base involves several important steps, including adjustments, allocation, and apportionment when the business operates in multiple states.

Below is a step-by-step, descriptive guide to accurately calculate the FTE tax owed.

Step 1: Determine Federal Taxable Income

Start by calculating or retrieving the entity’s federal taxable income. This is usually the income reported on:

- Form 1065 for partnerships

- Form 1120-S for S corporations

This federal income forms the base for Michigan’s FTE tax but will need adjustments for Michigan-specific rules.

Step 2: Apply Michigan-Specific Adjustments

To calculate Michigan taxable income, specific additions and subtractions must be made to federal income. These include:

Additions:

- Taxes based on income (e.g., state or local income taxes deducted on the federal return)

- Expenses related to income exempt from Michigan tax

- Non-Michigan depreciation differences

Subtractions:

- Interest from U.S. government obligations

- Income from other states not taxable in Michigan

- Federal bonus depreciation adjustments (if required)

These modifications align the federal income with Michigan’s tax rules.

Step 3: Apply Apportionment (if Multistate Business)

If the entity operates in more than one state, only the Michigan-apportioned share of income is subject to the FTE tax.

Michigan’s Apportionment Formula (for most entities):

(Michigan Sales ÷ Total Sales) = Michigan Apportionment Percentage

Michigan generally uses the MBT single sales factor method to apportion income.

Example: If your business made $4,000,000 in total sales and $1,000,000 of that was to Michigan customers, your apportionment factor is 25%.

Step 4: Calculate Michigan-Sourced Taxable Income

Apply the sales apportionment factor to the adjusted business income.:

Example:

- Federal taxable income: $2,000,000

- Michigan adjustments: +$50,000 (additions), –$20,000 (subtractions)

- Adjusted Michigan income: $2,030,000

- Apportionment factor: 30%

- Michigan taxable income = $2,030,000 × 30% = $609,000

Step 5: Apply the Tax Rate (4.25%)

Multiply the Michigan-sourced taxable income by the FTE tax rate:

FTETax=Michigan Taxable Income ×4.25%

Continuing the Example:

FTETax =$609,000×4.25% =$25,882.50

This is the total entity-level tax owed under Michigan’s FTE election.

Step 6: Allocate Tax Among Members/Owners

Once the total FTE tax is calculated, the entity must allocate it to each member, partner, or shareholder based on their ownership percentage or profit-sharing ratio.

This allocation is used to:

- Report each owner’s share of tax paid

- Issue the FTE Tax Credit Certificate, which owners will use to claim the credit on their individual Michigan income tax return (Form MI-1040)

Owner Credit Example:

If three partners own the business equally and the FTE tax is $25,882.50, each would receive a credit certificate for:

$25,882.50 ÷ 3 =$8,627.50

Full Example – Summary:

Let’s assume the following for XYZ Partnership:

- Federal taxable income: $1,200,000

- Additions: $20,000

- Subtractions: $10,000

- Net Michigan adjusted income: $1,210,000

- Michigan sales: $600,000

- Total sales: $2,400,000

- Apportionment: 600K / 2.4M = 25%

- Michigan taxable income: $1,210,000 × 25% = $302,500

- FTE tax owed: $302,500 × 4.25% = $12,856.25

If there are two equal partners, each receives a credit certificate for:

$12,856.25 ÷ 2 =$6,428.13

Each partner will claim that amount as a refundable credit on their MI-1040 return.

Notes and Compliance Tips

- Quarterly estimated payments are required if the tax is expected to exceed $800 annually.

- Underpayment may lead to interest and penalty assessments.

- Use Michigan Treasury Online (MTO) for filing, paying, and issuing credit certificates.

- Maintain accurate ownership records to ensure correct allocation of the FTE tax.

Required Forms and Reporting for Michigan FTE Tax

Electing the Michigan Flow-Through Entity (FTE) Tax involves multiple filing steps, each with specific forms, deadlines, and responsibilities. Accurate and timely reporting ensures that the entity complies with state law and that its owners can properly claim the tax credit on their individual income tax returns.

Below is a breakdown of all essential forms and reporting requirements, including who files them, when they’re due, and what they must include.

1. Michigan Treasury Online (MTO) – Election Submission

Purpose:

To opt into the FTE tax system for a specific tax year.

How:

- Submit the election through Michigan Treasury Online (MTO).

- The election must be made electronically — paper filings are not accepted.

Deadline:

- The election must be completed by the final day of the entity’s tax year (e.g., December 31, 2025 for calendar-year filers).

- Once made, the election is final and cannot be changed for that tax year.

2. Quarterly Estimated Payments

Required Reporting:

No specific paper form is filed for estimated payments, but payment details must be entered on MTO and reported later on the annual return (Form 5774).

Due Dates:

- April 15

- June 15

- September 15

- January 15 of the following year

Late estimated payments can lead to interest accrual and penalty assessments.

3. Form 5774 – Michigan Flow-Through Entity Tax Return

Purpose:

To report total Michigan-sourced income, compute the FTE tax liability, and reconcile payments for the tax year.

Key Sections Include:

- Entity details and election confirmation

- Michigan income (adjusted and apportioned)

- Tax liability calculation (at 4.25%)

- Estimated payments made

- Balance due or refund

- Summary of tax allocated to each owner/member

Filing Deadline:

- Must be filed by March 31 of the year after the tax year ends.

- No extensions are currently available.

Where to File:

- Must be filed electronically via MTO.

4. Flow-Through Entity Tax Credit Certificates

Purpose:

To document each member’s or owner’s share of the FTE tax paid by the entity.

Issued By:

- The entity after filing Form 5774

Content Includes:

- Owner’s name and SSN/ITIN

- Owner’s percentage of ownership or profit allocation

- Share of FTE tax paid

- Entity name and FEIN

- Tax year for which the credit applies

Due:

- Must be issued to owners promptly after filing Form 5774, so they can claim the credit on time.

5. Form MI-1040 – Individual Income Tax Return

Filed By:

- Michigan resident and nonresident owners of the electing FTE

Where It Fits:

- Owners claim the Flow-Through Entity Tax Credit on Schedule 3, Line 23 of Form MI-1040

- The credit amount should match the figure provided in the owner’s certificate

Credit Type:

- It’s refundable, meaning it can lower your tax bill and any surplus is returned as a refund.

Summary Table – Required Forms & Reporting

| Form / Item | Purpose | Filed By | Due Date | Filed Via |

| MTO Election Submission | Elect FTE tax treatment | Flow-through entity | By end of tax year | Michigan Treasury Online |

| Quarterly Estimated Payments | Meet ongoing tax obligations | Flow-through entity | 4 times/year | MTO |

| Form 5774 | Report income & calculate FTE tax | Flow-through entity | March 31 (next year) | MTO |

| FTE Tax Credit Certificates | Document owners’ credit eligibility | Flow-through entity | After filing Form 5774 | Issued by entity |

| Form MI-1040 + Schedule 3 | Claim FTE tax credit | Individual owners | April 15 (individual due) | Paper or e-file |

Penalties for Noncompliance with Michigan FTE Tax Requirements

While electing the Michigan Flow-Through Entity (FTE) tax is voluntary, once an election is made, the entity must comply with strict filing and payment obligations. Failing to do so can lead to financial penalties, interest charges, and potential disruption in credit allocation to owners.

Below is a comprehensive breakdown of the penalties that apply under Michigan law:

1. Late Payment of FTE Tax

If an electing entity fails to pay the full amount of FTE tax owed by the filing deadline (March 31), the Michigan Department of Treasury may assess:

Penalty:

- Unpaid taxes are subject to a 5% monthly penalty for the first two months, then,

- An additional 5% per month thereafter, up to a maximum of 25%.

Interest:

- Interest accrues daily at the annual rate set by the state, compounded monthly.

- The current rate (subject to change) is published by the Treasury and adjusted semiannually.

Example: If $10,000 in tax is unpaid and not submitted by the due date, the penalty could reach $2,500 over time, plus interest.

2. Late Filing of Form 5774

Even if tax is paid, failure to timely file Form 5774 (due by March 31) may result in separate penalties.

Penalty for Late Filing:

- Typically $10 to $25 per day, depending on entity size and filing history, up to a maximum of $250–$750.

Filing is required even if no tax is due — to validate the election and allow credit certificates to be issued.

3. Underpayment of Estimated Payments

Entities that underpay their required quarterly estimated payments are subject to penalty and interest, especially if the total FTE tax liability for the year exceeds $800.

Estimated Payment Thresholds:

- Entities are required to remit at least 85% of their current year liability, or

- Alternatively, full payment of last year’s tax is required if the FTE election was in effect.

Penalty for Underpayment:

- Similar to individual income tax underpayment penalties:

- Generally, a 1.5% monthly interest applies to the unpaid portion of each quarterly payment.

- Plus daily accruing interest

4. Failure to Issue FTE Credit Certificates to Owners

Failure to timely issue FTE Tax Credit Certificates to partners, shareholders, or members:

- May result in owners being unable to claim their rightful refundable credit

- Could expose the entity to complaints or disputes from owners

- Could trigger audit inquiries or administrative penalties

No formal monetary penalty is published for this failure, but it may indirectly jeopardize owner compliance and cause reputational harm.

5. Invalid or Missed Election

If an entity fails to make a valid election by the end of the taxable year, it:

- Cannot retroactively participate in the FTE program

- Will not be able to claim the entity-level deduction

- Will not be allowed to file Form 5774 or distribute FTE credits

There is no grace period or extension option — the election is strictly annual and irrevocable once missed.

Conclusion

The Michigan Flow-Through Entity Tax is a powerful tool for eligible businesses to lower the overall federal tax burden for their owners while ensuring compliance with state tax rules. Though optional, this election can lead to significant tax savings, particularly for high-income earners affected by the federal SALT cap. However, it requires careful annual planning, timely filing, and accurate allocation of income and credits among members

Frequently Asked Questions (FAQs)

What is the Michigan FTE Tax?

The Michigan Flow-Through Entity (FTE) Tax is an optional tax that pass-through businesses (like partnerships, S corporations, and LLCs taxed as such) can elect to pay at the entity level. It allows the business to deduct state taxes federally and provides a refundable credit to owners.

Why should a business elect the FTE tax?

Electing the FTE tax helps bypass the $10,000 federal SALT deduction cap imposed on individuals. The entity pays the state tax and deducts it as a business expense, reducing federal income. Owners then receive a refundable credit on their Michigan tax return.

Who is eligible to make the election?

Eligible entities include:

-Partnerships

-S corporations

-LLCs taxed as partnerships or S corps

Ineligible entities include:

-C corporations

-Sole proprietors

-Trusts

-Disregarded single-member LLCs

When is the election deadline?

For calendar-year entities, the election must be submitted by December 31 of that year. For fiscal-year filers, it’s due by the last day of their taxable year.

What is a Flow-Through Entity Tax Credit Certificate?

It’s a certificate issued by the electing entity that shows each owner’s share of FTE tax paid. Owners use this to claim a refundable credit on their Michigan Individual Income Tax Return (Form MI-1040).

Is the FTE tax election permanent?

No. It’s an annual election. Entities must make a new election each year if they want to continue participating.

Can the election be revoked or amended after year-end?

No. The election is irrevocable once made and cannot be changed after the deadline.

Are there penalties for late filing or payment?

Yes. Late filing or payment of FTE tax can result in:

–Up to 25% penalty on unpaid tax

–Daily interest

–Filing penalties up to $750

–Owner-level issues if credit certificates are delayed

Is the FTE tax credit refundable to owners?

Yes. The credit is fully refundable. If it exceeds the owner’s Michigan tax liability, the excess is refunded.

Does this affect federal income tax returns?

Yes. The FTE tax is treated as a deductible business expense on the federal return, reducing the federal taxable income of the entity and its owners.

Is Michigan’s FTE tax similar to other states’?

Yes. Michigan’s FTE tax is part of a national trend where states offer entity-level workarounds to the SALT deduction cap, like California, New York, Illinois, and others.