Lowa State Tax Refund In 2025: Filing Process, Calculations & Deadline

Table of Contents

When Will I Get My Lowa State Tax Refund? Everything You Need to Know

For Iowa residents and individuals with Iowa-source income, the state tax refund process is an essential part of annual tax planning. If you’ve paid more in income taxes than you actually owe for the year—whether through employer withholding, estimated quarterly payments, or refundable credits—you may be entitled to receive money back from the Iowa Department of Revenue (IDR).

What Is an Iowa State Tax Refund?

Lowa State Sax Refund is a reimbursement issued by the state government to taxpayers who have overpaid their individual income taxes. This overpayment can arise from:

- Withholding too much from wages during the year

- Paying excessive estimated quarterly taxes

- Being eligible for refundable credits that result in a tax refund when your liability falls below zero

The refund is only issued after you file a complete and accurate Iowa individual income tax return (Form IA 1040).

Who Can Claim an Lowa State Tax Refund?

Not everyone is required to file a state tax return, but many Iowans who do file are eligible for a refund—sometimes even when they had little or no tax liability. An Iowa state tax refund is available to any individual who overpaid their income tax to the state of Iowa through withholding, estimated payments, or qualifying refundable credits.

Below is a detailed overview of who qualifies:

1. Full-Year Iowa Residents

If you were a legal resident of Iowa for the entire tax year and:

- Had Iowa state income tax withheld from your paycheck (Box 17 on Form W-2), and

- Your actual tax liability (calculated using Form IA 1040) is less than the total amount withheld,

You are eligible to receive the difference as a refund.

Even if you didn’t have income high enough to owe taxes, you may still qualify for refundable credits that generate a refund.

2. Part-Year Residents

Anyone who relocated to or from Iowa during the tax year is considered a part-year resident. You can claim a refund if:

- You paid Iowa income tax during the portion of the year you lived in the state,

- And your tax withholdings or estimated payments exceeded your Iowa tax liability.

You’ll need to allocate income between Iowa and other states using Form IA 126.

3. Nonresidents with Iowa-Source Income

Even if you don’t live in Iowa, you may be eligible for a refund if:

- You earned Iowa-source income (e.g., wages, rental income, or business income),

- And Iowa taxes were withheld or paid through estimated payments.

If your Iowa income was over-withheld or miscalculated, and you paid more than what was actually owed based on Iowa’s tax rules, you can claim the excess via refund.

Nonresidents also use Form IA 126 to apportion income and calculate their refund.

4. Low-Income Earners and Seniors

You may be entitled to a refund even if you were not required to file a return, such as:

- Students and part-time workers whose total income was under the filing threshold

- Retirees receiving Social Security and small pension distributions

- Seniors or disabled individuals eligible for the Property Tax Credit or Rent Reimbursement

Example: A senior renter may be eligible to receive a refund through Iowa’s Rent Reimbursement Program, even with no income tax liability.

5. Taxpayers Eligible for Refundable Credits

Refundable credits reduce your tax liability below zero, resulting in a cash refund even if you paid no income tax. Common refundable Iowa credits include:

- Iowa Earned Income Tax Credit (EITC) – calculated as 15% of your federal EITC amount

- Child and Dependent Care Credit

- Early Childhood Development Credit

- Tuition and Textbook Credit

- Volunteer Firefighter/EMS Tax Credit

If your total credits exceed your calculated tax, the extra amount is refunded to you.

6. Self-Employed and Estimated Taxpayers

Freelancers, independent contractors, and business owners who pay quarterly estimated taxes may overestimate their liability. If:

- Your estimated payments for the year are higher than your final tax due,

- You have no tax penalties for underpayment,

Then the excess amount will be refunded upon filing Form IA 1040.

Important Note on Refund Eligibility:

To receive a refund, you must file within three years of the original return due date or one year from the payment date—whichever is later. Missing this deadline means the refund will be forfeited.

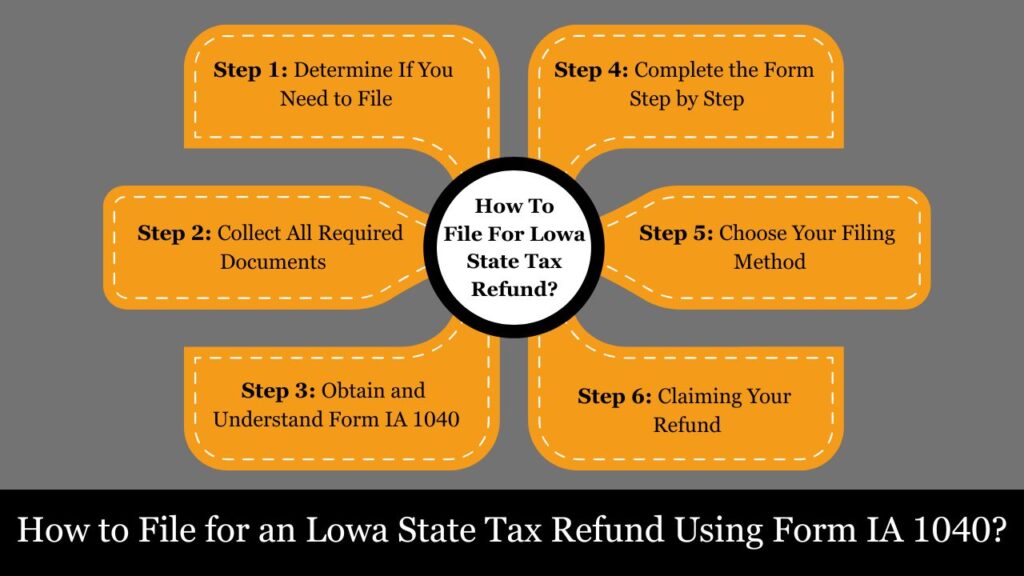

How to File for an Lowa State Tax Refund Using Form IA 1040?

To receive a refund for overpaid income taxes in Iowa, you must file a complete and accurate Iowa Individual Income Tax Return using Form IA 1040. This form determines your state tax liability, applies any deductions or credits, and calculates whether the taxes you’ve already paid (through withholding or estimated payments) exceed your final liability—resulting in a refund.

This guide explains everything you need to know about the filing process, documentation, methods, and timelines.

Step 1: Determine If You Need to File

Before anything else, determine if you should or must file a return:

You should file if:

- Iowa taxes were withheld from your paycheck or income

- You made estimated payments

- You qualify for refundable credits (e.g., Iowa Earned Income Tax Credit)

- You want to claim the Property Tax Credit or Rent Reimbursement

Even if your total income was below the filing threshold, you may still be entitled to a refund and should file to claim it.

Step 2: Collect All Required Documents

Gather the following information and forms before starting:

Income Documents

- W-2s from employers (Box 17 shows Iowa withholding)

- 1099s for contract, interest, pension, or unemployment income

- K-1s from partnerships, estates, or trusts

Federal Return Information

- Your completed IRS Form 1040 – Iowa starts with your Federal AGI (Adjusted Gross Income)

Personal Info

- Social Security Numbers (for you, spouse, and dependents)

- Bank routing and account numbers (for direct deposit)

Supporting Records

- Childcare provider expense receipts

- Education-related expenses for tuition credits

- Property tax statements or rent paid

- Previous Iowa tax return (if amending)

Step 3: Obtain and Understand Form IA 1040

Form IA 1040 is Iowa’s official individual income tax return. It consists of multiple parts that compute your Iowa taxable income, tax due, credits, and refund or balance owed.

You can obtain the form by:

- Downloading from https://tax.iowa.gov

- Using e-file platforms

- Requesting a printed version from the Iowa Department of Revenue

Step 4: Complete the Form Step by Step

Section Overview:

| Section | Purpose |

| Step 1 | Personal information: Name, SSN, residency, filing status |

| Step 2 | Enter Federal AGI from IRS Form 1040, Line 11 |

| Step 3 | Adjustments to income (e.g., military pay subtraction, college savings deductions) |

| Step 4 | Deduct standard or itemized deductions (Schedule A if itemizing) |

| Step 5 | Calculate Iowa taxable income and determine tax using the current rate structure |

| Step 6 | Claim nonrefundable and refundable credits (EITC, Child Care Credit, Tuition Credit) |

| Step 7 | Report withholding, estimated tax payments, and any prior-year overpayments |

| Step 8 | Calculate refund or balance due |

| Step 9 | Designate refund method (direct deposit or paper check) |

Required Schedules You May Need:

- Schedule A: For itemized deductions

- Schedule IA 126: For part-year or nonresident income apportionment

- Schedule IA 130: For tax credits

- Credit forms: If claiming tuition, dependent care, early childhood, or EITC

Step 5: Choose Your Filing Method

Option 1: Electronic Filing (Recommended)

E-filing is the fastest and most secure method. Iowa allows e-filing through:

- Iowa eFile & Pay: https://tax.iowa.gov/file-pay

- IRS Free File: For income under $79,000

- Commercial software: TurboTax, H&R Block, FreeTaxUSA, etc.

- Authorized e-file providers (accountants and tax preparers)

Refunds via e-file and direct deposit are typically issued within 2–6 weeks.

Option 2: Paper Filing

If filing by paper, mail your signed Form IA 1040 and all supporting schedules to:

Iowa Department of Revenue

P.O. Box 9187

Des Moines, IA 50306-9187

Include:

- All W-2s and 1099s with state withholding

- Supporting schedules and documentation

- Clear, legible handwriting or typed entries

Refunds by paper filing can take 8–12 weeks or longer.

Step 6: Claiming Your Refund

Once the form is completed, if your total tax payments exceed your calculated tax liability, the difference is your refund.

You can choose to:

- Receive it via direct deposit (fastest option)

- Apply it toward next year’s tax as a credit

- Receive a paper check

Ensure your bank routing and account numbers are accurate if selecting direct deposit.

Refund Filing and Claim Deadlines

| Action | Deadline |

| File 2024 Iowa return | April 30, 2025 |

| Claim refund | Within 3 years from due date or 1 year from payment date (whichever is later) |

| Amend a return | Same as refund claim deadline |

Filing after the deadline may result in losing your refund.

Example Scenario: Claiming a Refund

Emily, a part-year Iowa resident, worked in the state for six months in 2024. Her employer withheld $1,100 in Iowa tax. After adjusting for her Iowa income and applying the part-year allocation using Schedule IA 126, she finds her actual Iowa liability was only $820. After completing Form IA 1040, she files electronically and selects direct deposit. Her $280 refund is credited to her bank account within 3 weeks.

How to Calculate Your Iowa State Tax Refund?

Your Iowa state tax refund is calculated by comparing the total amount of income taxes you paid during the year (through paycheck withholding or estimated payments) to your actual Iowa tax liability, which is determined by your taxable income and the state’s tax structure.

If your payments exceed your liability, the difference is refunded to you.

Refund Calculation Formula

Refund = (Total Iowa Tax Withheld + Estimated Payments + Refundable Credits) - (Iowa Tax Liability + Penalties or Use Tax Owed)Components Explained Step-by-Step

1. Start with Federal AGI (Adjusted Gross Income)

Find this number on Line 11 of your IRS Form 1040 and enter it on Form IA 1040.

This is the base amount from which Iowa starts its tax calculation.

2. Make Iowa Adjustments

Iowa makes additions and subtractions to federal AGI. Examples include:

Common Additions:

- Federal bond interest (tax-exempt federally but taxable in Iowa)

Common Subtractions:

- Social Security benefits

- Military retirement pay

- College savings Iowa 529 plan contributions

This gives your Iowa net income.

3. Apply Deductions

You can claim either:

- Standard Deduction (for 2025):

- $2,210 for single filers

- $5,450 for married filing jointly

OR

- Itemized Deductions (Schedule A), which may include:

- Charitable contributionsMortgage interestMedical expenses

- Property taxes paid

This gives your Iowa taxable income.

4. Calculate Iowa Income Tax

Iowa’s tax system is transitioning to a flat tax:

- For tax year 2025, a flat 3.8% tax rate applies to all taxable income

IowaTaxLiability=Iowa Taxable Income ×3.8%

5. Subtract Tax Credits

Apply any credits that reduce your tax liability:

Nonrefundable Credits (reduce tax to $0, but not below):

- Tuition & Textbook Credit

- Child and Dependent Care Credit

- Volunteer Firefighter/EMS Tax Credit

Refundable Credits (can result in a refund):

- Iowa EITC (15% of federal EITC)

- Early Childhood Development Credit

- Claim of Right Credit

6. Calculate Total Payments Made

Add up:

- Iowa income tax withheld (from W-2s and 1099s)

- Quarterly estimated tax payments

- Prior-year overpayment applied to current year

This is your total pre-paid tax.

7. Calculate the Refund or Amount Owed

Compare your total payments to your tax liability after credits:

- If payments > liability → you get a refund

- If liability > payments → you owe the balance

Example: Iowa State Tax Refund Calculation

Taxpayer: John (Single)

Federal AGI: $40,000

Iowa Standard Deduction (2025): $2,210

Iowa Withholding: $1,600

Federal EITC: $1,000 (15% for Iowa = $150)

Calculation:

- Iowa Taxable Income = $40,000 − $2,210 = $37,790

- Iowa Tax (Flat 3.8%) = $37,790 × 3.8% = $1,436.02

- Refundable Credit (Iowa EITC) = −$150

- Final Tax Liability = $1,436.02 − $150 = $1,286.02

- Withholding Paid = $1,600

Refund = $1,600 − $1,286.02 = $313.98

Optional Additions/Subtractions That Can Affect Final Refund:

- Use tax due on online purchases (added to total tax)

- Penalties or interest (for underpayment or late payment)

- Property Tax Credit or Rent Reimbursement (may increase refund)

Conclusion

Claiming an Iowa state tax refund is a straightforward but time-sensitive process that begins with accurately filing Form IA 1040. Whether you’ve had too much tax withheld from your wages, qualify for refundable credits, or made estimated payments exceeding your final liability, Iowa allows eligible taxpayers to reclaim their overpayments.

To ensure you receive your refund:

- Gather your documents early

- File by the April 30 deadline

- Choose direct deposit for faster refunds

- Track your refund status online

Missing the refund window — generally three years from the return’s due date — may mean permanently forfeiting the money you’re owed. With proper documentation and timely filing, most taxpayers can expect a smooth refund experience from the Iowa Department of Revenue.

Frequently Asked Questions (FAQs)

Who is eligible for an Iowa state tax refund?

Anyone who has overpaid Iowa individual income taxes through wage withholding, estimated tax payments, or refundable tax credits may qualify for a refund. To assess your eligibility, you must submit a completed Form IA 1040.

What form is used to claim an Iowa state tax refund?

Use Form IA 1040 (Iowa Individual Income Tax Return) to report your income, calculate your tax liability, and claim any overpayment as a refund.

When is the deadline to file for a refund?

In most cases, you must file within three years of the return’s original due date or one year from the date the tax was paid—whichever comes later.

How soon can I expect to receive my Iowa state tax refund?

–E-file with direct deposit: Usually 2–6 weeks

–Paper filing with mailed check: Typically 8–12 weeks

How can I check my Iowa refund status?

Use Iowa’s “Where’s My Refund” tool by entering your Social Security number, tax year, and refund amount to check your refund status online.

Can I receive my refund via direct deposit?

Yes. You can request a direct deposit by entering your routing and account number on Form IA 1040 for a faster refund.

What if I made a mistake on my return?

File an amended return using Form IA 1040X. If it results in a refund, submit it within the same 3-year/1-year refund window.

Will Iowa tax my federal refund?

No. A federal income tax refund is not taxable income in Iowa and does not affect your Iowa state tax refund.

Can nonresidents get a refund from Iowa?

Yes, if Iowa tax was withheld or paid on Iowa-source income. Nonresidents should file Form IA 1040 with Schedule IA 126 to allocate income.

What if I miss the refund deadline?

Refund claims filed after the deadline are automatically denied. It’s important to file on time to preserve your right to a refund.