Iowa Sales Tax Exemption Certificate: An Excellent Overview In 2025

Table of Contents

Quick Guide to Iowa Sales Tax Exemption Certificate

The Iowa Sales Tax Exemption Certificate is a formal legal document used by eligible purchasers to claim exemption from paying Iowa sales and use tax on qualifying purchases. When this certificate is properly completed and presented to a seller, it serves as proof that the buyer is not required to pay sales tax on that specific transaction—because the item or service will be used in a way that Iowa tax law defines as non-taxable.

This form is most commonly used in transactions involving resale, manufacturing, farming, construction for exempt entities, or nonprofit organizational use.

Purpose and Legal Significance

The exemption certificate is crucial for:

- Allowing qualified buyers to make legitimate tax-free purchases

- Ensuring compliance with Iowa tax law for both sellers and buyers

- Serving as a defensive document during audits conducted by the Iowa Department of Revenue

Without this certificate, the seller is required by law to collect Iowa sales tax. If the form is not provided or is filled out incorrectly, the buyer may have to pay tax even if they would otherwise qualify for an exemption.

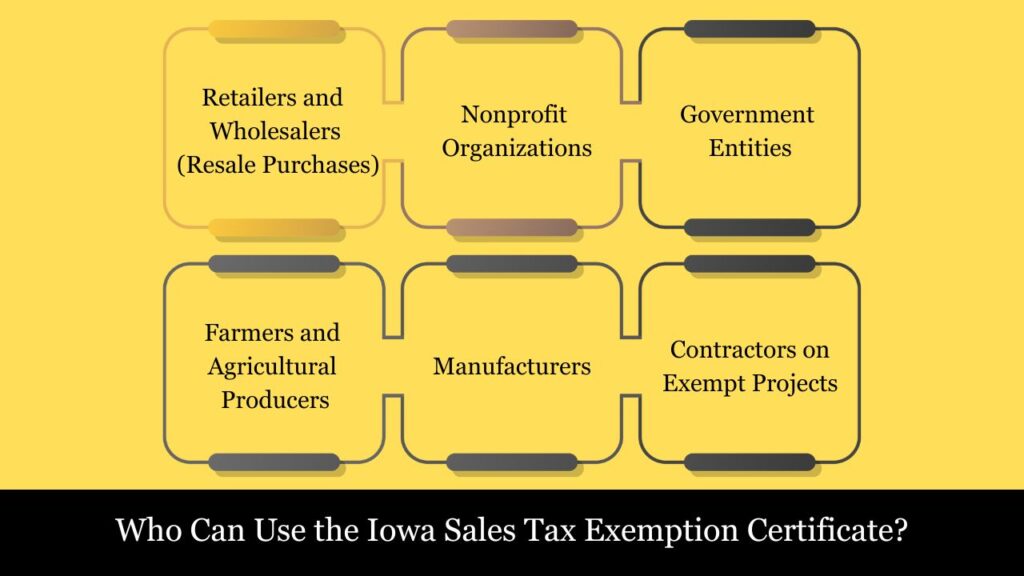

Who Can Use the Iowa Sales Tax Exemption Certificate?

The Iowa Sales Tax Exemption Certificate is not a universal form that every consumer can use. It is specifically reserved for qualified individuals, organizations, and businesses whose purchases fall under legally defined exemptions in Iowa tax law. These exemptions are based on how the purchased item or service will be used, and who is making the purchase.

Below is a detailed look at the categories of buyers who may lawfully use this form:

1. Retailers and Wholesalers (Resale Purchases)

Businesses that purchase tangible goods with the intent to resell them in the regular course of business can use the exemption certificate. This includes retailers, wholesalers, and distributors who are not the end-users of the product.

- Example: A bookstore buying books to stock its shelves for resale.

- Required Info: The purchaser must provide their Iowa sales tax permit number.

2. Nonprofit Organizations

Organizations that qualify under Section 501(c)(3) of the Internal Revenue Code and are engaged in charitable, religious, or educational activities may be eligible for exemption.

- Examples:

- Churches purchasing supplies for religious services.

- Private schools buying educational materials.

- Important: The purchase must directly support the organization’s tax-exempt mission. Personal or unrelated purchases do not qualify.

3. Government Entities

Federal, state, county, and municipal government agencies can use the certificate when making purchases for official government use. These agencies are automatically exempt under Iowa law.

- Examples:

- A city government purchasing office furniture for city hall.

- A public university buying lab equipment.

- Note: The purchase must be made directly by the government agency, not reimbursed through a third party.

4. Farmers and Agricultural Producers

Individuals engaged in agricultural production for market may claim exemption for goods and services used directly and primarily in farming activities.

- Examples:

- Fertilizer, feed, and seed.

- Farm machinery and replacement parts.

- Requirement: The buyer may need to certify that the item will be used primarily in production agriculture.

5. Manufacturers

Companies that manufacture goods may claim exemption on certain purchases used directly in the production process. This applies to both materials that become part of the final product and machinery that is essential for production.

- Examples:

- A factory buying conveyor belts or raw materials.

- Packaging materials used to ship finished goods.

- Note: Office supplies or administrative items do not qualify for exemption.

6. Contractors on Exempt Projects

Contractors performing construction, remodeling, or repair work on behalf of tax-exempt entities may claim exemption on materials used for that specific project.

- Example: A contractor working on a school building (which is tax-exempt) purchases drywall using the exemption certificate.

- Required: Typically requires project documentation or a construction exemption letter issued by the Iowa Department of Revenue.

Who Cannot Use the Iowa Sales Tax Exemption Certificate?

- General consumers buying items for personal use.

- Employees making reimbursed purchases unless directly authorized by the exempt entity.

- Businesses purchasing taxable items for internal use (e.g., office supplies for the company’s own use).

Using the exemption certificate without proper justification is illegal and may result in penalties, interest, and back taxes, as well as possible criminal prosecution for fraud.

Which Official Form Is Required To Claim Sales Tax Exemption In Iowa?

For claiming sales tax exemption in Iowa, the official form to use is:

Iowa Sales/Use/Excise Tax Exemption Certificate (Form 31-014a)

- This form is used by eligible purchasers to document their claim of exemption from Iowa sales and use tax.

- It must be completed by the buyer and provided to the seller to avoid sales tax collection.

- Sellers keep this form on file as proof of the exemption.

You can download Form 31-014a directly from the Iowa Department of Revenue website:

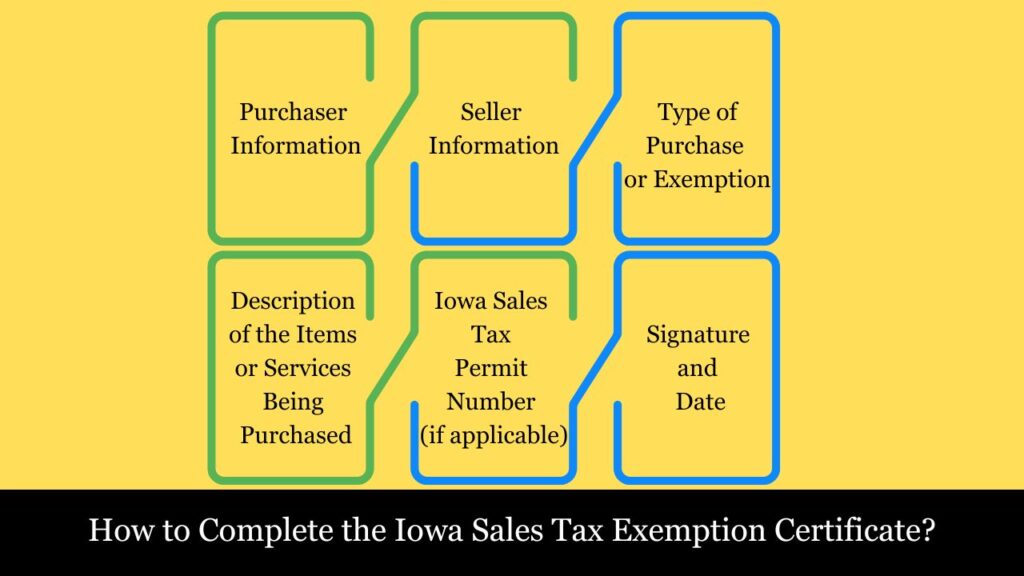

How to Complete the Iowa Sales Tax Exemption Certificate?

The Iowa Sales/Use/Excise Tax Exemption Certificate (Form 31-014a) must be properly filled out to ensure your purchase is legally exempt from Iowa sales tax. Completing this form correctly is essential for both the buyer (who claims the exemption) and the seller (who must retain the form as documentation in case of audit).

Let’s walk through each section of the certificate with clear explanations:

1. Purchaser Information

This section identifies the person or entity claiming the exemption.

You must include:

- Full legal name of the individual or business making the purchase.

- Address, including street, city, state, and ZIP code.

- Contact information such as phone number or email (if requested).

Tip: Use your official business or nonprofit address, not a personal one, unless you’re a sole proprietor.

2. Seller Information

This section documents who the purchaser is buying from.

You must provide:

- The seller’s business name.

- The seller’s address (or at minimum, the city and state).

Tip: If the seller has multiple store locations, include the one where the purchase is taking place.

3. Type of Purchase or Exemption

Here, the purchaser indicates why the transaction is exempt from Iowa sales tax.

You must check the appropriate exemption type. Common options include:

- Resale – You are buying goods to resell as-is or as part of a taxable service.

- Manufacturing – Items used directly and primarily in manufacturing.

- Agricultural Production – Goods and supplies used in farming operations.

- Government – Purchase made directly by a federal, state, or local agency.

- Nonprofit or Educational Institution – Must be a qualifying 501(c)(3) entity.

- Construction Contracts with Exempt Entities – For contractors purchasing materials for tax-exempt projects.

Tip: If the form allows space for additional explanation, briefly describe the nature of your business and how the item will be used.

4. Description of the Items or Services Being Purchased

Clearly describe what you are purchasing under the exemption claim.

Examples:

- “100 units of industrial-grade packaging film”

- “Farm tractor tires”

- “Textbooks and lab supplies for classroom use”

Tip: Be specific. A vague description like “supplies” could raise questions during an audit.

5. Iowa Sales Tax Permit Number (if applicable)

This is required for businesses claiming resale or manufacturing exemptions.

- If you’re claiming resale, enter your Iowa Retail Sales Tax Permit Number.

- For out-of-state businesses making resale purchases in Iowa, provide your home state sales tax permit number and state of issue.

Note: Nonprofits and government agencies are generally not required to have a permit.

6. Signature and Date

To finalize the form, the purchaser must:

- Sign the certificate

- Print their name

- Include the title (if signing on behalf of a business or organization)

- Enter the date of signing

This section certifies that the information provided is true and correct to the best of the signer’s knowledge and that they understand misuse of the certificate is punishable by law.

Reminder: Electronic signatures are acceptable if the form is submitted digitally.

Important Tips for Accuracy and Compliance

| Tip | Why It Matters |

| Fill out every field completely | Incomplete forms may be rejected or flagged during audits |

| Use consistent and legal names | Avoid nicknames or abbreviations not listed on tax permits |

| Match exemption reason to purchase | Claiming the wrong exemption can result in tax liability |

| Retain a copy for your records | You may need it if questioned later or audited |

| Do not use for personal purchases | The form is only for qualifying business or organizational use |

Where to Submit the Completed Iowa Sales Tax Exemption Form?

- Submit the completed certificate directly to the seller—not the Iowa Department of Revenue.

- The seller is required to retain the completed form as proof for not charging sales tax.

- The form can be reused (as a blanket certificate) for future qualifying purchases, provided the nature of the transactions remains the same.

Example

A nonprofit hospital is purchasing a shipment of wheelchairs from a medical supplier. The hospital fills out the Iowa exemption certificate by providing:

- Listing its 501(c)(3) name and address

- Identifying the seller

- Checking the box for nonprofit/charitable use

- Describing the purchase as “wheelchairs for patient use”

- Having the purchasing officer sign the form and include their official title

Because the hospital is using the equipment in direct support of its exempt purpose, the transaction qualifies for exemption.

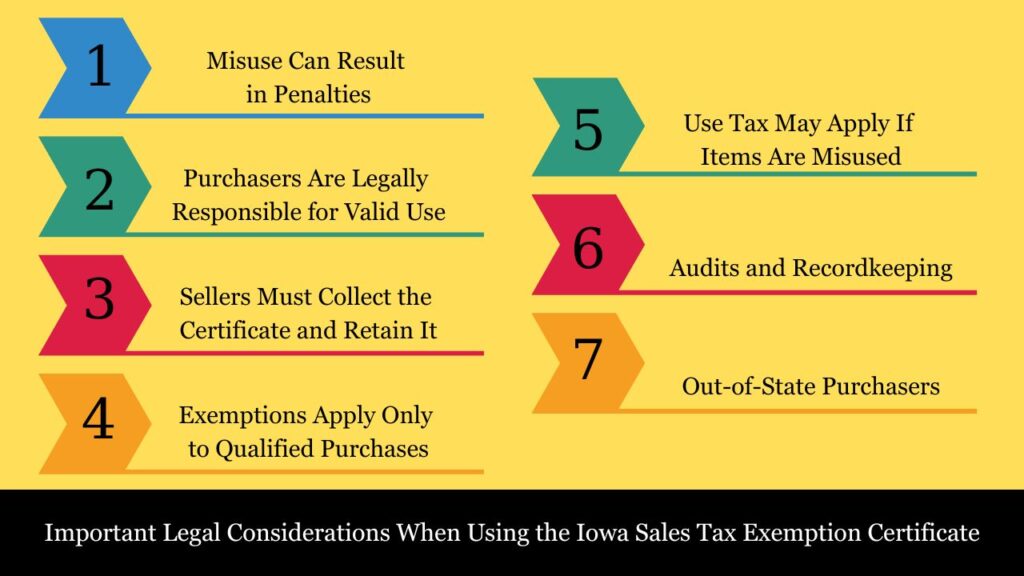

Important Legal Considerations When Using the Iowa Sales Tax Exemption Certificate

Filing the Iowa Sales Tax Exemption Certificate (Form 31-014a) involves significant legal obligations. Whether you’re a buyer claiming an exemption or a seller accepting the certificate, both parties must understand the legal implications to remain in compliance with Iowa tax laws.

1. Misuse Can Result in Penalties

The exemption certificate is a legal affidavit. By signing it, the purchaser is certifying under penalty of law that:

- They qualify for the exemption claimed.

- The items or services purchased will be used in the way described.

- The information provided is accurate and truthful.

Improper or dishonest use of the certificate may lead to:

- Payment of back taxes (plus interest)

- Civil penalties

- Potential criminal charges for tax fraud

2. Purchasers Are Legally Responsible for Valid Use

It is the purchaser’s duty to:

- Know which exemptions apply to their situation

- Complete the form accurately

- Ensure the items purchased are used strictly in accordance with the exemption claimed

If a purchaser claims an exemption for items later used in a taxable manner (e.g., personal or unrelated use), they may owe use tax on those items.

3. Sellers Must Collect the Certificate and Retain It

The seller must not accept the form casually. They are responsible for:

- Verifying that the certificate is accurately filled out when the purchase is made

- Verifying that the claimed exemption appears valid on its face

- Retaining the certificate in their records for at least 3 years (or longer if an audit or dispute arises)

If a seller does not collect and maintain a valid exemption certificate, they may be held liable for the unpaid sales tax—even if the purchaser should have been exempt.

4. Exemptions Apply Only to Qualified Purchases

Claiming an exemption is not a blanket right. Exemptions apply only to specific types of goods or services and for specific types of use.

- For example, a nonprofit may be exempt when buying school supplies for educational programs—but not when buying equipment for a for-profit subsidiary or personal use by staff.

- A manufacturer may be exempt when purchasing production machinery, but not for office furniture.

- Each transaction must be reviewed carefully to ensure it falls under a valid exemption category.

5. Use Tax May Apply If Items Are Misused

If exempt items are later used for a non-exempt purpose, the purchaser must report and pay Iowa use tax on the fair market value of those items.

- Example: A business buys tools tax-free for resale, but later uses them internally. Use tax is due on the tools used.

6. Audits and Recordkeeping

Both the buyer and seller must keep records to justify exemption claims if audited by the Iowa Department of Revenue. This includes:

- A copy of the exemption certificate

- Invoices or purchase orders

- Documentation supporting the tax-exempt nature of the item or project

Failure to maintain proper records can result in tax assessments and penalties.

7. Out-of-State Purchasers

Buyers from other states may claim exemption for resale or exempt purposes in Iowa, but they must:

- Provide a valid sales tax permit from their home state

- Clearly indicate the out-of-state status and intended use

If they fail to provide this documentation, Iowa tax may still be imposed.

Blanket vs. Single-Use Iowa Sales Tax Exemption Certificates

When claiming exemption from Iowa sales tax, buyers may use either a single-use exemption certificate or a blanket exemption certificate, depending on the nature and frequency of their purchases. Understanding the difference helps both purchasers and sellers maintain proper compliance and recordkeeping.

Single-Use Exemption Certificate

A single-use certificate is completed and provided for a specific, one-time purchase or transaction.

- Purpose: Covers only the particular sale or order described on the certificate.

- When to Use:

- For large, infrequent purchases.

- When the nature of the purchase or exemption changes from transaction to transaction.

- Seller Responsibilities:

- Retain this certificate as evidence for the specific transaction.

- The certificate cannot be reused for future purchases.

- Purchaser Responsibilities:

- Complete a new certificate for each exempt purchase.

Example: A manufacturing company buys a specialized machine once. They complete a single-use certificate describing that machine purchase.

Blanket Exemption Certificate

A blanket certificate covers multiple purchases of the same type or purpose over a period of time, eliminating the need to complete a new form for each transaction.

- Purpose: Simplifies ongoing exempt purchases between the same buyer and seller.

- When to Use:

- Frequent purchases of similar goods or services.

- Regular business relationships where the exemption status remains constant.

- Seller Responsibilities:

- Keep the blanket certificate on file and reference it for all qualifying sales.

- Purchaser Responsibilities:

- Confirm that the exemption reason applies to all future purchases covered.

- Renew or update the certificate as required by Iowa tax regulations or upon significant changes.

Example: A retailer who regularly purchases inventory for resale from a supplier submits a blanket certificate valid for all such purchases over the year.

Important Considerations

- Accuracy: Blanket certificates must clearly state they cover multiple transactions and specify the type of purchases exempted.

- Validity Period: While Iowa law does not specify a strict expiration for blanket certificates, sellers should periodically confirm that the certificate remains valid and current.

- Scope: Blanket certificates must only be used for purchases qualifying under the same exemption category. They should not be used for varied exemption types or unrelated purchases.

- Documentation: Both buyer and seller should keep a copy of the certificate for at least three years to support exemption claims during audits.

Conclusion

The Iowa Sales Tax Exemption Certificate (Form 31-014a) is an essential document that enables qualified buyers—such as retailers, nonprofits, manufacturers, farmers, government entities, and contractors—to lawfully purchase goods and services without paying Iowa sales and use tax. Proper completion and submission of this form to the seller not only ensures compliance with Iowa tax laws but also protects both parties during audits by providing valid documentation for the exemption.

Buyers must understand their eligibility and use the certificate only for qualifying purchases, while sellers have the responsibility to collect and retain these certificates to avoid liability for unpaid taxes. Misuse or incorrect completion can lead to penalties, interest, and legal consequences.

By following the guidelines for completing, submitting, and maintaining the Iowa Sales Tax Exemption Certificate, businesses and organizations can confidently manage their tax-exempt transactions and minimize unnecessary tax costs.

Frequently Asked Questions (FAQs)

What is the Iowa Sales Tax Exemption Certificate?

It is an official form (Form 31-014a) used by eligible buyers to claim exemption from Iowa sales and use tax on qualifying purchases. The certificate must be provided to sellers to avoid sales tax collection.

Who qualifies to use the exemption certificate?

Eligible users include retailers reselling goods, nonprofits, government agencies, manufacturers, farmers, and contractors purchasing for exempt projects. Typically, individuals buying for personal use do not qualify.

How do I complete the exemption certificate?

You must fill in purchaser and seller information, specify the exemption reason, describe the items purchased, provide your tax permit number (if applicable), and sign and date the form.

Can I use the exemption certificate for all purchases?

No. The exemption applies only to purchases that meet specific criteria defined by Iowa law. Personal use items or non-qualifying purchases do not qualify.

What is the difference between a single-use and blanket exemption certificate?

A single-use certificate covers one specific purchase, while a blanket certificate covers multiple purchases of the same nature over time between the same buyer and seller.

Do sellers have to keep exemption certificates?

Yes. Sellers must retain exemption certificates for at least three years to substantiate tax-exempt sales if audited.

What happens if the exemption certificate is misused?

Misuse can lead to back taxes owed, penalties, interest, and possible legal action against both the purchaser and seller.

Where can I get the Iowa Sales Tax Exemption Certificate form?

The form is available for download from the Iowa Department of Revenue website at https://tax.iowa.gov/forms.

Can out-of-state businesses use the exemption certificate?

Yes, if they provide a valid sales tax permit from their home state and the purchase qualifies under Iowa’s exemption rules.

Is the exemption certificate submitted to the Iowa Department of Revenue?

No. The certificate is given directly to the seller and kept on file. It is not filed with the Iowa Department of Revenue unless requested during an audit.