How to File for an Alabama State Tax Refund In 2025?

Table of Contents

Alabama State Tax Refund Delays? Here’s What You Need to Know

If you live or work in Alabama and have had more state income tax withheld than your final tax liability, you may be eligible for a state tax refund. Understanding the refund process helps ensure that you claim it correctly and receive it as quickly as possible.

What Is an Alabama State Tax Refund?

An Alabama state tax refund is the return of excess state income tax that you paid during the tax year—either through employer withholding, estimated payments, or refundable credits. If your total tax payments exceed your calculated tax liability, the difference is refunded to you by the Alabama Department of Revenue (ALDOR).

Who Is Eligible for an Alabama State Tax Refund?

You may be eligible for an Alabama state income tax refund if you overpaid your total tax liability during the tax year—either through employer withholding, estimated tax payments, or refundable tax credits. Eligibility applies to residents, part-year residents, and nonresidents who meet refund criteria based on their income and tax filings.

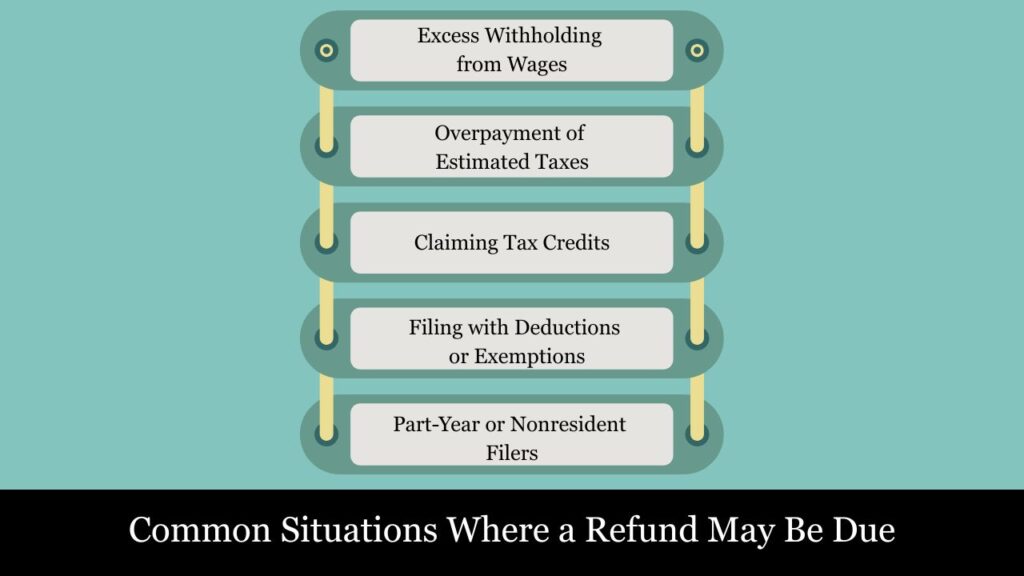

Common Situations Where a Refund May Be Due:

1. Excess Withholding from Wages

If your employer withheld more Alabama state income tax from your paychecks than your actual tax liability, you are entitled to receive the difference as a refund. This is one of the most common reasons taxpayers receive refunds.

2. Overpayment of Estimated Taxes

Those who are self-employed or receive non-salaried income may need to make quarterly estimated tax payments. If these payments exceed your actual tax due, the excess is refundable.

3. Claiming Tax Credits

If you qualify for refundable tax credits (e.g., Alabama Family Assistance Tax Credit or Qualified Irrigation System Credit) and your total credits exceed your tax liability, the unused amount may be refunded to you.

4. Filing with Deductions or Exemptions

You may be eligible for a refund if your income is reduced through exemptions (e.g., personal exemption, dependent exemption) or deductions (e.g., federal tax deduction, retirement income exclusion), resulting in lower taxable income and overpaid taxes.

5. Part-Year or Nonresident Filers

If you moved into or out of Alabama during the tax year and had tax withheld on all income, you may be eligible for a refund of tax paid on income not attributable to Alabama sources.

Basic Eligibility Requirements

To qualify for a refund, you must:

- File a complete and accurate Alabama Individual Income Tax Return (Form 40, 40A, or 40NR)

- Have tax payments that exceed your total calculated Alabama income tax liability

- Submit your return within the legal timeframe—typically within 3 years of the original due date or 2 years from the date the tax was paid.

Important Notes:

- Even if you are not required to file based on income thresholds, you must file a return to receive a refund if any tax was withheld.

- Dependents or students with part-time jobs and wage withholding may also be entitled to a refund.

- Refunds are not automatic—you must actively file your tax return and request it.

Example:

Emma, a college student, earned $8,000 in wages in Alabama and had $320 in state tax withheld. After filing her return and applying the standard deduction and personal exemption, she had zero tax liability. Because of the withheld amount, she is entitled to a full $320 refund—but only if she files a return.

When to File and Refund Processing Time? – Alabama State Tax (2025)

Understanding when to file and how long it takes to receive your Alabama state tax refund can help you plan ahead and avoid delays. Filing early and correctly can significantly shorten your wait time.

When to File?

- Annual Due Date:

Alabama individual income tax returns are generally due by April 15 following the end of the tax year (or the next business day if it falls on a weekend or holiday). For the 2024 tax year, the deadline to file your return is April 15, 2025. - Early Filing:

You can begin filing as soon as the Alabama Department of Revenue (ALDOR) opens the filing season—usually in late January or early February.

Filing early:- Reduces the risk of identity theft

- Increases the likelihood of faster refund processing

- Gives you more time to correct any errors if needed

- Extension Option:

If Alabama offers an automatic 6-month extension to file (until October 15, 2025 for Tax Year 2024). However, this extension does not apply to tax payments—interest and penalties may accrue if payment is not made by April 15.

Refund Processing Time

The time it takes to receive your refund depends on how you file and how you choose to receive the refund:

| Filing Method | Refund Method | Estimated Processing Time |

| E-file with Direct Deposit | Bank Account | 6 to 8 weeks |

| E-file with Paper Check | Mailed to address | 8 to 10 weeks |

| Paper Return with Check | Mailed to address | 10 to 12+ weeks |

Key Tips to Avoid Delays

- Use direct deposit – It’s the fastest and most secure refund delivery method.

- E-file your return – Reduces data entry errors and speeds up processing.

- Ensure accuracy – Double-check Social Security numbers, income, deductions, and bank info.

- Attach all W-2s and 1099s – Missing income statements are a common cause of delays.

- Respond promptly – If ALDOR contacts you for identity or income verification, respond as soon as possible.

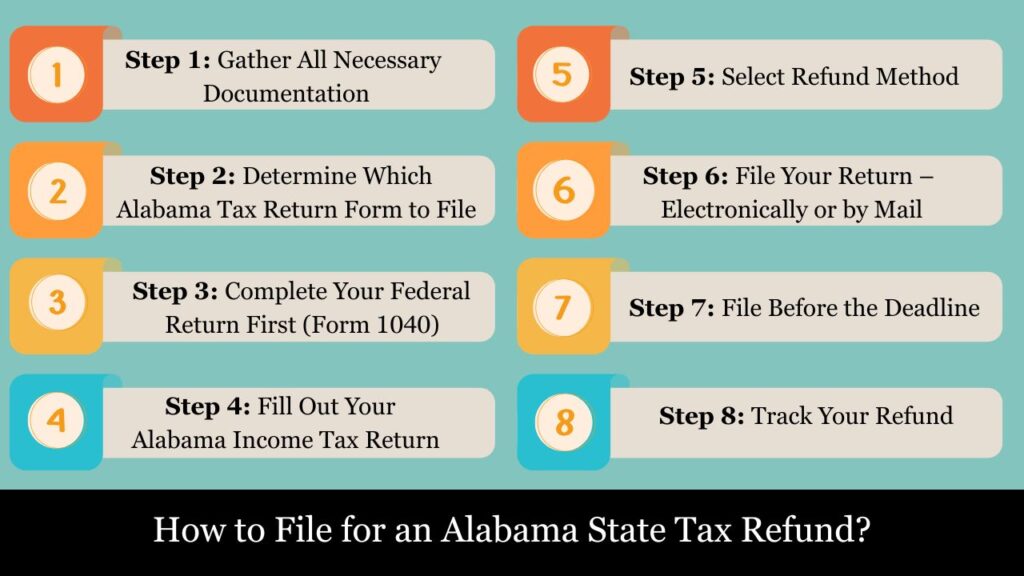

How to File for an Alabama State Tax Refund?

Filing for an Alabama state income tax refund is not automatic—you must submit a complete and accurate return to claim the overpayment of taxes withheld or paid during the year. Whether you’re a full-time resident, part-year resident, or earned income in Alabama as a nonresident, understanding the correct procedures will help you avoid delays and receive any refund you’re owed.

Step 1: Gather All Necessary Documentation

Begin the filing process by collecting the following documents:

Income Documentation

- W-2 forms from all employers showing Alabama state withholding

- 1099s (for interest, dividends, unemployment, freelance/contract work, retirement distributions)

- Documentation of self-employment earnings, deductible business costs, or rental income—if relevant to your return.

Tax Payment Records

- Estimated tax payments made to the Alabama Department of Revenue (ALDOR)

- Overpayments carried forward from the previous year

Personal and Dependent Information

- Social Security numbers for yourself, your spouse, and any dependents listed on your tax return

- Provide your bank routing number and account number to receive your refund via direct deposit

Step 2: Determine Which Alabama Tax Return Form to File

Alabama offers multiple return types depending on your residency and complexity of income:

| Form | Used By |

| Form 40 | Full-year residents with detailed income, deductions, or credits |

| Form 40A | Full-year residents with simple income and standard deduction |

| Form 40NR | Part-year or nonresidents with Alabama-source income |

| Form 40X | Submit an amended return to correct errors or omissions on a previously filed return and to claim a refund you may have missed |

Note: Most full-time employed residents file Form 40 or 40A, while people who lived part of the year in another state should use Form 40NR.

Step 3: Complete Your Federal Return First (Form 1040)

Before completing your Alabama return, it’s essential to first finish your federal Form 1040. Alabama begins with your federal adjusted gross income (AGI) as the starting point for state tax calculations.

This ensures:

- Proper alignment of income sources

- Accurate deductions and adjustments

- Eligibility for federal and state-specific tax credits

Step 4: Fill Out Your Alabama Income Tax Return

Now complete your Alabama return (Form 40, 40A, or 40NR). Key sections include:

1. Personal Information

- Name, SSN, address, filing status (single, married, etc.)

2. Income Reporting

- Include wages, salaries, business income, interest, dividends, pensions, or other taxable sources

- Alabama allows some income exclusions (e.g., certain retirement income, federal tax refund)

3. Adjustments & Deductions

- Apply standard or itemized deductions

- Subtract personal and dependent exemptions

4. Tax Liability Calculation

- Calculate Alabama tax owed using current tax brackets

- Apply any applicable nonrefundable and refundable tax credits

5. Report Payments

- Enter tax withheld from W-2/1099

- Report estimated payments made during the year

- Apply carryover credits from previous years

6. Determine Refund or Amount Owed

If your total payments and withholdings exceed your calculated Alabama tax liability, the difference is your refund amount.

Step 5: Select Refund Method

You’ll be asked how you want to receive your refund:

Direct Deposit (Recommended)

- Fastest method—usually within 6–8 weeks

- Enter your bank’s routing number and your account number (checking or savings)

Paper Check

- Mailed to the address listed on your return

- Typically takes 8–12 weeks for processing and delivery

Step 6: File Your Return – Electronically or by Mail

E-File (Preferred)

You can e-file using:

- My Alabama Taxes (MAT): https://myalabamataxes.alabama.gov

- IRS-approved tax software (e.g., TurboTax, TaxSlayer, FreeTaxUSA)

Benefits:

- Fewer errors

- Immediate confirmation of submission

- Faster refund processing

- Easier to track refund status

Mail-In Filing

If mailing a paper return, send it to:

Alabama Department of Revenue

Individual Income Tax Section

P.O. Box 327464

Montgomery, AL 36132-7464

Attach copies of all W-2s, 1099s, and withholding statements. Do not send originals.

Step 7: File Before the Deadline

The due date to file your Alabama return for tax year 2024 is:

April 15, 2025

If you need more time, Alabama allows an automatic 6-month extension to file (until October 15, 2025)—but any tax owed is still due by the original deadline to avoid penalties or interest.

Step 8: Track Your Refund

After filing, you can check your refund status by:

- Visiting: https://myalabamataxes.alabama.gov

- Calling the refund hotline: 1-855-894-7391

You’ll need:

- Your Social Security Number (SSN)

- Your exact refund amount

- The tax year you’re checking

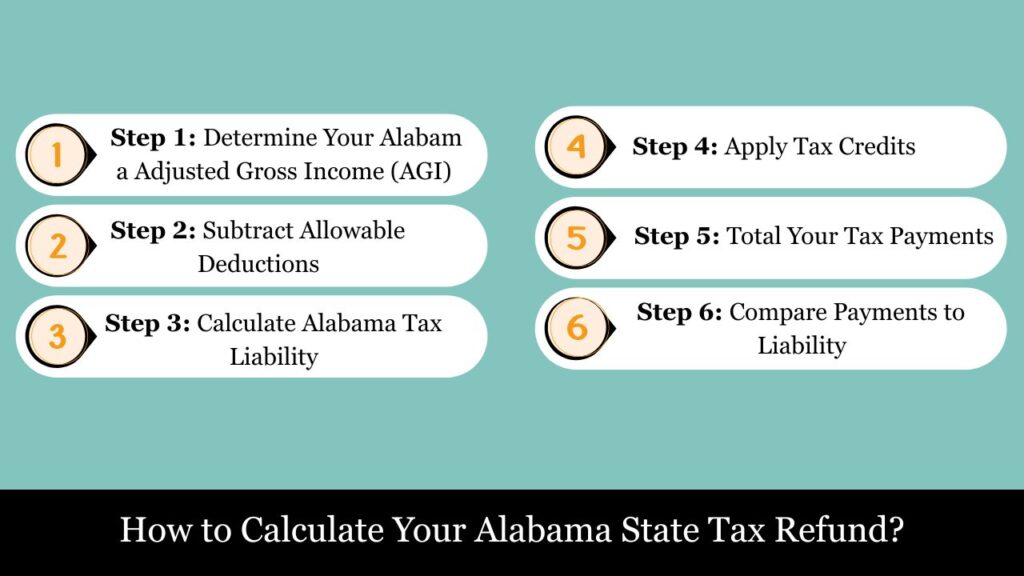

How to Calculate Your Alabama State Tax Refund?

Calculating your Alabama state tax refund involves comparing the total taxes you paid or had withheld during the year against your actual Alabama tax liability. If your total tax payments exceed your actual tax liability, you can claim a refund for the overpaid amount.

Basic Refund Formula:

Alabama State Tax Refund =[Total Tax Payments & Withholding] − [Total Tax Liability]

If the result is positive, you get a refund.

If it’s zero, you break even.

If it’s negative, you owe additional tax.

Step-by-Step Breakdown

Step 1: Determine Your Alabama Adjusted Gross Income (AGI)

Start with your federal AGI (from IRS Form 1040) and apply Alabama-specific additions or subtractions. Some income may be excluded (e.g., certain retirement income or federal tax refunds).

Step 2: Subtract Allowable Deductions

You can claim either:

- The standard deduction reduces your taxable income and differs based on your filing status and income level

- Or itemized deductions (e.g., mortgage interest, medical expenses)

Also subtract:

- Personal exemption (based on income and dependents)

This results in your Alabama taxable income.

Step 3: Calculate Alabama Tax Liability

Calculate your Alabama income tax by applying the state’s progressive tax rates to your taxable income based on your filing status:

| Taxable Income | Tax Rate (Single) |

| First $500 | 2% |

| Next $2,500 | 4% |

| Over $3,000 | 5% |

(For joint filers, thresholds are doubled.)

Tip: Alabama provides a tax table with precise amounts based on income and filing status.

Step 4: Apply Tax Credits

Subtract any:

- Nonrefundable credits (e.g., credit for taxes paid to other states)

- Refundable credits (e.g., Qualified Irrigation System Credit, Alabama Accountability Act Scholarship Credit)

Step 5: Total Your Tax Payments

Add together:

- State tax withheld from W-2s and 1099s

- Estimated tax payments made to ALDOR

- Payments made with an extension

- Any credits carried forward from the prior year

Step 6: Compare Payments to Liability

Now subtract your total Alabama tax liability (from Step 4) from your total tax payments (Step 5).

Example: Alabama State Refund Calculation

Scenario:

- Filing Status: Single

- Federal AGI: $32,000

- Alabama taxable income after deductions: $27,000

- Tax liability: $1,150

- Alabama state withholding from W-2: $1,600

- Estimated tax payments: $0

➤ Refund Calculation:

TotalPayments:$1,600

Tax Liability: –$1,150

——————————————— Expected Refund:$450

The taxpayer will receive a $450 refund from Alabama.

Alabama State Tax Refund Claim Deadlines

To successfully receive your Alabama state income tax refund, you must file your tax return within the state’s legally prescribed time limits. Missing the refund claim window means forfeiting your right to receive the money you’re owed, even if the overpayment was legitimate.

Standard Deadline to File and Claim a Refund

In most cases, you must file your Alabama return and claim a refund within three (3) years from the original due date of the return.

Rule:

You must claim your refund within three years of the return’s original due date or within two years from the date the tax was paid—whichever is later.

For Tax Year 2024:

- Original due date: April 15, 2025

- Deadline to claim refund: April 15, 2028

(Unless tax was paid later—then you may have until 2 years from the date of payment.)

Other Deadline Scenarios

Amended Returns (Form 40X)

If you file an amended return to correct errors or claim an overlooked refund:

- You must still do so within the 3-year or 2-year rule.

- Refunds from amended returns filed after that window are automatically denied.

Late-Filed Returns

If you did not file a return originally, but Alabama state taxes were withheld from your income (e.g., W-2), you can still file late and claim the refund— As long as your claim is submitted within three years of the return’s original due date, you remain eligible for a refund.

Extension Filers

An extension to file does not extend the refund claim window beyond 3 years from the original deadline. Your payment is still due by the April 15 deadline to avoid penalties and interest.

What Happens If You Miss the Deadline?

- The Alabama Department of Revenue (ALDOR) will deny your refund request.

- Any amount overpaid becomes non-refundable and is retained by the state.

- You will not receive interest on unclaimed refunds, even if eventually filed late.

Amending an Alabama State Tax Refund

If you discover an error on your filed Alabama return—such as missed income, deductions, or incorrect withholding—you can file Form 40X to amend it and adjust your refund.

When to Amend?

- You forgot to report income or deductions

- You received new tax documents (e.g., W-2, 1099)

- Your federal return was amended

- You claimed the wrong filing status or number of dependents

How to Amend?

- Use Form 40X (Alabama Amended Individual Income Tax Return)

- Enter original vs. corrected figures and explain the changes

- Attach all revised supporting documents

- Mail to:

Alabama Department of Revenue

P.O. Box 327464, Montgomery, AL 36132-7464

Deadline

- Within three years of the original tax return due date, or

- 2 years from the date tax was paid—whichever is later

Refund or Balance Due

- If the amendment results in a larger refund, you can claim the extra amount

- If it results in tax due, submit payment with Form 40X

Example

Madison filed her 2023 Alabama return and received a $200 refund. Months later, she realized she forgot to include a $1,000 tuition credit. She files Form 40X, updates her return, and becomes eligible for an additional $250 refund. Because she submitted her amended return within the three-year timeframe, ALDOR accepts the claim and issues the additional refund.

Conclusion

Claiming your Alabama state tax refund is a straightforward process when you file accurately and on time. By gathering the right documents, choosing the correct form, and filing electronically or by mail, you ensure that any overpaid taxes are returned efficiently. Whether you’re a full-time resident, part-year filer, or nonresident with Alabama income, staying informed about deadlines, refund methods, and eligibility is key to maximizing your return. To receive your refund more quickly, file electronically and choose direct deposit using My Alabama Taxes.

Frequently Asked Questions (FAQs)

Who is eligible for an Alabama state tax refund?

Any taxpayer who overpaid Alabama income tax—either through withholding, estimated payments, or credits—is eligible for a refund when they file a complete and accurate return.

When can I expect to receive my tax refund?

Refunds typically take 6–8 weeks for e-filed returns with direct deposit. Paper returns or check refunds may take 8–12 weeks or longer.

How can I check my Alabama refund status?

Visit My Alabama Taxes, or call the refund hotline at 1-855-894-7391. You’ll need your SSN, refund amount, and tax year.

What is the deadline to claim a refund?

Refunds must be claimed within 3 years from the original due date or 2 years from the date of payment, whichever is later.

Can I amend my return to claim a missed refund?

Yes. Use Form 40X to amend your return and claim additional refund amounts. Make sure to submit your return within the permitted filing timeframe.

Do I have to file a return if I earned very little income?

Not always—but if Alabama tax was withheld from your income, you must file a return to receive your refund.

Will I receive interest on a delayed refund?

Interest is not generally paid on refunds unless the delay exceeds a legally defined processing period and meets specific criteria.