Georgia State Tax Refund: An Ultimate Guide In 2025

Table of Contents

Let’s Begin With The Expert Guide On Georgia State Tax Refund

A Georgia State Tax Refund refers to the repayment made by the Georgia Department of Revenue (GA DOR) when an individual taxpayer overpays their state income tax. Overpayments may occur through withheld income taxes, estimated tax payments, or nonrefundable tax credits. Receiving a refund is not automatic; it must be claimed by filing a state tax return and complying with applicable requirements.

This guide covers eligibility, how to file, required forms, refund status tracking, timelines, offsets, and answers to frequently asked questions—providing a comprehensive overview for residents and nonresidents alike.

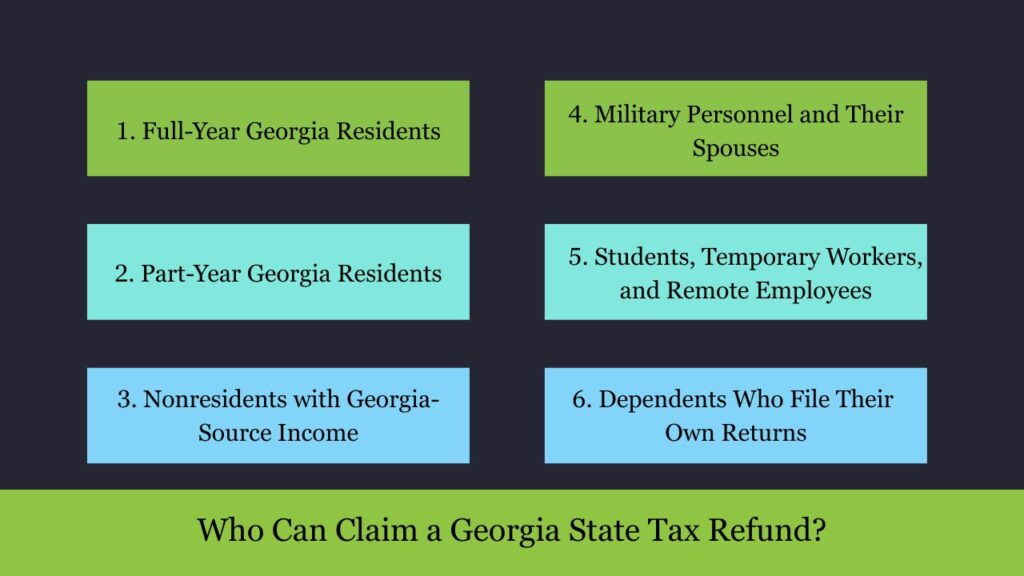

Who Can Claim a Georgia State Tax Refund?

A Georgia state tax refund is available to any individual taxpayer who has overpaid their Georgia income tax during the tax year. Refund eligibility depends not on residency alone, but on whether you had Georgia-source income and overpaid tax through withholdings, estimated payments, or refundable credits.

Let’s break this down more specifically by taxpayer category and income scenarios:

1. Full-Year Georgia Residents

You are considered a full-year resident if you lived in Georgia for the entire calendar year (January 1 to December 31). You may claim a refund if:

- Your employer withheld more tax than you owed

- You overpaid through estimated taxes during the year, resulting in a potential refund

- You qualified for refundable tax credits like the Child and Dependent Care Credit or Georgia Low-Income Credit

- You mistakenly overreported income and later correct it via an amended return

Example: You worked full-time in Georgia, had $2,000 withheld in GA taxes, but your total tax due was $1,500. You’re eligible for a $500 refund.

2. Part-Year Georgia Residents

If you moved into or out of Georgia during the tax year, you are classified as a part-year resident. You are required to report income earned while you were a Georgia resident and may claim a refund if:

- You overpaid on income earned in Georgia

- You filed using Form 500 and prorated income correctly between states

- You qualify for credits that reduce your Georgia tax below the amount withheld

Example: You moved to Georgia in June. Your employer withheld GA taxes from June to December, but your prorated GA income tax was less than what was withheld. You’re eligible for a refund.

3. Nonresidents with Georgia-Source Income

You don’t have to live in Georgia to owe or be refunded GA taxes. If you’re a nonresident but earned income from Georgia sources, you must file a return and may receive a refund if:

- Tax was withheld from Georgia-based income (e.g., consulting, rental property, freelancing, part-time remote work for a GA company)

- You overpaid based on your apportioned GA income

- You made estimated payments toward GA tax but owed less

Example: You reside in Florida but receive income from rental property located in Georgia. Your property manager withheld estimated GA tax throughout the year, but your final liability is lower. You are entitled to a refund of the difference.

4. Military Personnel and Their Spouses

The state of Georgia applies federal standards under the Servicemembers Civil Relief Act and the Military Spouses Residency Relief Act. If you’re stationed in Georgia but claim another state of legal residence, your military income may be exempt from GA tax. However:

- You may still file a GA return to claim withheld Georgia taxes

- Nonresident spouses with exempt income can file to recover withheld amounts

Example: A military spouse working remotely in Georgia has GA taxes withheld, but her legal residence is Texas. She may file for a full refund.

5. Students, Temporary Workers, and Remote Employees

If you’re a student or remote worker temporarily living or working in Georgia, you’re still responsible for paying Georgia tax on income earned in-state. However, you can also claim a refund if:

- You only worked part of the year and overpaid

- Your employer withheld Georgia tax in error

- You had dual-state employment but paid more than necessary to GA

Example: You interned in Atlanta from May to August and had full-year GA withholding. You’re eligible for a refund on the months you didn’t reside or earn in GA.

6. Dependents Who File Their Own Returns

Teenagers, college students, or dependents who earn income (e.g., from part-time jobs or scholarships) and have tax withheld are eligible to file for a refund even if claimed as dependents on their parents’ federal return.

Example: A high school senior earned $3,000 from a summer job with $80 withheld in GA tax. Even though they owe no GA tax, they are entitled to a full refund of the withheld amount.

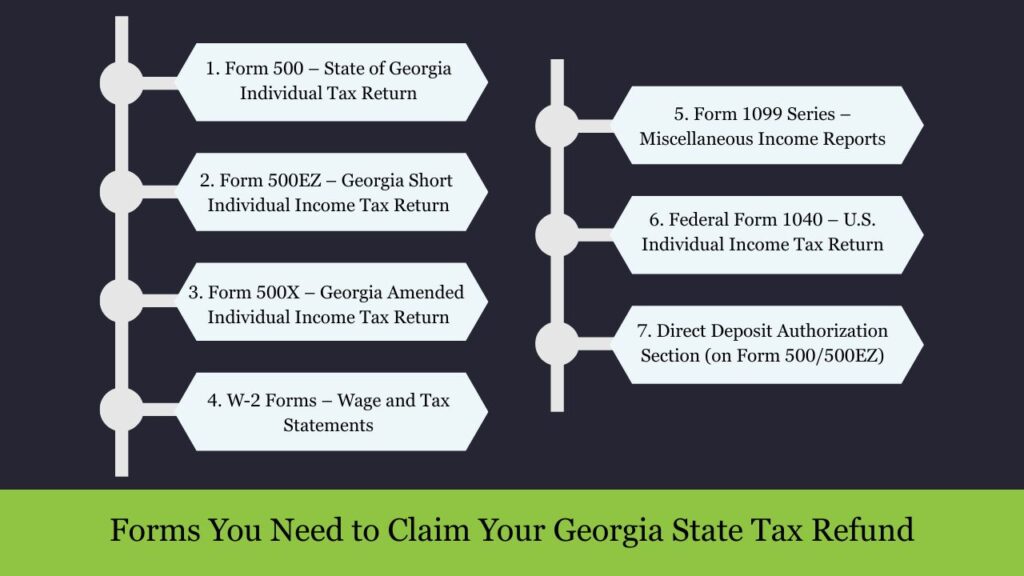

Forms You Need to Claim Your Georgia State Tax Refund

Filing for a Georgia state income tax refund requires the submission of specific forms that document your income, tax payments, and eligibility for credits. Depending on your taxpayer status, income level, and filing situation, some forms are mandatory while others may be optional but helpful.

Below is a complete breakdown of the essential forms required to file your Georgia refund, along with when and why you might need each one.

1. Form 500 – State of Georgia Individual Tax Return

Purpose: This is the primary income tax return form used by full-year residents, part-year residents, and nonresidents who earned income in Georgia.

When to Use:

- You are claiming a refund due to overpaid Georgia tax.

- You had Georgia tax withheld (from a W-2 or 1099).

- You want to itemize deductions or claim Georgia-specific tax credits.

Key Features:

- Includes sections for income, deductions, credits, and refund details.

- Allows direct deposit info for refunds.

- Requires supporting documents (W-2s, 1099s, federal 1040, etc.).

Note: You must sign this form, even if you file electronically.

2. Form 500EZ – Georgia Short Individual Income Tax Return

Purpose: Designed as a streamlined version of Form 500 for straightforward tax filings.

Eligibility Requirements:

- You earned less than $100,000.

- You are a full-year Georgia resident.

- You are taking the standard deduction (no itemized deductions).

- You do not claim dependent exemptions.

- You do not claim any tax credits.

Benefits:

- Shorter and easier to complete.

- Only two pages long.

- May be ideal for students, part-time workers, or single filers.

Tip: If you qualify for 500EZ, using it can speed up your refund.

3. Form 500X – Georgia Amended Individual Income Tax Return

Purpose: Used to correct a previously filed return that affects your refund (either increases or decreases it).

When to Use:

- You received additional W-2 or 1099 after filing.

- You discovered a calculation error.

- Your federal return was amended and affects your Georgia return.

- You incorrectly claimed deductions or omitted income.

What to Include:

- The original figures.

- Corrected figures.

- Explanation of changes.

- New refund (or tax due) amount.

Amended refunds can take 8–12 weeks to process.

4. W-2 Forms – Wage and Tax Statements

Purpose: Used to verify how much Georgia income tax was withheld from your salary or wages.

Who Issues: Your employer(s)

What It Shows:

- Total wages earned (Box 1)

- Reported Georgia wages and corresponding state tax withholding from your W-2 (Boxes 16 & 17)

Must be attached to your Form 500 or 500EZ, whether filed by paper or electronically.

5. Form 1099 Series – Miscellaneous Income Reports

Purpose: Reports non-wage income and state tax withholdings on:

- Freelance/contract income (1099-NEC)

- Investment income (1099-INT, 1099-DIV)

- Retirement distributions (1099-R)

- Unemployment (1099-G)

Why It’s Important:

- If Georgia tax was withheld on any 1099 income, it must be reported to claim that portion of your refund.

Compare Box 17 on your 1099 with your return to ensure accuracy.

6. Federal Form 1040 – U.S. Individual Income Tax Return

Purpose: Not required in all cases, but highly recommended to support your Georgia return.

When to Include:

- If you’re itemizing deductions.

- If you’re claiming federal-to-state credit adjustments.

- If you’re filing a paper return.

Benefit:

- Helps GA DOR verify your total income, dependents, and adjustments.

- May reduce review time and expedite refund.

7. Direct Deposit Authorization Section (on Form 500/500EZ)

Purpose: To provide your routing and account number for direct deposit of your refund.

Why It Matters:

- Ensures quicker refund processing (2–3 weeks vs. 6–8 weeks by check).

- Avoids refund loss due to mailing errors or theft.

Make sure your bank details are accurate and match the name on the return.

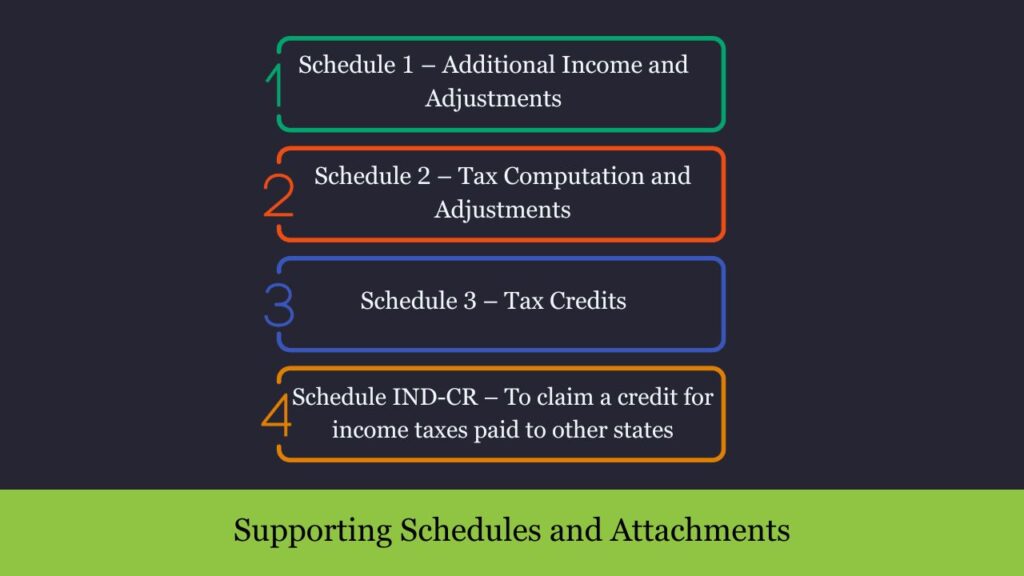

Supporting Schedules and Attachments

While Form 500 or Form 500EZ is the foundation of your Georgia state tax return, many taxpayers must include additional schedules and attachments to fully report income, claim deductions, or apply for credits. These supplementary forms help the Georgia Department of Revenue (GA DOR) validate your return and ensure an accurate refund or assessment.

Here is a breakdown of the most commonly used supporting schedules and attachments, along with their purposes and when to include them:

1. Schedule 1 – Additional Income and Adjustments

Purpose: To report other types of income not captured on the main return, such as:

- Business income or loss (Schedule C)

- Capital gains/losses

- Rental or royalty income (Schedule E)

- Farm income

- Unemployment compensation

- Other adjustments (e.g., educator expenses, IRA deductions)

When to Attach:

- You received income through freelance work, contract jobs, or running a small business.

- You are adjusting income for contributions to retirement accounts or HSAs.

Include federal equivalents (e.g., IRS Schedule 1 or 1040 Schedule C) for consistency.

2. Schedule 2 – Tax Computation and Adjustments

Purpose: To calculate additional state tax liabilities and adjustments such as:

- Lump-sum distributions

- Tax on early IRA withdrawals

- Recapture of tax credits

- Interest penalties for underpayment

When to Attach:

- You had tax-deferred distributions or unusual adjustments.

- The refund you’re claiming involves changes in prior-year calculations.

3. Schedule 3 – Tax Credits

Purpose: To claim nonrefundable and refundable credits against your Georgia tax liability.

Credits may include:

- Child and Dependent Care Expenses Credit

- Low-Income Credit

- Education Expense Credit (GEE Credit)

- Qualified Rural Hospital Organization Credit

- Film, Job, or Business Tax Credits

When to Attach:

- You are applying any state-specific credit that reduces your GA income tax.

- Your refund depends on refundable credits (e.g., if credit > tax liability).

Backup documentation such as donation receipts or tuition payment records may also be required.

4. Schedule IND-CR – To claim a credit for income taxes paid to other states

Purpose: Used to claim a credit for taxes paid to another U.S. state, to prevent double taxation of the same income.

When to Attach:

- You were a full-year or part-year resident of Georgia and paid income tax to another state on earnings received there.

Requirements:

- Include copies of the other state’s tax return.

- Ensure the credit is calculated correctly to prevent processing delays or denial.

Common for remote workers, consultants, or investors with multi-state income.

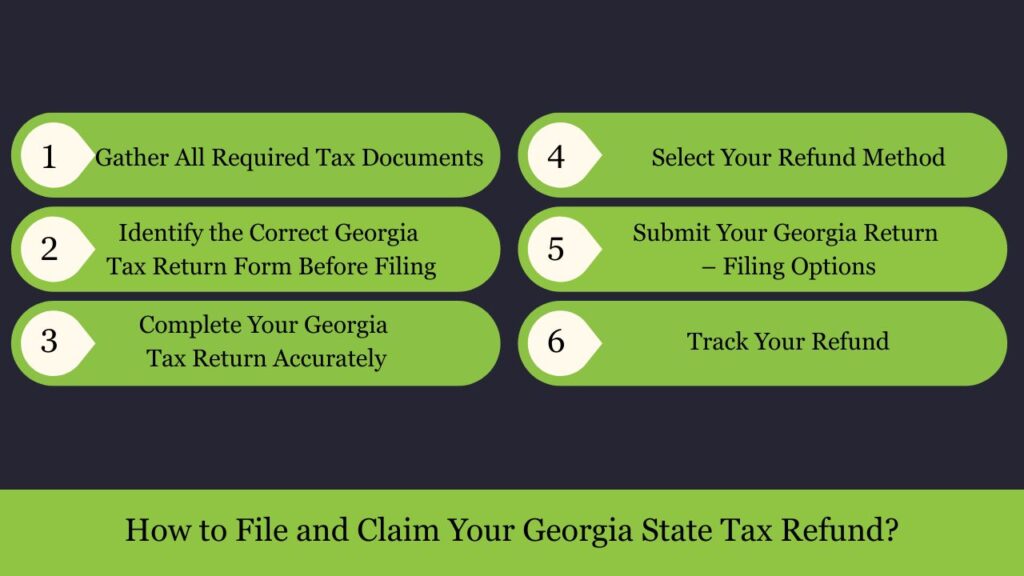

How to File and Claim Your Georgia State Tax Refund?

Step-by-step breakdown with explanations, timelines, and document requirements

Claiming a Georgia State Tax Refund is the process of filing your annual state income tax return with the Georgia Department of Revenue (GA DOR) and requesting a refund for any overpaid taxes. Whether you’re a full-time resident, part-year resident, or nonresident earning Georgia-source income, the process remains similar but with some important distinctions.

Here’s a comprehensive, expanded walkthrough of each step, including forms, methods, timelines, and practical examples.

Step 1: Gather All Required Tax Documents

This is the foundation of an accurate refund claim. Collect and organize all income and deduction documentation before you begin preparing your return.

Commonly Required Documents:

- W-2 forms issued by employers show your total earnings and the amount of Georgia state tax withheld.

- 1099s (from clients, banks, government): Reports non-wage income like self-employment, interest, dividends, retirement, or unemployment.

- Form 1040 (Federal Return): Needed to mirror income figures and support itemized deductions or credits.

- Receipts and expense logs: For deductions or Georgia-specific credits (e.g., dependent care, education donations).

- Prior-year Georgia return: Helpful for consistency, carryovers, and verifying prior refunds.

Use a physical or digital tax folder to avoid missing documents.

Step 2: Identify the Correct Georgia Tax Return Form Before Filing

Form 500 – Georgia Individual Income Tax Return

The standard full-length return used by:

- Full-year Georgia residents

- Part-year residents (moving in or out of GA)

- Nonresidents earning Georgia-source income (e.g., rental property, consulting income)

It allows:

- Standard or itemized deductions

- All available Georgia credits

- Direct deposit info for fast refunds

Form 500EZ – Georgia Short Form

Simplified return for:

- Full-year Georgia residents

- Income under $100,000

- No dependents

- No itemized deductions or credits

You cannot use 500EZ if you want to claim tax credits or itemized deductions.

Step 3: Complete Your Georgia Tax Return Accurately

This is where your refund amount is calculated. The refund is simply:

Refund = Total Tax Payments – Total Georgia Tax Liability

Sections to Pay Special Attention To:

- Total GA Gross Income (Line 1–5): Based on wages, freelance income, interest, etc.

- Adjustments & Deductions (Standard or Itemized): Reduces your taxable income.

- Exemptions and Credits: Dependents, education, and low-income credits reduce tax owed.

- Withholding and Payments (W-2s, 1099s, estimated payments): Already-paid taxes that count toward your refund.

- Refund or Amount Owed (Line 34 on Form 500): If the tax paid is more than what’s owed, the difference is your refund.

Check for math errors, misaligned social security numbers, and missing documents.

Step 4: Select Your Refund Method

You’ll need to decide how you want to receive your refund:

Direct Deposit

- Provide your bank’s routing and account numbers on Form 500 to receive a direct deposit.

- Fastest method – typically within 2–3 weeks for e-filed returns.

Paper Check

- Mailed to the address you list on your return.

- Can take 6–8 weeks, especially if filing by paper.

Always verify that your name matches the bank account to avoid rejection.

Step 5: Submit Your Georgia Return – Filing Options

E-Filing (Recommended)

Fast, secure, and preferred by GA DOR.

You can e-file through:

- Georgia Tax Center: https://gtc.dor.ga.gov

- Commercial software (TurboTax, TaxSlayer, H&R Block)

- IRS Free File (for qualified income)

- Licensed tax preparers or CPAs

Paper Filing (Traditional Method)

Mail the completed and signed Form 500, along with:

- All W-2s and 1099s with GA withholding

- Federal Form 1040 (recommended)

- Any supporting schedules (IND-CR, tax credit documentation)

Mail to:

Georgia Department of Revenue

P.O. Box 740380

Atlanta, GA 30374-0380

Always send paper returns via certified mail or with proof of delivery.

Step 6: Track Your Refund

Once your return is submitted, you can check the status of your refund online:

Georgia Refund Status Portal:

https://dor.georgia.gov/wheres-my-refund

You’ll need:

- Your Social Security Number or ITIN

- Tax Year (e.g., 2024)

- Exact refund amount (as shown on Line 34 of Form 500)

Refund Processing Timeframes:

| Filing Type | Estimated Refund Time |

| E-File + Direct Deposit | 2–3 weeks |

| E-File + Paper Check | 3–4 weeks |

| Paper Filing + Direct Deposit | 5–6 weeks |

| Paper Filing + Paper Check | 6–8 weeks or more |

First-time filers or those selected for identity verification may experience longer wait times.

What Can Delay or Reduce Your Refund?

Common Filing Errors:

- Missing or incorrect Social Security Number (SSN)

- Incorrect bank account for direct deposit

- Omitted W-2s or 1099s

- Failing to sign a paper return

- Not attaching federal Form 1040

Refund Offsets May Apply If You Owe:

- Unpaid GA income taxes

- Federal student loans

- Child support

- Unemployment overpayments

- Other state agency debts

In such cases, GA DOR will send you an offset notice showing how much was redirected and to whom.

Amended Returns (Form 500X) – Georgia State Tax Refund Corrections

Filing an amended Georgia tax return using Form 500X is the official method for correcting a previously filed Georgia individual income tax return (Form 500 or 500EZ). You may need to amend your return if you discover an error, receive additional income documents, or your federal return changes—especially if these adjustments affect your refund or tax owed.

Here’s a detailed breakdown of when, why, and how to use Form 500X:

What is Form 500X?

Form 500X is used to correct mistakes or update information on a previously filed Georgia individual tax return:

- Report changes in income

- Correct deductions, credits, or exemptions

- Reflect amended federal return changes (Form 1040X)

- Adjust withholding amounts or payments

- Claim an additional refund or correct an overstated refund

It replaces or modifies a return that has already been filed and accepted by the Georgia Department of Revenue (GA DOR).

When Should You File an Amended Georgia Return?

You should file Form 500X in the following situations:

Common Reasons to File:

- You received a new or corrected W-2 or 1099 after filing

- You discovered a math or clerical error

- You missed reporting income or deductions

- Your federal return was amended, affecting state income or credits

- You claimed a credit or deduction in error

If your federal return changes, you must file Form 500X within 180 days of the IRS finalizing your amendment.

What Can Be Amended with Form 500X?

| Item | Can It Be Amended? | Notes |

| Income (Wages, Self-employment) | Yes | Provide corrected W-2/1099 |

| Filing Status | Yes | Must be consistent with IRS |

| Itemized or Standard Deduction | Yes | Attach updated documentation |

| Dependents | Yes | Provide SSNs & relationship |

| Tax Credits | Yes | Include supporting forms |

| Withholding / Estimated Payments | Yes | Attach new evidence of payments |

| Direct Deposit Info | No | Refund method cannot be changed |

What to Include with Your Amended Return?

Your Form 500X should be fully supported with:

- A copy of the original Form 500 (or 500EZ)

- A detailed explanation of the changes on Page 2

- Copies of new or corrected W-2s/1099s

- Federal amended return (Form 1040X), if applicable

- Any new or updated schedules (e.g., Schedule IND-CR, Schedule 3)

- Documentation for credits or deductions now being claimed

The taxpayer must sign the 500X even if using a paid preparer.

When to File Form 500X – Deadline for Amendments

To qualify for a refund, Form 500X must typically be submitted no later than three years after the return’s initial deadling. If you filed the original return late, the 3-year clock starts from the filing date.

Amendment Deadline Example:

- Original return due: April 15, 2025

- Refund-related amended returns must be filed no later than April 15, 2028

If your amendment results in tax due, penalties and interest may apply if filed late.

What Happens After Filing Form 500X?

Refund Timing:

- 8 to 12 weeks is the average processing time.

- Processing may take longer if your return:

- Includes federal changes

- Requires verification of credits

- Has large refund adjustments

You Will Receive:

- A notice of adjustment if accepted

- A revised refund check or direct deposit

- An assessment notice if more tax is owed

GA DOR does not offer online tracking for amended return status.

How to File Form 500X?

1. Paper Filing Only (as of now):

Currently, Form 500X must be filed via mail. Electronic submission is not available.

2. Mailing Address:

Georgia Department of Revenue

P.O. Box 740380

Atlanta, GA 30374-0380

Always include your full name, SSN, and tax year clearly on each page.

3. Paid Tax

- Georgia imposes interest on any unpaid tax, even if a return is filed on time.

- Interest rate = Federal short-term rate + 3%, adjusted quarterly.

Example: If you owed $1,000 and filed late by 3 months, expect interest + late filing + late payment penalties.

4. Negligence & Substantial Understatement Penalty

- Up to 20% of the understated tax if:

- You omit significant income

- Overclaim deductions/credits

- File an inaccurate return due to neglect

5. Fraud Penalty

- If GA DOR determines that your return was filed with intent to deceive, the penalty is:

- Up to 50% of the tax owed

- Possible criminal prosecution in extreme cases

6. Refund Reversal or Offset Penalty

If you claim a refund in error (e.g., excessive withholding, unsupported credits), GA DOR may:

- Reverse the refund

- Apply the refund toward existing debts (child support, loans, tax bills)

- Assess penalties and interest on over-refunded amounts

Georgia Estimated Tax Deadlines (for Self-Employed & Investors)

If you are self-employed, an independent contractor, or have non-wage income, you must pay estimated Georgia income tax quarterly:

| Quarter | Due Date |

| Q1 (Jan–Mar) | April 15, 2025 |

| Q2 (Apr–May) | June 15, 2025 |

| Q3 (Jun–Aug) | September 15, 2025 |

| Q4 (Sep–Dec) | January 15, 2026 |

Penalty for Underpayment:

- If you underpay your quarterly tax liability, Georgia may assess an Estimated Tax Penalty, unless:

- You paid 90% of current year’s tax OR

- Pay the full amount of last year’s tax—or 110% if you’re considered a high-income taxpayer

Use Form 500-ES to pay estimated taxes.

Conclusion

Filing your Georgia state income tax return and claiming a refund is more than just submitting numbers — it’s about ensuring accuracy, timeliness, and full compliance with Georgia Department of Revenue (GA DOR) guidelines. Whether you’re a full-time resident, part-year filer, or nonresident with Georgia-source income, knowing which forms to file, what documents to include, and how to avoid errors is crucial to receiving your refund quickly and without complications.

Understanding Georgia’s tax system and staying compliant with refund rules doesn’t just save money — it safeguards your financial reputation. Whether you file independently or with a preparer, staying informed and proactive is the key to a smooth refund experience.

Frequently Asked Questions (FAQs)

When is the deadline to file my Georgia state tax return?

The deadline is April 15 of each year. If it falls on a weekend or holiday, it moves to the next business day.

How long does it take to get my Georgia tax refund?

–E-file with direct deposit: 2–3 weeks

–Paper filing: 6–8 weeks or longer

How can I check the status of my Georgia refund?

Visit Where’s My Refund – Georgia DOR and enter:

-Your Social Security Number

-Tax year

-Exact refund amount

Can I receive a Georgia refund without filing a state income tax return?

Yes. Even if no tax is owed, you must file Form 500 or 500EZ to claim a refund.

What if I filed the wrong information?

Use Form 500X to file an amended return. Georgia permits refund claims through amended returns if filed within three years of the initial deadline.

Is it possible to modify my refund delivery method after submitting my return?

No. Once you submit your return, you cannot switch from direct deposit to paper check (or vice versa).

What documents do I need to claim a refund?

-W-2s and 1099s showing Georgia tax withheld

-Federal Form 1040

-Georgia Form 500 or 500EZ

-Any credit/deduction documentation (if applicable)

Will my refund be delayed if I owe other debts?

Yes. Georgia may offset your refund for:

-State or federal tax debt

-Child support

-Student loans

-Other government debts

What happens if I file my return late?

You may face:

–Late filing penalty: 5% per month (up to 25%)

–Late payment penalty: 0.5% per month

-Interest on unpaid tax

Do I need to file a Georgia extension separately?

Yes. Use Form IT-303 to request an extension. Georgia requires a separate extension request; federal approval alone isn’t sufficient