Nonprofit Partnership: Easy Filing & Calculations For 2025

Table of Contents

Nonprofit Partnership: Detailed Guide

A nonprofit partnership refers to a collaborative relationship between two or more nonprofit organizations, or between a nonprofit and a different type of entity (such as a government agency, educational institution, or private business), that is formed to accomplish a shared mission or community-oriented goal. Unlike legal business partnerships that involve profit-sharing, nonprofit partnerships are mission-driven, focused on maximizing impact rather than generating revenue.

These partnerships are strategic in nature, and while each participating organization maintains its independent governance and tax-exempt status, they work jointly on projects, programs, or advocacy campaigns that benefit the public.

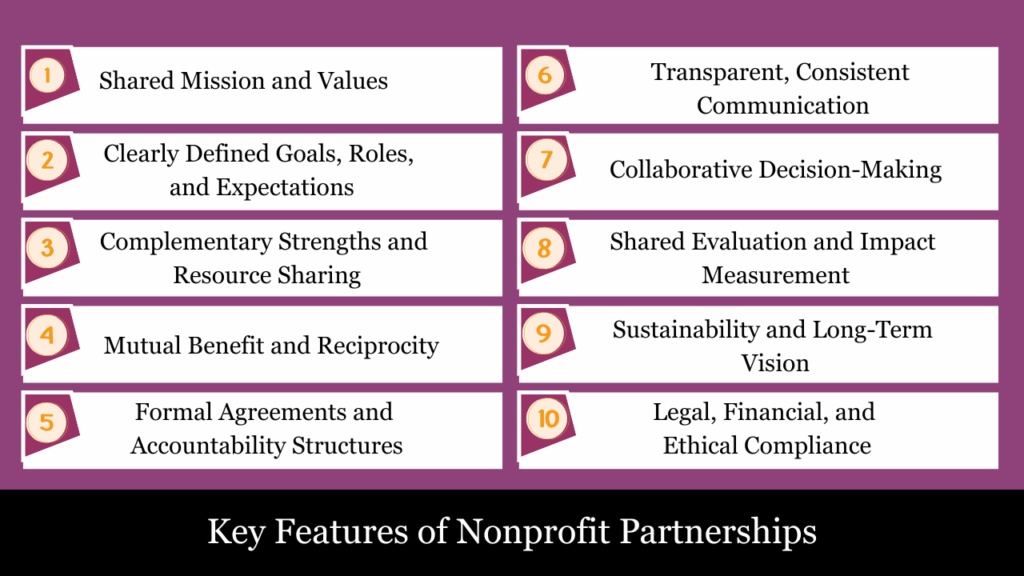

Key Features of Nonprofit Partnerships

Nonprofit partnerships are built on cooperation, trust, and a shared vision. They go beyond one-time collaborations and evolve into sustained, impactful relationships that benefit communities, strengthen program delivery, and create systemic change. Here are the core attributes that define effective and enduring nonprofit partnerships:

1. Shared Mission and Values

A strong partnership begins with deep mission alignment. Both organizations must serve complementary causes or populations and have similar values that guide their operations and ethics. This shared foundation ensures that all joint efforts support a unified purpose.

For example, a nonprofit addressing food insecurity may partner with one focused on maternal health to launch a nutrition program for pregnant women in low-income communities.

Shared alignment enhances unity, minimizes disputes, and strengthens the chances of achieving lasting, mission-driven outcomes.

2. Clearly Defined Goals, Roles, and Expectations

Every successful partnership needs clarity from the outset. This includes defining:

- What the partnership aims to achieve

- Who is responsible for what

- How progress will be measured

This often takes the form of a Memorandum of Understanding (MOU) or a legally binding contract that outlines deliverables, resource contributions, timelines, reporting duties, and dispute resolution procedures.

Unclear roles and expectations can result in confusion, overlapping efforts, and failure to achieve intended objectives.

3. Complementary Strengths and Resource Sharing

Strong partnerships enable each organization to capitalize on their unique strengths while addressing one another’s limitations. Shared resources may include:

- Financial support (joint grant applications or pooled funding)

- Facilities and infrastructure (shared event venues or office space)

- Technology (data-sharing systems or platforms)

- Human capital (staff training, volunteers, or consultants)

When partners share assets, they improve operational efficiency and reduce costs.

4. Mutual Benefit and Reciprocity

A true partnership is not one-sided. Both organizations should derive tangible and intangible value from the collaboration—whether it’s increased visibility, programmatic reach, knowledge exchange, or community trust.

A small local nonprofit may gain access to new tools and capacity, while a larger national nonprofit might benefit from the local partner’s grassroots community relationships.

Reciprocity builds goodwill and helps ensure long-term sustainability.

5. Formal Agreements and Accountability Structures

Successful partnerships are built on formal agreements that are revisited periodically. These documents:

- Establish each party’s responsibilities

- Set metrics for performance

- Detail financial obligations and restrictions

- Define confidentiality terms and data-sharing protocols

In addition to MOUs, partners may adopt shared governance models, like joint advisory boards or inter-agency committees.

6. Transparent, Consistent Communication

Effective communication is the lifeblood of collaboration. Strong partnerships maintain:

- Regular check-ins and progress meetings

- Open communication channels for feedback

- Joint problem-solving discussions

Partners often use digital tools such as:

- Slack or Teams for daily updates

- Google Workspace for document collaboration

- Shared dashboards or CRM systems

Open and honest communication allows for early issue detection, fosters mutual trust, and sustains collaborative progress.

7. Collaborative Decision-Making

In a partnership, decisions shouldn’t be made unilaterally. Both (or all) parties should have an equal seat at the table, especially for program design, financial planning, and evaluation.

Some partnerships use a consensus-based model, while others use a shared leadership structure where each partner rotates responsibility for specific tasks or projects.

8. Shared Evaluation and Impact Measurement

A good partnership includes data-driven decision-making. Together, partners should:

- Define key performance indicators (KPIs)

- Collect and analyze data across partners

- Assess outcomes, not just activities

Common tools used:

- Logic models or Theory of Change

- Evaluation frameworks

- Year-end impact reports for funders and stakeholders

Sharing results enhances credibility, strengthens future funding applications, and helps replicate success.

9. Sustainability and Long-Term Vision

Short-term collaborations may be useful, but long-term partnerships are where transformative impact occurs. Sustainable partnerships:

- Include succession planning

- Explore diversified funding streams

- Plan for scalability of programs

- Adapt as circumstances or community needs evolve

A good rule is to design for growth, even if starting small.

10. Legal, Financial, and Ethical Compliance

Nonprofit partnerships must comply with:

- IRS regulations (especially for 501(c)(3)s)

- Grant terms and funder restrictions

- State nonprofit corporation laws

- Data privacy and confidentiality agreements

- Ethical fundraising and donor acknowledgment rules

If money or fiduciary responsibilities are shared (e.g., via a fiscal sponsorship), clearly defined legal boundaries and internal controls are essential to avoid reputational or financial risks.

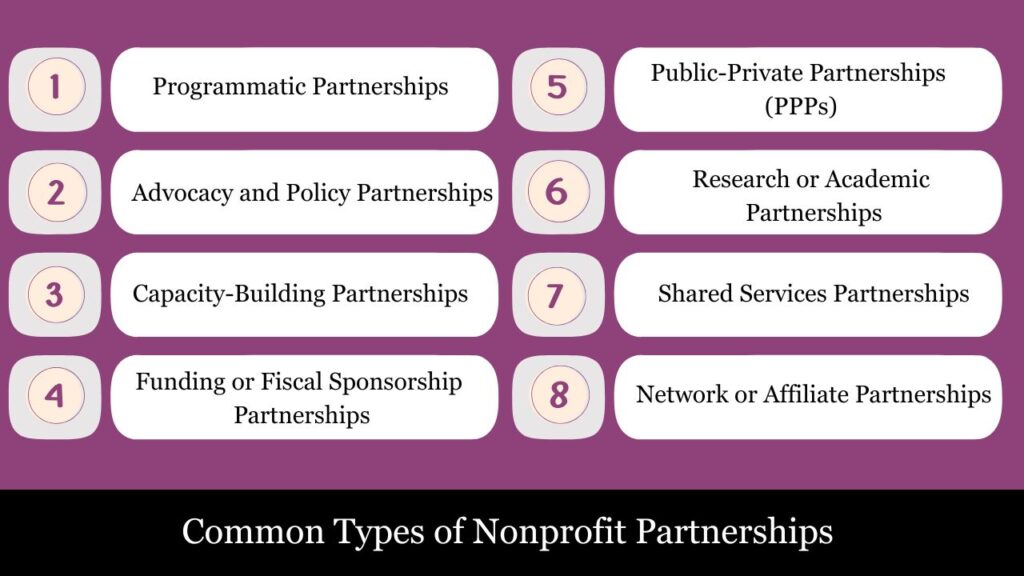

Common Types of Nonprofit Partnerships (Fully Descriptive)

Nonprofit partnerships vary in structure and purpose but are always centered on advancing a shared mission or serving a common public interest. Below are the most common types of nonprofit partnerships, with detailed descriptions and examples:

1. Programmatic Partnerships

Definition:

Two or more nonprofits collaborate to design, fund, and implement a specific program or service that addresses a common issue.

Key Features:

- Partners typically pool resources (e.g., staff, curriculum, outreach tools).

- The program is jointly branded or co-managed.

- Each partner retains its independence but agrees on mutual goals and metrics.

Example:

A food bank partners with a community health clinic to run a “Food as Medicine” program, providing healthy meals and nutrition education to diabetic patients.

2. Advocacy and Policy Partnerships

Definition:

Organizations work together to influence public policy, legislation, or public opinion related to their missions.

Key Features:

- May involve grassroots campaigns, lobbying efforts, petitions, or public awareness.

- Often involves coalitions or alliances with a formal name and shared leadership.

- Focus is on systemic change rather than direct service delivery.

Example:

Multiple environmental nonprofits form a statewide climate action coalition to advocate for renewable energy incentives and emissions regulations.

3. Capacity-Building Partnerships

Definition:

One organization helps another build its internal capacity by sharing tools, training, infrastructure, or expertise.

Key Features:

- May involve technology transfer, professional development, or joint training.

- Usually includes a larger or more established nonprofit helping a smaller or newer one.

- Enhances organizational sustainability and effectiveness.

Example:

A national nonprofit offers free grant writing workshops and donor CRM software access to smaller community-based partners.

4. Funding or Fiscal Sponsorship Partnerships

Definition:

One organization (usually a registered 501(c)(3)) acts as a fiscal sponsor for another project, allowing it to receive tax-deductible donations or grants.

Key Features:

- The sponsor manages funds, compliance, and legal oversight.

- The sponsored project operates under the umbrella of the fiscal sponsor.

- Common for start-up initiatives or temporary campaigns.

Example:

An emerging arts collective without legal nonprofit status operates under a local foundation’s fiscal sponsorship to receive grants for public installations.

5. Public-Private Partnerships (PPPs)

Definition:

A nonprofit collaborates with a government entity or private company to deliver services or infrastructure that benefits the public.

Key Features:

- Integrates government support, nonprofit accountability, and occasionally private sector creativity to achieve shared goals.

- Often used in large-scale initiatives like affordable housing, public health, or workforce development.

- Requires high levels of transparency, reporting, and formal agreements.

Example:

A nonprofit housing organization partners with the city government and a private developer to build low-income housing units with wraparound support services.

6. Research or Academic Partnerships

Definition:

Nonprofits partner with universities, think tanks, or research institutions to conduct studies, evaluations, or knowledge-sharing projects.

Key Features:

- Focus on evidence-based programming, monitoring and evaluation (M&E), or publishing findings.

- Strengthens the organization’s reputation, improves eligibility for grants, and supports effective measurement of outcomes.

Example:

A nonprofit focused on early childhood education partners with a local university to study the impact of pre-K curriculum on literacy outcomes.

7. Shared Services Partnerships

Definition:

Multiple nonprofits collaborate to share back-office services, such as HR, accounting, IT, or legal counsel, to reduce overhead costs.

Key Features:

- Helps smaller organizations access professional services affordably.

- Improves operational efficiency while preserving individual missions.

Example:

Three local nonprofits form a shared services consortium for payroll and benefits administration, reducing costs by 40%.

8. Network or Affiliate Partnerships

Definition:

Independent organizations operate under a larger parent organization or umbrella network, often sharing a brand, mission, and best practices.

Key Features:

- Local affiliates maintain autonomy but align with network standards and goals.

- Allows for nationwide or global impact while tailoring services to local communities.

Example:

Local YMCA chapters are part of a nationally affiliated network but are individually governed and funded.

How to File as a Nonprofit Partnership (U.S.)? – Detailed Guide

While the IRS does not officially recognize “nonprofit partnerships” as a standalone tax-exempt entity type, two or more individuals or organizations can collaborate under a partnership structure for nonprofit or charitable purposes. These partnerships are commonly formed to leverage shared missions, reduce costs, and enhance service delivery—especially in education, health, the arts, or humanitarian sectors.

1. Understand the Nature of a Nonprofit Partnership

A nonprofit partnership is usually a joint venture or unincorporated association formed by:

- Two or more 501(c)(3) organizations

- A nonprofit and an individual

- A nonprofit and a for-profit (with strict safeguards)

Important: Any income generated must directly support a tax-exempt mission. Profit distribution to partners is strictly prohibited.

2. Draft a Legally Binding Partnership or Joint Venture Agreement

This agreement lays the foundation of the nonprofit partnership’s legal and operational framework. It should include:

- Purpose Statement: Clearly define the charitable mission.

- Governance Structure: Roles and authority of each partner.

- Fiscal Sponsor (if applicable): If one partner holds the 501(c)(3), outline responsibilities.

- Financial Provisions: Banking, contributions, grants, cost-sharing, and how funds will be used.

- Exit & Dissolution Terms: How the partnership winds down and distributes assets (must go to another exempt entity).

3. Apply for an EIN (Employer Identification Number)

You must obtain an EIN from the IRS using Form SS-4, even if the nonprofit partnership:

- Is formed under an umbrella organization

- Will not have employees initially

The EIN is essential for:

- Opening a bank account

- Filing IRS returns

- Applying for grants

4. Register with the State

Depending on the state where the nonprofit operates:

- File as an Unincorporated Nonprofit Association or General Partnership

- Register as a Charitable Organization with the State Attorney General or Department of Revenue

- Obtain any applicable state tax exemptions or charitable solicitation licenses

5. Determine Tax-Exempt Status and File with the IRS

There are two pathways:

Option 1: File for Your Own 501(c)(3) Status

- Use Form 1023 or Form 1023-EZ

- Must demonstrate:

- Charitable purpose

- Activities aligned with public benefit

- No private inurement

Option 2: Operate Under an Existing 501(c)(3)

- Commonly called a fiscal sponsorship

- Partner organization retains control of funds and compliance responsibility

- The new partnership does not file for separate tax-exempt status

6. File IRS and State Tax Returns

Depending on your structure:

| Structure | Required IRS Forms | Notes |

| General Partnership | Form 1065 + Schedule K-1s | Required if treated as a partnership |

| Exempt Organization | Must file Form 990, 990-EZ, or 990-N annually | If it holds separate tax-exempt status |

| Joint Venture | Reported via Schedule R of Form 990 | If an exempt partner reports it |

Partnerships may also need to file Form 1099s, issue K-1s to partners, and comply with UBIT (Unrelated Business Income Tax) rules.

7. Maintain Ongoing Compliance

To maintain transparency and exemption:

- Annual Filings: IRS, state attorney general, and charity regulators

- Governance: Hold regular board/partner meetings and document minutes

- Audits: Retain clear financial records, especially if receiving grants

- Mission Consistency: Use funds strictly for charitable purposes

Example Scenario

A 501(c)(3) literacy nonprofit joins forces with a healthcare nonprofit to start a community reading program in hospitals. They:

- Draft a joint venture agreement

- Apply for an EIN

- Register as a charitable partnership in the state

- Submit filings through a parent 501(c)(3) organization by operating under a fiscal sponsorship arrangement.

- Submit financial reports via Form 990

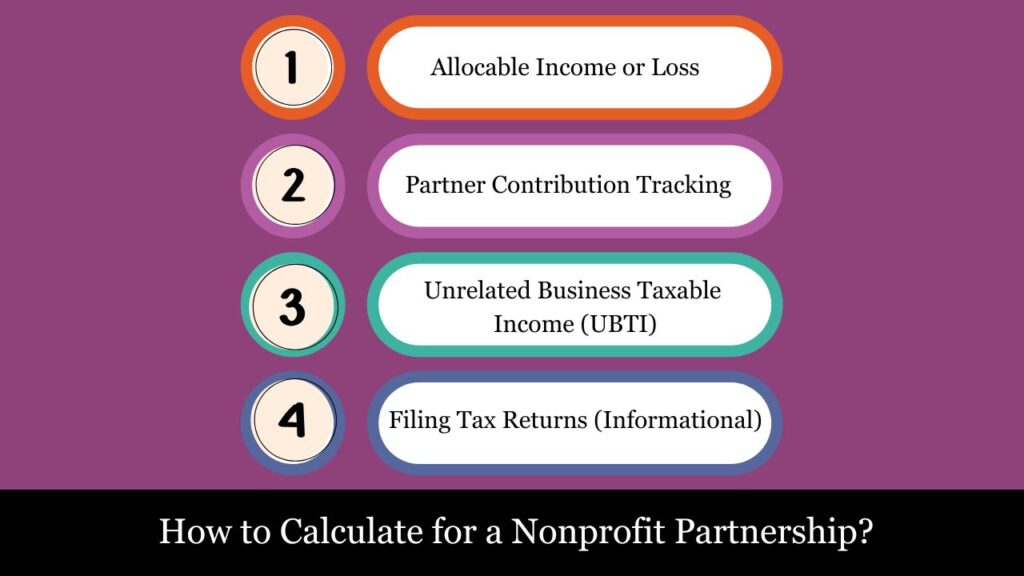

How to Calculate for a Nonprofit Partnership?

1. Allocable Income or Loss

While nonprofit partnerships typically operate under a not-for-profit mission, they may still have revenue (e.g., from donations, grants, service fees). The goal is not profit distribution, but proper fund allocation and accountability.

Example Calculation:

Total Revenue (Grants + Donations + Program Fees) – Total Expenses (Program + Admin + Fundraising) = Net Surplus or Deficit

Example:Total Revenue = $250,000 Total Expenses = $240,000 Net Surplus = $10,000 (reinvested into nonprofit activities)2. Partner Contribution Tracking

Each partner’s capital account must be tracked based on contributions (cash, property, services) and allocations (usually no profit distribution, but tracking for governance).

Capital Account Example:

| Partner | Initial Contribution | Add’l Contribution | Withdrawals | Ending Balance |

| Partner A | $20,000 | $5,000 | $0 | $25,000 |

| Partner B | $15,000 | $0 | $0 | $15,000 |

3. Unrelated Business Taxable Income (UBTI)

If the nonprofit earns unrelated business income (e.g., renting out space), that portion is subject to tax. You calculate UBTI as:

Gross Unrelated Business Income

– Direct Expenses Associated with That Income

= Net UBTI (Taxable)

UBTI Example:

Income from rental activity = $30,000 Direct expenses (maintenance, utilities) = $10,000 UBTI = $20,000 → Taxable under IRS rules4. Filing Tax Returns (Informational)

Even if no taxes are owed, nonprofit partnerships must file IRS Form 1065 and attach Schedule K-1s to report each partner’s share of revenues or expenditures.

Compliance and Cautions for Nonprofit Partnerships

Operating as a nonprofit partnership introduces a unique blend of compliance requirements from both the IRS and state regulatory authorities. Unlike conventional partnerships, nonprofit collaborations must uphold their mission focus, ensure financial accountability, and comply rigorously with tax-exempt regulations. Below is a structured overview of key compliance areas and potential pitfalls to avoid.

1. Filing Requirements

a. Form 1065 – U.S. Return of Partnership Income

- Must be filed annually, even if the nonprofit is tax-exempt.

- Used to report income, expenses, and the allocation of items to each partner.

- Schedule K-1 must be issued to each partner.

b. Form 990 or 990-EZ

- If the nonprofit partnership has obtained 501(c)(3) or other exempt status, it must file Form 990 instead of Form 1065.

- Required to disclose mission activities, revenue, compensation, and significant transactions.

c. Form 990-T

- If the partnership earns Unrelated Business Taxable Income (UBTI) (e.g., rental income or advertising revenue), this form is required.

- Filing triggers potential tax liability even for exempt organizations.

2. Proper Use of Funds

- All income must be used solely for charitable, educational, or mission-aligned purposes.

- No profit distributions to partners are allowed.

- Noncompliance can result in IRS-imposed penalties and the loss of tax-exempt status.

3. Recordkeeping & Transparency

- Maintain clear records of:

- Donations

- Partner contributions

- Grants and restricted funds

- Expense allocations

- Retain supporting documentation for at least 3–7 years depending on the record type.

Best Practice: Conduct internal audits and use accounting software tailored for nonprofits.

4. Avoiding Private Inurement and Self-Dealing

- Private inurement: Prohibited; partners, board members, or insiders cannot receive excessive personal benefit from nonprofit income or assets.

- Self-dealing: Transactions between the nonprofit and related parties (e.g., leases, contracts) must be fair-market and fully disclosed.

5. State-Level Registration and Reporting

- Many states require:

- Annual charitable registration

- State income or franchise tax exemptions

- Renewals for fundraising licenses

Failure to comply can result in:

- Suspension of operations

- Revocation of state tax-exempt status

- Fines and penalties

6. Partner Responsibilities and Fiduciary Duty

Each partner in a nonprofit partnership:

- Required to operate with integrity and prioritize the nonprofit’s mission in all decisions and actions.

- Shares legal and fiduciary responsibility.

- Should avoid conflicts of interest and disclose any financial relationships with the nonprofit.

Conclusion

Nonprofit partnerships offer a powerful structure for like-minded organizations to collaborate, pool resources, and amplify their mission-driven impact. While they combine the operational flexibility of a partnership with the purpose of a nonprofit, they also come with strict compliance responsibilities.

From IRS filings to state-level registrations, financial transparency, and restrictions on private benefit, nonprofit partnerships must uphold high standards of accountability. With proper governance, strategic planning, and rigorous recordkeeping, these partnerships can thrive—delivering sustained benefits to the communities they serve.

Frequently Asked Questions (FAQs)

Can a nonprofit be formed as a partnership?

Yes. While rare, two or more nonprofits or tax-exempt entities can form a partnership to work jointly on shared charitable objectives. However, they must ensure that no profit is distributed and that all activities align with their exempt purposes.

Does a nonprofit partnership have to file IRS Form 1065?

In most cases, yes—unless the partnership has independently obtained tax-exempt status, such as recognition under 501(c)(3). In such cases, Form 990 may be filed instead. Schedule K-1 must still be issued to each partner to show each one’s share of income or expenses.

Can a nonprofit partnership earn income?

Yes, but income must support the organization’s charitable mission. If the income is unrelated to the exempt purpose, it may be classified as Unrelated Business Taxable Income (UBTI) and subject to taxation via Form 990-T.

Is it legal to distribute surplus funds among the partners?

No. Nonprofit partnerships cannot distribute profits to partners or individuals. Any surplus must be reinvested in mission-based activities.

How are decisions made in a nonprofit partnership?

Through a partnership agreement that outlines governance, contributions, operational roles, and dispute resolution. All decisions must further the public good and comply with nonprofit rules.

Do nonprofit partnerships need to register at the state level?

Yes. Depending on the state, nonprofit partnerships may need to:

-Register as charitable organizations

-File annual reports or renewals

-Comply with fundraising regulations

Can a for-profit organization be a partner in a nonprofit partnership?

Generally not, unless the arrangement preserves the nonprofit’s tax-exempt integrity and avoids private benefit issues. Legal counsel is recommended in such cases.

What happens if a nonprofit partnership violates IRS rules?

The partnership and its partners may face:

-Loss of tax-exempt status

-IRS penalties and back taxes

-State-level fines

-Revocation of fundraising privileges