Form 990 Instructions: A Complete Guide to Filing Like a Pro

Table of Contents

Decode Form 990 Instructions: Easy-to-Follow Instructions for Stress-Free Filing

IRS Form 990 Instructions, officially titled “Return of Organization Exempt From Income Tax,” is a publicly accessible informational return that most federally tax-exempt organizations must file annually with the Internal Revenue Service. It is not used to calculate a tax liability, but rather to ensure transparency, maintain tax-exempt status, and provide the public and regulators with insight into an organization’s operations, finances, governance, and compliance.

Primary Purpose of Form 990

Form 990 serves several key purposes:

- Regulatory Compliance: Ensures the organization continues to qualify under IRS guidelines for tax-exempt status, such as under §501(c)(3), §501(c)(4), or other sections of the Internal Revenue Code.

- Public Accountability: Provides a detailed picture of how the organization earns and spends its money, what it pays key staff, and what governance policies it has in place.

- Donor Confidence & Public Trust: Enables the public and donors to assess whether the nonprofit is responsibly managing its assets and carrying out its stated mission.

- Internal Benchmarking: Helps nonprofits internally track changes in finances, performance, and governance across years.

Who Must File IRS Form 990?

IRS Form 990 is required to be filed annually by most organizations that have been granted tax-exempt status under the Internal Revenue Code (IRC), Primarily governed by Section 501(a), this includes organizations recognized under subsections like 501(c)(3), 501(c)(4), 501(c)(6), and other qualifying nonprofit categories.

The requirement to file depends on gross receipts, total assets, and the organization’s type. Here is a detailed breakdown:

1. Tax-Exempt Organizations Under Section 501(c)

Organizations exempt under IRC §501(c)—including charities, foundations, social welfare groups, and trade associations—are typically required to file one of the 990 series returns annually:

- 501(c)(3): Public charities, private foundations, educational institutions, and religious-affiliated nonprofits

- 501(c)(4): Social welfare organizations

- 501(c)(5): Labor and agricultural unions

- 501(c)(6): Business leagues, chambers of commerce

- 501(c)(7): Social and recreational clubs

- 501(c)(19): Veterans organizations

2. Gross Receipts & Filing Thresholds

The specific version of Form 990 an organization is required to file is determined by its annual gross receipts and the value of its total assets:

| Form | Who Must File |

| Form 990-N | Small tax-exempt organizations with gross receipts ≤ $50,000 |

| Form 990-EZ | Organizations with gross receipts < $200,000 and assets < $500,000 |

| Form 990 (Full) | must be filed by organizations with annual gross receipts of $200,000 or more, or total assets of $500,000 or more |

| Form 990-PF | Every private foundation is required to file, regardless of its income or the value of its assets |

Note: Private foundations must file Form 990-PF, even if they meet the thresholds for 990-N or 990-EZ.

3. Exceptions — Who Does Not Need to File?

Certain entities are automatically exempt from filing Form 990, including:

- This includes churches, affiliated ministries, and church-related conventions or associations

- Religious orders that are part of a church

- Government entities and organizations affiliated with government units

- State institutions, such as publicly controlled universities

- Some political organizations are exempt from filing Form 990 and must instead submit Form 1120-POL or Form 8872, depending on their structure and activities

- Subordinate entities that are part of a group return submitted by a central or parent organization are not required to file separately.

4. Consequences for Not Filing

- Failure to submit a 990-series return for three straight years will result in automatic revocation of the organization’s tax-exempt status by the IRS..

- This is known as “automatic revocation,” and reinstatement requires a formal application and IRS approval.

- Penalties may also be imposed for late filing, with amounts based on the size of the organization and duration of delinquency.

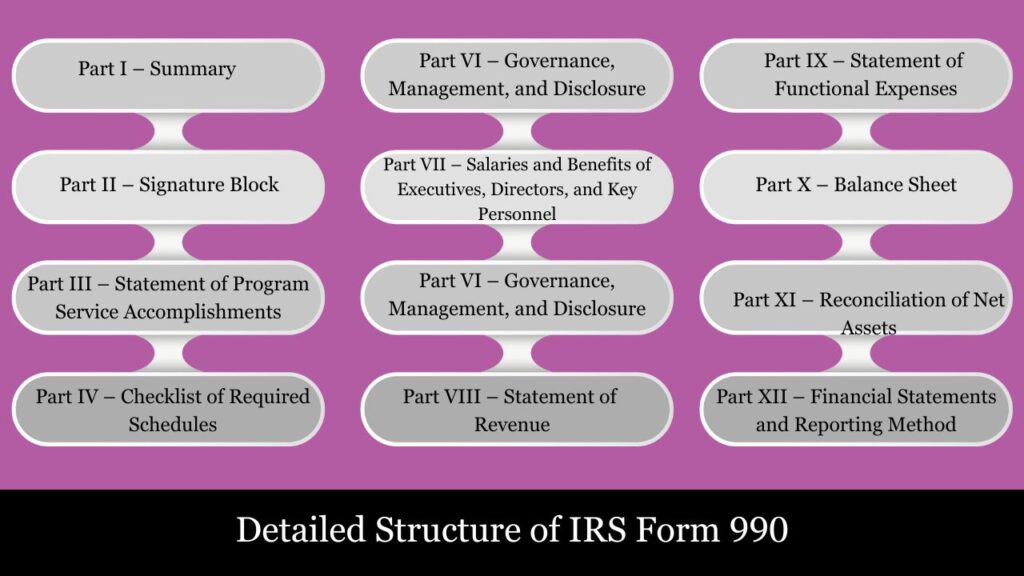

Detailed Structure of IRS Form 990

IRS Form 990 is a comprehensive annual filing used by tax-exempt organizations to report financial information, operations, governance, and compliance with the Internal Revenue Code. The form is composed of a core return and numerous schedules, depending on the organization’s activities.

Part I – Summary

- A snapshot of the organization’s mission, key activities, financial highlights, and governance.

- Includes totals for revenue, expenses, net assets, and basic contact info.

- Serves as a concise overview for donors, regulators, and the general public to understand an organization’s financial and operational status.

Part II – Signature Block

- Must be signed under penalties of perjury by an authorized officer (typically the president, treasurer, or CFO).

Part III – Statement of Program Service Accomplishments

- Outlines the nonprofit’s mission and highlights its top three program service accomplishments during the year.

- Reports expenses and revenues associated with each activity.

- Essential for demonstrating the organization’s charitable impact and validating its eligibility for tax-exempt status.

Part IV – Checklist of Required Schedules

- A yes/no checklist that determines which of the 16+ supplemental Schedules A–R the organization must attach.

- Helps flag compliance requirements such as lobbying, fundraising, foreign activities, etc.

Part V – Statements Regarding Other IRS Filings

- Confirms whether the organization filed required forms like W-2, 1099, 4720, etc.

- Includes questions about employment taxes, unrelated business income, and donations of motor vehicles.

Part VI – Governance, Management, and Disclosure

- Details about the board of directors, conflict of interest policies, and public disclosure practices.

- Assesses governance transparency and oversight.

Part VII – Salaries and Benefits of Executives, Directors, and Key Personnel

- Lists compensation for top executives, officers, directors, and key contractors.

- Promotes transparency and is a focal point for public and media scrutiny.

Part VIII – Statement of Revenue

- Breaks down all revenue sources, including:

- Contributions and grants

- Program service revenue

- Membership dues

- Investment income

- Fundraising and unrelated business income

Part IX – Statement of Functional Expenses

- Categorizes expenses as program services, management and general, or fundraising.

- Lists common categories like salaries, rent, professional fees, office supplies, etc.

Part X – Balance Sheet

- Reports the organization’s assets, liabilities, and net position at both the start and close of the tax year.

- A key financial statement used to assess solvency.

Part XI – Reconciliation of Net Assets

- Reconciles changes in net assets from the prior year.

- Reconciles operational surplus or deficit with changes in net assets reported on the balance sheet.

Part XII – Financial Statements and Reporting Method

- Indicates accounting method (cash, accrual, or other).

- Notes whether the financial statements were audited, compiled, or reviewed by an independent accountant.

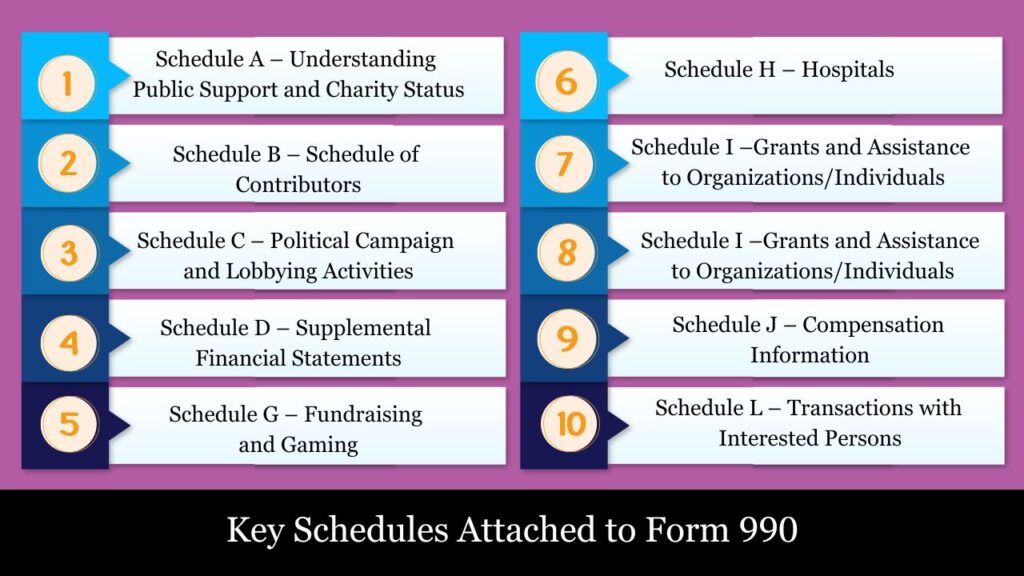

Key Schedules Attached to Form 990 – Detailed Overview

Form 990 isn’t complete without its schedules, which provide crucial supplemental information. Depending on the organization’s operations, size, and financial transactions, up to 16 different schedules may be required.

Schedule A – Understanding Public Support and Charity Status

- Purpose: Establishes whether the organization qualifies as a public charity under IRC §170(b)(1)(A).

- Includes:

- Five-year summary of public contributions.

- Calculation of public support percentage.

- Classification as 509(a)(1), 509(a)(2), or other.

- Who Must File: Most Section 501(c)(3) public charities.

Schedule B – Schedule of Contributors

- Purpose: Discloses contributions from certain donors.

- Includes:

- Donors who gave $5,000 or more (or 2% of total contributions for larger organizations).

- Amount and type of contribution (cash, stock, etc.).

- Who Must File: Organizations receiving significant donations; private foundations must always file.

Schedule C – Political Campaign and Lobbying Activities

- Purpose: Details political and lobbying expenditures.

- Includes:

- Whether the organization attempted to influence legislation.

- 501(h) election for lobbying limits.

- Who Must File: Any organization that lobbies or engages in political activity.

Schedule D – Supplemental Financial Statements

- Purpose: Expands on asset and liability information from the balance sheet.

- Includes:

- Endowments, conservation easements, art collections.

- Donor-advised funds and escrow accounts.

- Who Must File: Orgs with complex assets or restricted funds.

Schedule G – Fundraising and Gaming

- Purpose: Details professional fundraising efforts and gaming activities.

- Includes:

- Compensation to fundraising consultants.

- Explains how organizations maintain public charity status by meeting public support requirements.

- Who Must File: If more than $15,000 raised from events or gaming.

Schedule H – Hospitals

- Purpose: Required for 501(c)(3) hospitals.

- Includes:

- Community benefit reports.

- Billing and collection practices.

- Emergency care policies.

- Who Must File: Only hospital organizations.

Schedule I – Grants and Assistance to Organizations/Individuals

- Purpose: Reports on domestic grants issued.

- Includes:

- Name, location, and amount given to each grantee.

- Purpose and method of grant oversight.

- Who Must File: Orgs that made grants over $5,000 to any domestic recipient.

Schedule F – International Operations and Expenditures Summary

- Purpose: Discloses operations, investments, or grants outside the U.S.

- Includes:

- Region-specific activity.

- Foreign grants over $5,000.

- Foreign bank account reporting.

- Who Must File: Orgs with foreign activity or assets.

Schedule J – Compensation Information

- Purpose: Details highly paid staff and compensation practices.

- Includes:

- Officers and key employees earning over $150,000.

- Bonuses, deferred compensation, non-taxable benefits.

- Who Must File: Any organization with such employees.

Schedule L – Transactions with Interested Persons

- Purpose: Discloses potential conflicts of interest or insider transactions.

- Includes:

- Loans to/from officers.

- Family member transactions.

- Business dealings with insiders.

- Who Must File: If any reportable transaction occurred.

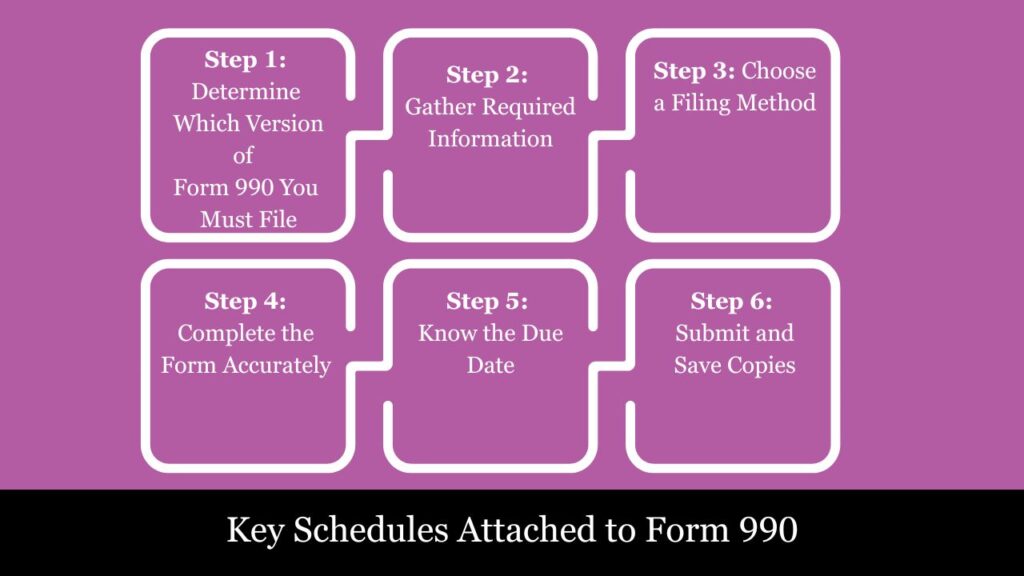

How to File IRS Form 990?: Complete Step-by-Step Guide

Form 990 must be filed annually by most tax-exempt organizations, including charities, foundations, and some religious and educational institutions. The form discloses financials, governance, and mission-driven activities.

Step 1: Determine Which Version of Form 990 You Must File

Select the Correct 990 Variant According to Financial Criteria:

| Form | Eligibility |

| 990-N (e-Postcard) | Gross receipts ≤ $50,000 |

| 990-EZ | Gross receipts < $200,000 and total assets < $500,000 |

| Full Form 990 | Gross receipts ≥ $200,000 or total assets ≥ $500,000 |

| Form 990-PF | All private foundations, regardless of income |

| Form 990-T | If the organization has unrelated business income of $1,000 or more |

Step 2: Gather Required Information

Before filling out Form 990, collect the following:

- EIN (Employer Identification Number)

- Legal name, address, and website

- Tax year (calendar or fiscal)

- Mission statement and program descriptions

- Financial statements (revenue, expenses, assets, liabilities)

- Board member list and compensation details

- Policies (conflict of interest, whistleblower, etc.)

- Details on grants, donations, and political activities

- Prior year’s Form 990 (for reference)

Step 3: Choose a Filing Method

Electronic filing (e-file) is mandatory for all Form 990 variants (except certain 990-N filers).

You can file using:

- IRS Authorized E-file Providers (e.g., Tax990, TaxBandits, File990.org)

- Tax professionals (CPA or EA firms)

- IRS MeF (Modernized e-File) system via approved software

IRS no longer accepts paper Form 990 filings (except rare exceptions with written IRS approval).

Step 4: Complete the Form Accurately

Each section of Form 990 must be filled carefully. Here’s a brief focus:

- Part I (Summary): Mission, program, total income and expenses

- Part III (Program Service): Describe your key charitable programs

- Part VII: Report salaries of officers and directors

- Part IX: Classify expenses by functional categories

- Schedules: Only attach schedules that apply (e.g., Schedule A for public support, Schedule B for donors)

Tip: Use prior year’s 990 as a reference to ensure consistency.

Step 5: Know the Due Date

- Organizations must file Form 990 by the 15th day of the fifth month following the close of their tax year.

- For calendar-year orgs, that’s May 15.

- Form 8868 can be submitted to receive an automatic six-month filing extension.

Step 6: Submit and Save Copies

- Submit electronically through an IRS-authorized e-file system.

- After submission:

- Save a digital copy of the return

- Share with board members

- Consider posting publicly (e.g., on your website)

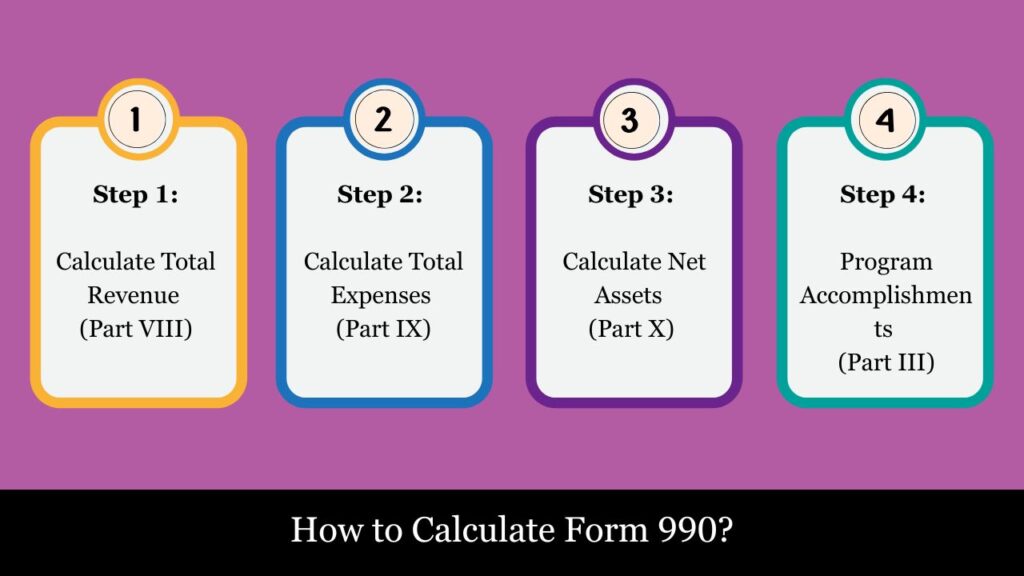

How to Calculate Form 990?

Form 990 serves as a public disclosure document for nonprofit and tax-exempt entities. While no tax is calculated, accurate financial reporting is critical for IRS compliance and public transparency. The core sections involve revenue, expenses, assets, and liabilities.

Step-by-Step Calculations

Step 1: Calculate Total Revenue (Part VIII)

Revenue is divided into categories:

| Revenue Type | What to Include |

| Contributions & Grants | Donations, federal/state grants, private foundations |

| Program Service Revenue | Fees from services related to your mission |

| Investment Income | Interest, dividends, capital gains |

| Other Income | Rent, sponsorships, unrelated business income (UBI), etc. |

Calculation:

Let’s assume the following:

- Contributions & Grants: $300,000

- Program Fees: $150,000

- Investment Income: $20,000

- Rent Revenue: $10,000

Total Revenue = $300,000 + $150,000 + $20,000 + $10,000 = $480,000

Disclosed in Part I, Line 12 and also reflected in Part VIII, Line 12, Column A.

Step 2: Calculate Total Expenses (Part IX)

Expenses are broken down into three functional categories:

| Type | Examples |

| Program Services | Costs directly related to mission activities |

| Management & General | Admin expenses like accounting, legal, rent |

| Fundraising | Campaigns, donor relations, marketing |

Example Calculation:

- Salaries (Program): $180,000

- Program Supplies: $70,000

- Admin Salaries: $40,000

- Office Rent: $20,000 (split 70% Program, 30% Admin)

- Fundraising Event: $35,000

Program = $180,000 + $70,000 + (70% × $20,000) = $264,000

Management = $40,000 + (30% × $20,000) = $46,000

Fundraising = $35,000

Total Expenses = $264,000 + $46,000 + $35,000 = $345,000

Reported on Part I, Line 18 and Part IX, Line 25 (column A).

Step 3: Calculate Net Assets (Part X)

This section provides a snapshot of the organization’s financial position.

| Line | Description |

| Assets | Cash, receivables, equipment, land |

| Liabilities | Payables, loans, deferred income |

| Net Assets | Assets − Liabilities |

Example:

- Cash: $100,000

- Grants receivable: $50,000

- Investments: $200,000

- Equipment: $150,000

- Mortgage Loan: $70,000

- Accounts Payable: $30,000

Total Assets = $100,000 + $50,000 + $200,000 + $150,000 = $500,000

Total Liabilities = $70,000 + $30,000 = $100,000

Net Assets = $500,000 − $100,000 = $400,000

Reported on Part I, Line 22, and Part X, Line 33.

Step 4: Program Accomplishments (Part III)

For each program:

- Describe what the program did.

- Report direct expenses incurred.

- Include number of people served or measurable output.

Example:

- Tree Planting Program: Planted 15,000 trees in 10 states

- Cost: $100,000

Reported in Part III, Line 4a

Repeat for each major program.

Due Date & Extensions for IRS Form 990

The filing deadline for Form 990 falls on the 15th day of the fifth month following the close of the organization’s fiscal year.

Example:

- Nonprofits operating on a calendar year must file Form 990 by May 15 of the following year.

Extension Option:

Nonprofits can use Form 8868 to automatically extend their Form 990 filing deadline by six months.

- No explanation required for requesting the extension.

- This does not extend the time to pay any taxes due (if applicable, for example in Form 990-T).

Example with Extension:

- If the tax year ends on December 31 → Original due date: May 15

- With extension → New due date: November 15

Penalties for Late Filing or Noncompliance – IRS Form 990

Failure to file Form 990 on time—or providing incomplete/inaccurate information—can lead to serious consequences, especially for tax-exempt organizations.

Monetary Penalties

For Small to Mid-Size Organizations:

- If gross receipts < $1,222,000:

- Penalty: $20 per day (for each day late)

- Maximum Penalty: Up to $12,000 or 5% of gross receipts, whichever is less.

For Larger Organizations:

- If gross receipts ≥ $1,222,000:

- Penalty: $120 per day

- Maximum Penalty: Up to $61,000

Automatic Revocation of Tax-Exempt Status

- If an organization fails to file Form 990, 990-EZ, or 990-N for 3 consecutive years, the IRS automatically revokes its tax-exempt status.

- To regain exemption, the organization must reapply by filing Form 1023 or 1024.

Other Compliance Risks

- Failure to file Schedule B (contributors list, if applicable)

- Omission of required schedules or disclosures

- Misreporting executive compensation or program service accomplishments

Significance of Form 990 for Donors, Grantmakers, and Oversight Bodies

Form 990 serves as a vital transparency tool that allows the public, including donors, foundations, regulatory agencies, and watchdog organizations, to evaluate a nonprofit organization’s financial health, governance practices, and overall mission effectiveness.

For donors, Form 990 offers insight into how contributions are being used—whether funds are being spent responsibly on programs and services rather than overhead. It helps build confidence by showcasing the organization’s commitment to accountability.

For grantmakers and philanthropic institutions, the form helps in vetting potential grantees. It provides a clear breakdown of revenue sources, expenditures, and compliance with nonprofit regulations—critical for ensuring that their funds support credible, mission-aligned efforts.

For oversight bodies and watchdog groups, such as the IRS, state regulators, and independent evaluators (e.g., Charity Navigator or Guidestar), Form 990 is essential for monitoring tax-exempt compliance, detecting red flags, and ensuring that tax benefits are not being abused.

Ultimately, Form 990 strengthens nonprofit integrity, supports informed giving, and reinforces trust between tax-exempt organizations and the public they serve.

Conclusion

IRS Form 990 is far more than just a tax document—it’s a powerful instrument for transparency, accountability, and public trust in the nonprofit sector. By detailing an organization’s financial activities, governance practices, and program effectiveness, Form 990 offers stakeholders—including the IRS, donors, funders, and the general public—a clear window into how a nonprofit operates.

Filing Form 990 accurately and on time not only ensures compliance with federal tax laws but also enhances an organization’s reputation and credibility. For nonprofits committed to their mission, Form 990 is a strategic opportunity to demonstrate fiscal responsibility, good governance, and meaningful impact.

Frequently Asked Questions (FAQs)

Are all tax-exempt organizations required to submit Form 990?

Filing isn’t required for churches and specific church-related entities, though it is mandatory for most other organizations.

What’s the difference between 990 and 990-EZ?

990-EZ is a simplified version for smaller organizations under the financial threshold.

Can a previously filed Form 990 be corrected or revised?

Yes, by checking the “Amended Return” box and resubmitting the corrected form.

Is Form 990 available to the public?

Yes. Organizations must provide copies upon request and are encouraged to post it online.