Master Form 941 Schedule B: A Must-Know for Semiweekly Schedulers

Table of Contents

Confused by Form 941 Schedule B? Here’s the Clear-Cut Guide

Form 941 Schedule B is a critical attachment for employers who follow a semiweekly deposit schedule for payroll taxes. It provides a detailed, day-by-day breakdown of tax liabilities within each quarter, helping the IRS verify that deposits are made on time. Lets go with a step by step guide to understad it in a detailed manner.

IRS Form 941 is a quarterly tax return that employers use to report wages paid to employees, income taxes withheld, and both the employer and employee share of Social Security and Medicare taxes (collectively known as FICA taxes). It also captures adjustments for tax credits, overpayments, and other applicable federal employment tax-related events.

Purpose of Form 941

Form 941 serves multiple critical functions:

- Tracks payroll tax liability on a quarterly basis.

- Verifies accurate reporting and payment of federal income and FICA taxes.

- Reconciles amounts deposited with the actual tax liability incurred during the quarter.

- Allows adjustments for sick leave credits, group-term life insurance, COBRA subsidies (when applicable), and more.

Who Must File IRS Form 941?

IRS Form 941, also known as the Employer’s Quarterly Federal Tax Return, is a critical payroll tax form required for most U.S. businesses and nonprofit organizations that employ workers and pay wages subject to federal tax withholding. This form allows the IRS to track the employer’s liability for:

- Federal income tax withheld from employee paychecks

- Social Security tax (both employee and employer portions)

- Medicare tax (both employee and employer portions)

- Additional Medicare Tax, when applicable

General Requirement

Employers who withhold federal income tax or FICA (Social Security and Medicare) from employee wages must file Form 941 quarterly.

This includes all types of employers:

- For-profit businesses

- Tax-exempt organizations (e.g., 501(c)(3) nonprofits)

- Government entities

- Educational institutions

- Religious organizations that withhold payroll taxes

Specific Employers Required to File

You must file IRS Form 941 if:

- You issue regular wages to employees, no matter how many you have.

- You are required to withhold:

- Federal income tax

- Payroll taxes for Social Security and Medicare, including the employer’s share

- You are not specifically permitted to file Form 944 or Form 943 instead.

- You are assigned an Employer Identification Number (EIN) and actively pay wages.

Even if you have no tax liability for a given quarter (e.g., you didn’t pay wages that period), you must still file a “zero return” unless exempted.

Employers NOT Required to File Form 941

There are exceptions where Form 941 is not required, typically based on the nature of your employment or IRS approval for alternative forms.

You might be exempt from filing Form 941 under the following conditions:

1. Seasonal Employers

- You only hire employees during specific seasons (e.g., summer or holiday retail).

- You can skip quarters where no wages were paid, but still must file 941 in active quarters.

- Indicate your seasonal status by selecting the appropriate box on Form 941.

2. Small Employers with IRS Permission to File Form 944

- If your total annual payroll tax liability is $1,000 or less, you may request to file Form 944 (annual return) instead of quarterly Forms 941.

- You must receive direct confirmation from the IRS approving your use of Form 944.

3. Employers of Household Employees

- If you hire nannies, caretakers, or other in-home workers, you do not file Form 941.

- Taxes are reported on Schedule H, which you file with your Form 1040.

4. Agricultural Employers

- Employers with farm workers or agricultural laborers file Form 943 (Employer’s Annual Tax Return for Agricultural Employees), not Form 941.

5. Religious Organizations with Special Exemptions

- Some churches or religious bodies not subject to payroll tax under IRS exemption rules may be exempt, but only if properly documented and approved.

Special Situations

Professional Employer Organizations (PEOs)

- These are third-party entities that handle payroll and tax filings for client businesses.

- PEOs file Form 941 on behalf of their clients and must attach Schedule R (Form 941) to allocate wages and taxes per client.

Businesses with Multiple EINs or Entity Changes

- If your company undergoes a merger, name change, or gets a new EIN, separate filings may be required.

Terminated or Final Returns

- If you close your business or stop paying wages, you must still file a final Form 941 and indicate it’s the last return.

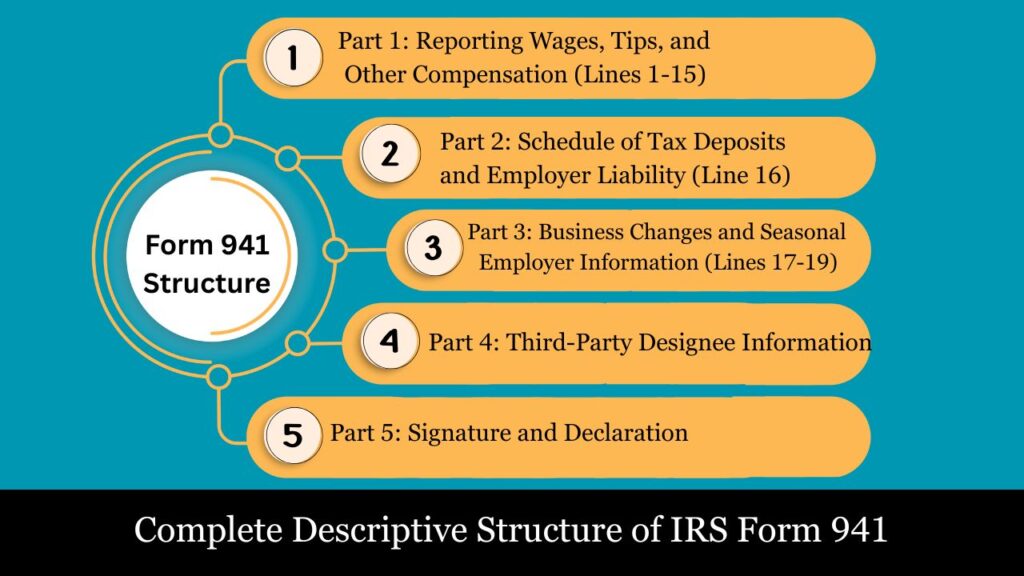

Complete Descriptive Structure of IRS Form 941

IRS Form 941, officially titled the Employer’s Quarterly Federal Tax Return, is used by businesses to report income taxes, Social Security tax, or Medicare tax withheld from employees’ paychecks and used to report and pay the employer’s share of Social Security and Medicare taxes, filed quarterly as part of federal payroll compliance.

Below is a detailed, part-by-part descriptive breakdown of Form 941:

Part 1: Reporting Wages, Tips, and Other Compensation (Lines 1-15)

This is the most critical section of the form where the employer provides a comprehensive summary of wages and federal tax liabilities for the quarter.

- Line 1: Enter the number of employees who received wages, tips, or other compensation during the pay period that includes March 12 (for Q1), June 12 (for Q2), September 12 (for Q3), or December 12 (for Q4).

- Line 2: Report total taxable wages, tips, and other compensation paid to all employees during the quarter.

- Line 3: Indicate the total amount of federal income tax withheld from employees’ pay.

- Line 4: Select this box only if none of the wages, tips, or compensation are taxable under Social Security or Medicare.

- Lines 5a – 5d: Break down the wages and tips that are subject to Social Security and Medicare taxes. This includes:

- 5a: Taxable Social Security wages

- 5b: Taxable Social Security tips

- 5c: Taxable Medicare wages and tips

- 5d: Includes wages and tips liable for Additional Medicare Tax due to income surpassing the set limit

- Line 6: Combine total Social Security and Medicare taxes.

- Line 7: Make any adjustments for fractions of cents.

- Line 8: Adjustments for sick pay provided by third parties.

- Line 9: Adjustments for tips and group-term life insurance.

- Line 10: Calculate total taxes after adjustments (sum of Line 6 through Line 9).

- Line 11: Enter the payroll tax credit claimed for increasing research activities, if applicable.

- Line 12: Subtract Line 11 from Line 10 to arrive at the total taxes due for the quarter.

- Line 13: Enter the total amount of federal tax deposits made for the quarter, including overpayments from prior quarters.

- Line 14: Enter the difference as the balance due if Line 12 exceeds Line 13.

- Line 15: If Line 13 is greater than Line 12, enter the overpayment and indicate whether to apply it to the next return or request a refund.

Part 2: Schedule of Tax Deposits and Employer Liability (Line 16)

This section determines whether you’re a monthly or semiweekly depositor for employment tax purposes.

- If you deposit monthly, provide the tax liability amounts by month for the entire quarter.

- If you’re a semiweekly depositor, you must check the appropriate box and attach Schedule B (Form 941), which details the tax liability by day.

This part ensures that you’re depositing taxes on the appropriate schedule as required by the IRS based on your total tax liability during a lookback period.

Part 3: Business Changes and Seasonal Employer Information (Lines 17-19)

This section helps the IRS track changes in your business status or filing requirements.

- Line 17: If your business has closed or you’ve stopped paying wages, check the box and provide the final date of wage payments.

- Line 18: Select this box if you’re a seasonal employer who doesn’t issue wages each quarter to avoid unnecessary IRS notices.

- Line 19: Indicate whether you’re authorizing a third-party designee (e.g., a payroll provider) to discuss this return with the IRS.

Part 4: Third-Party Designee Information

If you selected “Yes” in Line 19, fill out this section:

- Include the name of the designee.

- Provide their phone number.

- Choose a five-digit personal PIN the designee will use when contacting the IRS.

This section enables easier communication if questions arise about the return.

Part 5: Signature and Declaration

The return must be signed by an authorized individual, which could be:

- The business owner

- A corporate officer

- A partner or member of an LLC

The signature attests that the information provided is accurate and complete. If the return is prepared by a paid third-party preparer, their information must also be included:

- Name and signature

- Firm’s name and address

- Preparer’s PTIN (Preparer Tax Identification Number)

Schedule B (Form 941 )

Schedule B (Form 941) is a supplemental schedule required for employers who are classified as semiweekly schedule depositors or those with a tax liability of $50,000 or more during the lookback period. This schedule provides the IRS with a day-by-day breakdown of when payroll tax liabilities were incurred during the quarter—not when the deposits were made.

Purpose

Its purpose is to help the IRS monitor whether semiweekly depositors are following proper deposit schedules. It allows the IRS to match tax liability dates with actual deposit dates to identify late deposits and impose penalties if necessary.

Structure of Schedule B

- The schedule is divided into three months, each with 31 numbered boxes, one for each day of the quarter.

- Employers must enter the exact amount of tax liability incurred on each day wages were paid to employees.

- This includes liabilities for:

- Federal income tax withheld

- Both the employer’s and employee’s shares of Social Security and Medicare taxes

- Additional Medicare Tax withheld

Note: Do not report the date or amount of actual tax deposits made to the IRS on Schedule B. This form is solely for tracking liability, not payments.

Filing Example

Suppose you pay employees weekly on Fridays. Schedule B requires you to record your payroll tax liability for each Friday within the quarter. For example:

- March 7 – $4,000

- March 14 – $4,200

- March 21 – $4,500

These amounts should be recorded in the corresponding boxes for those dates in the March section.

Why It’s Important

- The IRS uses Schedule B to verify timely deposits of employment taxes.

- Late, underreported, or misdated liabilities can trigger:

- Deposit penalties

- Accuracy-related penalties

- Additional scrutiny during audits

Tips for Accurate Filing

- Match liabilities to pay dates, not deposit dates.

- Double-check for zero liability days—leave them blank rather than entering zero.

- Ensure total liability on Schedule B matches Line 12 (Total taxes after adjustments) of Form 941.

When to File IRS Form 941

Form 941—the Employer’s Quarterly Federal Tax Return—must be filed four times each year, corresponding to each calendar quarter. This form reports federal income tax, Social Security, and Medicare taxes withheld from employees, along with the employer’s share of Social Security and Medicare taxes.

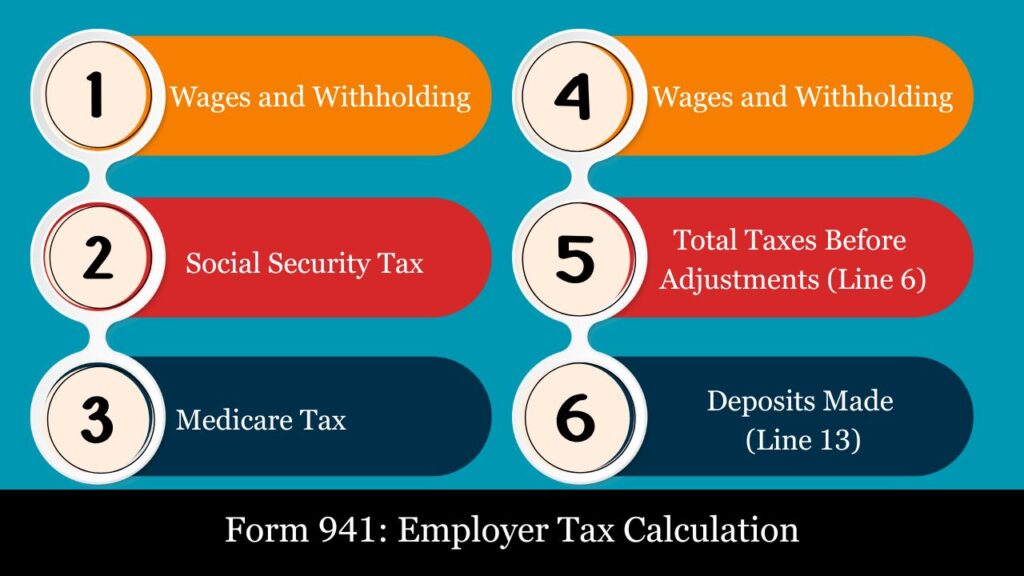

Form 941 Example: Employer Tax Calculation

Assume the following:

- Total number of employees: 5

- Each earns $10,000 this quarter

- Total wages paid: $50,000

- Federal income tax withheld: $5,000

- All wages are subject to Social Security and Medicare

- No pre-tax deductions or other adjustments

Step-by-Step Calculation

1. Wages and Withholding

- Line 1 (Number of employees): 5

- Line 2 (Total wages paid): $50,000

- Line 3 (Federal income tax withheld): $5,000

2. Social Security Tax

- Employee portion: 6.2% × $50,000 = $3,100

- Employer portion: 6.2% × $50,000 = $3,100

- Total Social Security Tax (Line 5a): $6,200

3. Medicare Tax

- Employee portion: 1.45% × $50,000 = $725

- Employer portion: 1.45% × $50,000 = $725

- Total Medicare Tax (Line 5c): $1,450

4. Total Taxes Before Adjustments (Line 6)

- $5,000 (Federal income tax withheld)

- $6,200 (Social Security)

- $1,450 (Medicare)

= $12,650 total taxes

5. Deposits Made (Line 13)

Assume employer deposited $12,000 in payroll taxes this quarter.

6. Balance Due or Overpayment

- Line 14: $12,650 (Tax owed) − $12,000 (Deposits made)

= $650 balance due

Quarterly Filing Deadlines

| Quarter | Period Covered | Filing Deadline |

| Q1 | January 1 – March 31 | April 30 |

| Q2 | April 1 – June 30 | July 31 |

| Q3 | July 1 – September 30 | October 31 |

| Q4 | October 1 – December 31 | January 31 (following year) |

Example: For wages paid between January 1 and March 31, the Form 941 is due by April 30.

Extension of Time to File

- The IRS does not automatically grant an extension to file Form 941.

- However, you may request additional time by submitting Form 8809, although it is typically reserved for informational returns, not payroll returns.

- If you owe taxes, paying them on time is critical—even if your return is delayed.

Penalties for Late Filing or Payment of IRS Form 941

Failing to timely file Form 941 or pay the associated payroll taxes can result in significant IRS penalties and interest charges. These penalties vary depending on whether the issue is late filing, late payment, or failure to deposit taxes properly.

1. Late Filing Penalty

- Failure to file Form 941 on time may result in an IRS penalty of:

- 5% of the unpaid tax due with the return per month or part of a month the return is late.

- The maximum penalty is 25% of the total tax due.

Example: If $10,000 of tax is due and you file the return two months late, the penalty could be 10% ($1,000).

2. Late Payment Penalty

- If you file Form 941 on time but fail to pay the full tax due, the IRS may charge:

- 0.5% of the unpaid tax per month (or part of a month), up to a maximum of 25%.

- This penalty increases to 1% per month if the tax remains unpaid 10 days after receiving a final notice of intent to levy.

3. Late Tax Deposit Penalties

The IRS imposes deposit penalties if you fail to deposit payroll taxes according to your required monthly or semiweekly schedule:

| Days Late | Penalty Rate |

| 1–5 days | 2% of the unpaid deposit |

| 6–15 days | 5% |

| 16+ days | 10% |

| After IRS notice issued | 15% |

These penalties apply per deposit period and are based on when the taxes were due, not when you filed.

4. Interest Charges

- In addition to penalties, the IRS also charges interest on any unpaid tax from the due date until paid in full.

- Each quarter, the interest rate is determined by adding 3% to the federal short-term rate.

How to Minimize or Avoid Penalties

- You must file Form 941 by the due date, regardless of your ability to pay in full.

- Make timely deposits based on your filing frequency (monthly/semiweekly).

- Use EFTPS (Electronic Federal Tax Payment System) for secure, timely tax deposits.

- Communicate with the IRS early if you anticipate payment issues—you may qualify for a payment plan or penalty relief.

What’s New on IRS Form 941 in 2025

The IRS periodically updates Form 941 to reflect tax law changes, credit expirations, and reporting requirements. As of 2025, here are the most notable updates affecting employers filing Form 941:

1. Expiration of COVID-19-Related Credits

- Employee Retention Credit (ERC), Qualified Sick and Family Leave Credits, and related COVID-19 payroll tax relief provisions have officially expired.

- Lines previously used for these credits have been removed or marked as “Reserved for future use.”

- Employers cannot claim retroactive ERC through Form 941; amended returns (Form 941-X) must be used if applicable.

2. Social Security Wage Base Increased

- The Social Security wage base for 2025 has risen to $173,700, compared to $168,600 in 2024.

- Employers must withhold and match 6.2% Social Security tax up to this new wage limit.

3. Updated Medicare Thresholds

- No change in the 1.45% Medicare tax rate.

- The Additional Medicare Tax of 0.9% still applies on wages exceeding:

- $200,000 (Single)

- $250,000 (Married filing jointly)

- $125,000 (Married filing separately)

4. Electronic Filing Threshold Lowered

- Starting in 2025, the IRS requires e-filing for most filers submitting 10 or more returns (combined total across various forms, including W-2s, 1099s, and 941s).

- Employers who previously filed paper Forms 941 may now need to transition to e-file using IRS-approved software or payroll providers.

5. Changes to Tax Deposit Rules

- The IRS clarified its lookback period criteria for determining whether an employer is a monthly or semiweekly depositor.

- The IRS lookback period used to determine deposit schedules for 2025 is July 1, 2023 – June 30, 2024.

6. New IRS Form 941 Instructions

- Form 941 instructions have been revised by the IRS for 2025 to provide clearer guidance on:

- Claiming R&D payroll tax credit (Line 11)

- Rules for fractional adjustments on Lines 7–9

- Filing requirements for seasonal employers

Conclusion

Form 941 plays a crucial role in payroll tax compliance. Employers must ensure that they correctly withhold, deposit, and report taxes each quarter. Errors or delays can lead to penalties, so it’s important to stay updated on IRS instructions and seek assistance when needed.

Frequently Asked Questions (FAQs)

What’s the due date for Form 941?

It’s due by the last day of the month following each quarter’s end:

-Q1: April 30

-Q2: July 31

-Q3: October 31

-Q4: January 31 (following year)

What are the consequences of late filing or late tax payments?

Up to 5% per month for late filing (max 25%) and 0.5% per month for late payment.

Can I file Form 941 electronically?

Yes. As of 2025, e-filing is required if you file 10 or more returns in a year.

Do I need to attach Schedule B?

Only if you’re a semiweekly depositor or have a payroll tax liability of $50,000+ during the lookback period.

What’s new in the 2025 version?

COVID-related credits removed, higher Social Security wage base ($173,700), and mandatory e-file threshold lowered to 10 returns.

How do I fix an error on a submitted Form 941?

Use Form 941-X to amend a previously filed Form 941.

What is the Additional Medicare Tax?

Wages over $200,000 are taxed an extra 0.9% for Medicare, and this tax is not matched by the employer.