Form 4562: Best Overview On Depreciation & Amortization

Table of Contents

Here Is A Step By Step Guide On Form 4562

IRS Form 4562, titled Depreciation and Amortization (Including Information on Listed Property), is a crucial tax form used by businesses and individuals to claim deductions for the cost recovery of tangible and intangible assets over time. It ensures that taxpayers correctly report expenses related to business-use property, elect Section 179 expensing, apply bonus depreciation, and amortize eligible costs in compliance with the Internal Revenue Code.

Why Form 4562 Matters: Purpose and Use

Form 4562 allows taxpayers to:

- Deduct the cost of tangible personal property (like machinery, vehicles, or equipment) over time using depreciation.

- Amortize intangible assets, such as goodwill, trademarks, or startup costs.

- Make a Section 179 election, enabling immediate expensing of certain qualified property.

- Claim special (bonus) depreciation on eligible property.

- Report and track listed property, such as business-use vehicles and electronics, which require extra scrutiny due to potential personal use.

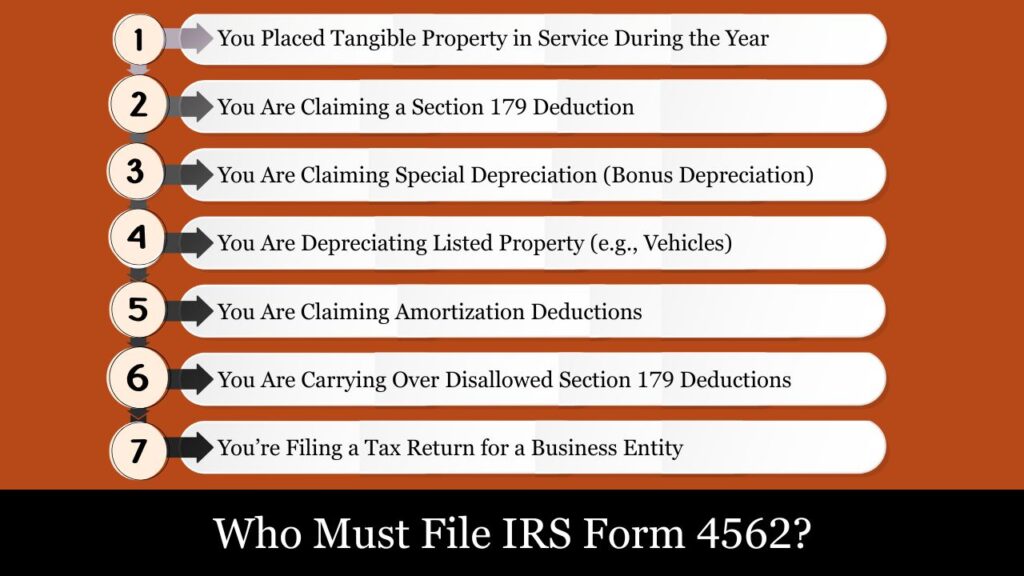

Who Must File IRS Form 4562?

IRS Form 4562 must be filed by any individual, business, or entity that is claiming deductions for depreciation or amortization during the tax year. Depreciation and amortization are methods of recovering the cost of property over time, and Form 4562 is the IRS’s tool for tracking those deductions in a standardized manner.

You are required to file Form 4562 if any of the following conditions apply:

1. You Placed Tangible Property in Service During the Year

If you acquired and began using tangible business property—such as computers, office furniture, equipment, or vehicles—during the tax year and you want to claim depreciation on that asset, you must file Form 4562.

Example: You purchased a $10,000 printer for your business in 2025 and began using it in April. You must file Form 4562 to begin depreciating that printer using the MACRS schedule.

2. You Are Claiming a Section 179 Deduction

If you elect to immediately expense the cost of qualifying property under IRC Section 179 (instead of depreciating it over time), you must report this election on Form 4562. Section 179 permits businesses to immediately expense the entire cost of qualifying property in the year it is placed in service, up to the IRS-defined limits.

Example: You purchase $50,000 worth of office equipment and elect to expense the full amount under Section 179. You must use Part I of Form 4562 to make this election.

3. You Are Claiming Special Depreciation (Bonus Depreciation)

If you’re claiming bonus depreciation (also known as the special depreciation allowance), which provides a faster recovery of qualified property, you must use Part II of Form 4562. For 2025, bonus depreciation is allowed at 60% of the cost for qualified assets.

Example: You buy a $100,000 machine that qualifies for bonus depreciation. You must report the allowable depreciation in Part II.

4. You Are Depreciating Listed Property (e.g., Vehicles)

Listed property” includes assets that are commonly used for both personal and business activities. Common examples include:

- Passenger vehicles

- Cameras

- Laptops or tablets

- Cell phones

If you use any listed property for business and want to claim a deduction, you must complete Part V of Form 4562, which includes mileage logs and business-use percentage calculations.

Example: You drive a vehicle 70% for business purposes. You must file Form 4562 to claim vehicle depreciation and provide documentation in Part V.

5. You Are Claiming Amortization Deductions

If you are claiming amortization for intangible assets—such as goodwill, trademarks, franchise rights, or startup expenses—you are required to complete Part VI of Form 4562.

Example: You acquired a company and recognized $60,000 as goodwill on your books.. You must amortize that amount over 15 years and report it annually on Form 4562.

6. You Are Carrying Over Disallowed Section 179 Deductions

If you were unable to deduct the full Section 179 amount in a prior year due to income limitations, and are now carrying forward the unused portion, you must report this on the current year’s Form 4562.

Example: In 2024, you could only deduct $30,000 of your $40,000 Section 179 election. You must file Form 4562 in 2025 to deduct the remaining $10,000 (if eligible).

7. You’re Filing a Tax Return for a Business Entity

Corporations (Form 1120), S corporations (Form 1120-S), partnerships (Form 1065), and sole proprietors (Form 1040 Schedule C) must file Form 4562 if they:

- Are depreciating or amortizing property

- Elect Section 179 expensing

- Use listed property

- Claim bonus depreciation

Even if you are not a business entity but are reporting rental income (Schedule E) or farming income (Schedule F) and claiming depreciation, Form 4562 must be included.

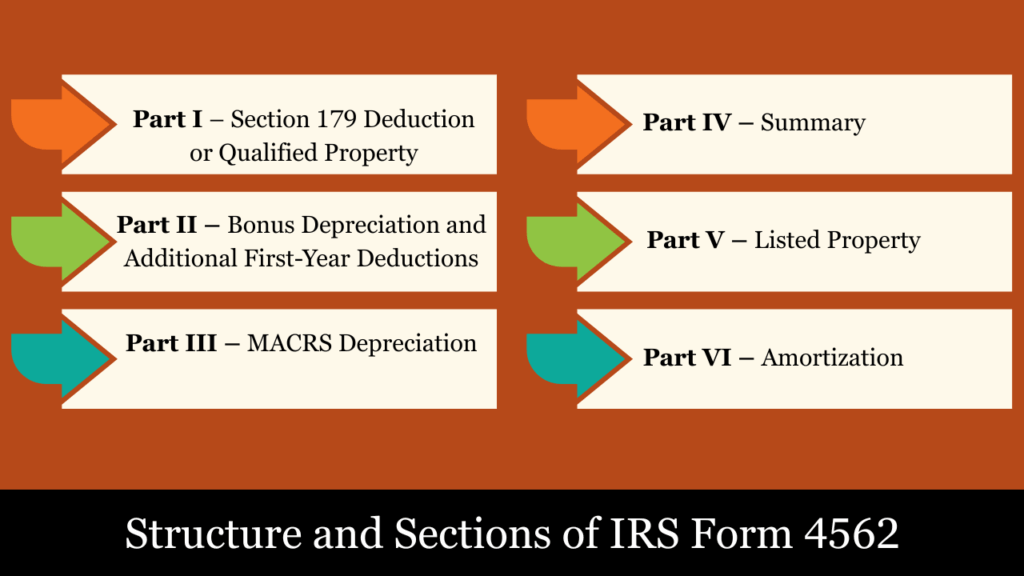

Structure and Sections of IRS Form 4562: A Complete Breakdown

IRS Form 4562 is divided into six structured parts, each designed to handle specific types of cost recovery — including depreciation, amortization, and expensing elections. Understanding the layout of this form is essential to accurately report the use of business assets, both tangible and intangible, and to comply with IRS requirements.

Part I – Section 179 Deduction for Qualified Property

This section allows you to elect to immediately expense the cost of certain qualifying property rather than depreciating it over several years. This is known as the Section 179 election.

Key Features:

- Only specific tangible property used more than 50% for business qualifies.

- There is an annual deduction limit (e.g., $1,220,000 for tax year 2025), which phases out dollar-for-dollar when total qualifying asset purchases exceed a set cap (e.g., $3,050,000 in 2025).

- The deduction is limited to the amount of taxable income from the business. Unused amounts can be carried forward to later tax year.

Common Assets:

- Office equipment, computers

- Machinery

- Business-use vehicles

- Off-the-shelf software

Lines Covered:

- Line 1–5: Cost and description of each property

- Line 11: Business income limitation

- Line 12: Total allowable Section 179 deduction

Part II – Bonus Depreciation and Additional First-Year Deductions

This section covers bonus depreciation, also known as the special depreciation allowance, which is a percentage of the cost of qualified property that can be deducted in the first year it’s placed in service.

Key Features:

- Applies only to new or used qualified property with a recovery period of 20 years or less.

- The bonus depreciation rate for 2025 is 60%, as part of the TCJA phase-out schedule.

- Used in addition to (not in place of) regular depreciation methods.

Typical Use Cases:

- Qualified improvement property (QIP)

- Certain business-use vehicles

- Heavy machinery

Lines Covered:

- Line 14–16: Property description, cost, special depreciation allowed

Part III – MACRS Depreciation

The IRS relies on MACRS to determine depreciation for most types of business property. This section is used to compute depreciation for property placed in service during the year under MACRS rules.

Key Features:

- Includes both the standard GDS method and the slower ADS method for calculating depreciation.

- Requires specification of:

- Class life (e.g., 5-year, 7-year, 15-year property)

- Convention used (half-year, mid-quarter, or mid-month)

- Depreciation method (200% DB, 150% DB, straight-line)

Examples of MACRS Asset Classes:

- 5-Year: Automobiles, computers

- 7-Year: Office furniture, manufacturing equipment

- 15-Year: Land improvements

- 39-Year: Nonresidential real property

Lines Covered:

- Line 19a–19i: Detailed columns for each asset, including description, method, life, basis, and computed depreciation

Part IV – Summary

This part summarizes all depreciation and expensing deductions reported in earlier sections. It combines Section 179 expense, bonus depreciation, regular depreciation, and listed property depreciation (from Part V).

Key Features:

- The total depreciation amount calculated here is the amount reported on the business’s tax return (e.g., Schedule C, Schedule E, Form 1120).

- Helps taxpayers and preparers double-check and consolidate total deductions from all asset categories.

Lines Covered:

- Line 21: Total deductions for the year

- Line 22: Amounts applicable to different parts of the tax return

Part V – Listed Property

This section focuses on property that is likely to be used for both personal and business purposes, requiring stricter documentation and use verification. Examples include:

- Passenger automobiles

- Cameras

- Cell phones

- Computers not used exclusively at a regular business location

Key Features:

- You must provide the percentage of business use.

- Mileage logs and usage records are required for vehicles.

- If business use is below 50%, property must be depreciated using the ADS straight-line method and may trigger recapture of previously claimed deductions.

Required Information:

- Date placed in service

- Business miles vs. total miles (for vehicles)

- Cost, basis, and depreciation method

- Whether personal use was involved

Lines Covered:

- Line 26–28: Description of listed property, including vehicle details

- Line 29–33: Business-use percentage, depreciation calculation, limitations

Part VI – Amortization

This section is used to claim amortization deductions for intangible assets, which cannot be depreciated in the traditional sense but still lose value over time.

Key Features:

- Assets are usually amortized on a straight-line basis over a specified period (often 15 years).

- Amortizable costs include:

- Goodwill from acquisitions

- Trademarks

- Organizational costs

- Start-up costs

- Franchise rights

Lines Covered:

- Line 42: Description of intangible asset

- Line 43–44: Amortization method, start date, recovery period, amortization amount

How to Calculate Depreciation on Form 4562: Step-by-Step With Example

Let’s assume you’re a sole proprietor running a delivery business and in 2025, you placed the following assets in service:

Assets Purchased in 2025:

| Asset | Cost | Business Use % | Property Class | Listed Property? |

| Computer | $2,000 | 100% | 5-year | No |

| Delivery Van | $30,000 | 80% | 5-year | Yes |

| Office Furniture | $10,000 | 100% | 7-year | No |

| Franchise Rights | $15,000 | 100% | Intangible | No |

Step 1: Section 179 Election (Part I)

You choose to apply the Section 179 deduction to the computer and a portion of the office furniture.

Limits (2025):

- Deduction limit = $1,220,000

- Phase-out begins at $3,050,000 (not exceeded here)

- Limited to business income. Suppose your net business income = $35,000.

Section 179 Deduction:

- Computer: $2,000 (fully deducted)

- Office Furniture (partial): $10,000, but you elect only $20,000 – $2,000 = $18,000 remaining Section 179 limit

- Total elected = $20,000

- Business income limit = $35,000 → fully deductible

Enter in Part I (Line 12): $20,000

Step 2: Bonus Depreciation (Part II)

Bonus depreciation in 2025 is 60% of the cost basis for qualified property (after Section 179).

Eligible for bonus: Office furniture

- Office furniture cost = $10,000

- Minus Section 179 applied = $8,000 left

- Bonus depreciation = 60% × $8,000 = $4,800

Enter in Part II (Line 14): $4,800

Step 3: MACRS Depreciation (Part III)

Use MACRS 200% declining balance, half-year convention.

Computer:

- Section 179 fully applied → No further depreciation

Office Furniture:

- Already claimed $20,000 under 179 and bonus → Only $3,200 basis remains ($10,000 – $2,000 – $4,800 = $3,200)

- Use MACRS 7-year table: Year 1 rate ≈ 14.29%

- Depreciation = $3,200 × 14.29% = $457

Enter in Part III (Line 19): $457

Step 4: Listed Property (Part V) – Delivery Van

This section requires:

- Business use: 80%

- Van cost: $30,000

- Business-use basis = $30,000 × 80% = $24,000

Use 5-year MACRS with 200% DB, half-year convention.

Bonus Depreciation:

- 60% of $24,000 = $14,400

Remaining Basis:

- $24,000 – $14,400 = $9,600

- MACRS rate for Year 1 = 20%

- Depreciation = $9,600 × 20% = $1,920

Enter in Part V (Line 29–33)

- Business miles must be reported

- Personal use (20%) is not depreciable

Step 5: Amortization (Part VI)

You purchased franchise rights for $15,000.

- Amortization period = 15 years

- Method = Straight-line

- Monthly deduction = $15,000 ÷ 180 months = $83.33

- Annual amortization = $83.33 × 12 = $1,000

Enter in Part VI (Line 44): $1,000

Step 6: Summary of Total Deductions (Part IV)

| Deduction Type | Amount |

| Section 179 (Part I) | $20,000 |

| Bonus depreciation (Part II) | $4,800 |

| MACRS depreciation (Part III) | $457 |

| Vehicle (Part V) | $14,400 + $1,920 = $16,320 |

| Amortization (Part VI) | $1,000 |

Total Deduction on Form 4562 =

$20,000 + $4,800 + $457 + $16,320 + $1,000 = $42,577

This amount flows to:

- Reported on Schedule C, Line 13 as depreciation and Section 179 expense.

- Schedule E or F if applicable

Summary Table:

| Asset | Deduction Type | Deducted Amount |

| Computer | Section 179 | $2,000 |

| Office Furniture | Section 179 + Bonus + MACRS | $2,000 + $4,800 + $457 |

| Delivery Van | Bonus + MACRS | $14,400 + $1,920 |

| Franchise Rights | Amortization | $1,000 |

| Total | $42,577 |

When and Where to File IRS Form 4562?

When to File?

Form 4562 is submitted alongside your annual federal tax return for any year in which you:

- Place depreciable or amortizable property into service

- Elect the Section 179 deduction

- Claim bonus depreciation

- Deduct expenses for listed property (e.g., vehicles, electronics)

- Claim amortization for intangible assets

- Carry forward disallowed Section 179 or prior-year depreciation

If no new assets are placed in service, and you’re only continuing prior-year depreciation, Form 4562 is not required.

Filing Deadlines

| Filer Type | Tax Form | Deadline |

| Individuals | Form 1040 | April 15 (Oct 15 with extension) |

| Partnerships | Form 1065 | March 15 (Sept 15 with extension) |

| S Corporations | Form 1120-S | March 15 (Sept 15 with extension) |

| C Corporations | Form 1120 | April 15 (Oct 15 with extension) |

Where to File?

- Electronically (e-file):

Attach Form 4562 to your e-filed tax return using IRS e-file or tax software. No separate mailing is needed. - By Mail (Paper Filing):

Include Form 4562 with your paper tax return and mail the full package to the IRS address for your return type and location.

Retention

Keep all supporting documents for depreciated or amortized assets, including:

- Purchase receipts

- Use logs (for vehicles)

- Cost basis and business use percentages

Retention period: 3–7 years after filing, depending on the asset type.

Conclusion

Form 4562 helps taxpayers properly claim depreciation, amortization, and immediate expensing under Section 179. Whether you’re a sole proprietor, corporation, or rental property owner, properly completing this form ensures you claim the full tax benefits allowed while staying compliant with IRS rules. Timely filing with your annual return, maintaining thorough records, and applying the correct depreciation methods can significantly impact your overall tax liability.

For complex cases—like listed property, partial business use, or multiple asset classes—consulting a tax professional is strongly recommended.

Frequently Asked Questions (FAQs)

Can land be depreciated on Form 4562?

No, land is not depreciable. Only buildings and improvements qualify.

Is software deductible under Section 179?

Yes, off-the-shelf software can qualify for Section 179 if used in business and meets other criteria.

Can I skip Form 4562 if I only use prior-year depreciation schedules?

Yes, if no new assets were placed in service, and no Section 179, listed property, or amortization is involved, Form 4562 may not be required.

What happens if business use of a vehicle drops below 50%?

You must recapture the accelerated depreciation and begin using straight-line depreciation under ADS.