Form 1120: An Ideal Detailed Review

Table of Contents

Quick-Start To The Comprehensive Guide On Form 1120

Form 1120 is the annual federal income tax return that must be filed by C corporations operating within the United States. It serves as the official document for reporting all corporate financial activity, including gross receipts, operating expenses, taxable income, tax credits, and tax liability. IRS Form 1120 plays a vital role in the corporate tax framework, requiring comprehensive disclosure of a corporation’s taxable income.

What Is IRS Form 1120

IRS Form 1120, titled “U.S. Corporation Income Tax Return,” is the IRS’s primary mechanism for collecting income tax information from U.S.-based C corporations, which are legally recognized as separate entities from their shareholders.

Primary Objectives of Form 1120:

- To report the corporation’s worldwide income

- To determine a corporation’s federal income tax liability under U.S. tax regulations.

- To claim tax deductions, credits, and losses

- To disclose balance sheet and retained earnings activity

- To report any foreign ownership, intercompany activity, or international transactions

Corporations must maintain extensive accounting records throughout the tax year to ensure the accuracy of information filed on Form 1120.

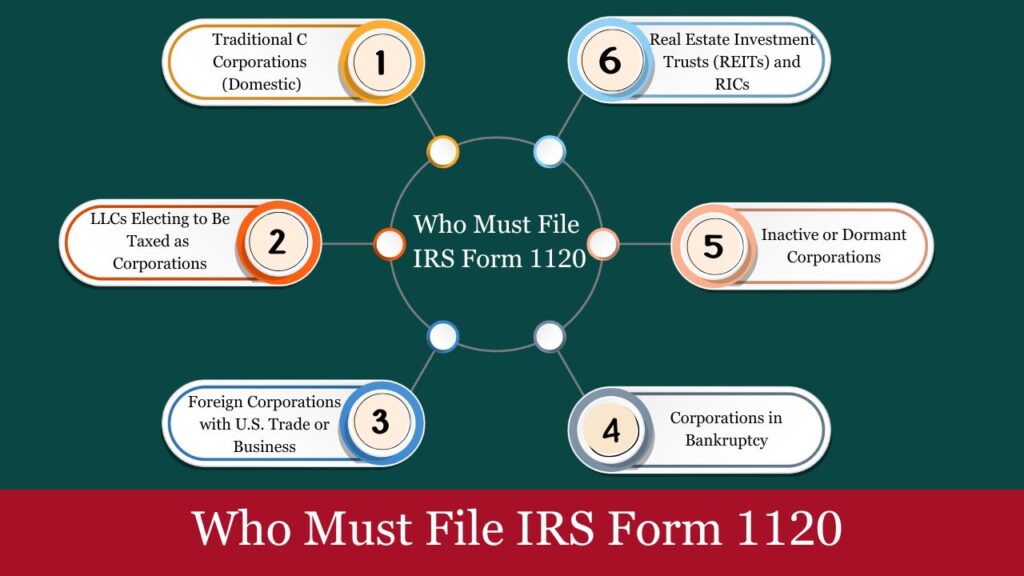

Who Must File IRS Form 1120

IRS Form 1120 must be filed by every domestic corporation that is organized under the laws of the United States and is treated as a C corporation for federal income tax purposes. This includes a wide variety of business entities and corporate structures that are subject to entity-level federal income taxation.

1. Traditional C Corporations (Domestic)

- Any corporation incorporated in the U.S. under state law and operating as a C corporation (i.e., not an S corp).

- It applies to corporations of all sizes and sectors, from startups to large enterprises..

- Filing is mandatory even if the corporation had no taxable income or operations during the year.

2. LLCs Electing to Be Taxed as Corporations

- A Limited Liability Company (LLC) may choose to be taxed as a C corporation by filing IRS Form 8832.

- Once this election is made, the LLC must file Form 1120 annually, as if it were a corporation.

3. Foreign Corporations with U.S. Trade or Business

- A foreign (non-U.S.) corporation must file Form 1120 if it earns income effectively connected with a U.S. trade or business (ECI).

- This includes foreign entities with:

- U.S. branches,

- U.S. employees or agents,

- U.S. source income tied to business activities.

4. Corporations in Bankruptcy

- A corporation that is undergoing bankruptcy (Chapter 7 or Chapter 11) must continue to file Form 1120 until it is officially dissolved.

- If the business remains operational during bankruptcy proceedings, it is still subject to federal tax.

5. Inactive or Dormant Corporations

- Corporations that were legally formed but had no income, expenses, or activity during the year are still required to file Form 1120 unless dissolved through state procedures.

- Filing a “zero return” maintains legal compliance and avoids penalties.

6. Real Estate Investment Trusts (REITs) and RICs

- Although these entities use specialized versions of the 1120 (e.g., Form 1120-REIT or Form 1120-RIC), they still fall under the broader umbrella of Form 1120 filers.

- They are subject to specific income tests and distribution requirements but must file annually with the IRS.

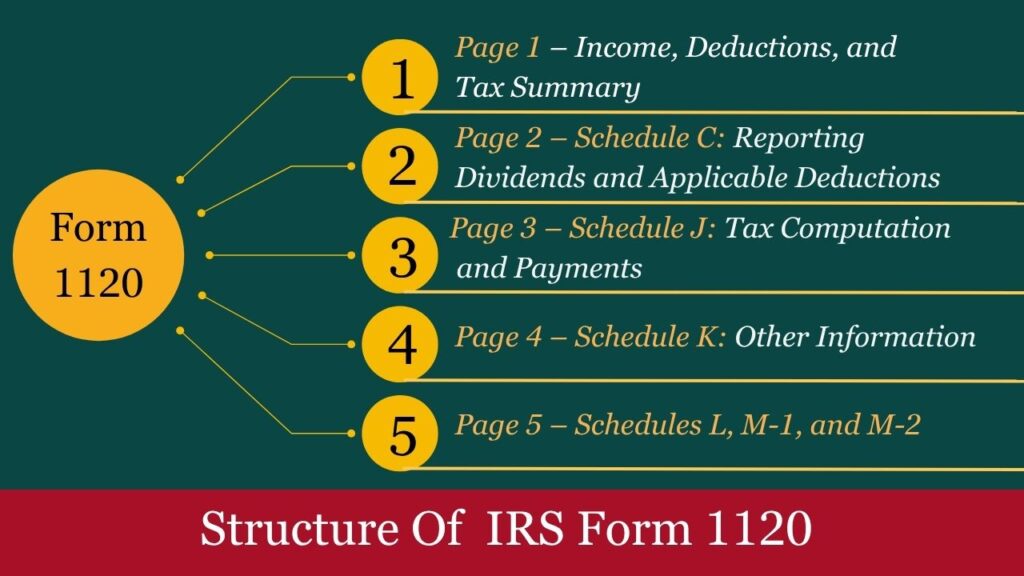

Structure and Components of IRS Form 1120 Instructions

IRS Form 1120 is a multi-part corporate income tax return composed of five core pages and numerous optional attachments. Its structure is designed to provide the IRS with a complete picture of a corporation’s financial health, taxable income, credits, and balance sheet activity.

Here is a part-by-part explanation of the key components of Form 1120:

Page 1 – Income, Deductions, and Tax Summary

This is the main body of the return, where the corporation reports its gross income, business deductions, and calculates its taxable income and total tax liability.

Key Sections:

- Lines 1a–11:

Report gross receipts or sales, cost of goods sold (via Form 1125-A), dividends, interest, capital gains, and other income sources. - Lines 12–29c:

List all ordinary business deductions, such as:- Salaries and wages (excluding officer compensation)

- Rent, interest, bad debts

- Depreciation (from Form 4562)

- Advertising, pension plans, charitable contributions, etc.

- Line 30: Taxable income before net operating loss and special deductions.

- Line 31: Net operating loss deduction.

- Line 32: Special deductions (e.g., dividends received deduction).

- Line 33: Total taxable income.

- Line 34–35: Computed income tax liability and any estimated tax penalties.

- Line 36–38: Total payments, balance due or overpayment.

The form must be signed and dated by a corporate officer (e.g., CEO, CFO), and the paid preparer (if applicable).

Page 2 – Schedule C: Reporting Dividends and Applicable Deductions

Schedule C is used to report:

- Dividends received from domestic and foreign corporations.

- Special deductions, particularly the Dividends Received Deduction (DRD) under IRC §243–§245.

- Income from controlled foreign corporations or section 78 gross-up.

This helps reduce double taxation for corporate investors in other corporations.

Page 3 – Schedule J: Tax Computation and Payments

Schedule J computes the actual corporate tax liability.

Sections include:

- Line 1: Total tax from line 35 (page 1).

- Lines 2–5: Include alternative minimum tax (AMT) (pre-TCJA carryover), foreign tax credit, and general business credits.

- Lines 10–13: Estimated tax payments and any overpayments from prior years applied to the current year.

- Lines 14–16: Resulting balance due or refund.

This section is critical for matching payments against computed tax to prevent underpayment penalties.

Page 4 – Schedule K: Other Information

Schedule K gathers disclosure-level information about the corporation. It doesn’t compute tax but is essential for IRS oversight.

Topics covered:

- Accounting method (cash, accrual, or other)

- Business activity code (based on NAICS)

- Whether the corp is a personal holding company or closely held

- Questions about ownership (foreign or U.S.), transfers, or stock activity

- Details on:

- Gross receipts for the year

- Whether the return is consolidated

- Filing obligations for Forms 5471, 5472, 8938, etc.

Key trigger for additional schedules like Form 5471 (foreign corporations) or Form 8990 (interest expense limits under §163(j)).

Page 5 – Schedules L, M-1, and M-2

Schedule L – Balance Sheet per Books

- Provides a snapshot of the company’s financial position at the start and end of the tax year .

- Must match GAAP or book-based financials

Schedule M-1 – Reconciliation of Book Income to Taxable Income

- Clarifies the discrepancies between book income and taxable income, including items such as:

- Depreciation methods

- Meals & entertainment

- Fines and penalties

- Book-to-tax adjustments

Mandatory for corporations with total assets > $250,000.

Schedule M-2 – Analysis of Retained Earnings

- Tracks retained earnings:

- Beginning balance

- Adjustments for net income

- Distributions to shareholders

- Other changes

Used to show equity buildup or depletion during the year.

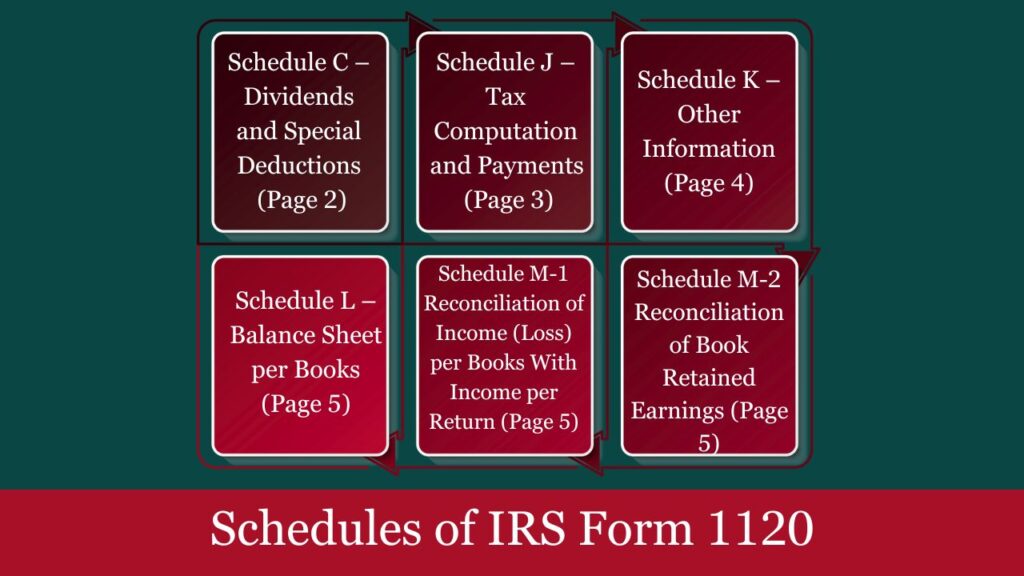

Schedules of IRS Form 1120

Form 1120 includes several internal schedules and often requires external supporting schedules based on the corporation’s financial activities. These schedules help the IRS verify income, deductions, ownership structure, and tax liability.

Core Schedules Within IRS Form 1120

1. Schedule C – Dividends and Special Deductions (Page 2)

Purpose

To report dividends received and calculate the Dividends Received Deduction (DRD) under IRC §§243–245.

Used When

- The corporation earned dividend income from U.S. or international corporate investments.

- The entity is eligible for the DRD to reduce double taxation.

2. Schedule J – Tax Computation and Payments (Page 3)

Purpose

Calculates the actual tax due, applies credits, and reports estimated payments or overpayments from prior years.

Includes

- Regular tax (Line 1)

- Tax credits applied

- Other taxes (e.g., recapture, backup withholding)

- Total tax liability vs. payments

- Balance due or refund

3. Schedule K – Other Information (Page 4)

Purpose

Collects important disclosure information about:

- Accounting method

- Business activity code (NAICS)

- Foreign transactions

- Related-party activity

- Shareholder changes

- Filing of related forms like 5471, 5472, 8990

Must be completed by all filers.

4. Schedule L – Balance Sheet per Books (Page 5)

Purpose

Reports the corporation’s book balance sheet at the beginning and end of the tax year.

Includes

- Cash, inventory, fixed assets, liabilities, and equity

- Must match the financial statements

Required if

Total receipts or total assets ≥ $250,000.

5. Schedule M-1 – Reconciliation of Income (Loss) per Books With Income per Return (Page 5)

Purpose

Reconciles the book income (GAAP or accounting profit) with taxable income reported on Form 1120.

Common Adjustments

- Depreciation differences (book vs. tax)

- Meals/entertainment disallowance

- Fines, penalties, tax-exempt income

Required if

Total assets ≥ $250,000.

6. Schedule M-2 – Reconciliation of Book Retained Earnings (Page 5)

Purpose

Tracks changes in retained earnings throughout the tax year.

Includes

- Net income per books

- Distributions/dividends

- Adjustments (prior period, tax audit corrections)

Required for all filers unless exempt.

Common External Schedules & Attachments

| Form/Schedule | Purpose | When Required |

| Form 1125-A | Cost of Goods Sold | Product-based or inventory-heavy businesses |

| Form 1125-E | Compensation of Officers | Officer pay > $150,000 or required by entity type |

| Form 4562 | Depreciation/Amortization | Fixed asset depreciation or section 179 expense |

| Form 4797 | Sale of Business Property | Disposition of property used in trade/business |

| Schedule D + Form 8949 | Capital Gains/Losses | Sale of capital assets (e.g., stocks, investments) |

| Form 3800 | General Business Credit | Claiming any of 30+ business-related tax credits |

| Form 8990 | Interest Expense Limitation | If IRC §163(j) applies (large businesses) |

| Form 5471 / 5472 | Foreign Ownership/Transactions | Foreign shareholders or foreign affiliate dealings |

| Form 2439 | Capital gains from regulated investment companies (RICs) | If receiving undistributed capital gains |

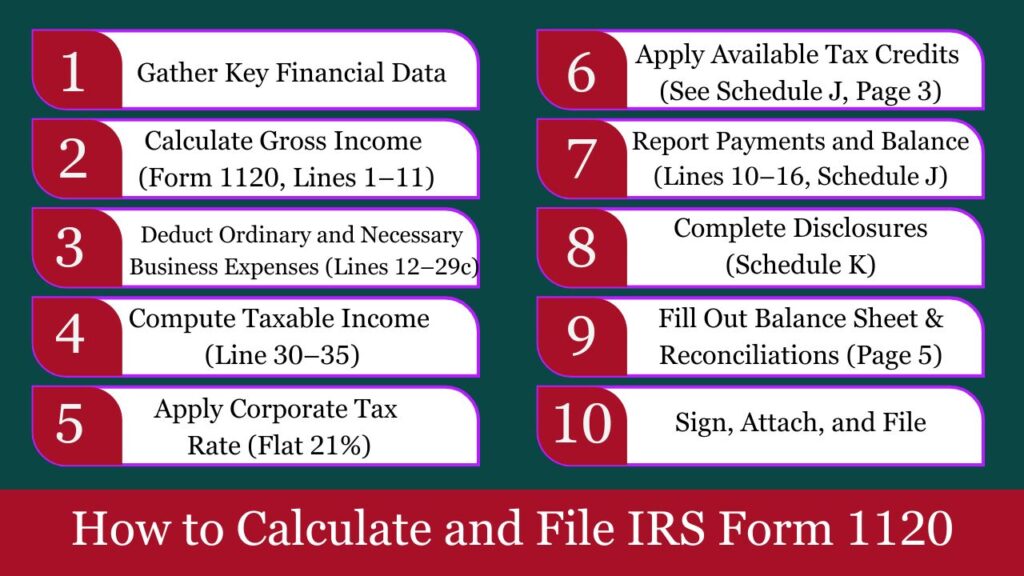

How to Calculate and File IRS Form 1120 (C Corporation Return)

Filing Form 1120 is mandatory for all U.S. C corporations. Below is a step-by-step, real-world process for accurately calculating corporate tax and completing the return.

Step 1: Gather Key Financial Data

Before beginning the return, ensure you have:

- Trial balance and year-end financials

- Chart of accounts (mapped to tax line items)

- EIN, incorporation date, and NAICS business code

- Prior year return (to carry forward any NOLs or credits)

- Details on:

- Officer compensation

- Asset purchases/sales

- Loans, interest paid, and income earned

Most tax software integrates directly with accounting platforms (like QuickBooks or Xero) to auto-import trial balance data.

Step 2: Calculate Gross Income (Form 1120, Lines 1–11)

Gross Receipts or Sales(–) Returns and Allowances(–) Cost of Goods Sold (COGS via Form 1125-A)(+) Other Income (interest, dividends, capital gains, rents)= Gross IncomeCOGS includes raw materials, direct labor, and production overhead. Calculate this first using Form 1125-A.

Step 3: Deduct Ordinary and Necessary Business Expenses (Lines 12–29c)

Enter actual business expenses directly from your accounting records. These include:

- Salaries and wages (Line 13)

- Rent (Line 16)

- Depreciation (Line 20 – attach Form 4562)

- Taxes (Line 17 – exclude federal income tax)

- Officer compensation (Form 1125-E)

- Professional fees, advertising, insurance, etc.

Total these to get Line 27: Total Deductions.

Step 4: Compute Taxable Income (Line 30–35)

Line 30 = Gross Income – Total DeductionsLine 31 = Subtract Net Operating Loss (if any)Line 32 = Subtract Special Deductions (e.g., Dividends-Received Deduction)Line 33 = Taxable IncomeUse prior-year Form 1120 or tax software to check available NOL carryforwards.

Step 5: Apply Corporate Tax Rate (Flat 21%)

Once you reach Line 33 (Taxable Income):

Tax Due (Line 34) = Taxable Income × 21%There are no brackets—flat rate only.

Step 6: Apply Available Tax Credits (See Schedule J, Page 3)

Apply any eligible tax credits:

- Foreign Tax Credit (Form 1118)

- General Business Credit (Form 3800)

- R&D Credit (Form 6765)

- Energy-efficient investment credits

Enter credits on Lines 5–9 of Schedule J to reduce final tax due.

Step 7: Report Payments and Balance (Lines 10–16, Schedule J)

Include:

- Estimated tax payments (quarterly via EFTPS)

- Overpayments from previous year

- Backup withholding, if any

Final Tax = Total Tax (Line 11) – Payments (Line 15)Balance Due (Line 16) or Overpayment (Line 17)Step 8: Complete Disclosures (Schedule K)

Provide required information on:

- Business activity and method of accounting

- Shareholders (foreign or domestic)

- Filing status (consolidated or separate)

- Gross receipts for the year

Step 9: Fill Out Balance Sheet & Reconciliations (Page 5)

| Schedule | Purpose |

| L | Beginning and ending year balance sheet (must match books) |

| M-1 | Book income vs. taxable income reconciliation |

| M-2 | Retained earnings reconciliation |

These are mandatory if assets ≥ $250,000.

Step 10: Sign, Attach, and File

- Sign and date by authorized officer

- Attach required forms (1125-A, 1125-E, 4562, etc.)

- E-file through authorized IRS software (mandatory for most)

- Pay any balance via EFTPS or included payment voucher

Example: Quick Calculation

ABC Corp has:

- $800,000 gross sales

- $500,000 COGS

- $150,000 total deductions

- $0 prior-year NOL

Calculation:

- Gross Income: $800,000 – $500,000 = $300,000

- Taxable Income: $300,000 – $150,000 = $150,000

- Tax: 21% × $150,000 = $31,500

IRS Form 1120: Penalties and Non-Compliance Consequences (2025 Guide)

Failing to file Form 1120 accurately and on time can result in substantial penalties, interest charges, and increased IRS scrutiny. Whether the issue is late filing, non-payment, or failure to include required disclosures, the IRS has specific penalty structures in place.

1. Late Filing Penalty (Form Not Filed by Deadline)

If a C corporation fails to file Form 1120 by the original or extended due date, the IRS imposes a monthly penalty.

Penalty Amount:

- $500 per month (or part of a month)

- Maximum: 12 months

- Applies even if no tax is due

Penalty is assessed against the corporation, not the individual officer.

Example:

A corporation files Form 1120 5 months late with no balance due:

Penalty=$500×5=$2,500

2. Late Payment of Tax Owed

The IRS imposes penalties and interest on unpaid taxes not settled by the original due date, regardless of an extension filing.

Penalty:

- 0.5% of unpaid tax per month

- Capped at 25% of the total tax due

- Increases to 1% per month if IRS sends a notice and demand for payment and it remains unpaid

Interest:

- Compounded daily on unpaid taxes

- Rate is the federal short-term rate + 3%

3. Failure to Report Required Information (Schedules & Forms)

Failing to include certain required disclosures with Form 1120 can result in severe flat-rate penalties, especially for foreign-related forms.

| Missing Form | Penalty |

| Form 5471 (foreign corp ownership) | $10,000 per form |

| Form 5472 (25%+ foreign ownership) | $25,000 minimum |

| Form 8938 (foreign assets) | $10,000–$50,000 |

| Form 8990 (interest limitations) | Disallowed deduction until properly reported |

These penalties apply per return, per entity, per year — and stack if multiple shareholders or transactions are involved.

4. Accuracy-Related Penalties

If the IRS determines that the tax underpayment is due to negligence, disregard of rules, or substantial understatement, they may impose:

20% Accuracy Penalty

- Applies to:

- Negligence or failure to keep adequate books

- A tax understatement is deemed substantial if it equals or exceeds 10% of the required tax or $10,000, whichever is more.

- Valuation misstatements

5. Other IRS Penalties

| Situation | Penalty |

| Frivolous Return | $5,000 |

| Failure to File Electronically (when required) | IRS may reject the return |

| Willful disregard or fraud | Up to 75% of tax due or criminal prosecution |

How to File Form 1120: Electronic vs. Paper Filing

Electronic Filing (E-Filing) – Required for Most Corporations

- Mandatory E-Filing Thresholds:

- Electronic filing is mandatory for corporations whose total assets meet or exceed $10 million at the end of the tax year.

- Corporations that are required to file 250 or more returns of any type during the calendar year (e.g., Forms W-2, 1099, etc.) must e-file Form 1120.

- How to E-File:

- Use an IRS-approved tax software such as UltraTax, Lacerte, or Drake.

- Alternatively, file through an Authorized IRS e-file Provider, such as a CPA or enrolled agent.

- Benefits of E-Filing:

- Faster IRS processing

- Immediate filing confirmation

- Reduced error rates

- Easier electronic payment integration via EFTPS

Paper Filing (Only If Eligible)

- Who May Paper File:

- Small corporations not meeting the e-filing thresholds

- Filers with system access issues or IRS-granted waivers

- Where to Mail:

- The correct mailing address depends on:

- The state in which your business is located

- Whether you are including a payment with the return

- The correct mailing address depends on:

- How to Find the Address:

- Visit the IRS official page:

Where to File Form 1120

- Visit the IRS official page:

- Include Required Documents:

- Original signed Form 1120

- All required schedules and supporting forms (e.g., Forms 1125-A, 1125-E, 4562, Schedule D, etc.)

- Payment voucher (Form 8109-B), if paying by check.

Conclusion

Form 1120 is more than a tax return—it is a comprehensive financial disclosure document. Corporations must carefully track their income, deductions, foreign operations, and ownership structures throughout the year to ensure compliance. Filing an accurate and complete Form 1120 minimizes audit risk, avoids penalties, and ensures the company remains in good standing with the IRS.

For companies with complex operations, foreign subsidiaries, or heavy intercompany activity, working with a tax advisor familiar with corporate tax law and IRS reporting standards is essential.

Frequently Asked Questions (FAQs)

What is IRS Form 1120 used for?

Form 1120 is the U.S. Corporation Income Tax Return. It is used by C corporations to report income, claim deductions and credits, and calculate the amount of tax owed to the IRS.

Who must file Form 1120?

All domestic C corporations, including:

-Traditional corporations

-LLCs that elect to be taxed as corporations

-Certain foreign corporations with U.S. income

-Inactive corporations (unless dissolved)

When is Form 1120 due?

For calendar-year corporations, Form 1120 is due by April 15 of the following year. Fiscal-year filers must file by the 15th day of the fourth month after the end of their tax year.

Can a corporation apply for additional time to file Form 1120?

Yes. Use Form 7004 to request an automatic 6-month extension. However, it does not extend the time to pay your taxes — payment must be made by the original due date.

What is the corporate tax rate for 2025?

The federal corporate tax rate is a flat 21% on all taxable income.

Does an inactive corporation need to submit Form 1120?

Yes. Even inactive or dormant corporations must file Form 1120 annually until they are formally dissolved at the state level and the IRS is notified.

What schedules are required with Form 1120?

Key schedules include:

–Schedule C – Dividends and Special Deductions

–Schedule J – Tax computation and payments

–Schedule K – General information

–Schedule L, M-1, M-2 – Financial reconciliations (required if total assets or receipts ≥ $250,000)

-1125-A / 1125-E / 4562 – If applicable

What happens if I file late?

Late filing triggers a $500 per month penalty, up to 12 months. Unpaid taxes incur a 0.5% monthly penalty, plus daily interest.

What is the difference between Form 1120 and 1120-S?

–Form 1120 is for C corporations, which pay corporate tax.

–Form 1120-S is for S corporations, which pass income through to shareholders.