Form 1065: A Comprehensive Overview

Table of Contents

Overview of Form 1065 as the U.S. Return of Partnership Income

Form 1065 is the official tax return used by partnerships to report their financial activity to the Internal Revenue Service (IRS). It is not a tax payment form; instead, it acts as an informational return for pass-through entities such as general partnerships, limited partnerships (LPs), and limited liability partnerships (LLPs).

Partnerships themselves do not pay federal income tax. Instead, income, deductions, credits, and other financial details are passed through to individual partners, who report their share on personal or corporate tax returns. Form 1065 facilitates this by outlining the partnership’s complete income statement and balance sheet for the year.

Key details reported on Form 1065 include

- Total income, expenses, and net profit or loss

- Distributions to partners

- Partner capital accounts and contributions

- Business activities and partner details

A critical attachment to Form 1065 is Schedule K-1, which breaks down each partner’s individual share of income, deductions, and credits.

Filing Form 1065 is mandatory for most domestic and foreign partnerships engaged in a U.S. trade or business. The deadline for filing the form is usually March 15 for calendar-year partnerships and with an extension form filing it might get a extra 6 month period to fle that is 15th of September. Failure to file on time can result in penalties per partner, per month, until the return is submitted.

Importance of Form 1065 for Partnerships and Multi-Member LLCs

Form 1065 is essential for partnerships and multi-member LLCs taxed as partnerships because it serves as the official method for reporting the entity’s annual financial performance to the IRS. While these entities do not pay income tax at the business level, they are required to disclose their income, deductions, and other tax items in detail.

For partnerships, Form 1065 ensures that the IRS receives a transparent record of business operations and how profits or losses are allocated among partners.

For multi-member LLCs, which are treated as partnerships by default for tax purposes, Form 1065 is equally crucial. It helps maintain compliance and ensures each member receives a Schedule K-1, detailing their share of income or loss for personal or corporate tax reporting.

Failing to file Form 1065 can result in penalties and disrupt the accuracy of each partner’s or member’s individual tax return.

In short, Form 1065 is vital for

- Demonstrating proper allocation of profits and losses

- Ensuring accurate member taxation

- Maintaining transparency with the IRS

- Avoiding compliance penalties

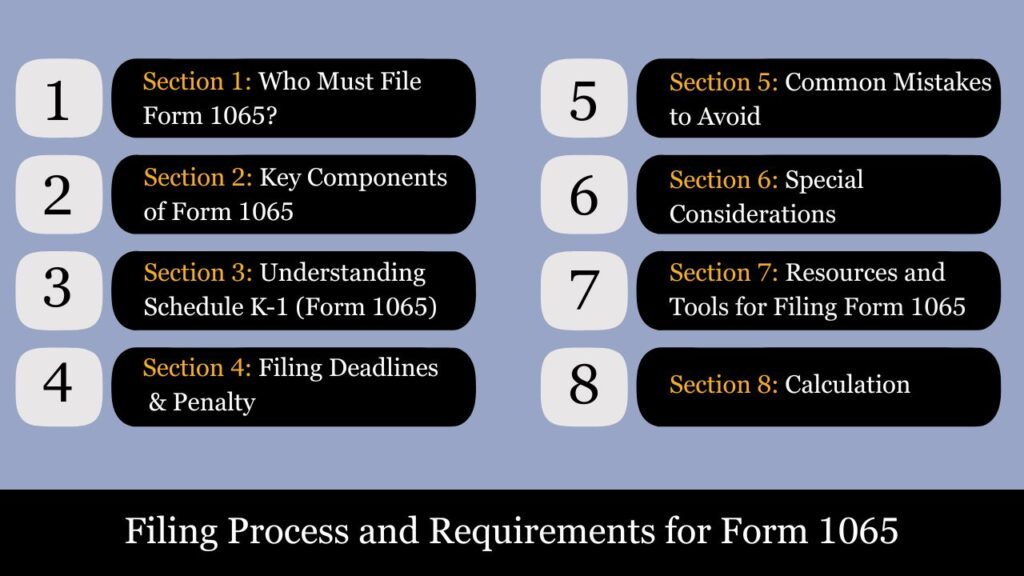

Demystifying the Filing Process and Requirements for Form 1065

Filing Form 1065 follows a structured process designed to cover all key financial activities of a partnership or multi-member LLC.

What’s Needed to File The Form 1065

- Income statement (profit and loss statement)

- Balance sheet showing assets, liabilities, and capital

- Partner information, including ownership percentages

- Supporting schedules such as Schedule K, Schedule L, Schedule M-1, and Schedule M-2 OR M-3

- Schedule K-1s for each partner, showing their share of income, deductions, and credits

Filing Deadline

- Actual deadline is March 15 For calendar-year partnerships & with extension there is a 6 moth of grace period & the deadline gets shifted to 15th of september.

- Extensions can be requested using Form 7004

How to File– The Medium

- Can be filed electronically through an IRS-approved provider or by mail (if eligible)

- Most partnerships file electronically who has more than 100 partners in it.

Understanding the filing requirements and following the correct process ensures IRS compliance, prevents penalties, and keeps partners’ tax filings accurate and timely.

Section 1: Who Must File Form 1065?

Form 1065 must be filed by business entities treated as partnerships for federal tax purposes. It includes domestic partnerships, multi-member LLCs, and certain foreign partnerships with U.S. income for the better structurise system.. Below is a breakdown of each category:

1. Domestic Partnerships

A domestic partnership is a U.S.-based entity formed by two or more individuals or businesses that agree to share profits and losses. These partnerships must report annual income, deductions, and other financial items to the IRS using Form 1065.

Example

A U.S.-based law firm with three equal partners must file Form 1065 to report partnership income and issue Schedule K-1s to each partner.

2. Multi-Member LLCs

LLCs with two or more members are automatically classified as partnerships for tax purposes unless they elect to be taxed as a corporation. These entities must file Form 1065 to disclose their business activity and allocate earnings among members.

Example

A real estate investment LLC with four members must file Form 1065 and distribute Schedule K-1s reflecting each member’s share of profits and losses.

3. Foreign Partnerships with U.S. Income

Foreign partnerships must file Form 1065 if they are engaged in a U.S. trade or business or generate effectively connected income (ECI) within the U.S territory. This ensures proper tax reporting and withholding.

Example

A UK-based consulting firm that earns revenue from U.S. clients must file Form 1065 for its U.S.-sourced operations.

4. Filing Exemptions

Not all entities are required to file Form 1065. Single-member LLCs, considered disregarded entities, typically report business activity on the owner’s personal tax return instead.

Example

A freelance graphic designer operating a single-member LLC is not required to file Form 1065 but reports income on Schedule C of Form 1040.

Key Takeaway

Form 1065 is mandatory for domestic partnerships, multi-member LLCs, and foreign partnerships with U.S. income. However, entities like single-member LLCs are generally exempt unless they opt for partnership or corporate tax treatment.

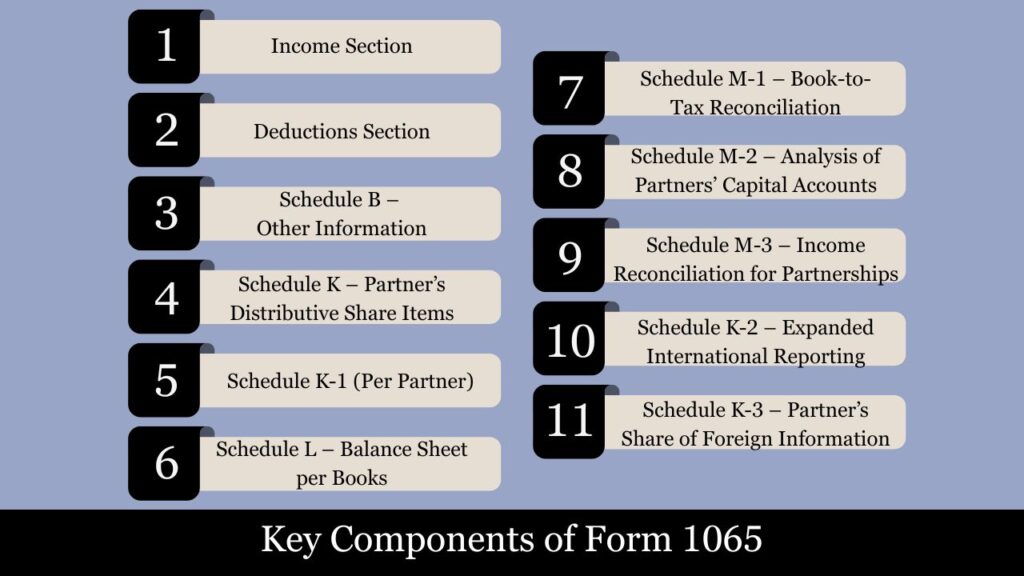

Section 2: Key Components of Form 1065

Form 1065 is composed of multiple pages and supplemental schedules designed to comprehensively report a partnership’s income, financial position, and partner allocations. Below are its most critical components:

Page 1: Basic Partnership Information

This opening page records essential data such as:

- Partnership name and Employer Identification Number (EIN)

- Address and principal business activity code

- Return type (initial, final, amended) and accounting method

Income Section

Reports the partnership’s revenue streams:

- Gross receipts or sales (Line 1a)

- Returns and allowances

- Cost of goods sold (COGS)

- Other income such as interest, rents, and gains

Example

A firm with $500,000 in gross sales lists this amount on Line 1a and reduces it by any applicable returns or COGS.

Deductions Section

Details the business’s deductible operating expenses, including:

- Salaries and wages

- Rent and utilities

- Repairs, maintenance, and advertising

- Other deductions

Example

A partnership incurring $30,000 in rent expenses reports this under the “Other deductions” section.

Schedule B – Other Information

Comprises a set of yes/no questions that cover:

- Foreign transactions

- Partner changes

- Involvement in other partnerships or trusts

- Tax elections and accounting methods

This section provides a compliance and operational snapshot for the IRS.

Schedule K – Partner’s Distributive Share Items

Schedule K compiles a summary of the total income, deductions, credits, and other tax items that are to be allocated to the partners. This includes each category of income (like rental or portfolio income), self-employment earnings, charitable contributions, and investment interest expenses. It does not show how the items are divided among individual partners but presents the partnership’s collective financial picture for the year.

This schedule summarizes key items allocated to all partners, including:

- Ordinary business income/loss

- Rental income, dividends, interest

- Tax credits and foreign transactions

Example

A $50,000 partnership income split equally among four partners results in each receiving $12,500 via Schedule K.

Schedule K-1 (Per Partner)

One of the most important components of Form 1065 is Schedule K-1, which is issued to each partner individually. It details that partner’s specific share of the partnership’s income, deductions, credits, and other tax-related items. Each K-1 must be filed with the IRS and distributed to partners so they can include it in their personal or business tax returns. The K-1 also shows the partner’s capital account balance, distributions received, and ownership percentage.

Issued individually to each partner, Schedule K-1 breaks down their share of:

- Income, deductions, and credits

- Foreign taxes paid

- Capital gains and losses

It ensures that partners report their respective tax obligations on personal or corporate returns.

Schedule L – Balance Sheet per Books

Schedule L provides a snapshot of the partnership’s assets, liabilities, and capital at both the beginning and end of the tax year. It mirrors the balance sheet prepared for financial reporting and helps the IRS ensure that reported income and equity changes align with financial activity. This

Reflects the partnership’s year-end financial condition, listing:

- Total assets, liabilities, and equity

- Beginning and ending balances

Example

$200,000 in assets and $50,000 in liabilities would be reported in Schedule L accordingly.

Schedule M-1 – Book-to-Tax Reconciliation

Schedule M-1 reconciles the differences between the partnership’s book income (as reported in financial statements) and taxable income (as reported on Form 1065). Adjustments might include items such as tax-exempt interest, nondeductible expenses, and depreciation differences. This helps the IRS understand why there may be discrepancies between accounting records and tax filings.

Used to reconcile differences between book income and taxable income. It adjusts for:

- Non-deductible expenses

- Income items not recorded for book purposes

- Timing differences

Example

If the partnership had $10,000 in non-deductible expenses, Schedule M-1 accounts for this when aligning book income with tax income.

Schedule M-2 – Analysis of Partners’ Capital Accounts

It includes beginning balances, contributions, distributions, net income or loss, and any other adjustments. This schedule ensures transparency regarding how the partnership’s

Tracks movements in capital accounts during the year, including:

- Partner contributions

- Distributions made

- Allocated net income or loss

Example

A $20,000 cash contribution by a partner increases their capital account balance accordingly.

Schedule M-3 – Income Reconciliation for Partnerships

Partnerships with assets of $10 million or more must file Schedule M-3 instead of M-1. It offers a more detailed reconciliation of book-to-tax differences, breaking down temporary and permanent differences for more transparent financial reporting.

- Separates temporary and permanent differences

- Offers greater transparency than Schedule M-1

Example

A partnership that reports $2 million more income on its financial statements than on its return due to permanent differences must itemize and explain these on Schedule M-3.

Schedule K-2 – Expanded International Reporting

Schedule K-2 expands on Schedule K by providing detailed information on:

- Foreign income

- Foreign taxes paid

- International tax credits

- Section 250 deductions (FDII, GILTI)

Required when the partnership has foreign partners or international activity.

Schedule K-3 – Partner’s Share of Foreign Information

Schedule K-3 complements K-2 by giving each partner their share of foreign income, deductions, and credits. It helps partners comply with:

- Foreign tax credit claims

- International reporting requirements (e.g., Form 1116, Form 8993)

Example

If a U.S. partner is entitled to claim foreign tax credits, Schedule K-3 provides the necessary details to complete their individual return.

Section 3: Understanding Schedule K-1 (Form 1065)

What is Schedule K-1?

Schedule K-1 (Form 1065) is a tax document issued to each partner in a partnership. It calculate the taxable income of each partner by breaking down the partner’s share of the partnership’s income, deductions, credits, and other tax attributes. The IRS uses this form to ensure that each partner accurately reports their share of the partnership’s tax-related items on their personal or corporate tax return.

Why Schedule K-1 Matters to Partners

Since a partnership does not pay federal income tax at the entity level, all profits and losses “flow through” to the partners. Every individual partner’s taxable amount depends on what’s reported on their K-1. Each partner Uses their K-1 to:

- Report ordinary business income or loss

- Claim their portion of tax deductions or credits

- Account for capital gains, rental income, and other activity

Example

ABC Partnership earns $100,000 in ordinary income and has three equal partners. Each partner receives a Schedule K-1 showing $33,333 in Box 1 (Ordinary Business Income). This amount must be included on each partner’s tax return—even if no money was distributed.

Detailed Breakdown of Key Boxes and Codes

| Box | Description | Example |

| Box 1 | Ordinary Business Income (or Loss) | A partner reports $50,000 share of net income |

| Box 2 | Net Rental Real Estate Income (or Loss) | Shows $5,000 rental profit from a shared property |

| Box 3 | Other Net Rental Income | $2,000 from equipment rental jointly owned by the partnership |

| Box 4 | Guaranteed Payments | $10,000 salary-equivalent for active partner services |

| Box 5 | Interest Income | $500 earned from partnership bank accounts |

| Box 7 | Royalties | $3,000 from intellectual property licensed by the partnership |

| Box 13 | Deductions like charitable contributions or investment interest | $1,000 donated to a qualified charity |

| Box 14 | Self-Employment Earnings | Income subject to SE tax if the partner is active |

| Box 16 | Foreign Transactions | Includes foreign taxes paid or foreign income earned |

| Box 19 | Distributions | $15,000 distributed to the partner during the year |

| Box 20 | Other information – includes tax basis changes, Section 199A info, etc. | Includes qualified business income details for QBI deduction |

Filing Deadlines and Extensions

- Partnerships must issue Schedule K-1 to every partner by March 15 for calendar-year filers.

- In case The partnership needs more time to file their return, can file Form 7004 to extend the deadline to September 15.

Example

DEF LLC, taxed as a partnership, files Form 1065 by March 15. Each of its five partners receives a Schedule K-1 on the same date and uses it to complete their individual tax returns by April 15.

Section 4: Filing Deadlines & Penalty

Filing Deadline

Form 1065, along with all accompanying Schedule K-1s, must be filed by March 15 of the year following the end of the partnership’s tax year (for calendar-year filers). In case the due date falls on holiday or weekend, the deadline gets shifted to the next business day.

Extension Option

Partnerships firm can get more six-month of extension period by filing Form 7004. This moves the due date from March 15 to September 15, but it only extends the time to file, not to furnish K-1s to partners or pay tax (if applicable).

Late Filing Penalty

Failing to file Form 1065 on time can result in steep penalties:

- Each partner fined $220 per month, for up to 12 months.

- The penalty gets applied even if there is no tax is owed.

Example

If a partnership with 5 partners files 3 months late, the total penalty is:

$220 × 5 × 3 = $3,300

This penalty increases with the number of partners and the length of delay, making timely compliance essential.

E-Filing Requirement

The IRS requires electronic filing (e-filing) for partnerships with 100 or more partners. This process helps streamline execution and reduce errors. Smaller partnerships can still file on paper but they are encouraged to file electronically for accuracy and speed.

Section 5: Common Mistakes to Avoid

Incorrect Partner Information

Providing outdated or inaccurate partner details—such as names, addresses, or Employer Identification Numbers (EINs)—can result in IRS processing delays or mismatches.

Example

If a partner’s EIN changes due to a business restructuring and the new EIN is not updated on Form 1065, it may lead to IRS correspondence or rejection.

Omitting Required Schedules

Each Form 1065 must include all relevant schedules based on the partnership’s financial activity. Failure to this can lead to incomplete returns and attracts high penalties.

Example

If a partnership with multiple partners files Form 1065 but forgets to attach Schedule K-1s for each partner, the IRS will consider the return incomplete.

Misreporting Income or Deductions

Errors in income allocation or improper classification of expenses can distort tax liability and lead to audits.

Example

Reporting a $5,000 business expense (e.g., office supplies) as a personal withdrawal could reduce deductible expenses and inflate taxable income.

Failure to Distribute Schedule K-1s Timely

Each partner must receive a Schedule K-1 in time to report their income on their individual or corporate tax return. Delay in providing these can affect partner compliance.

Example

A partnership files Form 1065 on time but sends K-1s to partners after the March 15 deadline—this can lead to confusion or late filings on the partners’ part.

Section 6: Special Considerations

Foreign Partners and Schedule K-3

Partnerships with foreign partners must provide detailed information about international tax items on Schedule K-3. This schedule complements Schedule K-1 and ensures foreign partners receive the necessary data to comply with U.S. and foreign tax rules.

Example

If a partnership has a partner residing in Germany, it must include foreign-source income, withholding taxes, and U.S. tax treaty benefits on Schedule K-3 for that partner.

Amended Returns (Form 1065-X)

When a partnership identifies errors or omissions after filing Form 1065, it must file Form 1065-X to amend the return. This allows corrections to previously reported income, deductions, or partner allocations.

Example

If a $10,000 business expense was left out of the original return, Form 1065-X must be filed to correct the deduction and adjust partner shares accordingly.

Partnership Termination

A partnership is considered terminated when it ceases all operations and liquidates its assets. In this case, it must file a final Form 1065 and mark the return as “Final.” Final Schedule K-1s must also be issued to all partners, reflecting the closure of capital accounts.

Example

If a two-member LLC closes its operations and distributes all assets in 2024, it must file a final 2024 Form 1065 and final K-1s showing zero balances for all capital accounts.

Key Takeaway

pecial scenarios such as international partnerships, corrections via amended returns, or business closure require additional forms and attention to detail. Timely and accurate reporting ensures full IRS compliance.

Section 7: Resources and Tools for Filing Form 1065

IRS Resources

The Internal Revenue Service offers extensive support materials to help partnerships accurately file Form 1065. These include downloadable forms, official instructions, and FAQs, all available on the IRS Website.

Example

The IRS Instructions for Form 1065 provide step-by-step guidance on completing each section, including how to prepare Schedules K, K-1, M-1, and K-3.

Tax Filing Software

Several tax software programs are tailored for partnership returns, making the filing process smoother and more efficient. These platforms automate calculations, check for common errors, and generate electronic files ready for e-filing.

Example

- Intuit ProSeries: Widely used by small accounting firms for its robust Form 1065 modules and easy e-filing.

- Drake Tax: Known for its cost-efficiency and ability to handle complex partnership returns, including multi-state filings and foreign disclosures.

Professional Assistance

Complex partnership structures, international partners, or significant deductions often require professional expertise. Hiring a Certified Public Accountant (CPA) or Enrolled Agent (EA) can help avoid errors and ensure compliance with evolving tax laws.

Example

A real estate investment partnership with foreign investors and multi-state income should consult a CPA to ensure all Schedule K-1s and K-3s are properly prepared and that apportionment rules are applied correctly.

Section 8: Calculation Section — How Income, Deductions & Distributions Work on Form 1065

This section demonstrates how partnerships use Form 1065 to calculate their annual income, deduct expenses, and allocate profits to partners based on agreed profit-sharing ratios. Proper calculations ensure accurate reporting and tax compliance for both the partnership and its individual partners.

1. Calculating the Partnership’s Total Income

A partnership may generate revenue from multiple sources, such as product sales, services, interest, or royalties. These are mentioned on the 1st page of Form 1065.

Example

- Product Sales: $300,000

- Service Revenue: $30,000

- Interest Income: $20,000

Total Income = $300,000 + $30,000 + $20,000 = $350,000

This figure represents gross receipts before any deductions.

2. Allocating Income Among Partners

Each partner receives a share of income based on the profit-sharing agreement outlined in the partnership agreement. This is reflected on Schedule K-1.

Example

If the partnership has three partners with the following ownership stakes:

- Partner A: 40%

- Partner B: 35%

- Partner C: 25%

Income Allocation from $350,000 Gross Income

- Partner A: $350,000 × 40% = $140,000

- Partner B: $350,000 × 35% = $122,500

- Partner C: $350,000 × 25% = $87,500

Each partner reports this income on their personal or corporate return via Schedule K-1.

3. Deducting Business Expenses

Allowable business expenses reduce the partnership’s taxable income. These deductions are entered in the Deductions Section of Form 1065.

Example

- Office Rent: $30,000

- Salaries: $50,000

- Supplies & Miscellaneous: $20,000

Total Expenses = $100,000

Net Taxable Income = $350,000 (Total Income) − $100,000 (Expenses) = $250,000

This figure is used to calculate the partners’ share of taxable income.

4. Calculating a Partner’s Taxable Income

The taxable income of Individual partner is based on their percentage of the partnership’s net income.

Example

If Partner A has a 40% profit share, and the partnership’s net taxable income is $250,000:

Partner A’s Taxable Income = $250,000 × 40% = $100,000

This amount will appear on Box 1 of Partner A’s Schedule K-1.

Conclusion

IRS Form 1065 is more than just a tax return—it’s the central reporting tool for partnerships to present their income, deductions, distributions, and overall financial health to the IRS. Since partnerships themselves don’t pay income taxes, the responsibility of reporting accurate information shifts to the partners through their Schedule K-1s.

Filing Form 1065 correctly ensures that:

- Each partner’s share of profits, losses, and credits is properly allocated.

- Supporting schedules (such as Schedule B, K, L, M-1, M-2, K-2, and K-3) are accurately completed and reflect the partnership’s true activity.

- The partnership stays in good standing with the IRS and avoids costly penalties.

Whether your partnership is a small startup or a multi-partner enterprise with international dealings, accuracy, organization, and compliance are essential. Staying ahead of filing deadlines, using reliable tax software, and seeking professional guidance when needed can simplify the process and protect the partnership from future issues.

Frequently asked questions (FAQs)

1. What is IRS Form 1065 used for?

IRS Form 1065 is used by partnerships to report their income, deductions, gains, and losses to the IRS. It is an informational return and does not calculate any tax due, as income is passed through to the partners.

2. Who is required to file Form 1065?

All domestic partnerships, including multi-member LLCs treated as partnerships for tax purposes, must file Form 1065 annually—even if they had no income or activity during the year.

3. Do single-member LLCs file Form 1065?

No, single-member LLCs are considered disregarded entities for federal tax purposes and report income on Schedule C (Form 1040), not Form 1065.

3. Do single-member LLCs file Form 1065?

No, single-member LLCs are considered disregarded entities for federal tax purposes and report income on Schedule C (Form 1040), not Form 1065.

4. What happens if Form 1065 is filed late?

Late filing can result in penalties of $235 per partner per month, for up to 12 months. Timely filing and providing each partner with a Schedule K-1 is essential to avoid fines.