EFIN Application: A Simple Guide to IRS e-Filing Success In 2025

Table of Contents

From Tax Preparer to Pro: Complete Your EFIN Application Today

An Electronic Filing Identification Number EFIN Application number is a unique number assigned by the IRS to tax professionals and entities authorized to electronically file tax returns. Any tax professional planning to electronically file over 10 returns per year must obtain an EFIN; it’s a legal requirement for e-filing on behalf of clients.

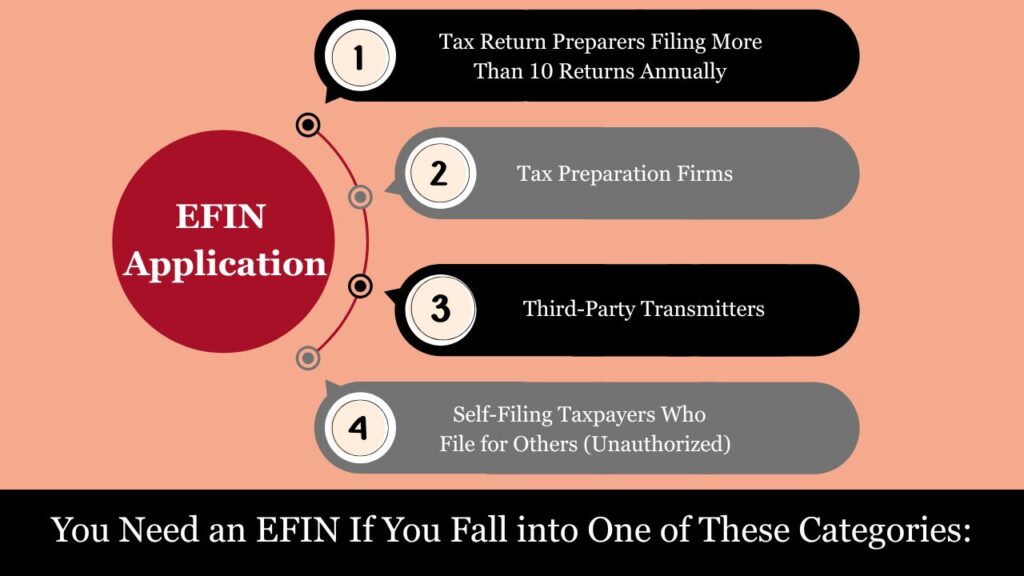

Who Needs An EFIN?

The IRS requires an Electronic Filing Identification Number (EFIN) for anyone who plans to e-file tax returns for others. This requirement ensures that all e-file providers are verified, legitimate, and authorized to transmit sensitive taxpayer data through secure IRS systems.

You Need an EFIN If You Fall into One of These Categories:

1. Tax Return Preparers Filing More Than 10 Returns Annually

If you are a paid tax preparer and you submit 11 or more individual or business tax returns in a calendar year, the IRS mandates that those returns be e-filed. In such cases, you must have an EFIN for your firm or yourself (if you’re a sole proprietor).

Example: A CPA firm filing 200 individual Form 1040 returns for clients every year must apply for and use an EFIN.

2. Tax Preparation Firms

Firms that employ multiple preparers need an EFIN assigned to the business entity. Each preparer must also have their own Preparer Tax Identification Number (PTIN), but only the firm itself needs the EFIN.

Note: If the business has multiple physical locations, each location may need its own EFIN.

3. Third-Party Transmitters

Entities that develop and maintain tax software or transmit returns to the IRS on behalf of others (e.g., payroll processors or bulk e-filers) are considered transmitters and must have an EFIN.

Example: A software company that submits returns through its tax prep product must obtain an EFIN as a software developer and transmitter.

4. Self-Filing Taxpayers Who File for Others (Unauthorized)

An EFIN is not required if you are electronically filing only your personal tax return. However, if you use your personal IRS e-Services account to file for multiple people — even family members — the IRS may require you to obtain an EFIN and register formally as an Authorized IRS e-file Provider.

When Is an EFIN Not Required?

You don’t need an EFIN if:

- You only file your own personal return.

- You manually prepare and mail returns (not recommended).

- You are a volunteer with a program like VITA (Volunteer Income Tax Assistance), which uses a group EFIN through a sponsoring organization.

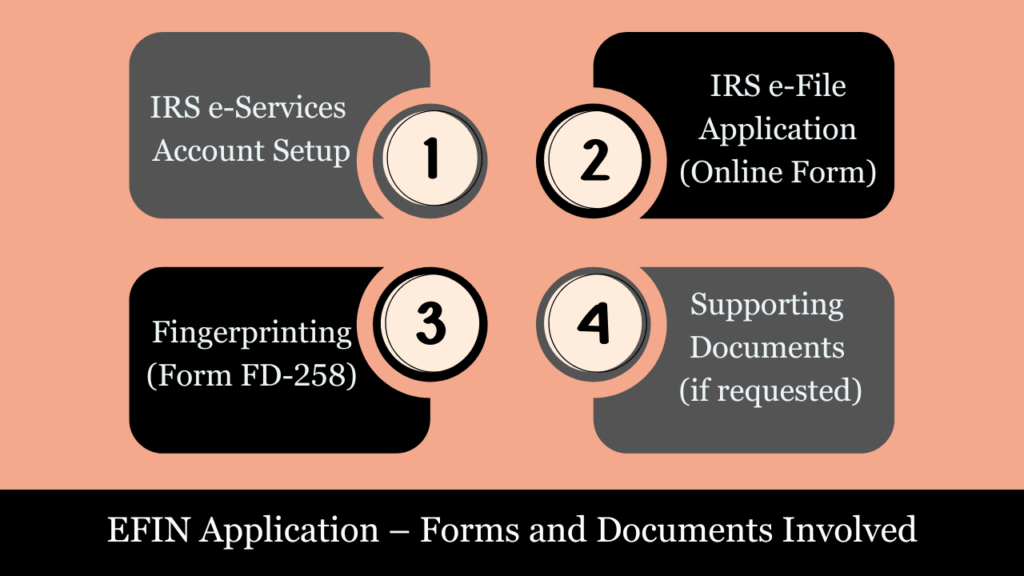

EFIN Application – Forms and Documents Involved

There is no single paper “EFIN form” in the traditional sense. Instead, the Electronic Filing Identification Number (EFIN) is applied for online through the IRS e-Services portal. However, during the application process, a few important documents and steps function like forms. Here’s what you need to know

1. IRS e-Services Account Setup

Before you can apply, you must:

- Visit IRS e-Services.

- Create a secure online account.

- Verify your identity through Secure Access authentication.

2. IRS e-File Application (Online Form)

Once your e-Services account is set up:

- Log in and select “Apply for e-file”.

- Complete the IRS e-file Application, which includes:

- Business Type (e.g., sole proprietor, LLC, partnership)Firm Information (EIN, address, contact)Principal and Responsible Official(s) informationElectronic Return Originator (ERO) or other roles selection

- Services being offered (1040, 1120, etc.)

3. Fingerprinting (Form FD-258)

If you are not exempt (e.g., not a CPA, attorney, or enrolled agent):

- Submission of Form FD-258 (Fingerprint Card) is required.

- You can request a fingerprint packet from the IRS by calling the e-Help Desk at 866-255-0654.

- Mail the completed card to:

IRS-e-FileApplication

Attn:FingerprintCards

310LowellStreet

Andover,MA01810

4. Supporting Documents (if requested)

- Business license or formation documents

- Social Security Number (SSN)

- EIN (Employer Identification Number)

- State professional credentials (CPA, EA, Attorney license if applicable)

Important Notes

- The entire EFIN application is managed online only, through the IRS e-Services portal.

- There is no downloadable PDF version of the application.

- You can track application status through your IRS e-Services account.

- Ensure your business and responsible parties pass the suitability check (background check, tax compliance review, etc.).

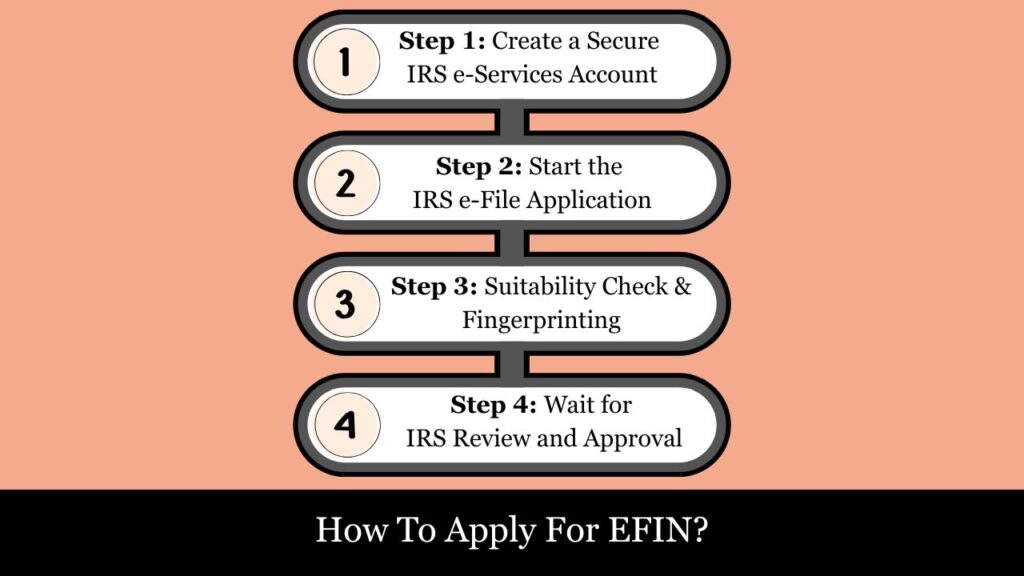

How To Apply For EFIN?

Step 1: Create a Secure IRS e-Services Account

- Go to www.irs.gov/e-services.

- Click on “Create Account.”

- Each Principal and Responsible Official must:

- Enter your full legal name, Social Security Number, date of birth, and current address.

- Undergo Secure Access Verification:

- Requires a financial account (e.g., credit card, mortgage).

- Requires a U.S.-based mobile number for identity verification.

- Requires ID.me or Login.gov authentication in newer IRS systems.

Step 2: Start the IRS e-File Application

- Once the account is verified and active, log in and click “Apply to e-file.”

- The application asks for:

- Type of firm (Sole Proprietor, LLC, Corporation, etc.).

- Legal business name and EIN.

- Physical locations (if multiple offices).

- EFIN role designation for each official:

- Principal (owner or major stakeholder).

- Responsible Official (person managing daily e-file operations).

- Types of returns you plan to e-file:

- Individual, Business, Employment, Estate/Trust, etc.

Step 3: Suitability Check & Fingerprinting

- IRS conducts a background suitability check on all Principals and Responsible Officials:

- Verifies tax compliance history.

- Screens for criminal convictions or fraudulent activity.

- Ensures ethical conduct in prior tax prep or e-file handling.

- Fingerprinting is mandatory unless the applicant is:

- An attorney, CPA, EA, or officer of a publicly traded corporation.

- Obtain and submit FBI Form FD-258 fingerprint cards through IRS-approved vendors or local law enforcement.

- Fingerprinting must be completed no later than 30 days after application submission.

Step 4: Wait for IRS Review and Approval

- Please allow up to 45 days for the IRS to review and process your application.

- If approved, you’ll receive:

- A unique 6-digit EFIN (e.g., 123456).

- Notification through IRS e-Services portal or by mail.

- If additional documentation is required (e.g., fingerprint resubmission or entity clarification), the IRS will notify you with instructions.

Example Scenario:

A CPA firm with 5 tax preparers wants to file 300 client returns. The firm owner (Principal) and office manager (Responsible Official) each create IRS e-Services accounts, undergo identity verification, and submit fingerprints. After completing the e-file application for business and individual returns, they are approved within 35 days and receive their EFIN to start e-filing.

EFIN Application Timelines

1. IRS e-Services Account Setup

- Estimated Time: 1–3 business days

- Details:

- Includes ID verification via phone, financial record, or ID.me.

- Can be delayed if identity proof fails or if you lack supporting documents.

2. Completing the e-File Application

- Estimated Time: 30–60 minutes

- Details:

- This section must be filled out by the Principal or Responsible Official.

- Includes details on the entity, roles, return types, and submission plan.

3. Fingerprinting (if required)

- Estimated Time to Schedule: 1–7 business days

- Deadline: Submit within 30 days of filing your application

- Review Time After Submission: Up to 30 days

- Details:

- Use IRS-authorized vendors or law enforcement to obtain and mail fingerprint cards (Form FD-258).

4. Background & Suitability Check

- IRS Review Time: Up to 45 business days

- Factors Checked:

- Criminal history

- Tax compliance

- Prior ethical violations (if any)

- Delays Possible If:

- Fingerprint cards are unreadable

- Information discrepancies arise

- Additional verification is needed

5. EFIN Issuance

- Typical Total Timeline: 30 to 45 days from full application submission

- Notification Method: Through IRS e-Services or U.S. Mail

- What You Receive:

- A unique Electronic Filing Identification Number (EFIN)

- IRS approval letter and instructions for e-filing software setup

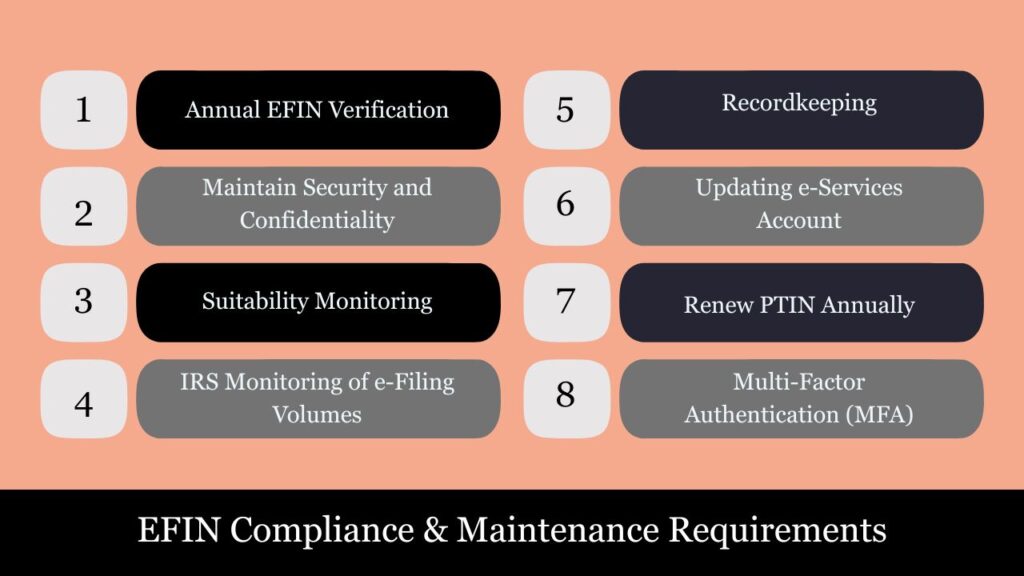

EFIN Compliance & Maintenance Requirements

1. Annual EFIN Verification

- To maintain compliance, each EFIN undergoes periodic IRS checks for authorized use.

- You must notify the IRS of:

- Business name or address changes

- Ownership or control changes

- Any change to the Responsible Official

2. Maintain Security and Confidentiality

- Security Standards:

- Implement safeguards to protect taxpayer data (IRS Pub 4557).

- Use updated anti-virus software, secure networks, and encryption.

- Compliance With IRS Requirements:

- Develop and follow a Written Information Security Plan (WISP).

- Train employees on data protection policies.

3. Suitability Monitoring

- The IRS may re-evaluate your suitability at any time.

- Factors include: criminal convictions, tax non-compliance, or unethical conduct.

- Non-compliance may lead to:

- Suspension or revocation of your EFIN

- Penalties or prosecution in serious cases

4. IRS Monitoring of e-Filing Volumes

- The IRS monitors filing volumes under each EFIN to detect misuse.

- Excessive returns from unauthorized locations may trigger review or investigation.

5. Recordkeeping

- Retain e-file authorization forms (e.g., Form 8879) for at least 3 years.

- Keep logs of system access and return transmissions as part of audit preparedness.

6. Updating e-Services Account

- Promptly update e-Services whenever there is a:

- Change in Responsible Official

- Change in return types filed

- Addition of locations or satellite offices

7. Renew PTIN Annually

- If you’re also a paid preparer, your PTIN (Preparer Tax Identification Number) must be renewed each calendar year through the IRS PTIN system.

8. Multi-Factor Authentication (MFA)

- The IRS requires multi-factor login authentication for e-Services accounts.

- Always maintain access recovery options and secure login credentials.

Conclusion: EFIN Application and Maintenance

Obtaining and maintaining an Electronic Filing Identification Number (EFIN) is essential for any tax professional or firm intending to file returns electronically with the IRS. The EFIN not only legitimizes a provider’s ability to e-file but also acts as a regulatory gateway ensuring that firms meet stringent IRS suitability standards.

Once approved, continued compliance and security diligence are critical. EFIN holders must keep their IRS records current, adhere to federal data protection standards, and be responsive to any verification or monitoring processes initiated by the IRS. Failure to follow these obligations can lead to penalties, revocation of EFIN privileges, and potential criminal implications.

Ultimately, the EFIN process is not just a regulatory formality—it is a commitment to ethical tax practice, secure taxpayer data handling, and IRS partnership in maintaining the integrity of the electronic filing system. Staying informed and compliant ensures uninterrupted operation and builds client trust in an increasingly digital tax environment

Frequently Asked Questions (FAQs)

Who needs to apply for an EFIN?

Any individual, firm, or organization planning to e-file 11 or more individual or business tax returns in a calendar year must apply for and obtain an EFIN from the IRS.

How long does it take to get an EFIN?

The approval process typically takes up to 45 days, depending on background checks, fingerprint processing, and IRS review time.

Is there a fee to apply for an EFIN?

No. The EFIN application is free of charge.

Do I need to get fingerprinted?

Yes, if you’re a first-time applicant and not already vetted by the IRS, you’ll need to complete the IRS fingerprinting process, unless you’re exempt (e.g., attorneys, CPAs, or enrolled agents with active credentials).

Can multiple EFINs be obtained by one business?

Yes, but it depends on the number of office locations or business structures. Each location that e-files may require its own EFIN.

What documents are needed to apply?

You’ll typically need:

-Personal identification

-Business information (EIN if applicable)

-Professional credentials (PTIN, CPA license, etc.)

-Completed fingerprint cards (unless exempt)

What is the difference between an EFIN and PTIN?

–EFIN identifies a business or firm to the IRS for e-filing.

–PTIN (Preparer Tax Identification Number) identifies an individual who prepares tax returns for compensation.

Do EFINs expire?

No, but the IRS may suspend or revoke an EFIN for noncompliance or inactivity. It’s essential to keep your information up to date in IRS e-Services.

What should I do if I change my business address or ownership?

You must update your EFIN information through your IRS e-Services account or contact the IRS E-Help Desk to reflect any business structure, ownership, or address changes.

Where do I apply for an EFIN?

You apply through the IRS e-Services portal at https://www.irs.gov/e-services. You’ll need to create an account and complete the e-file application online.