Effectively Connected Income (ECI): Detailed Briefing

Table of Contents

A Complete Review On Effectively Connected Income (ECI)

Effectively Connected Income (ECI) refers to income earned by a nonresident alien or foreign corporation that is connected with the conduct of a trade or business within the United States. The Internal Revenue Code (IRC) treats ECI differently from other types of foreign-source income, particularly Fixed, Determinable, Annual, or Periodical (FDAP) income.

If income is treated as Effectively Connected Income (ECI), it becomes taxable under U.S. federal income tax rules, similar to how U.S. citizens or resident aliens are taxed. This concept is crucial for determining tax obligations for foreign entities and individuals earning income from U.S. sources.

Who Is Subject to ECI Tax Rules?

The U.S. tax rules surrounding Effectively Connected Income (ECI) apply specifically to foreign persons—a category that includes nonresident aliens, foreign corporations, foreign partnerships, and certain foreign trusts and estates—when they engage in a trade or business within the United States. If such foreign entities or individuals earn income that is effectively connected with U.S. business activities, they are subject to U.S. federal income tax on that income, often at graduated rates, just like U.S. residents.

Let’s break this down into the primary categories of affected taxpayers:

1. Nonresident Aliens

Nonresident individuals who are not U.S. Individuals who are not U.S. citizens and fail to meet the green card or substantial presence criteria are classified as nonresident aliens for tax purposes. If they perform services, operate a business, or generate active income within the U.S., that income may be considered ECI. This includes:

- Freelancers or consultants physically working in the U.S.

- Owners of rental property who choose to treat the income as effectively connected with a U.S. trade or business (ECI) can be taxed on a net basis.

- Nonresidents engaged in partnerships or joint ventures that operate within the U.S.

They are required to file Form 1040-NR to report such income.

2. Foreign Corporations

A foreign corporation refers to an entity established or incorporated outside the United States. If such a corporation conducts business within the U.S.—whether through a branch, office, agent, or even significant operations—it may earn income that is classified as ECI. Examples include:

- Running a U.S. branch of a foreign company

- Selling products or services through a permanent establishment in the U.S.

- Owning U.S. assets that generate active income (e.g., commercial property)

Foreign corporations with ECI must file Form 1120-F and may also be subject to the Branch Profits Tax, which applies to repatriated earnings.

3. Foreign Partnerships

When a foreign partnership is engaged in a trade or business in the U.S., its income is treated as ECI. This has implications for all partners—including foreign and U.S. partners—since each partner must report their share of ECI individually on their respective tax returns.

In addition:

- The partnership files Form 1065, and

- Each foreign partner receives a Schedule K-1 reflecting their portion of ECI.

Foreign partners may be required to file Form 1040-NR (if individuals) or Form 1120-F (if entities) and may be subject to withholding on ECI allocations.

4. Foreign Trusts and Estates

A foreign trust or estate can also fall under ECI rules if it earns U.S.-source income tied to a trade or business conducted within the United States. For example:

- A foreign estate that rents or sells U.S. real estate

- A foreign trust actively investing in U.S. real property or partnerships

Such trusts or estates may need to file Form 1040-NR, Form 1041, or other informational forms like Form 3520-A, depending on structure and activity.

5. Beneficiaries and Shareholders of U.S. Income from Foreign Sources

Even when a foreign individual is not personally operating a business in the U.S., they may still be treated as engaged in a U.S. trade or business under certain conditions, they may still be subject to ECI rules if they are:

- Shareholders of a foreign corporation earning ECI

- Beneficiaries of foreign trusts with U.S. business activity

- Partners in U.S. or foreign partnerships generating ECI

In these cases, pass-through income must still be reported as ECI, and applicable tax returns must be filed.

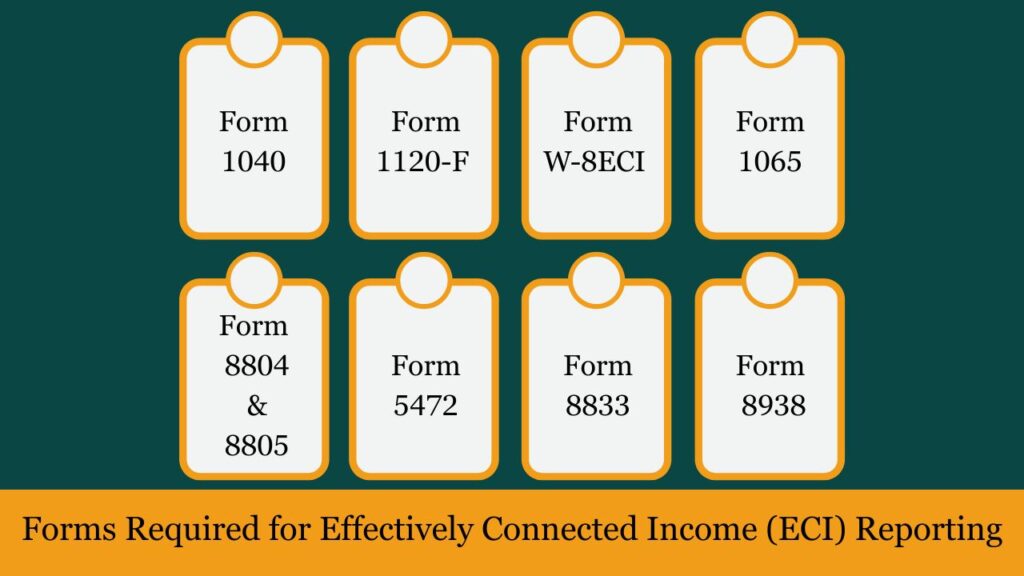

Forms Required for Effectively Connected Income (ECI) Reporting

Foreign individuals, entities, and partnerships that earn Effectively Connected Income (ECI) in the United States are required by the IRS to file specific tax forms to report their income, claim deductions, and calculate taxes due. Filing the right forms is crucial to maintain compliance with U.S. To comply with tax regulations and prevent excessive withholding or potential penalties.

Below is a detailed guide to the essential IRS forms required for ECI reporting, based on taxpayer type and transaction nature.

1. Form 1040-NR – U.S. Nonresident Alien Income Tax Return

Who must file:

Nonresident aliens—foreign individuals who are neither U.S. citizens nor green card holders, and who do not meet the substantial presence test—must file Form 1040-NR if they earn effectively connected income from U.S. sources. This includes income from:

- Employment or independent contracting in the U.S.

- U.S.-based business activities

- Rental income (if treated as ECI through election)

- U.S. partnership distributions

Purpose

- To disclose gross income that is linked to a trade or business conducted within the United States.

- To claim allowable deductions such as business expenses, travel, and state taxes

- To apply treaty benefits (if applicable)

- To calculate final tax liability on a graduated rate basis

Supporting schedules

- Schedule NEC is used to report passive income, such as FDAP, that is not effectively connected with a U.S. trade or business.

- Schedule OI: Provides residency details, U.S. presence, and treaty claim positions

Due date

Typically April 15 (or June 15 if no wages were earned in the U.S.)

2. Form 1120-F – U.S. Income Tax Return of a Foreign Corporation

Who must file

Foreign corporations engaged in a U.S. trade or business, including through a branch, a permanent establishment, or ownership of U.S. real estate (FIRPTA), are required to file Form 1120-F. This applies to:

- Foreign banks with U.S. branches

- Foreign manufacturing companies with U.S. agents or contracts

- Foreign landlords selling or renting U.S. properties

- Foreign investors in U.S. partnerships with ECI

Purpose

- To report all income effectively connected with a trade or business carried out in the United States.

- To deduct U.S. business-related expenses

- To determine the corporate tax liability based on net taxable income.

- To determine and report the Branch Profits Tax, which applies when profits are repatriated out of the U.S.

Key schedules

- Schedule I: Details on effectively connected income

- Schedule M-1 and M-2: Book-to-tax adjustments

- Schedule H: Branch profits calculation

Filing deadline

Due by April 15 for calendar-year taxpayers, with an automatic filing extension available through Form 7004.

3. Form W-8ECI

Used by foreign individuals or entities to certify that their income is effectively connected with a U.S. trade or business.

Who uses it

Foreign individuals, corporations, or partnerships who receive U.S.-source income that is effectively connected (such as rent, royalties, or business proceeds) must submit Form W-8ECI to U.S. payers.

Purpose

- To certify that the income being earned is effectively connected with a U.S. trade or business

- To prevent the standard 30% withholding tax usually imposed on passive FDAP income.

- To allow income to be taxed on a net basis with deductions, rather than gross

When to submit

Before receiving payment, and updated every three years or upon material change

Common usage scenarios

- A foreign company leasing equipment to a U.S. business

- A foreign landlord managing U.S. rental property as a business

- A foreign author receiving royalties from U.S. publishers through a permanent establishment

4. Form 1065 – U.S. Return of Partnership Income

Who must file

Any U.S. or foreign partnership engaged in a U.S. trade or business must file Form 1065 to report:

- Gross income from U.S. operations

- Ordinary business deductions

- Distributive shares of income to partners (foreign or domestic)

Why it matters for ECI

Foreign partners in such partnerships are deemed to be engaged in a U.S. trade or business through the partnership. Their share of income is ECI, even if they don’t directly participate in operations.

Required forms for foreign partners

- Schedule K-1: Reports each partner’s share of income and deductions

- Foreign partners must file Form 1040-NR or 1120-F depending on their entity type

5. Form 8804 and Form 8805 – Annual Return for Partnership Withholding Tax (Section 1446

Who must file

U.S. partnerships that have foreign partners and earn ECI are required to withhold tax on behalf of those partners under IRC Section 1446.

Form 8804

Summarizes the total withholding tax liability at the partnership level.

Form 8805

A form provided to each foreign partner that outlines their individual share of relevant partnership items, including:

- Allocable share of ECI

- Tax withheld and paid on their behalf

Importance

These forms ensure that foreign partners meet their U.S. tax obligations and receive credit for taxes paid.

6. Form 5472 – Information Return of a 25% Foreign-Owned U.S. Corporation

Who must file

Any U.S. corporation that is at least 25% foreign-owned and has reportable transactions with related foreign parties must file Form 5472. This includes:

- Loans

- Royalties

- Management fees

- Transfer of inventory or equipment

Connection to ECI

These transactions often occur in the context of U.S. branches or subsidiaries of foreign companies and can result in ECI subject to U.S. taxation.

Filed with

Form 1120 or 1120-F

7. Form 8833 – Treaty-Based Return Position Disclosure

Who must file

Any foreign taxpayer claiming a reduction or exemption from tax under a U.S. income tax treaty where such position overrides normal IRS tax rules must file this form.

Relevance to ECI

This includes situations where:

- A taxpayer claims they are not engaged in a U.S. trade or business due to a permanent establishment clause

- A foreign partner claims reduced taxation under treaty rules on their share of ECI

8. Form 8938 – Statement of Specified Foreign Financial Assets

Who must file

U.S. persons (including resident aliens) who hold significant foreign financial assets, and in some cases, foreign individuals with U.S. reporting obligations.

Relevance to ECI

Helps the IRS trace income sources and compliance, particularly when foreign income, partnerships, or trusts contribute to U.S. tax obligations, including ECI.

Final Thoughts: Why These Forms Matter

Proper reporting of Effectively Connected Income is essential for:

- Avoiding excessive withholding

- Claiming allowable deductions

- Preventing IRS penalties for underreporting or late filing

- Maintaining eligibility for treaty benefits

- Ensuring transparency in cross-border business dealings

Filing the right ECI-related forms ensures that foreign persons and entities:

- Are taxed on net income, not gross receipts

- Receive credit for taxes already withheld

- Maintain good standing with the IRS

ECI Tax Form

Foreign individuals, corporations, and partnerships that engage in a trade or business in the United States are generally subject to U.S. taxation on their Effectively Connected Income (ECI). Unlike FDAP income, which is typically taxed at a flat 30% rate on the gross amount, ECI is taxed on a net basis, permitting deductions for related costs and expenses.

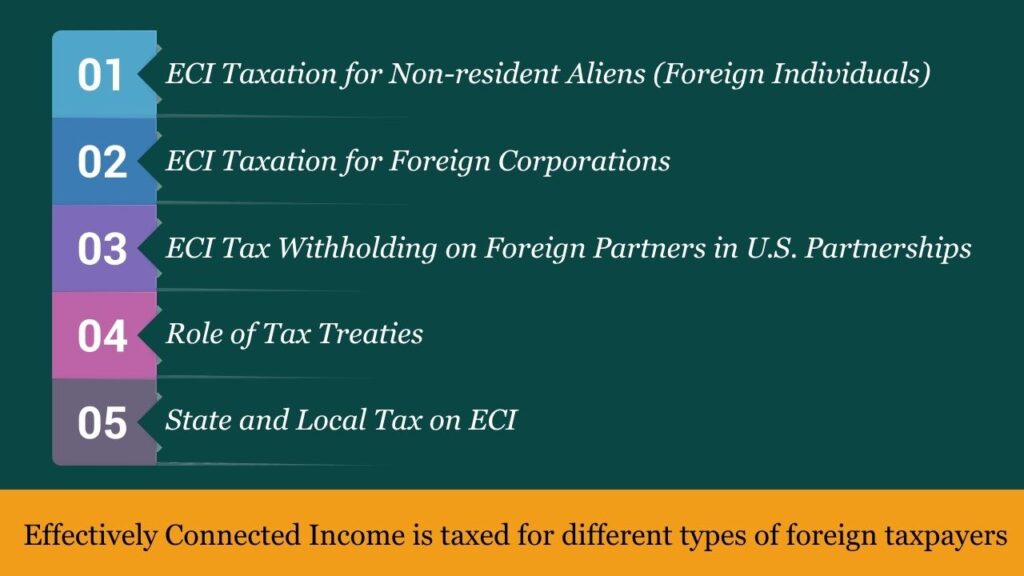

The tax treatment of ECI depends on who earns the income—an individual, a corporation, or a foreign partner in a U.S. business. Below is a comprehensive explanation of how ECI is taxed for different types of foreign taxpayers.

1. ECI Taxation for Non-resident Aliens (Foreign Individuals)

Foreign individuals who are classified as non-resident aliens for U.S. tax purposes are taxed on their net ECI at the same graduated rates applicable to U.S. citizens and residents.

How It Works

- The individual computes gross income derived from U.S. Income that has a direct connection to a trade or business operated within the United States.

- Allowable deductions (such as business expenses, salaries, rent, and state taxes) are subtracted.

- The resulting net income is subject to federal income tax using the individual tax brackets.

2025 Tax Brackets for Single Non-resident Aliens

| Taxable Income | Rate |

| Up to $11,600 | 10% |

| $11,601 – $47,150 | 12% |

| $47,151 – $100,525 | 22% |

| $100,526 – $191,950 | 24% |

| $191,951 – $243,725 | 32% |

| $243,726 – $609,350 | 35% |

| Over $609,350 | 37% |

Important Considerations

- Standard deduction is not allowed unless the taxpayer is from India due to a specific treaty exception.

- Only itemized deductions related directly to ECI are permitted.

- Additional taxes may apply if self-employment income is earned.

2. ECI Taxation for Foreign Corporations

Foreign corporations that earns being effectively connected with a U.S. trade or business are subject to U.S. taxation on that income and are taxed at the federal corporate tax rate, and potentially subject to additional branch-level taxes.

Basic Federal Rate

- Flat 21% on net ECI (same as U.S. domestic corporations)

Additional Branch-Level Taxes

| Tax Type | Rate | Applicability |

| Branch Profits Tax | 30% (treaty-reducible) | Applied to repatriated ECI income, mimicking dividend taxation |

| Branch Interest Tax | 30% (treaty-reducible) | Applied to interest deemed paid by the U.S. branch to foreign parties |

Example

A German manufacturing company operates a U.S. branch generating $1 million in net ECI. It would pay:

- 21% corporate tax on the $1 million ECI = $210,000

- 30% branch profits tax on any repatriated after-tax profits unless reduced by the U.S.-Germany tax treaty

3. ECI Tax Withholding on Foreign Partners in U.S. Partnerships

When a foreign person—individual or corporation—is a partner in a partnership that conducts business in the U.S., they are considered to be engaged in a U.S. Trade or business and are taxed on their allocated portion of the partnership’s effectively connected income (ECI).

Withholding Obligations under IRC Section 1446

The partnership must withhold and remit tax on behalf of its foreign partners, regardless of whether income is actually distributed.

| Type of Foreign Partner | Withholding Rate |

| Individual (nonresident alien) | Up to 37% (based on income brackets) |

| Foreign corporation is generally taxed | Flat 21% corporate rate, and may also face a 30% branch profits tax, unless reduced by an applicable tax treaty. |

Required Forms

- Form 8804: Annual return for partnership withholding

- Form 8805: Statement to each foreign partner showing their share of ECI and withheld tax

4. Role of Tax Treaties

Many countries have income tax treaties with the U.S. that modify how ECI is taxed. These treaties can:

- Exempt ECI from U.S. taxation if the taxpayer does not have a permanent establishment in the U.S.

- The branch profits tax rate may be reduced under tax treaties—for instance, 15% for India and between 5% and 15% for France.”

- Allows a credit for U.S. taxes paid to help prevent double taxation in the foreign country. To access these benefits:

To claim benefits

- File Form 8833, Treaty-Based Return Position Disclosure, with Form 1040-NR (for individuals) or Form 1120-F (for corporations)

5. State and Local Tax on ECI

Beyond federal taxation, foreign taxpayers may also be subject to state and local taxes on their effectively connected income (ECI):

Key Points

- Because many states disregard federal tax treaties, exemptions granted under those treaties usually aren’t recognized for state tax purposes.

- Nexus rules vary, but income derived from operations, property, or services in a state can trigger tax liability.

- State corporate income tax rates vary by jurisdiction, generally ranging from 1% to 12%.

Example

A foreign software firm with U.S. clients in California may be required to:

- File a California tax return

- Pay state corporate income tax on income attributable to California operations

Summary Table: ECI Tax Rates by Entity Type

| Taxpayer Type | Federal Tax Rate | Additional Taxes |

| Nonresident Individual | 10%–37% (graduated) | Self-employment tax (if applicable) |

| Foreign Corporation | 21% (flat) | 30% Branch Profits Tax (treaty-reduced) |

| Foreign Partner (Individual) | Up to 37% (withholding) | Withholding under IRC Section 1446 |

| Foreign Partner (Corporation) | 21% (withholding) | Branch Profits Tax + Section 1446 Withholding |

Summary

Effectively Connected Income (ECI) is subject to varying tax rates depending on the taxpayer’s entity type and applicable deductions. While the general structure follows U.S. tax rules for net income, the specific tax rate and compliance obligations vary based on:

- The type of foreign taxpayer

- Whether the income is derived via direct operations or through partnerships

- The existence of a permanent establishment under a tax treaty

- Whether branch taxes apply

Understanding ECI tax rates is essential for avoiding double taxation, ensuring compliance, and optimizing cross-border tax strategy.

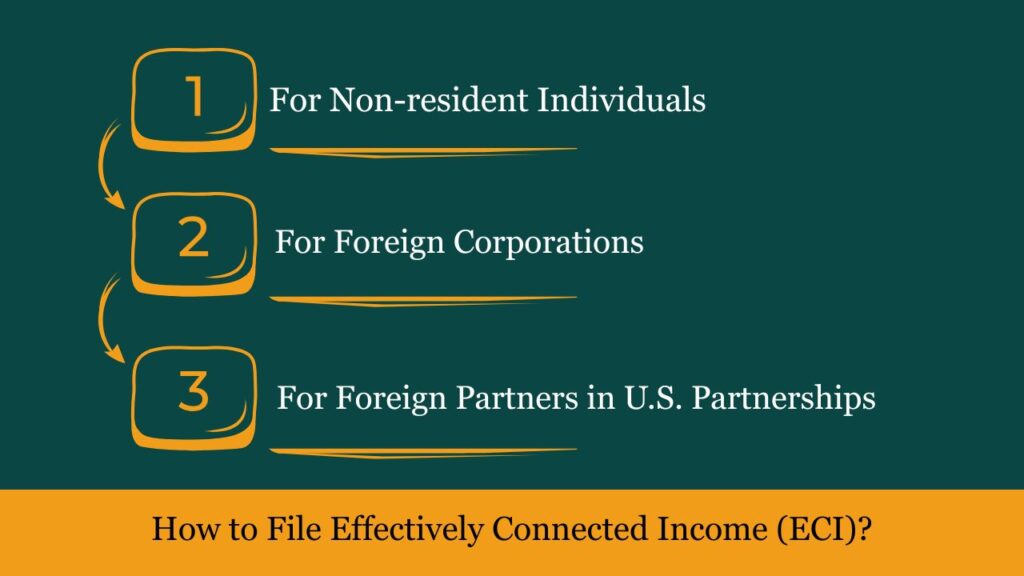

How to File Effectively Connected Income (ECI) – A Step-by-Step Guide

Filing taxes on Effectively Connected Income (ECI) is a crucial obligation for foreign individuals and entities who earn income from a U.S. trade or business. Unlike passive income (e.g., interest or dividends), ECI is taxed on a net basis, which allows deductions for expenses directly related to the U.S. operations. To stay compliant with the IRS, it’s important to understand how to properly report ECI and which forms are required based on your taxpayer status.

A. For Non-resident Individuals

Step 1: Determine Residency Status

Confirm that you are a non-resident alien under IRS rules (typically based on the substantial presence test or green card test). Non-resident individuals report only U.S.-source income.

Step 2: Identify ECI

Determine and classify income connected to a U.S.-based trade or business. This may include::

- Compensation for services performed in the U.S.

- Income from U.S. real estate or business operations

- Gains from the sale of U.S. business assets

Step 3: Prepare Form 1040-NR

File Form 1040-NR (U.S. Non-resident Alien Income Tax Return) to report your ECI.

Key items to include:

- Gross ECI

- Related deductions (expenses, depreciation, taxes, etc.)

- Net income subject to tax

- Treaty-based disclosures (if applicable)

Step 4: Attach Form 8833 (If Claiming Treaty Benefits)

If you are claiming an exemption or reduced rate under an income tax treaty, file Form 8833, Treaty-Based Return Position Disclosure, along with your Form 1040-NR.

Step 5: Include All Schedules

Depending on the type of ECI, you may need to file additional forms or schedules, such as:

- Schedule C (business income)

- Schedule E (rental real estate)

- Schedule SE (self-employment tax, if applicable)

B. For Foreign Corporations

Step 1: Determine if You’re Engaged in a U.S. Trade or Business

Foreign corporations must file taxes if they are effectively connected through a U.S. branch, subsidiary, or permanent establishment.

Step 2: File Form 1120-F

Use Form 1120-F Used to file the U.S. Income Tax Return of a Foreign Corporation, this form is required to report:

- Gross ECI and deductions

- Taxable income and U.S. tax liability

- Branch profits tax (if applicable)

Step 3: Attach Required Statements

Corporations are required to attach comprehensive financial statements and supporting schedules that:

- Allocate expenses between U.S. and non-U.S. operations

- Report interest and dividend income

- Claim treaty benefits (if applicable)

Step 4: File Form 8833 (If Treaty Position Claimed)

Similar to individuals, corporations claiming treaty benefits must file Form 8833.

C. For Foreign Partners in U.S. Partnerships

Step 1: Withholding at Partnership Level

The partnership is required to withhold and remit taxes on ECI allocable to foreign partners under IRC Section 1446.

Step 2: Partner Reporting

Each foreign partner receives:

- Schedule K-1 (Form 1065) showing their share of income

- Form 8805, titled ‘Foreign Partner’s Information Statement of Section 1446 Withholding,’ is issued to foreign partners to report their share of effectively connected income (ECI) allocated by the partnership.

- They must then report this income on their individual U.S. tax return, typically using Form 1040-NR or Form 1120-F, depending on their entity type..

Foreign partners must report their share of effectively connected income (ECI) on their U.S. tax return, typically using Form 1040-NR for individuals or Form 1120-F for foreign corporations.

- Form 1040-NR (for individuals)

- Form 1120-F (for corporations)

Filing Deadlines

| Taxpayer Type | Form | Due Date |

| Nonresident Individual file | Form 1040-NR | April 15 or by June 15 if they have no wages subject to U.S withholding. |

| Foreign Corporation | Form 1120-F | April 15 (extension available) |

| Partnership Withholding | Form 8804/8805 | March 15 (extension available) |

Where to File

ECI-related forms can be filed:

- Electronically through IRS e-file (individuals and partnerships)

- By mail to the appropriate IRS address listed in the form instructions

ECI Income Calculation Example

Scenario

A foreign individual from Germany operates a graphic design business while temporarily residing in the U.S. under a work visa. During the 2025 tax year, the business generates $160,000 in gross income from U.S. clients. The taxpayer incurs the following ordinary and necessary business expenses:

- Office lease in Boston: $22,000

- Travel, lodging, and meals for client meetings: $9,000

- Payments to freelance staff: $18,000

- Software subscriptions and marketing: $6,000

Step 1: Calculate Total Business Expenses

All expenses are directly connected to the U.S. business activity and therefore deductible under IRS rules for calculating ECI.

$22,000 (office lease)

+ $9,000 (travel and meals)

+ $18,000 (freelancers)

+ $6,000 (software and marketing)

= $55,000 total expenses

Step 2: Calculate Net Effectively Connected Income (Net ECI)

Now subtract the allowable expenses from the gross U.S. business income:

$160,000 (gross income) – $55,000 (expenses) = $105,000 (net ECI)

Step 3: Determine Taxable Amount

The $105,000 in net ECI is taxable under the U.S. graduated income tax rates for nonresident aliens. Since the individual cannot claim the standard deduction (unless treaty benefits apply), the entire $105,000 is subject to U.S. tax.

Summary

| Component | Amount (USD) |

| Gross U.S. Income | $160,000 |

| Deductible Expenses | $55,000 |

| Net Effectively Connected Income | $105,000 |

| Form Filed | 1040-NR |

| Tax Basis | Graduated rates on net income |

Notes

- The taxpayer must report this income and deductions on Form 1040-NR and attach all relevant schedules (e.g., Schedule C for business income).

- If the U.S.–Germany tax treaty applies and provides exemptions or rate reductions, the taxpayer should file Form 8833 to disclose treaty positions.

- Estimated tax payments may be required during the year if no withholding occurred.

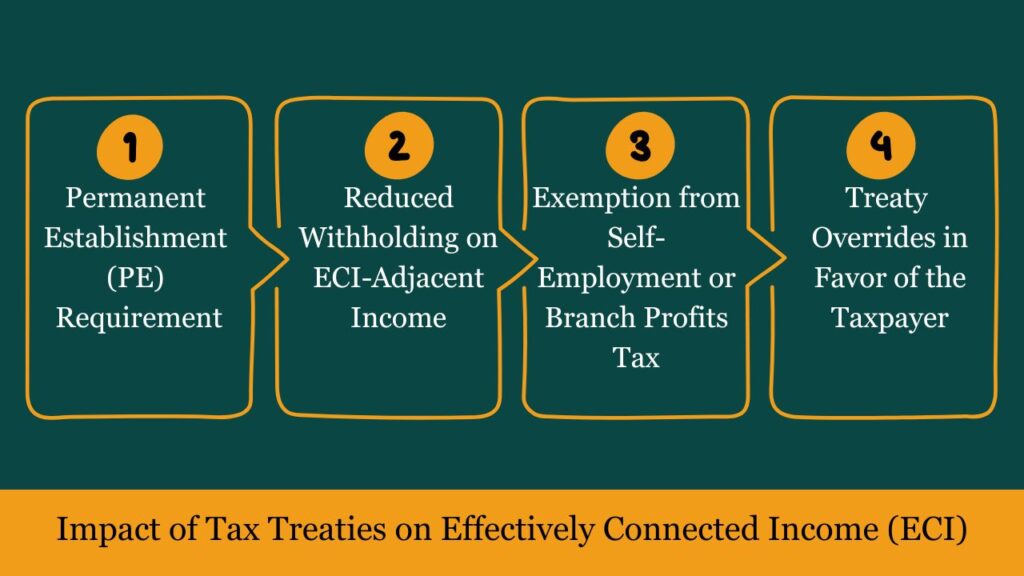

Impact of Tax Treaties on Effectively Connected Income (ECI)

What Are Tax Treaties?

The United States has entered into bilateral income tax treaties with more than 60 countries to prevent double taxation and encourage international trade and investment. These treaties define how and where income earned by a foreign person should be taxed—either in the U.S., their home country, or both, often with mechanisms to avoid double taxation.

How Do Tax Treaties Affect ECI?

Effectively Connected Income (ECI) refers to income earned by a nonresident alien or foreign entity that is directly associated with a trade or business carried on within the United States. While this income is normally subject to U.S. income tax on a net basis, tax treaties may modify how it is taxed, in the following ways:

1. Permanent Establishment (PE) Requirement

Most treaties contain a Permanent Establishment clause, which limits the U.S.’s ability to tax business income of a foreign person unless the person has a fixed place of business or agent in the U.S.

Impact: Impact: If a tax treaty is in effect and the taxpayer does not have a U.S. permanent establishment, the United States typically cannot tax the income as ECI—even if it is U.S.-sourced, such as compensation for services performed within the U.S.

Example

A German consultant earns $50,000 from U.S. clients remotely. Under the U.S.–Germany treaty, if the consultant does not have a U.S. office or dependent agent, the income is not ECI and not taxable in the U.S.

2. Reduced Withholding on ECI-Adjacent Income

Some income that could be treated as ECI or FDAP (Fixed, Determinable, Annual, or Periodic income) may qualify for reduced withholding rates or exemptions under a treaty.

Impact: Royalty, interest, or dividend income that is normally taxed at 30% may qualify for a reduced rate or exemption if it is ECI or treated as part of ECI under treaty rules.

3. Exemption from Self-Employment or Branch Profits Tax

Certain treaties may exempt self-employed individuals from U.S. self-employment tax or allow foreign corporations to avoid the branch profits tax if specific criteria are met.

Impact: A foreign sole proprietor or corporation earning ECI may save significantly on additional tax burdens.

4. Treaty Overrides in Favor of the Taxpayer

According to IRC Section 894(a)(1), tax treaties can override provisions in the Internal Revenue Code if the treaty benefits the taxpayer. This includes redefining ECI thresholds, reducing effective tax rates, or excluding certain types of income.

Impact: A treaty position can be used to legally avoid ECI classification or reduce the resulting U.S. tax liability.

Penalties for Noncompliance with ECI Tax Rules

Failing to accurately report and pay tax on Effectively Connected Income (ECI) can expose non-resident individuals and foreign entities to a variety of IRS-imposed penalties. These penalties apply when tax returns are filed late, payments are delayed, or required documentation is incomplete or missing. Below is a detailed breakdown of the most common ECI-related penalties:

1. Late Filing Penalty

If a taxpayer fails to file a return that reports ECI (such as Form 1040-NR or Form 1120-F) by the IRS deadline and no extension has been granted, a late filing penalty may apply.

- Penalty Rate: 5% of the unpaid tax amount is charged for each month or partial month the return remains unfiled.

- Maximum Penalty: Up to 25% of the unpaid tax

2. Late Payment Penalty

Even if the return is filed on time, failure to pay the ECI-related tax due can trigger a late payment penalty.

- Penalty Rate: 0.5% of the unpaid tax is assessed for each month or part of a month the payment is late.

- This penalty accrues monthly until the tax is fully paid, with a maximum limit of 25% of the unpaid amount.

3. Accuracy-Related Penalty

If the taxpayer understates the amount of tax owed on ECI due to negligence, careless reporting, or substantial understatements, the IRS may impose a 20% accuracy-related penalty.

- Applies when there is a substantial understatement of tax or failure to maintain proper records

4. Failure to Submit Form W-8ECI

Foreign persons receiving U.S. business required to provide Form W-8ECI to the withholding agent to certify that the income is effectively connected with a U.S. trade or business

- Consequence: If not submitted, the withholding agent may withhold 30% of the gross income amount

- This can lead to cash flow disruptions and delays in claiming refunds

5. Information Reporting Penalties

Certain foreign taxpayers must also file additional disclosure forms, such as:

- Form 5472 (for foreign-owned U.S. corporations)

- Form 8833 (to disclose treaty-based return positions)

Failure to file these forms can result in steep penalties:

- Minimum Penalty: $10,000 per form

- Escalation: Penalties increase if the failure continues after notification by the IRS

Conclusion

Understanding Effectively Connected Income (ECI) is essential for any nonresident alien or foreign entity earning income from U.S. sources. Proper classification between ECI and FDAP can drastically impact your U.S. tax liability. Filing the correct forms, using elections wisely, and maintaining compliance can minimize risks and ensure accurate taxation.

Frequently Asked Questions (FAQs)

Is ECI subject to U.S. tax?

Yes. ECI is taxed at graduated rates like U.S. income.

What is the difference between ECI and FDAP

Effectively Connected Income (ECI) generally involves active U.S. business activities and is taxed on a net basis after allowable deductions. In contrast, Fixed, Determinable, Annual, or Periodic (FDAP) income is typically passive—such as interest, dividends, or royalties—and is taxed on a gross basis at a flat 30% rate (unless reduced by treaty).

Do I need to file taxes if I earn ECI?

Yes. Foreign individuals and corporations with ECI must file Form 1040-NR or 1120-F.

How can I avoid 30% withholding on ECI?

Submit Form W-8ECI to the payer to certify that income is ECI.