FORM 8938: Your Solution To Specified Financial Assets

Table of Contents

Understanding The Complete Scenario On IRS Form 8938?

Form 8938, officially known as the “Statement of Specified Foreign Financial Assets,” is a mandatory IRS reporting form used by certain U.S. taxpayers to declare foreign financial assets that meet or exceed specific monetary thresholds. This form was introduced as part of the Foreign Account Tax Compliance Act (FATCA), a law enacted in 2010 aimed at combating tax evasion by U.S. persons holding assets offshore.

The form is filed along with an individual’s Form 1040 and is designed to provide transparency about foreign financial holdings that may otherwise go unreported. It serves as a critical enforcement tool for the IRS to identify undisclosed offshore income and prevent underreporting.

Purpose of Form 8938

Form 8938 was introduced under the Foreign Account Tax Compliance Act (FATCA) and is used to report certain foreign financial assets to the IRS. It aims to enhance tax transparency and enforce compliance by requiring U.S. taxpayers to report foreign financial assets that could otherwise facilitate tax evasion.

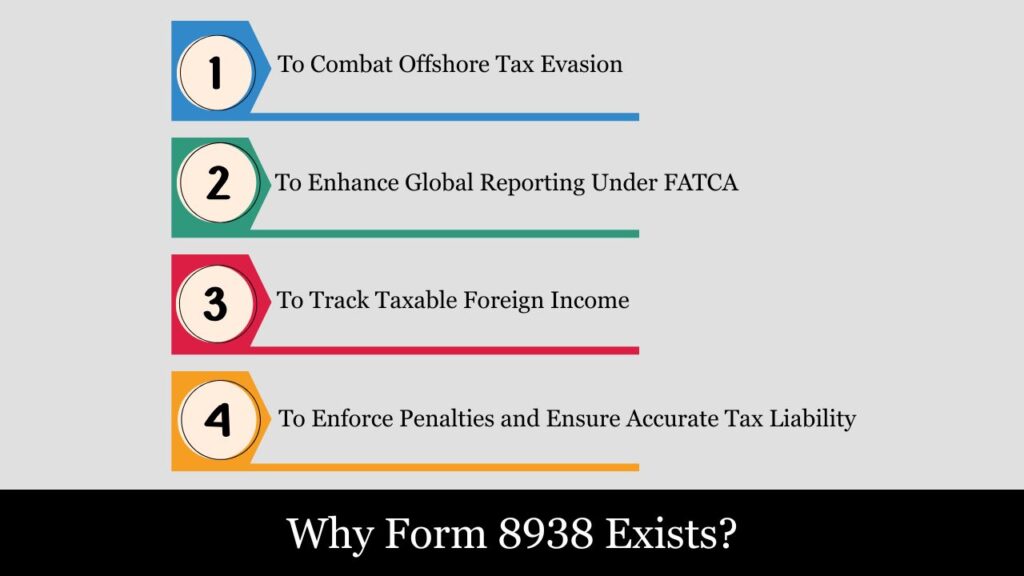

Why Form 8938 Exists:

- To Combat Offshore Tax Evasion:

- The IRS uses Form 8938 to identify undisclosed foreign income and investments that may escape traditional U.S. tax reporting systems.

- To Enhance Global Reporting Under FATCA:

- FATCA requires foreign financial institutions (FFIs) to report details of accounts held by U.S. persons.

- Form 8938 complements this by requiring U.S. taxpayers themselves to report foreign financial assets.

- To Track Taxable Foreign Income:

- By requiring reporting of income-generating assets, the IRS can match income reported (or not reported) on a tax return.

- To Enforce Penalties and Ensure Accurate Tax Liability:

- Noncompliance with Form 8938 can trigger civil penalties and, in some cases, criminal charges, making it a powerful tool for enforcement.

Who Must File IRS Form 8938?

IRS Form 8938 – Statement of Specified Foreign Financial Assets is required for certain U.S. taxpayers whose foreign asset holdings exceed the threshold amounts established by the IRS. The obligation to file is based on your taxpayer status, where you reside, and how much foreign wealth you control directly or indirectly.

This form helps the IRS enforce the Foreign Account Tax Compliance Act (FATCA) and ensures that U.S. individuals and certain entities are fully reporting offshore holdings and income.

1. Who Qualifies as a “Specified Individual”?

A “specified individual” is a U.S. taxpayer who meets one of the following criteria:

- A U.S. citizen, regardless of where they live

- A resident alien for tax purposes, which includes:

- Green card holders (lawful permanent residents)

- Individuals who satisfy the substantial presence test, such as those residing in the U.S. for minimum 183 days in the year.

- A non-resident alien who:

- Elects to file a joint tax return with a U.S. spouse under IRC §6013(g) or (h)

- Is considered a bona fide resident of a U.S. territory (e.g., Puerto Rico) and required to file Form 1040

Note: U.S. corporations, partnerships, and trusts do not file Form 8938 unless the IRS explicitly requires it for certain closely held entities or disregarded entities in the future.

2. What Triggers the Filing Requirement?

A specified individual must file Form 8938 if the total value of all specified foreign financial assets they own or control exceeds the thresholds listed below—either at the end of the year or at any moment in the year.

3. Reporting Thresholds – Based on Filing Status and Residency

| Filing Status | Living in the U.S. | Living Abroad |

| Single / Head of Household | > $50,000 on Dec 31 or > $75,000 at any time | > $200,000 on Dec 31 or > $300,000 at any time |

| Married Filing Jointly | > $100,000 on Dec 31 or > $150,000 at any time | > $400,000 on Dec 31 or > $600,000 at any time |

| Married Filing Separately | > $50,000 on Dec 31 or > $75,000 at any time | > $200,000 on Dec 31 or > $300,000 at any time |

The IRS uses the aggregate fair market value of all specified foreign financial assets to determine if reporting is required.

4. Types of Ownership That Require Filing

Filing is not limited to direct ownership. You may need to file Form 8938 if you have any type of interest in a foreign financial asset, including:

Direct Ownership

- You own a foreign bank account, mutual fund, or stock issued by a foreign corporation.

Indirect or Constructive Ownership

- You own a foreign entity (e.g., a trust or corporation) that holds financial accounts or securities.

- You are the beneficiary of a foreign trust, retirement fund, or annuity.

- You are a shareholder in a foreign mutual fund, even if you do not directly manage it.

Joint Ownership

- You jointly own foreign assets with a spouse or another individual.

- Each spouse must file their own Form 8938 if they meet the threshold and file separate returns.

Spousal Aggregation

- On a joint return, both spouses’ foreign assets are combined to determine if the threshold is met.

5. What If You’re Already Filing FBAR (FinCEN Form 114)?

Form 8938 is not a replacement for FBAR. Even if you’ve already filed the Report of Foreign Bank and Financial Accounts, you may still need to file Form 8938 if:

- You own non-account assets like foreign-issued stock, bonds, insurance, or interests in partnerships or trusts.

- Your foreign financial assets exceed the IRS-defined reporting limits that trigger the filing requirement for Form 8938.

Numerous taxpayers must file both the FBAR and Form 8938 to meet foreign asset reporting obligations.

6. Examples: Who Must File Form 8938?

Example 1:

Sarah, a single U.S. citizen living in New York, owns:

- A $35,000 bank account in France

- A $25,000 investment in a Swiss mutual fund

Total value: $60,000

Since her assets exceed $50,000 at year-end, Sarah must file Form 8938.

Example 2:

A U.S. couple living abroad files jointly. They have:

- A joint savings account in Germany worth $350,000

- A life insurance policy from the UK with a cash value of $100,000

Total: $450,000

Since they are married, live abroad, and their combined assets exceed $400,000, they must file Form 8938.

What Are Specified Foreign Financial Assets?

“Specified foreign financial assets” is a broad term used by the IRS to describe certain types of non-U.S. financial holdings that must be reported on Form 8938 if their aggregate value exceeds the IRS thresholds for a given taxpayer.

Understanding what qualifies as a “specified” asset is crucial for compliance with FATCA (Foreign Account Tax Compliance Act) and avoiding penalties.

1. Core Categories of Specified Foreign Financial Assets

Assets fall into three primary categories for Form 8938 reporting purposes:

A. Foreign Financial Accounts

These are accounts maintained by non-U.S. financial institutions, including:

- Bank deposit accounts (savings, checking, CDs) at foreign banks

- Investment and brokerage accounts held with foreign firms

- Foreign retirement or pension accounts, such as:

- UK SIPPs (Self-Invested Personal Pensions)

- Canadian RRSPs or RRIFs

- Indian Provident Funds (in some cases)

Important Note: These accounts often overlap with FBAR requirements but still must be reported separately on Form 8938 if thresholds are met.

B. Other Foreign Financial Assets or Instruments

These are financial assets that are not accounts, but still have monetary value and are issued or held outside the U.S. This includes:

- Stocks and securities issued by foreign corporations (not held in a U.S. brokerage)

- Foreign mutual funds, ETFs, and hedge funds

- Foreign bonds, notes, or debentures

- Foreign-issued life insurance policies with cash value

- Annuity contracts from non-U.S. insurance providers

- Foreign derivatives or forward contracts held directly

Even if you don’t have signature authority or direct control, you may still need to report these if you’re a beneficial owner.

C. Interests in Foreign Entities

If you own or control a share of a foreign business or trust, you may need to report:

- Ownership in foreign partnerships, corporations, or LLCs

- Interests in foreign trusts or estates

- Indirect ownership of foreign assets through pass-through entities

- Private equity, venture capital, or hedge fund stakes in foreign-registered vehicles

These are often missed by taxpayers but can trigger large penalties if not reported.

2. What’s NOT Considered a Specified Foreign Financial Asset?

The IRS excludes certain foreign-held assets from Form 8938 reporting:

- Foreign real estate held in your name (unless held through a foreign entity)

- Personal items held abroad (e.g., artwork, jewellery, collectibles)

- Currency held outside an account (e.g., physical cash in a safe)

- Social Security or government pension accounts provided by foreign governments

- Direct business inventory or equipment in another country

Real estate is not directly reportable on Form 8938 unless held through a foreign entity, such as a corporation or trust—in which case the interest in the entity must be reported, not the property itself.

3. Examples of Reportable vs. Non-Reportable Assets

| Asset Type | Reportable? | Notes |

| Foreign savings account | Yes | Must include account number and max value during the year |

| Shares of a foreign company (held directly) | Yes | Even if not held in a brokerage |

| Apartment in Paris owned personally | No | Real estate is not reportable unless held via foreign entity |

| Foreign mutual fund | Yes | Report full value even if no income generated |

| Physical gold stored abroad | No | Not reportable unless held in a foreign financial account |

| Swiss annuity contract | Yes | you must report its cash value along with any associated income types. |

| Foreign employer-sponsored retirement plan | Usually | Depends on structure — some require disclosure |

| Indian PPF/EPF | Likely | Reportable if under your control and meets value thresholds |

4. Valuation of Foreign Financial Assets

- All foreign assets must be converted to U.S. dollars using the year-end exchange rate published by the U.S. Treasury Department.

- You are required to disclose the highest fair market value of each asset held at any point during the tax year.

- Valuation must be reasonable and consistent; professional appraisals are not always required but must be justifiable.

5. What If You Forget to Report These Assets?

Failure to include specified foreign financial assets on Form 8938 can result in:

- $10,000 base penalty per missed form

- Up to $50,000 in continued penalties for noncompliance

- A 40% penalty on any underreported income linked to those assets

- Criminal charges in cases of deliberate non-disclosure

How to File IRS Form 8938?

Form 8938 is used to report ownership of specified foreign financial assets to the IRS under the Foreign Account Tax Compliance Act (FATCA). It must be filed by individuals (and in some cases, entities) who meet the asset value thresholds based on residency and filing status.

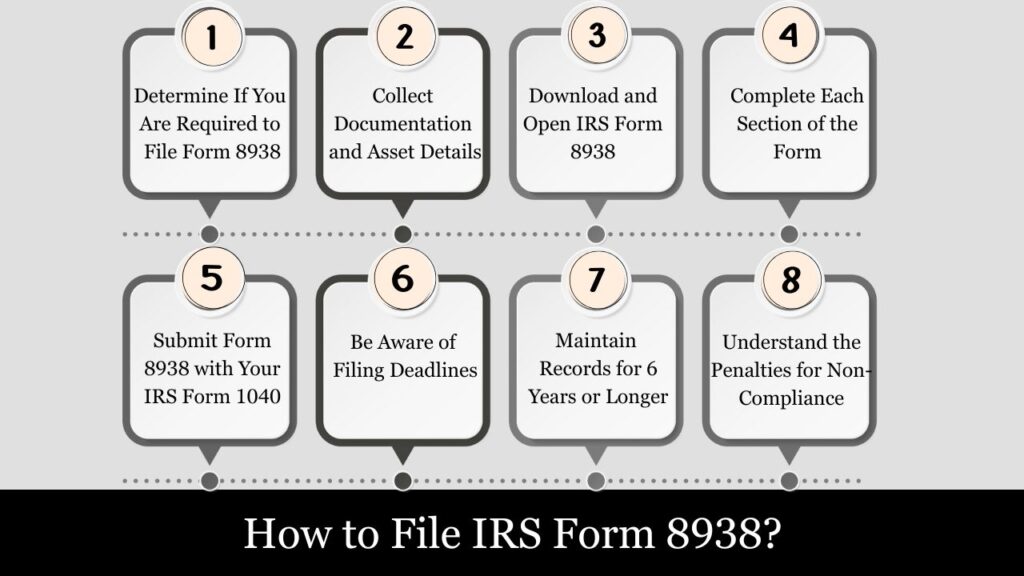

Step 1: Determine If You Are Required to File Form 8938

You must file Form 8938 if:

- You are a U.S. citizen, resident alien, or certain nonresident aliens who file a U.S. income tax return.

- You have an interest in specified foreign financial assets (foreign accounts, investments, or business interests).

- The aggregate value of those assets exceeds IRS thresholds, based on your filing status and residency.

Thresholds vary by status:

- For single filers in the U.S., reporting is required if foreign assets exceed $50,000 at year-end or $75,000 at any point during the year.

- Joint filers abroad: >$400,000 at year-end or >$600,000 any time

(Full threshold table available if needed)

Step 2: Collect Documentation and Asset Details

Gather information for each foreign asset, including:

- Name of the financial institution, issuer, or entity

- Account numbers or registration details

- Type of asset (e.g., bank account, stock, mutual fund, life insurance, partnership interest)

- Country of origin

- Highest asset value during the tax year, converted to U.S. dollars.

- Indicate if the asset was acquired or disposed of during the tax year.

- Income generated, if any

Use Treasury FX rates for year-end currency conversion.

Step 3: Download and Open IRS Form 8938

- Access the latest version: Form 8938 on IRS.gov

- Use IRS-approved tax software (e.g., TurboTax, TaxAct, Drake) or complete it manually

- Form 8938 must be filed along with your Form 1040; it cannot be submitted as a standalone form.

Step 4: Complete Each Section of the Form

Part I – Foreign Deposit and Custodial Accounts

Report bank and investment accounts held at foreign financial institutions:

- Bank savings/checking accounts

- Brokerage/investment accounts

- Foreign pension plans (in many cases)

Provide account type, institution name, max value, account number, and country.

Part II – Other Specified Foreign Financial Assets

Report non-account assets such as:

- Foreign mutual funds, ETFs, stocks and bonds (not held in U.S. brokerages)

- Foreign annuity and life insurance policies with cash value

- Interests in foreign corporations, partnerships, or trusts

Include issuer name, asset type, fair market value, acquisition/disposition dates, and country of issuance.

Part III – Summary of Reported Assets

Summarize:

- Total number of foreign accounts reported in Part I

- Total number of other assets reported in Part II

- Total fair market value for each category

Part IV – Reporting of Income

Indicate whether any of the assets generated:

- Interest income

- Dividends

- Capital gains or losses

- Royalties or rents

You must cross-reference these amounts with the lines on your Form 1040, Schedules B, D, or E.

Part V – Other Forms Filed

Report whether you’ve also filed:

- FBAR (FinCEN Form 114)

- Form 3520, 5471, 8621, 8865, etc.

This helps the IRS identify overlapping reporting and prevent omissions.

Step 5: Submit Form 8938 with Your IRS Form 1040

- Do not file it separately

- Include Form 8938 in your Form 1040 or 1040-NR filing package

- If e-filing, use tax software that supports Form 8938

- If mailing a paper return, staple it behind your main return

Step 6: Be Aware of Filing Deadlines

- April 15 – Normal tax deadline (Form 8938 included with Form 1040)

- June 15 – Automatic 2-month extension for U.S. taxpayers living abroad

- October 15 – Extended deadline if you file Form 4868

Step 7: Maintain Records for 6 Years or Longer

Maintain Supporting Documentation for Each Reported Asset, Including:

- Foreign bank or brokerage statements

- Purchase/sale agreements

- Year-end valuation reports

- Income summaries (even if not distributed)

Step 8: Understand the Penalties for Non-Compliance

- $10,000 penalty for failing to file

- Up to $50,000 for continued failure

- 40% Penalty May Apply to Undisclosed Foreign Asset Income Understatements

- Potential criminal charges for willful evasion

Example Scenario

Emma, a single U.S. taxpayer living in California, owns:

- A bank account in Germany ($40,000)

- Foreign mutual fund ($20,000)

- Life insurance policy in Canada ($30,000 cash value)

Total value = $90,000

Since she exceeds the $75,000 “any time during the year” threshold, she must file Form 8938 with her Form 1040.

Form 8938 vs. FBAR (FinCEN Form 114): Comprehensive Comparison

U.S. taxpayers holding foreign financial assets or accounts must determine whether they are obligated to file Form 8938, FBAR (FinCEN Form 114), or both. While both aim to promote transparency and prevent offshore tax evasion, they are governed by different laws, filed with separate agencies, and cover distinct types of assets. Here’s a fully descriptive, side-by-side analysis to guide compliance.

Core Purpose

- Form 8938: Required under the Foreign Account Tax Compliance Act (FATCA), this form discloses specified foreign financial assets to the IRS as part of your income tax return. It focuses on income-generating assets that may impact U.S. taxation.

- FBAR: Mandated by the Bank Secrecy Act (BSA), FBAR is filed with FinCEN to report financial interest in or signature authority over foreign financial accounts, regardless of income earned. It serves an anti-money laundering and transparency function.

Who Must File?

| Criteria | Form 8938 | FBAR (FinCEN Form 114) |

| Filing Entity | Individuals (U.S. citizens, residents, some nonresidents); certain domestic entities | U.S. individuals, trusts, estates, corporations, partnerships |

| Financial Interest | Required | Required |

| Signature Authority (without ownership) | Not Required | Required |

What Must Be Reported?

Although Similar, Form 8938 and FBAR Have Distinct Foreign Asset Reporting Requirements.

Reportable Under Both Forms:

- Foreign bank accounts: Includes savings, checking, and time deposits held with foreign financial institutions.

- Foreign brokerage accounts: Accounts that contain investments like stocks, bonds, or mutual funds abroad.

- Insurance or annuity contracts: Must be reported if they have cash value (e.g., foreign life insurance or investment-based annuities).

Only Reported on Form 8938:

- Foreign-held stocks and securities not in accounts: Direct ownership of shares in foreign corporations must be reported if not held via a brokerage account.

- Foreign partnership or LLC interests: If you own an interest in a foreign partnership or limited liability company, you must report it.

- Foreign hedge funds and private equity funds: These are often excluded from FBAR but are covered under FATCA.

- Foreign mutual funds not held in an account: Reportable even if held outside a traditional financial account.

- Foreign trusts and estates: If you are a beneficiary or have an interest, these must be disclosed.

- Foreign real estate held through an entity: If you own property abroad via a corporation, partnership, or trust, the entity itself becomes a reportable asset.

Only Reported on FBAR:

- Accounts where you only have signature authority: Even if you don’t own the funds, having control or access triggers FBAR filing.

Not Reported on Either Form:

- Real estate held directly: Neither form requires reporting for personally owned foreign real estate.

- Personal tangible assets: Items like foreign jewelry, art, or vehicles are not reportable.

Emerging Category – Cryptocurrency:

- Virtual currencies: Currently, FBAR does not require reporting of crypto holdings. The IRS has not definitively included crypto in Form 8938 either, but this is subject to change. Future guidance is expected.

Reporting Thresholds

| Filing Status | Form 8938 Threshold | FBAR Threshold |

| For single U.S. resident | Form 8938 applies if assets exceed $50,000 at year-end or $75,000 at any time, | while FBAR is required if the total value of all foreign accounts exceeds $10,000 at any point during the year. |

| Married Filing Jointly (U.S. resident) | $100,000 / $150,000 | $10,000 |

| Single (Living abroad) | $200,000 / $300,000 | $10,000 |

| Married Filing Jointly (Abroad) | $400,000 / $600,000 | $10,000 |

Filing Process & Deadlines

| Feature | Form 8938 | FBAR |

| Filing Method | Attached to IRS Form 1040 or business return | Electronically through FinCEN BSA e-Filing System |

| Extension Availability | Yes, with tax return extension (Form 4868 or 7004) | Yes, automatic extension to October 15 |

| Due Date | April 15 for Form 8938 & may be extended to October 15 with a tax return extension | April 15 due date while FBAR is automatically extended to October 15. |

Penalties for Noncompliance

| Penalty Type | Form 8938 | FBAR |

| Failure to File | $10,000 per violation | Up to $10,000 per non-willful violation |

| Continued Failure | Additional $10,000 per 30 days (max $50,000) | Up to greater of $100,000 or 50% of account value (willful) |

| Accuracy-Related | 40% of underreported income | Criminal penalties for willful violations |

When Both Forms Must Be Filed?

You are required to file both Form 8938 and FBAR if your foreign assets meet the separate reporting thresholds for each form:

- You are a U.S. person who holds a financial interest in, or has signature authority over, foreign accounts with a combined value exceeding $10,000 at any time during the year (FBAR requirement).

- AND the total value of your specified foreign financial assets exceeds the Form 8938 thresholds

Final Takeaway: Summary Comparison

| Category | Form 8938 | FBAR (FinCEN Form 114) |

| Governing Law | FATCA | Bank Secrecy Act |

| Filing Agency | Internal Revenue Service (IRS) | Financial Crimes Enforcement Network (FinCEN) |

| Reporting Focus | Foreign financial assets (broader) | Foreign financial accounts (narrower) |

| Includes Asset Income? | Yes | No |

| Includes Non-Account Assets? | Yes | No |

| Signature Authority Reporting? | No | Yes |

| Reporting Threshold | Variable ($50K–$600K) | $10,000 (aggregate) |

| Filing Format | Part of tax return | Filed separately online |

| Penalty Severity | Civil & income-related penalties | Civil + criminal penalties for willful failure |

Conclusion

Form 8938 is a vital disclosure form for U.S. taxpayers with substantial foreign holdings. Compliance is not optional—failure to file can result in serious penalties, even if no income was earned from the foreign assets. If you hold assets abroad, review your situation carefully and consult a tax professional to ensure you’re meeting all your FATCA obligations.

Frequently Asked Questions (FAQs)

Do I need to file Form 8938 even if my foreign assets didn’t produce income?

Yes. The form reports asset ownership—not just income. Income is reported separately.

Can Form 8938 be filed electronically?

Yes. When e-filing your Form 1040, Form 8938 is submitted as an attachment.

Are foreign pension plans considered specified foreign financial assets for reporting purposes?

Yes. Many foreign pensions are reportable, especially if they have a cash value or are held in a foreign financial institution.

What if I discover I should have filed in prior years?

You can amend previous returns using Form 1040-X and include the appropriate Form 8938. It’s advisable to seek guidance from a tax attorney if you need to address overdue foreign asset disclosures.