Delaware State Tax Refund: A Complete Descriptive Guide (2025)

Table of Contents

Where’s My Delaware State Tax Refund? Track It Now

If you’ve paid more state income tax to Delaware than what you actually owe—through employer withholding, estimated payments, or refundable credits—you may be eligible for a Delaware state tax refund. This guide explains who qualifies, how to file, how long it takes, how to track your refund, and what could delay it.

What Is a Delaware State Tax Refund?

A Delaware state tax refund is the return of excess tax payments made to the Delaware Division of Revenue. When your actual tax liability (calculated on your Delaware Individual Income Tax Return) is less than the tax you’ve paid, the surplus is refunded to you.

Refunds generally arise from:

- Overwithholding from paychecks by your employer

- Overpayments made through estimated tax payments

- Credits that may result in a refund, like the Delaware Earned Income Tax Credit (EITC)

- Amended returns correcting errors on original filings

Who Is Eligible for a Delaware State Tax Refund?

A taxpayer is eligible for a Delaware state tax refund when the total tax payments or credits made during the year exceed their actual Delaware income tax liability. These payments may include state income tax withheld by an employer, estimated quarterly payments, or refundable credits claimed on a state return.

Eligibility applies to various taxpayer types and situations. Below is a detailed overview:

1. Delaware Residents

You might qualify for a refund if you meet any of the following conditions:

- Lived in Delaware for the full tax year,

- Filed Form 200-01 (Resident Individual Income Tax Return),

- Had more state income tax withheld than your final tax liability, or

- Qualify for refundable credits such as the Delaware Earned Income Tax Credit (DE EITC).

Example:

You earned $45,000 and your employer withheld $1,500 in Delaware income tax. If your calculated tax liability is only $1,200 after standard deductions and credits, you will receive a refund of $300.

2. Nonresidents and Part-Year Residents

If you are not a full-year resident but earned Delaware-source income, you may qualify for a refund by filing Form 200-02 (Nonresident/Part-Year Resident Return).

You may be eligible if:

- You had Delaware income tax withheld on wages, contract income, or business earnings,

- The actual tax liability for your Delaware-source income is less than what was withheld.

Example:

You worked in Delaware for 3 months, and your employer withheld $800 in Delaware tax. If your Delaware-source income results in only $500 of liability, you will receive a $300 refund.

3. Taxpayers Claiming Refundable Credits

Delaware offers limited but valuable refundable tax credits, such as:

- Earned Income Tax Credit (EITC) – based on a percentage of the federal EITC

- Overpayment from prior years applied to the current return

If your credits exceed your liability, the excess amount is refunded—even if you owe no other tax.

Note: Unlike nonrefundable credits (which only reduce tax to zero), refundable credits can generate a cash refund even when your tax liability is zero.

4. Individuals Making Estimated Tax Payments

If you are self-employed, an investor, or receive non-wage income and make quarterly estimated payments, you may overpay.

You may be eligible for a refund if:

- Your actual income was lower than expected,

- You applied deductions that reduced your liability,

- Your estimated payments exceeded your calculated liability.

5. Amended Return Filers

If you discover an error on your previously filed Delaware return (e.g., you overstated income or forgot to claim deductions), you may file an amended return (Form 200X) and File a refund claim for any overpaid taxes, as long as it falls within the permitted timeframe..

Refunds May Be Denied or Reduced If:

- You submitted your return beyond the refund claim deadline—generally three years from the original filing due date.

- The refund is offset due to:

- Outstanding state or federal tax debt

- Unpaid child support

- Unemployment benefit overpayments

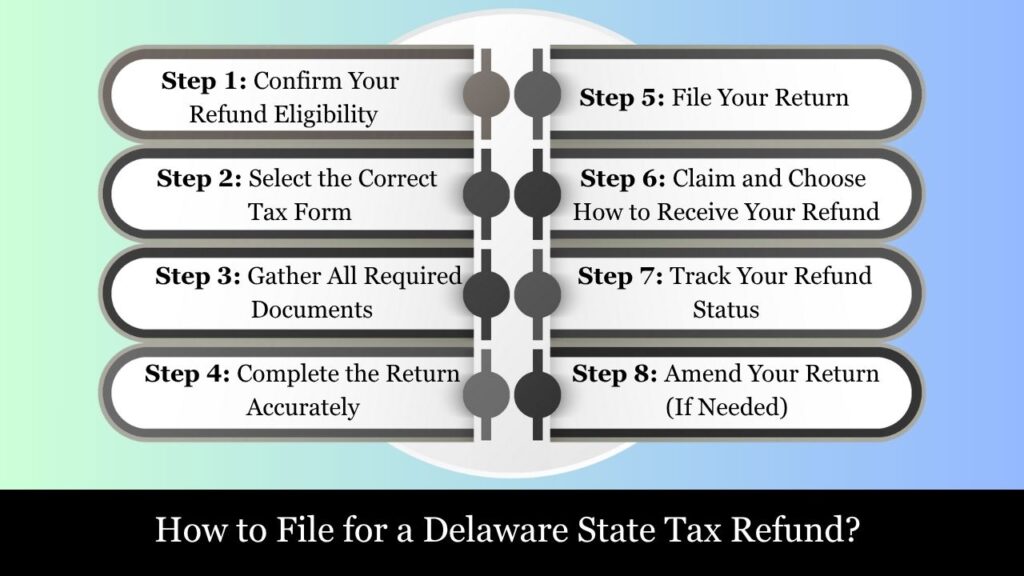

How to File for a Delaware State Tax Refund (2025 Edition)

Filing for a Delaware state tax refund involves more than simply submitting a return. It requires understanding your eligibility, choosing the right form, collecting proper documentation, completing all schedules accurately, and deciding how you want the refund issued. Here’s a step-by-step guide covering the entire process—from filing to receiving your refund.

Step 1: Confirm Your Refund Eligibility

Confirm your refund eligibility before submitting your tax return. You qualify if:

- Your Delaware state income tax withheld (from wages, pensions, etc.) exceeds your actual tax liability.

- You made estimated tax payments that exceeded your annual tax due.

- You qualify for refundable tax credits, such as the Delaware Earned Income Tax Credit.

- You filed an amended return (Form 200X) and corrected a prior overpayment.

Refunds are not automatic—they must be claimed on an official tax return.

Step 2: Select the Correct Tax Form

Depending on your residency status and tax circumstances, Delaware requires you to use different forms:

| Form | Used By |

| Form 200-01 | Full-year Delaware residents |

| Form 200-02 | Nonresidents and part-year residents |

| Form 200X | Any filer amending a previously filed return |

Ensure you’re using the latest version of the required forms, which can be found on the Delaware Division of Revenue’s official website.

Step 3: Gather All Required Documents

To accurately file your return and calculate your refund, collect the following:

- W-2 forms showing Delaware state income tax withheld

- 1099 forms (interest, dividends, pensions, independent contractor income)

- Proof of estimated tax payments made to Delaware

- Information about any credits or deductions you plan to claim

- Bank routing and account numbers for direct deposit

- Prior year’s return for reference (optional but helpful)

Having accurate documents minimizes the risk of delays or refund adjustments.

Step 4: Complete the Return Accurately

If You’re Using Form 200-01 or 200-02:

- Report your total income from all sources.

- Subtract deductions such as the Delaware standard deduction, itemized deductions, or retirement exclusions.

- Claim credits (both nonrefundable and refundable) such as the DE Earned Income Credit.

- Report all Delaware tax withheld and estimated payments.

- Calculate your total tax due and compare it to your payments to determine if a refund is owed.

If You’re Using Form 200X (Amended Return):

- Explain why you are amending the return (e.g., additional W-2 received, error in reported income).

- Submit the original return together with any revised or additional supporting documents.

- Only include amounts that are being changed.

Accuracy Tip: Double-check Social Security Numbers, mailing addresses, and bank details.

Step 5: File Your Return

Option A: File Electronically (Recommended)

- Offers faster processing and quicker refunds (usually within 4–6 weeks).

- Use:

- Approved online tax software (e.g., TurboTax, TaxSlayer, H&R Block)

- E-filing through Delaware’s Revenue portal:

https://revenue.delaware.gov

Option B: File a Paper Return

If you choose to mail your return:

Mail to this address if expecting a refund:

Delaware Division of Revenue

P.O. Box 8710

Wilmington, DE 19899-8710

Important: Returns must be postmarked by April 30 (or the next business day) for timely filing.

Step 6: Claim and Choose How to Receive Your Refund

In the refund section of the return:

- Indicate if you want the refund via direct deposit (faster and safer)

- Or request a paper check sent to your mailing address

- Alternatively, you can choose to apply the refund to next year’s tax obligation

Direct Deposit Tip: Use a checking or savings account that matches your name for secure transfer.

Step 7: Track Your Refund Status

Once your return is submitted:

Use Delaware’s Refund Tracker:

Check Refund Status

You will need:

- Your Social Security Number

- The precise refund amount reported on your tax return

When to check: Allow 1–2 weeks after e-filing, or 3–4 weeks after mailing, before checking status.

Step 8: Amend Your Return (If Needed)

If you later discover:

- A missing W-2 or 1099,

- Incorrect deductions or credits,

- An error in your income,

You can file Form 200X to correct the return and claim an additional refund.

Filing Deadline for Amendments:

- No later than three years from the original filing deadline, or

- Alternatively, within two years of the tax payment date—whichever date is later.

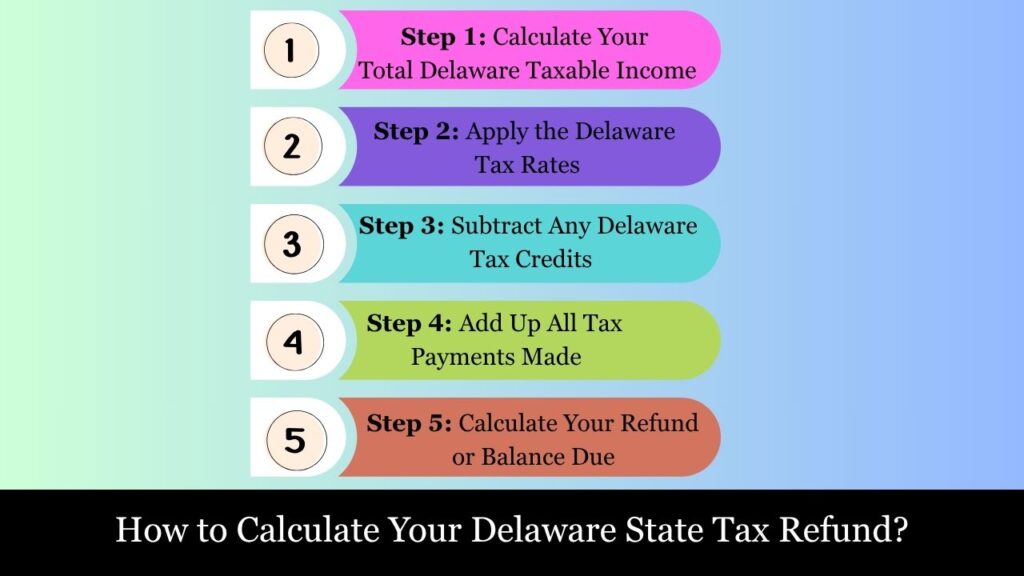

How to Calculate Your Delaware State Tax Refund? (2025 Guide)

To calculate your Delaware state tax refund, compare the total amount of taxes paid and credits claimed to your actual state tax owed. If the payments exceed the liability, the difference is your refund. If your tax liability exceeds your payments, you’ll need to pay the remaining balance to the state.

Step-by-Step Refund Calculation Process

Step 1: Calculate Your Total Delaware Taxable Income

Start with your federal adjusted gross income (AGI) and then apply Delaware-specific modifications.

- Federal AGI (from IRS Form 1040, Line 11)

- Additions (Delaware adjustments such as tax-exempt interest, out-of-state income)

- Subtractions (retirement exclusions, state tax refunds, certain military income)

Formula:

DelawareTaxableIncome=Federal AGI + Additions − Subtractions − Standard/Itemized Deduction

Standard Deduction (2024 return filed in 2025):

- $3,250 for Single

- $6,500 for Married Filing Jointly

- OR itemized deductions (if greater)

Step 2: Apply the Delaware Tax Rates

Use the Delaware progressive tax brackets to calculate your tax liability:

Delaware 2024 Income Tax Brackets (2025 Filing Year)

| Income Bracket | Tax Rate |

| $0 – $2,000 | 0% |

| $2,001 – $5,000 | 2.2% |

| $5,001 – $10,000 | 3.9% |

| $10,001 – $20,000 | 4.8% |

| $20,001 – $25,000 | 5.2% |

| $25,001 – $60,000 | 5.55% |

| Over $60,000 | 6.6% |

Example:

If your Delaware taxable income is $50,000, you’d calculate your tax by applying each rate to the applicable income tier.

Step 3: Subtract Any Delaware Tax Credits

Delaware allows several nonrefundable and refundable credits, including:

- Personal credits: $110 per exemption

- Child care or dependent care expense credit

- Delaware Earned Income Tax Credit (DE EITC)

- Tax paid to another state (nonresidents or dual filers)

Formula:

TaxAfterCredits=Calculated Tax Liability − Allowable Credits

Step 4: Add Up All Tax Payments Made

Add all payments made during the year, including:

- Delaware state tax withheld by your employer, shown in Box 17 of your W-2 form.

- Withholding from pensions or 1099s (if applicable)

- Estimated tax payments (quarterly)

- Refundable credits (such as refundable portion of EITC)

Formula:

TotalPayments=Withholding + Estimated Payments + Refundable Credits

Step 5: Calculate Your Refund or Balance Due

Compare Total Payments to your Tax After Credits:

- If Payments > Tax, the difference = Refund

- If Tax > Payments, the difference = Tax Due

Refund Formula:

Refund=TotalPayments−TotalTax(AfterCredits)

Owe Formula:

BalanceDue=TotalTax(AfterCredits)−TotalPayments

Delaware State Tax Refund – Example

Taxpayer Profile

- Filing Status: Single

- Federal AGI: $45,000

- Delaware Resident: Full-year

- Pension Subtraction: $2,500

- Standard Deduction: $3,250

- W-2 Delaware Tax Withheld: $2,150

- Other Income/Credits: None (except personal credit)

Step-by-Step Calculation Example

1. Delaware Taxable Income

$45,000 (Federal AGI)

−$2,500 (Pension subtraction)

−$3,250 (Standard deduction)

=$39,250 Delaware Taxable Income

2. State Income Tax Owed (Using 2024 Brackets)

- First $2,000 = $0

- $2,001–$5,000 @ 2.2% → $66

- $5,001–$10,000 @ 3.9% → $195

- $10,001–$20,000 @ 4.8% → $480

- $20,001–$25,000 @ 5.2% → $260

- $25,001–$39,250 @ 5.55% → $796.38

Total Tax (before credit): $1,797.38

3. Subtract Personal Credit:

$1,797.38 −$110=$1,687.38 ≈$1,687 Tax Liability

4. Compare to Withholding:

$2,150 (Withheld) −$1,687 (Tax Owed) =$463Refund

Delaware State Tax Refund Claim Deadlines (2025 Edition)

If you’re owed a refund from the State of Delaware, it’s important to file your return within the statutory deadline. Failing to file on time can result in the forfeiture of your refund, even if you were legitimately entitled to it.

General Refund Claim Deadline

According to Delaware law, you must file a refund claim within:

3 years from the original due date of the return

OR

Within two years of the date the tax payment was made.

— whichever is later.

This time frame mirrors the IRS statute of limitations and applies whether you’re filing an original return claiming a refund or an amended return (Form 200X).

Example:

If your 2024 Delaware return is due on April 30, 2025, you have until April 30, 2028 to claim a refund for that tax year.

For Amended Returns (Form 200X)

You can also claim a refund by amending your return. The deadline is the same:

- No later than three years after the original return’s due date, or

- 2 years from the date tax was paid (e.g., if paid late or under extension).

Tip: If you are claiming a refund based on a federal change (e.g., IRS audit adjustment), Delaware requires you to file Form 200X within 90 days of the final federal determination.

What Happens if You Miss the Deadline?

If you file after the statute of limitations, your refund claim will be denied, even if excess tax was withheld or overpaid.

- The state will not issue refunds or apply credits after the allowable time has passed.

- Interest on refunds is only paid if the claim is processed beyond the required time frame by the state (usually more than 90 days), but only on timely-filed claims.

Extension to File ≠ Extension to Claim Refund

If you filed for an extension to file your return, the refund claim deadline is still based on the original due date, not the extended date.

Filing under an extension does not extend the refund claim period—you must still file and request your refund within three years of the original due date.

Conclusion

Timely filing is essential to ensure you receive any Delaware state income tax refund you are rightfully owed. Whether you’re submitting an original return or an amended one, you must adhere to the 3-year or 2-year rule—whichever provides the longer window. If you miss this deadline, you forfeit your refund—even if too much tax was withheld or overpaid.

Maintaining accurate records, filing on time, and knowing your eligibility help ensure you can claim any overpaid taxes without facing delays or denial. If in doubt, consult a tax professional or contact the Delaware Division of Revenue to ensure compliance and secure your refund on time

Frequently Asked Questions (FAQs)

Who is eligible to claim a Delaware state tax refund?

You are eligible if the total Delaware income tax withheld or paid (through W-2 withholding, estimated payments, or refundable credits) exceeds your actual state tax liability for the year.

How long do I have to claim a Delaware tax refund?

Your claim must be submitted within three years of the return’s original due date or within two years of the tax payment—whichever date is later.

How do I check the status of my refund?

Use the Delaware Refund Status Tool. You must supply your Social Security Number along with the exact amount of the expected refund.

How long does it take to receive my refund?

–E-filed returns with direct deposit: typically processed within 4–6 weeks

–Paper-filed returns: may take 8–12 weeks or longer during peak season

Can I apply my refund to next year’s taxes?

Yes. You may elect to carry forward your refund to the next year’s Delaware tax liability by indicating so on your return.

What if I made an error and overpaid?

File an amended return (Form 200X) to correct your mistake and claim the excess as a refund, within the allowed timeframe.

Can the state deny my refund claim?

Yes. The Delaware Division of Revenue may deny claims that are filed late, incomplete, or unsupported by proper documentation.

Will I earn interest on a delayed refund?

Interest may be paid if the state takes longer than 90 days to issue your refund on a timely-filed return, but only under certain conditions.

Do I need to file if I’m not required but had tax withheld?

Yes. If tax was withheld but you’re below the filing threshold, you must still file a return to claim your refund.

Can I get a refund if I move out of Delaware after the tax year?

Yes. As long as you earned income in Delaware and had tax withheld or paid, you can file as a nonresident and claim any overpaid tax.