Connecticut State Tax Refund In 2025: Avoid The Delays Today

Table of Contents

Everything You Need to Know About Your Connecticut State Tax Refund

If you overpaid your Connecticut income taxes through wage withholding, estimated payments, or refundable credits, you may be entitled to receive a Connecticut state tax refund. Whether you’re a full-time resident, a part-year resident, or a nonresident earning income from Connecticut sources, understanding how the state refund process works is crucial to ensure you receive what you’re owed.

This guide provides a complete breakdown of eligibility, calculation, filing instructions, claim deadlines, refund timelines, and frequently asked questions

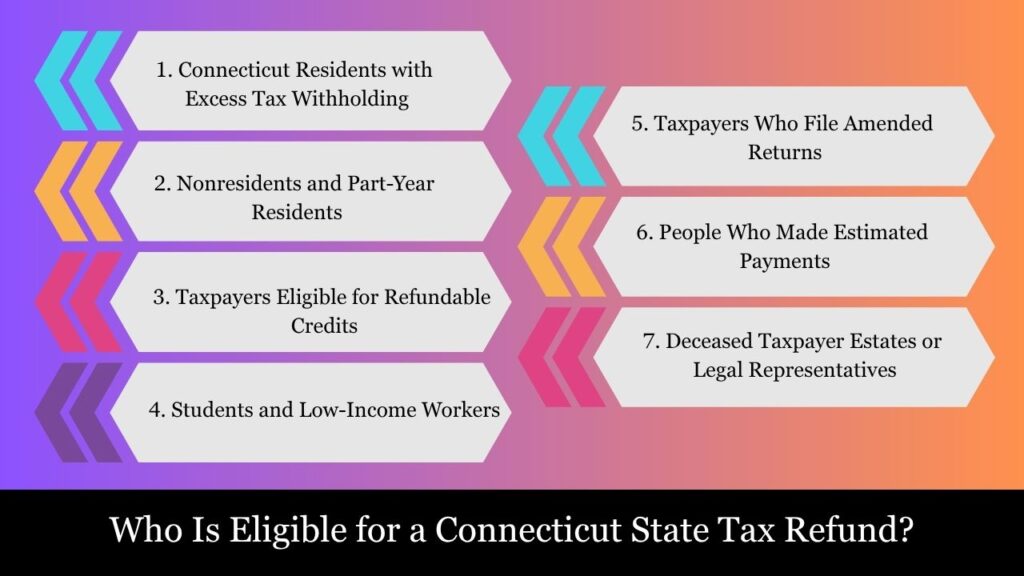

Who Is Eligible for a Connecticut State Tax Refund?

You may be eligible for a Connecticut state tax refund if you have overpaid your state tax liability during the year, whether through withholding, estimated payments, or eligibility for certain credits. Eligibility is not limited to high-income earners—even low-income or part-year residents may qualify if specific conditions are met.

Let’s break this down by category:

1. Connecticut Residents with Excess Tax Withholding

If you lived in Connecticut for the full tax year and your employer withheld more CT income tax than you ultimately owed (as determined on your CT-1040 return), you’re eligible for a refund.

Example:

- Your employer withheld $2,000 from your paychecks

- Your actual CT tax liability was only $1,600

- You are eligible for a $400 refund

2. Nonresidents and Part-Year Residents

Even if you didn’t live in Connecticut all year (or at all), you may still qualify for a refund if:

- You earned Connecticut-source income (e.g., wages, rental income, freelance work, etc.)

- You overpaid taxes on that income

- You had Connecticut withholding on your income, but your prorated tax liability is lower

Such taxpayers file Form CT-1040NR/PY to allocate income earned inside and outside of Connecticut and calculate the overpayment.

3. Taxpayers Eligible for Refundable Credits

Connecticut offers certain refundable tax credits, meaning you can receive the credit as a refund even if you owe no tax.

Eligible credits include:

- Connecticut Earned Income Tax Credit (CT EITC): Offers a percentage of the federal EITC to support eligible low- and moderate-income earners.

- Connecticut Property Tax Credit (if eligible): Limited availability based on income and property taxes paid.

If these credits exceed your tax liability, the difference is refunded to you.

4. Students and Low-Income Workers

If you’re a student, part-time worker, or someone with low income but had any state tax withheld, you should still file a return. You may be entitled to receive a full refund of the withheld amount.

Example:

- A student earns $6,000 in a part-time job

- $120 is withheld in CT tax

- She owes no tax based on her income level

- She can file Form CT-1040 and claim a $120 refund

5. Taxpayers Who File Amended Returns

If you originally over-reported income or missed deductions/credits, you can file Form CT-1040X (Amended Return). If the correction reduces your total tax liability, the difference becomes refundable, as long as it’s claimed within the statutory time limits (generally 3 years).

6. People Who Made Estimated Payments

If you’re self-employed or earn non-wage income, you may have made quarterly estimated tax payments. If those payments exceed your final tax liability, the surplus is refunded.

7. Deceased Taxpayer Estates or Legal Representatives

If a taxpayer passed away but is owed a refund, the refund may be claimed by the estate or an authorized individual (e.g., spouse or legal representative) using Form CT-1310 to request the refund legally.

Not Eligible:

You cannot claim a Connecticut tax refund if any of the following apply:

- You filed after the refund statute of limitations (typically 3 years from the original due date or 2 years from payment)

- You underpaid your taxes and still owe a balance

- Your return is incomplete or incorrect and cannot be processed

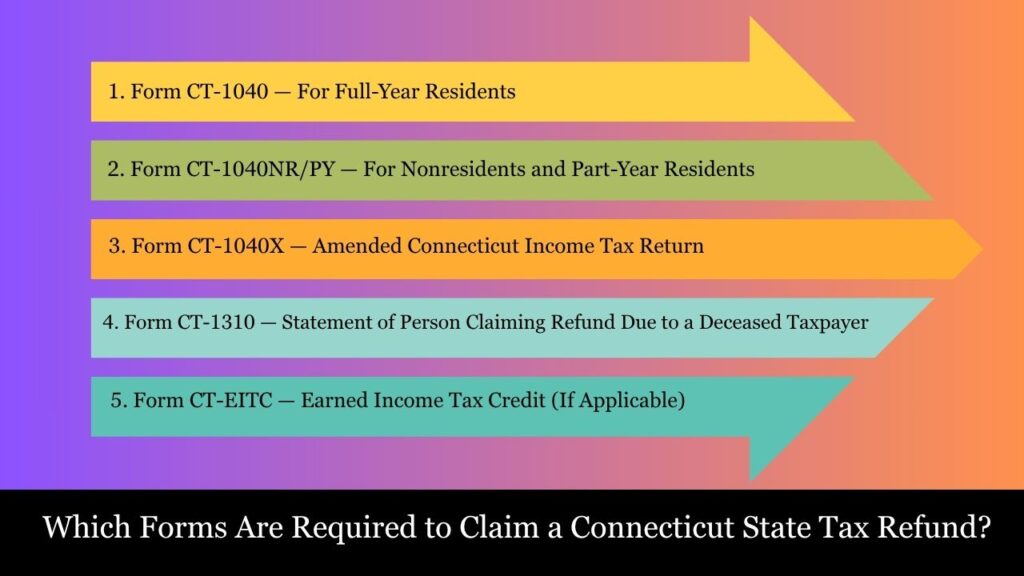

Which Forms Are Required to Claim a Connecticut State Tax Refund?

To claim a refund from the Connecticut Department of Revenue Services (DRS), you must file the appropriate individual income tax return, based on your residency status and whether you’re filing an original or amended return. The required forms depend on your individual situation, as detailed below.

1. Form CT-1040 — For Full-Year Residents

Who uses it?

Individuals who resided in Connecticut for the full duration of the tax year.

Purpose:

This is the standard individual income tax return used by residents to report total income, calculate Connecticut taxable income, claim tax credits, and determine the amount of refund (or tax due).

Refund Eligibility Through This Form:

- Overpayment of CT income tax through employer withholding (Box 17 on Form W-2)

- Excess estimated tax payments

- Refundable credits such as the Connecticut Earned Income Tax Credit (CT EITC)

- Income adjustments or deductions resulting in lower tax liability

Additional Filing Options:

CT-1040 can be filed electronically via the DRS Taxpayer Service Center (TSC) or through tax software providers.

2. Form CT-1040NR/PY — For Nonresidents and Part-Year Residents

Who uses it?

- Nonresidents who earned income from Connecticut sources (e.g., remote work for CT clients, rental income, or freelance services).

- Individuals who lived in Connecticut for only part of the tax year due to moving into or out of the state.

Purpose:

This form allocates income earned in Connecticut separately from out-of-state income. It calculates what portion of your total income is taxable by Connecticut and determines whether you’re due a refund based on your tax liability and prior payments.

Refund Eligibility Through This Form:

- Overpaid CT withholding on Connecticut-source income

- Overpayment of CT estimated payments

- Refundable tax credits for eligible part-year residents

- Incorrectly taxed income that should have been excluded

Example:

A nonresident who had $1,200 withheld on $10,000 of CT-source freelance income may find their CT liability was only $800 — and would thus claim a $400 refund.

3. Form CT-1040X — Amended Connecticut Income Tax Return

Who uses it?

Any taxpayer who previously filed a CT-1040 or CT-1040NR/PY but later discovers:

- An error in reporting income

- Missed deductions or credits

- Incorrect residency classification

- A change in filing status

Purpose:

Form CT-1040X is used to correct errors or update a previously filed return. If the amendment reduces your tax liability and you’ve already paid, the overpayment can be claimed as a refund.

Time Limit for Refunds from Amended Returns:

Must be filed within the later of:

- 3 years from the original due date

- 2 years from the date of payment

Supporting Documentation:

Include all updated W-2s, 1099s, and schedules that support the amended items.

4. Form CT-1310 — Statement of Person Claiming Refund Due to a Deceased Taxpayer

Who uses it?

A surviving spouse, estate executor, or authorized representative filing a refund claim on behalf of a deceased taxpayer.

Purpose:

This form is required when a refund is due, but the person who was entitled to it has passed away before the refund could be issued.

Filing Requirements:

- Attach to the deceased person’s Form CT-1040 or CT-1040NR/PY

- Include a copy of the death certificate

- Complete authorization section confirming your legal right to claim the refund

5. Form CT-EITC — Earned Income Tax Credit (If Applicable)

Who uses it?

Taxpayers eligible for the Connecticut Earned Income Tax Credit, a state version of the federal EITC, based on income and family size.

Purpose:

While this is not always a standalone form, certain filers may need to attach documentation or complete a state EITC worksheet to calculate the credit amount. The refundable EITC may result in a refund even if no tax is owed.

Summary Table

| Form | Used By | Refund Scenario |

| CT-1040 | Full-year CT residents | Standard filing to claim refund due to overpayment or credits |

| CT-1040NR/PY | Nonresidents or part-year residents | To allocate income and claim refund based on CT-source income |

| CT-1040X | Any filer amending a prior return | To correct errors and reclaim overpaid tax |

| CT-1310 | Survivors/representatives | To claim a refund on behalf of a deceased taxpayer |

| CT-EITC worksheet/info | For use by survivors or representatives | to request a refund on behalf of a deceased taxpayer |

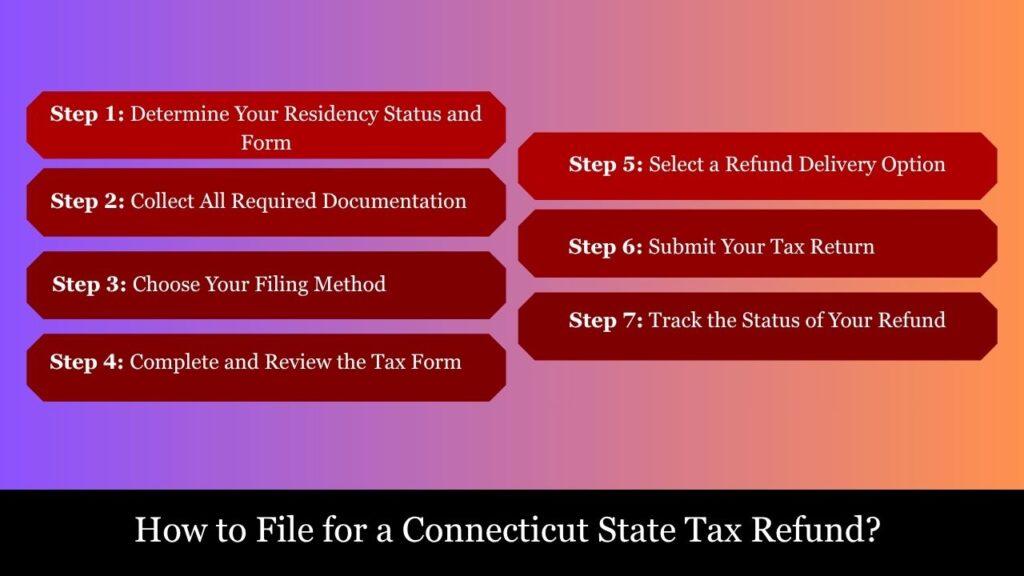

How to File for a Connecticut State Tax Refund?– Step-by-Step Guide (2025)

Filing for a Connecticut (CT) state tax refund involves preparing and submitting the appropriate income tax return, verifying your refund eligibility, and selecting how you’d like to receive your refund. Whether you’re a full-time resident, part-time resident, or nonresident with CT-source income, following a detailed and accurate process is essential to avoid delays and maximize your refund.

Below is a comprehensive, structured guide that walks you through every step of the process.

Step 1: Determine Your Residency Status and Form

Start by identifying your Connecticut residency classification for the tax year, as this determines which tax form you need to file:

Step 2: Collect All Required Documentation

To accurately complete your return and calculate your refund, gather the following documents:

Income & Tax Documents:

- Form W-2 – shows Connecticut withholding (Box 17)

- Form 1099 (e.g., MISC, INT, DIV) – used to report various types of non-wage income

- K-1 (if applicable) – for pass-through entities

- Documentation of estimated tax payments, such as canceled checks or online payment confirmations

Federal Tax Return:

- Your IRS Form 1040 (Connecticut starts its calculation with your federal AGI)

Credit Documentation (if claiming any):

- Childcare expenses

- CT property tax bills (if claiming CT Property Tax Credit)

- EITC qualification based on federal return

Banking Information:

- Bank routing and account numbers – required for processing your direct deposit refund.

Step 3: Choose Your Filing Method

Connecticut allows you to file your tax return in one of two ways:

Option A: E-File (Recommended)

The Connecticut Department of Revenue Services (DRS) strongly encourages electronic filing for speed, accuracy, and refund security.

Ways to E-file:

- DRS Taxpayer Service Center (TSC):

Free electronic filing platform for individual taxpayers.

https://portal.ct.gov/TSC - Authorized Commercial Tax Software:

Examples: TurboTax, H&R Block, TaxAct - Professional Tax Preparers:

E-file is standard practice among CPAs and tax professionals

Benefits of E-filing:

- Faster processing (Refund in 2–3 weeks)

- Immediate confirmation of receipt

- Secure data encryption

- Built-in error checks

- Enables direct deposit refund

Option B: Paper Filing

Alternatively, you can print the appropriate forms, fill them out manually, and submit them by mail.

Mail to (if requesting a refund):

Department of Revenue Services

PO Box 2976

Hartford, CT 06104-2976

Drawbacks of paper filing:

- Longer processing time (6–12 weeks)

- No instant confirmation

- More prone to error or omission

Step 4: Complete and Review the Tax Form

Key Components to Complete:

- Personal information: Name, SSN, address

- Federal AGI & Connecticut Adjustments

- CT taxable income & tax calculation

- Withholding & payments made

- Credits claimed (e.g., CT EITC, property tax credit)

- Refund amount due or tax owed

- Bank info for direct deposit

Review your return for accuracy, verify all calculations, and be sure to sign and date it. If filing jointly, both spouses must sign.

Step 5: Select a Refund Delivery Option

You can choose to receive your Connecticut refund in one of two ways:

| Method | Advantages |

| Direct Deposit | Fastest, secure, no mailing delays |

| Paper Check | Slower, subject to delivery issues, can take up to 12 weeks |

Important: Enter the correct routing and account number if opting for direct deposit. Incorrect info may delay your refund or send it to the wrong account.

Step 6: Submit Your Tax Return

Submit your completed return by the tax deadline (typically April 15, unless extended).

- E-filed returns are submitted automatically and generate a confirmation.

- Paper returns must be postmarked by the due date.

Step 7: Track the Status of Your Refund

Once your return is filed, use the online refund tracker to monitor progress:

Check Refund Status – CT DRS

What you’ll need:

- Social Security Number (SSN)

- Filing status

- Exact refund amount expected

Refund status is typically available:

- Within 48–72 hours of e-filing

- After 2–4 weeks for paper returns

Refund Processing Timelines

| Filing Method | Estimated Refund Time |

| E-filing with direct deposit | 2 to 3 weeks |

| Paper filing with paper check | 6 to 12 weeks |

| Amended returns (CT-1040X) | 10 to 16 weeks or more |

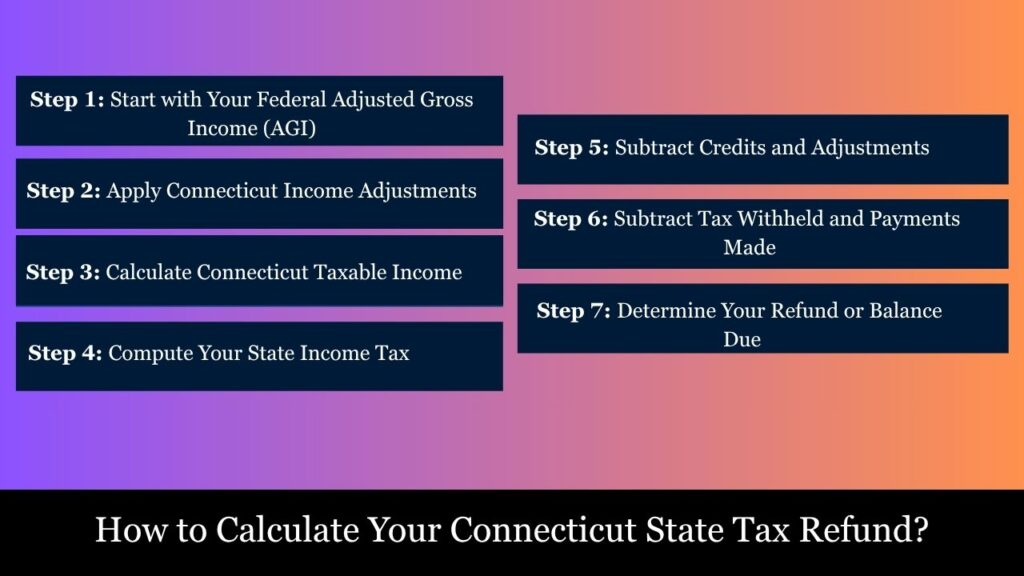

How to Calculate Your Connecticut State Tax Refund?

Your Connecticut state tax refund is the difference between what you paid (via withholding or estimated payments) and your actual state income tax liability. If you’ve overpaid, you’re eligible for a refund; if you’ve underpaid, you owe the difference.

Let’s walk through the step-by-step calculation process using the structure of Form CT-1040 (for residents) as a basis.

Step 1: Start with Your Federal Adjusted Gross Income (AGI)

Connecticut starts its tax computation using your federal AGI from IRS Form 1040.

Locate this on:

- IRS Form 1040, Line 11

Example:

Federal AGI = $55,000

Step 2: Apply Connecticut Income Adjustments

Certain income items may be added or subtracted to calculate your Connecticut adjusted gross income (CT AGI).

Common Additions:

- Interest from non-Connecticut state or municipal bonds

- Non-qualified withdrawals from CHET (Connecticut Higher Education Trust) accounts

Common Subtractions:

- Federally taxable Social Security benefits

- Contributions to CT 529 plans (up to the limit)

- Certain military retirement benefits

Example:

- Federal AGI = $55,000

- Subtractions = $2,000

CT AGI = $53,000

Step 3: Calculate Connecticut Taxable Income

If you qualify for personal exemptions, subtract them from your CT AGI.

Personal Exemption Amounts (2025 Estimated):

| Filing Status | Exemption |

| Single | $15,000 |

| Married Filing Jointly | $24,000 |

| Head of Household | $19,000 |

Example:

- CT AGI = $53,000

- Filing status = Single

- Exemption = $15,000

CT Taxable Income = $38,000

Step 4: Compute Your State Income Tax

Connecticut uses marginal tax brackets. For tax year 2025, here are the estimated brackets for single filers:

| Taxable Income | Tax Rate |

| $0–$10,000 | 3% |

| $10,001–$50,000 | 5% |

| $50,001–$100,000 | 5.5% |

Example Calculation (Single filer, $38,000 taxable income):

- First $10,000 × 3% = $300

- Next $28,000 × 5% = $1,400

Total CT Tax = $1,700

Step 5: Subtract Credits and Adjustments

You may lower your tax liability by applying nonrefundable or refundable tax credits.

Common CT Credits:

- CT Earned Income Tax Credit (EITC): A refundable credit equal to a percentage of your federal EITC

- Property Tax Credit: Up to $200, based on income limits (nonrefundable)

Example:

- CT Tax: $1,700

- Property Tax Credit: $200

CT Tax After Credits = $1,500

Step 6: Subtract Tax Withheld and Payments Made

Now subtract:

- CT income tax withheld (from W-2s, 1099s – Line 17 of each W-2)

- Estimated tax payments (if any)

- Payments made with extension or prior overpayments

Example:

- Tax withheld from W-2: $1,800

- Estimated payments: $0

Total Payments = $1,800

Step 7: Determine Your Refund or Balance Due

Use the formula:

Refund = Total Payments – CT Tax Due

If your payments > tax, the extra is refunded.

If your payments < tax, you owe the difference.

Example:

- Tax Due = $1,500

- Payments = $1,800

Refund = $300

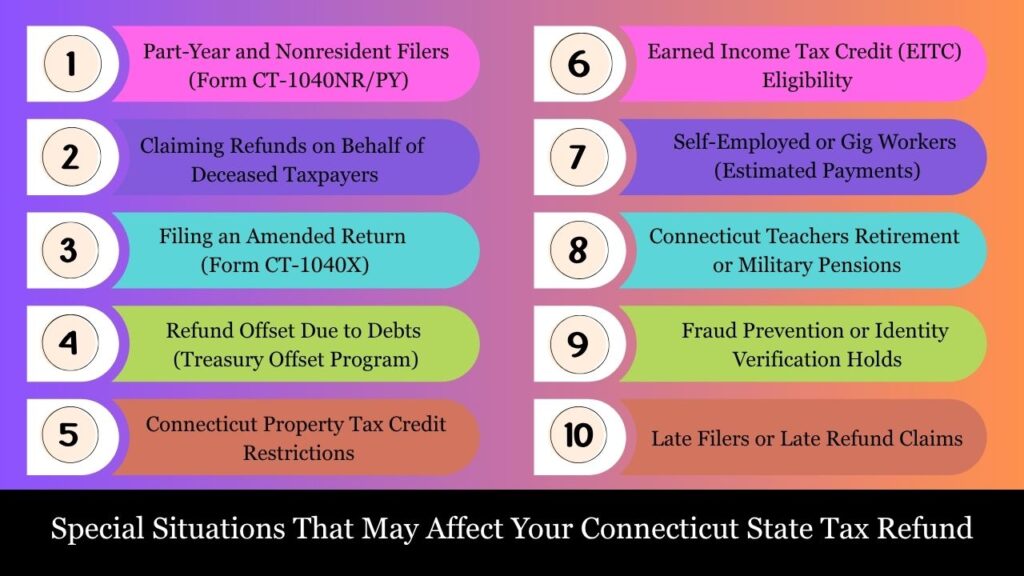

Special Situations That May Affect Your Connecticut State Tax Refund

While most Connecticut taxpayers follow a standard process for filing and receiving their state tax refunds, there are several special situations that may affect how your refund is calculated, delayed, offset, or denied. Whether you’re a part-year resident, a nonresident, or filing on behalf of someone else, it’s important to understand the nuances that could apply to your situation.

Below is a detailed breakdown of key scenarios:

1. Part-Year and Nonresident Filers (Form CT-1040NR/PY)

Description:

If you lived in Connecticut for only part of the year or earned Connecticut-source income as a nonresident, you must use Form CT-1040NR/PY.

Key Considerations:

- Only Connecticut-sourced income is taxable.

- Refund is only issued if more tax was withheld than your CT tax liability.

- You must allocate income between Connecticut and other states.

Example:

A Massachusetts resident who worked remotely for a CT company for 3 months may be eligible for a partial refund if CT tax was withheld on income not earned within CT.

2. Claiming Refunds on Behalf of Deceased Taxpayers

Description:

If a taxpayer passed away before receiving a tax refund, a surviving spouse, executor, or other legal representative must file on their behalf using Form CT-1310.

Key Requirements:

- Attach the death certificate.

- Submit with the final CT-1040 or CT-1040NR/PY.

- Ensure legal authority is documented.

Refund Routing:

Refunds may be paid directly to the estate or surviving spouse, depending on circumstances.

3. Filing an Amended Return (Form CT-1040X)

Description:

Use this form if you’ve discovered an error after filing your original return—such as an omitted W-2, overreported income, or missed credit.

Key Points:

- You may be entitled to an additional refund.

- You must file within 3 years of the original due date or within 2 years from the date the tax was paid—whichever is later.

- Requires documentation to support changes.

4. Refund Offset Due to Debts (Treasury Offset Program)

Description:

Your refund may be intercepted or reduced by the state to cover certain outstanding obligations.

Common Offsets:

- Unpaid CT state income taxes

- CT unemployment overpayments

- Delinquent child support

- Federal or state agency debts

- Student loan defaults (federal)

What You Can Do:

- Check the “Notice of Adjustment” from the DRS.

- You can dispute the offset with the agency that claims the debt, not with DRS.

5. Connecticut Property Tax Credit Restrictions

Description:

Although CT offers a property tax credit (up to $200), it is subject to income limitations and phase-outs.

Restrictions:

- Generally limited to full-year residents.

- Phases out above certain income thresholds (e.g., ~$100,000+ for joint filers).

- Not refundable—won’t increase your refund beyond tax liability.

6. Earned Income Tax Credit (EITC) Eligibility

Description:

Connecticut offers a refundable EITC equal to a percentage of the federal EITC. This can generate a refund even if no tax was owed.

Requirements:

- Must qualify for the federal EITC.

- Must file a CT-1040.

- Include federal return or CT EITC worksheet.

2025 Rate (Projected):

- Up to 40% of the federal EITC (subject to legislative update)

7. Self-Employed or Gig Workers (Estimated Payments)

Description:

Self-employed individuals or freelancers who did not have tax withheld from income must pay quarterly estimated taxes to avoid underpayment penalties.

Refund Consideration:

- If you overpaid estimated taxes, you can receive a refund.

- Be sure to attach proof of estimated tax payments with your return.

8. Connecticut Teachers Retirement or Military Pensions

Description:

Some types of income (e.g., certain military or teachers’ pensions) may be partially or fully exempt from Connecticut taxation.

Refund Relevance:

If you incorrectly reported this income as taxable and paid tax on it, you may be eligible for a refund through an amended return.

9. Fraud Prevention or Identity Verification Holds

Description:

The Connecticut DRS may hold your refund if your return is flagged for potential identity theft or fraud.

Resolution:

- You may receive a notice requesting ID verification.

- Promptly respond with required documents (e.g., driver’s license, utility bill).

- Delays may range from 2 to 8 weeks depending on response time.

10. Late Filers or Late Refund Claims

Description:

Filing after the April deadline or beyond the refund statute of limitations may result in loss of refund eligibility.

Time Limits:

- Submit your return no later than three years from its original due date.

- Amended returns with refund claims must also be timely.

Conclusion

The Connecticut Department of Revenue Services provides a clear and timely process for claiming state income tax refunds. If you’ve overpaid taxes or qualify for credits, ensure you file your CT-1040 or CT-1040NR/PY accurately and on time. E-filing with direct deposit is the best way to receive your refund quickly. Don’t miss the three-year window, and always track your status online to stay updated.

Frequently Asked Questions (FAQs)

When will I get my refund?

–E-filers with direct deposit: 2–3 weeks

–Paper filers: 6–12 weeks

Am I eligible for a refund even if I had no income?

If CT tax was withheld from any source, or you’re eligible for a refundable credit, you may receive a refund—even with low or no income.

What happens if I file late?

Filing your claim after the refund deadline will result in the forfeiture of your refund.

Can I amend a return to claim a refund?

Yes. File CT-1040X within the refund time limits.

What if my refund is incorrect or never arrives?

Contact DRS at 1-800-382-9463 (within CT) or 860-297-5962 (out of state), or submit a Refund Inquiry via their website.