Missouri State Tax Refund: What Every Filer Should Know In 2025?

Table of Contents

Missouri State Tax Refund: A Step-by-Step Guide

If you live in Missouri or earned income sourced from the state, and you’ve had more state tax withheld or paid than you ultimately owe, you are eligible for a Missouri state income tax refund. This guide walks you through who qualifies, how to claim a refund, how it’s processed, and what to expect during each stage.

What Is a Missouri State Tax Refund

A Missouri state tax refund is the return of overpaid state income taxes to an individual taxpayer. Overpayments usually result from:

- Withholding from your paychecks that exceeds your final liability

- Estimated tax payments that surpass actual taxes owed

- Eligibility for refundable tax credits

- Filing an amended return to update previously submitted information, such as unclaimed deductions or credits

Refunds are issued by the Missouri Department of Revenue (MoDOR) once your return is reviewed and accepted.

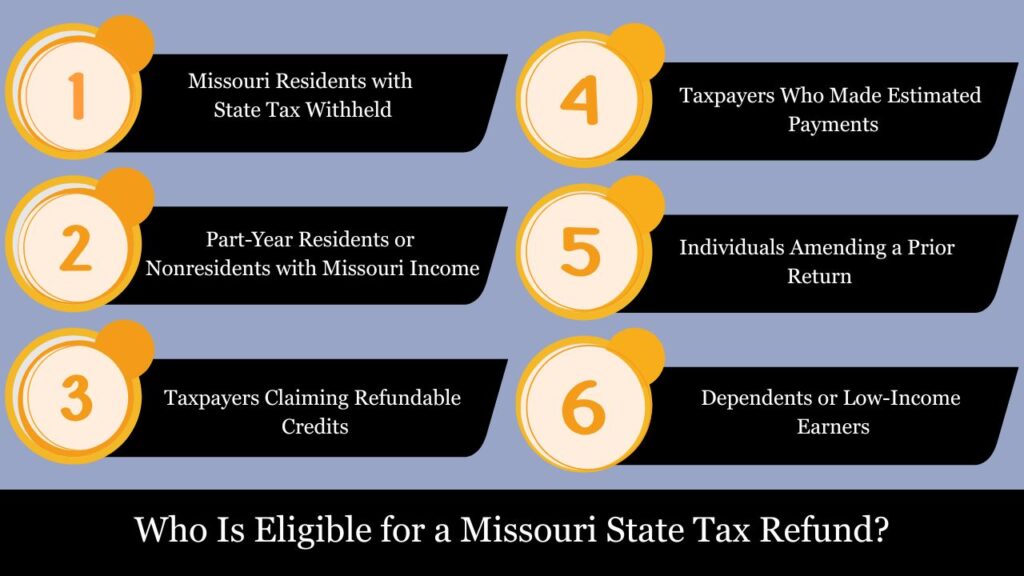

Who Is Eligible for a Missouri State Tax Refund?

You may be eligible for a Missouri state income tax refund if you’ve overpaid taxes to the state of Missouri during the tax year. Overpayments typically result from withholding, estimated payments, or refundable credits that exceed your actual state tax liability when your return is finalized.

Here’s a breakdown of individuals who qualify:

1. Missouri Residents with State Tax Withheld

If you are a full-year resident of Missouri and had Missouri state income tax withheld from your wages, salary, unemployment benefits, retirement distributions, or other income sources—and your actual tax owed is less than the amount withheld—you qualify for a refund.

Example: You earned $40,000 and had $1,200 withheld in Missouri taxes. If your final Missouri tax liability is only $950, you’re entitled to a $250 refund.

2. Part-Year Residents or Nonresidents with Missouri Income

If you lived in Missouri for part of the year or are a nonresident who earned income from Missouri sources (like rental income, a job, or business activity within the state), you may also qualify for a refund if Missouri tax was overpaid.

To claim, you must file Form MO-1040 with a MO-NRI (Nonresident Income Schedule) to allocate the income and determine overpayment.

3. Taxpayers Claiming Refundable Credits

You’re eligible for a refund even if no taxes were withheld, as long as you qualify for refundable tax credits. These credits can reduce your tax liability below zero, triggering a cash refund.

Common Missouri refundable credits include:

- Senior Citizens Property Tax Credit (Circuit Breaker)

- Family Development Account Tax Credit

- Food Pantry Tax Credit

- Adoption Tax Credit

Example: A senior who pays property taxes but has little or no taxable income may receive a refund via the Property Tax Credit.

4. Taxpayers Who Made Estimated Payments

If you made estimated tax payments during the year (common among self-employed individuals, freelancers, or those with large investment income), and those payments exceed your actual Missouri tax liability, you will be refunded the difference.

5. Individuals Amending a Prior Return

If you discovered a mistake or missed credit after filing your return, and you later amend the return (using Form MO-1040 with corrections), you may become eligible for a refund you didn’t originally claim.

Amendments must be filed within the refund window—either three years from the return’s original due date or two years from the date the tax was paid, whichever is later.

6. Dependents or Low-Income Earners

You might still qualify for a refund even if your income is below Missouri’s filing requirement, provided that:

- Your employer withheld Missouri taxes from your pay

- You qualify for a refundable credit

You must file a return to receive the refund—it’s not automatic.

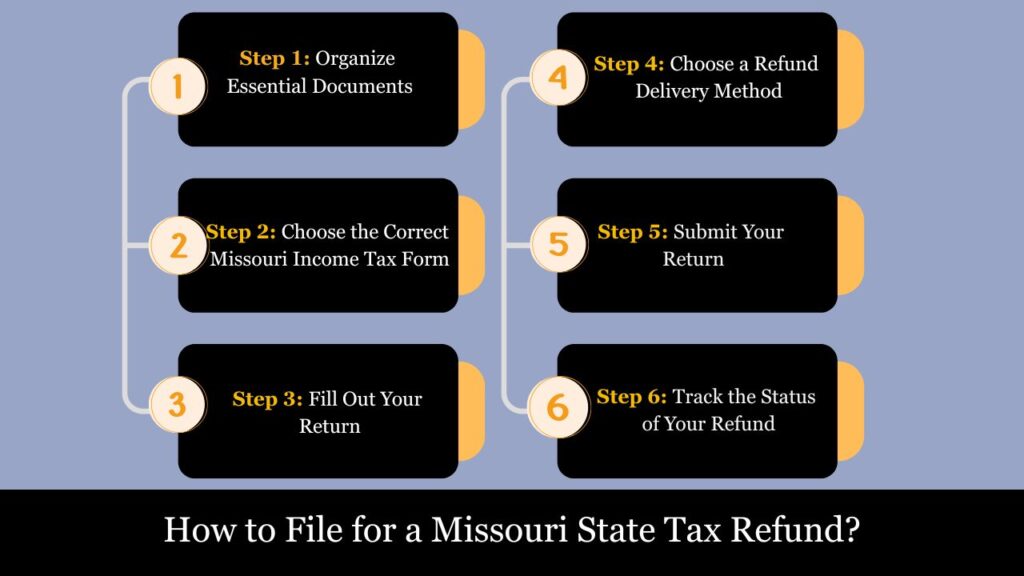

How to File for a Missouri State Tax Refund?

Filing for a Missouri state tax refund is a multi-step process that begins with determining your eligibility and ends with either receiving a direct deposit or a check from the Missouri Department of Revenue (MoDOR). Whether you’re a full-year resident, part-year resident, or nonresident with Missouri income, filing correctly ensures that any overpayment of taxes is returned to you promptly and accurately.

Step 1: Organize Essential Documents

Before beginning your tax return, gather all the documents necessary to support your income, withholding, and eligibility for deductions or credits. These typically include:

- W-2 Forms – showing your earned income and the amount of Missouri state tax withheld by your employer.

- 1099 Forms – for freelance, unemployment, pension, or interest/dividend income

- Federal Form 1040 – Missouri calculates state income tax based on your federal adjusted gross income (AGI)

- Social Security Numbers – for yourself, your spouse, and any dependents included on your return

- Proof of estimated tax payments, if applicable

- Receipts or records to support state-specific credits (such as rent or property tax payments for senior credits)

Tip: Having these documents ready will reduce errors and speed up refund processing.

Step 2: Choose the Correct Missouri Income Tax Form

Missouri offers several tax return forms based on your residency status and filing needs:

Form MO-1040

This is the standard, comprehensive individual income tax return. Use this form if you:

- Have multiple sources of income

- Are claiming itemized deductions or tax credits

- Are a nonresident or part-year resident

Form MO-1040A

This is the simplified version of the return, suitable for full-year Missouri residents with:

- Income only from wages, retirement, interest, and unemployment

- No itemized deductions

- No complex credits

Form MO-NRI

This nonresident/part-year resident income schedule must be used alongside Form MO-1040 to correctly apportion income earned in and out of Missouri.

Step 3: Fill Out Your Return

Key Sections on Form MO-1040:

- Start with your Federal Adjusted Gross Income (AGI)

This figure is the basis for your Missouri taxable income. - Apply Missouri Adjustments

Add or subtract state-specific income modifications—e.g., subtracting Social Security benefits or Missouri public pensions. - Calculate Missouri Taxable Income

After deductions (standard or itemized), determine how much of your income is taxable by Missouri. - Compute Your Missouri Income Tax Liability

Use the Missouri tax tables provided with the return instructions. - Apply Credits

Enter any eligible nonrefundable and refundable tax credits, such as:- Property Tax Credit (MO-PTS)

- Food Pantry Credit

- Adoption Credit

- Report Missouri Withholding and Estimated Tax Payments

Include amounts already paid via paycheck withholding (from W-2s and 1099s) or directly through quarterly estimates. - Calculate Overpayment / Refund

If your payments and credits exceed your total tax liability, the difference is your state refund.

Step 4: Choose a Refund Delivery Method

When completing the return, indicate how you want your refund delivered:

Direct Deposit (Recommended)

- Enter your bank’s routing number and account number

- You may choose savings or checking

- Refunds typically issued within 2 to 6 weeks via e-file

Paper Check

- Mailed to your address on file

- Processing may take 8 to 12 weeks or longer, especially during peak season

Important: Double-check your banking information to avoid rejected deposits or refund delays.

Step 5: Submit Your Return

Option 1: E-File (Preferred for Speed and Accuracy)

E-filing is the fastest, most secure method. You can:

- File using authorized tax software—many providers offer free options for qualifying taxpayers

- File directly through the state’s official online portal

Benefits of e-filing:

- Immediate submission confirmation

- Faster refund processing

- Fewer manual errors

Option 2: Paper Filing (If Required or Preferred)

Send your completed tax forms to the correct mailing address provided in the form instructions. For refunds, the mailing address is:

Missouri Department of Revenue

P.O. Box 500

Jefferson City, MO 65106-0500

Include:

- W-2 and 1099 attachments

- All applicable schedules and documentation

Step 6: Track the Status of Your Refund

After filing, you can monitor the progress of your refund online or by phone:

Online:

Visit the Missouri Refund Status Tool

You’ll need:

- SSN

- Filing status

- Exact refund amount

By Phone:

Call the Missouri refund hotline at 573-526-8299 (Monday–Friday, 8 a.m. to 5 p.m. CST)

Example:

Daniel, a Missouri resident, had $1,500 in state tax withheld from his job. After completing his Form MO-1040, he finds his Missouri tax liability is $1,100. He’s entitled to a $400 refund. He e-files via MyTax Missouri, selects direct deposit, and receives his refund within 3 weeks.

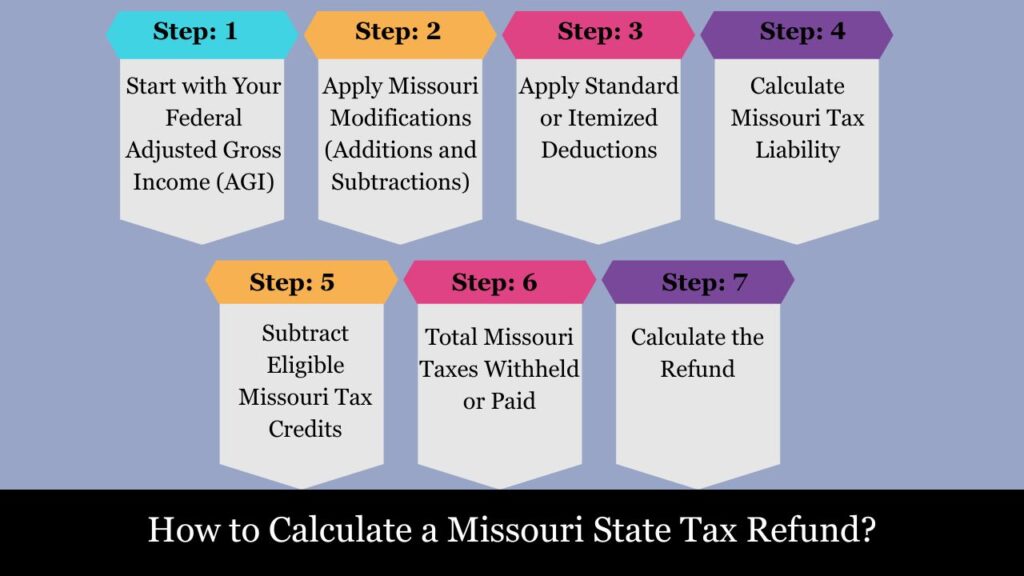

How to Calculate a Missouri State Tax Refund (2025 Guide)

Calculating your Missouri state tax refund involves comparing the total amount of Missouri income tax withheld or paid during the tax year to your actual Missouri income tax liability. If your payments (via withholding, estimated payments, or refundable credits) exceed the amount you owe, you are entitled to a refund for the difference.

Step-by-Step Refund Calculation Process

Step 1: Start with Your Federal Adjusted Gross Income (AGI)

Missouri bases its tax calculations on your Federal Adjusted Gross Income (AGI), located on Line 11 of IRS Form 1040.

Example:

Your Federal AGI = $42,000

Step 2: Apply Missouri Modifications (Additions and Subtractions)

Adjust your AGI using Missouri-specific rules:

- Subtract exempt income, such as:

- Social Security benefits

- Missouri public pension exclusions

- Add taxable income not included on your federal return, such as non-Missouri municipal bond interest

Example:

- Social Security Exclusion = $4,000

- Adjusted Missouri Income = $42,000 – $4,000 = $38,000

Step 3: Apply Standard or Itemized Deductions

Missouri allows either the:

- Standard deduction (matches federal amount, e.g., $13,850 for single in 2025), or

- Itemized deductions, if greater than the standard

Example:

You use standard deduction of $13,850

Taxable Income = $38,000 – $13,850 = $24,150

Step 4: Calculate Missouri Tax Liability

Use Missouri’s 2025 income tax brackets to determine your tax liability.

2025 Missouri Income Tax Brackets (Single Filers):

| Taxable Income | Tax Rate |

| $0 – $1,100 | 0% |

| $1,101 – $2,200 | 1.5% |

| $2,201 – $3,300 | 2.0% |

| $3,301 – $4,400 | 2.5% |

| $4,401 – $5,500 | 3.0% |

| $5,501 – $6,600 | 3.5% |

| $6,601 – $7,700 | 4.0% |

| $7,701 – $8,800 | 4.5% |

| Over $8,800 | 4.8% (flat rate) |

Example:

Taxable income = $24,150

Since it exceeds $8,800, the flat 4.8% applies:

Missouri Tax Liability = 4.8% × $24,150 = $1,159.20

Step 5: Subtract Eligible Missouri Tax Credits

Apply any:

- Nonrefundable credits (e.g., family development account credit)

- Refundable credits (e.g., Senior Citizens Property Tax Credit)

Example:

No credits claimed → Tax Liability remains $1,159.20

Step 6: Total Missouri Taxes Withheld or Paid

Now calculate how much you already paid to Missouri through:

- Withholding from wages (Box 17 of W-2)

- Estimated tax payments

- Overpayments applied from a prior year

- Other payments

Example:

Missouri tax withheld by employer: $1,400

Step 7: Calculate the Refund

Compare total tax paid with tax liability:

Refund = Tax Paid – Tax Liability

Example:

$1,400 paid – $1,159.20 owed = $240.80 refund

Missouri Tax Refund = $240.80

Missouri State Tax Refund Claim Deadlines

To receive a Missouri state income tax refund, you must file your return within the legally allowed timeframe. Missing the deadline means you could forfeit your right to claim any refund, even if you overpaid taxes.

General Rule: 3-Year Refund Deadline

Under Missouri law (similar to IRS rules), you must claim your refund within:

Submit your claim within three years of the return’s original due date, or within two years of the payment date—whichever is later, whichever is later.

Example 1: Filing by the 3-Year Deadline

If your 2021 Missouri income tax return was due April 15, 2022, then:

- You must submit your return by April 15, 2025, to receive a refund for the 2021 tax year

- Filing after April 15, 2025, means your refund will be denied, even if you overpaid

Example 2: Late Tax Payment Scenario

If you paid your 2022 Missouri state tax late on September 15, 2023, then:

- You must claim your refund by September 15, 2025, which is two years from the date the tax was paid

- This can extend your refund window beyond 3 years from the original return deadline

Refund for Estimated Payments or Withholding

If your refund is based on:

- Wage withholding (Form W-2)

- 1099 income tax withholding

- Quarterly estimated payments

You must file within the 3-year or 2-year deadline; otherwise, any overpayment will be kept by the state of Missouri.

Example

Ethan, a Missouri resident, had $1,000 in state tax withheld from his job. After completing MO-1040, he finds his actual Missouri tax liability is $750. Therefore, he is eligible for a $250 refund. He selects direct deposit and files electronically through MyTax Missouri. His refund is processed and issued in about 3 weeks.

Conclusion

Claiming your Missouri state tax refund is a straightforward process when you understand the key steps: determine your eligibility, file the correct return, calculate your refund accurately, and meet the state’s deadlines. Whether you’re a full-time resident, part-year filer, or a nonresident with Missouri-source income, filing a timely and accurate return ensures that any overpaid taxes are rightfully returned to you.

By gathering proper documentation, using the correct forms (such as MO-1040), and choosing direct deposit for faster processing, you can avoid unnecessary delays. Remember, refunds must be claimed within three years of the return’s original due date (or within two years of payment), so don’t wait.

If you’re eligible for refundable credits—like the Property Tax Credit for seniors or the low-income Food Pantry Credit—you could receive a refund even if no tax was withheld. Filing, even when not strictly required, can result in money back in your pocket.

Bottom Line: Filing your Missouri return accurately and on time is the only way to claim the refund you may be owed. Stay informed, stay compliant, and don’t leave your refund unclaimed.

Frequently Asked Questions (FAQs)

Who qualifies for a Missouri state tax refund?

Anyone who has overpaid Missouri state income taxes through wage withholding, estimated payments, or refundable credits may qualify. This applies to full-year residents, part-year residents, and nonresidents who earned income from Missouri sources.

How do I know if I’m due a refund?

You are due a refund if the total taxes paid or withheld during the year exceed your actual Missouri tax liability. Use Form MO-1040 or MO-1040A to calculate this.

What forms do I need to file for a refund?

Most taxpayers use Form MO-1040. If you’re a nonresident or part-year resident, include Form MO-NRI. Attach W-2s, 1099s, and any relevant credit schedules like the MO-PTS for the Property Tax Credit.

How long does it take to receive a Missouri refund?

–E-file with direct deposit: 2–6 weeks

–Paper filing: 8–12 weeks or longer

Refunds may be delayed if the return has errors or requires additional verification.

What’s the best way to track the status of my tax refund ?

Visit mytax.mo.gov and use the “Where’s My Refund” tool. You’ll need your SSN, filing status, and exact refund amount.

Can I receive my refund by direct deposit?

Yes. Missouri offers direct deposit for faster refunds. You’ll need to enter your bank’s routing number and account number when filing.

What is the deadline to claim a refund?

A refund claim must be submitted within three years of the return’s original due date or within two years of the tax payment date, whichever is later.

What happens if I miss the refund deadline?

Filing after the deadline means you lose your right to a refund, even if you overpaid or the state owes you. The Missouri Department of Revenue does not honor late claims.

Do I still need to file if I earned low income?

Yes, if taxes were withheld or you qualify for refundable credits like the Property Tax Credit, you should file to claim your refund—even if your income was below the filing threshold.

How do I amend a previously filed return to claim a missed refund?

File an amended return using Form MO-1040. Clearly mark it as “amended,” and submit any new or corrected documentation. Make sure it’s within the refund claim period.