US Tax Classification- Simplified In 2025

Table of Contents

A Clear Breakdown of US Tax Classification

Tax classification is a vital process in the U.S. tax system, determining how individuals and entities are taxed, what forms they must file, and the applicable tax rates. Whether you’re a taxpayer, business owner, investor, or estate administrator, understanding your correct tax classification is vital for compliance and financial planning.

What Is U.S. Tax Classification?

US tax classification refers to how the Internal Revenue Service (IRS) identifies and categorizes taxpayers based on their structure, purpose, and income sources. Each classification defines how income is taxed, what forms are required, who is responsible for payment, and whether taxes are assessed at the entity or individual level.

Incorrect classification can lead to penalties, missed deductions, or double taxation. Therefore, knowing the tax classification that applies to you or your business is essential.

Types of U.S. Tax Classifications

A proper understanding of these classifications is vital for accurate tax reporting, legal compliance, and minimizing tax liability. Taxpayers in the U.S. fall into several primary classifications.

1. Individual Taxpayer Classification

Every Citizen of U.S. Having income sources must file income taxes. The IRS classifies individuals based on filing status, which affects income thresholds, tax brackets, deductions, and eligibility for credits.

Types of Individual Filing Status:

- Single – Unmarried individuals with no dependents.

- Married Filing Jointly – Married couples filing one combined tax return.

- Married Filing Separately – Married couples filing individually.

- Head of Household – Unmarried individuals supporting dependents.

- Qualifying Widow(er) – Recent widows/widowers with dependent children (for 2 years after spouse’s death).

Tax rates and standard deduction amounts vary by status.

2. Business Entity Tax Classifications

Business entities in the U.S. are classified based on their legal structure. The classification determines which tax return the business files and whether profits are taxed at the corporate or individual level.

a. Sole Proprietorship

- Default classification for unincorporated individuals running a business.

- Not a separate legal entity.

- Income and expenses are reported on Schedule C (Form 1040).

- Business income is taxed at the individual level.

b. Partnership

- Two or more individuals or entities share ownership.

- Must file Form 1065 to report partnership income.

- Profits/losses are passed through to partners via Schedule K-1.

- Partners report their share on individual returns.

c. C Corporation (Regular Corporation)

- Separate legal and tax entity from its owners.

- Files Form 1120.

- Subject to corporate income tax (currently 21% federal rate).

- Shareholders pay additional tax on dividends (double taxation).

d. S Corporation

- Must file IRS election using Form 2553.

- Not taxed at the corporate level.

- Files Form 1120-S.

- Pass-through taxation: income, losses, deductions passed to shareholders.

- Shareholders report income on personal returns.

Eligibility rules apply: 100 shareholder limit, U.S. residents only, one class of stock.

e. Limited Liability Company (LLC)

- Offers legal protection with tax flexibility.

- Single-member LLC: treated as disregarded entity (taxed as sole proprietorship).

- Multi-member LLC: taxed as partnership by default.

- choose to be taxed as a C corporation or an S corporation by filing Form 8832 or Form 2553, by inspecting the criteria.

3. Trust and Estate Classifications

These entities are taxed separately from individuals and businesses and have their own reporting requirements.

a. Trusts

- Created to hold and manage assets for beneficiaries.

- File Form 1041 (U.S. Income Tax Return for Estates and Trusts).

- Types:

- Simple Trust: Distributes all income annually.

- Complex Trust: May accumulate or retain income.

- Grantor Trust: Income taxed on the grantor, rather than trust.

b. Estates

- Created upon a person’s death to manage their assets.

- Also use Form 1041 if income is over $600 during administration.

- Responsible for paying taxes on income generated before asset distribution.

4. Foreign and Non-resident Classifications

Foreign persons and entities with U.S. income are subject to different tax rules.

a. Nonresident Aliens

- Not U.S. citizens or residents for tax purposes.

- Taxed only on U.S.-sourced income.

- Must file Form 1040-NR.

- Withholding rules apply (typically 30% unless treaty benefits apply).

b. Foreign Entities

- May be taxed if associated in any business or trade in U.S.

- Subject to tax on effectively connected income (ECI) and fixed or determinable annual or periodical (FDAP) income.

- May be required to file Form 1120-F (U.S. Income Tax Return of a Foreign Corporation).

Entity Classification Elections – Detailed Overview (U.S. Tax System)

In the U.S., the IRS allows certain business entities to elect how they want to be taxed through a process called entity classification election. This flexibility enables businesses to choose a tax structure that aligns with their financial goals, liability preferences, and growth plans.

These elections are made primarily through Form 8832 and, for S Corporations, Form 2553.

What Is an Entity Classification Election?

The election classification of an entity is a mechanism that allows a business entity to be treated differently under the federal income tax system than its Default us tax classification.

This election does not change the legal structure under state law, but it changes how the entity is taxed at the federal level.

Default IRS Classifications

Unless an election is made, the IRS assigns a default classification based on the entity’s structure and number of owners:

| Type of Entity | Default IRS Tax Classification |

| Single-member LLC | Disregarded entity (taxed as sole proprietorship) |

| Multi-member LLC | Partnership |

| Corporation | C Corporation |

| Foreign eligible entity | Varies by local law and U.S. classification rules |

If a business owner wants a different classification—for example, an LLC being taxed as an S Corporation—they must file an election.

Key IRS Forms for Election

1. Form 8832 – Entity Classification Election

This form allows certain business entities to choose their federal tax classification.

Who Can File?

- Domestic and foreign eligible entities (primarily LLCs)

- Not available for publicly traded companies or entities already classified by statute (e.g., corporations under IRC §7701)

Election Options

- Single-member LLC:

- Default: Disregarded entity

- Choose between a C Corporation and a S Corporation (using Form 2553)

- Multi-member LLC:

- Default: Partnership

- Can elect: C Corporation or S Corporation

- Foreign Entity:

- Can choose to be taxed as a corporation, partnership, or disregarded entity depending on ownership and activities.

Election Timing

- Effective date: Can be up to 75 days before or 12 months after the date the form is filed.

- Late election relief may be available under certain circumstances.

2. Form 2553 – Election by a Small Business Corporation

This form is used by corporations and LLCs that want to be taxed as S Corporations.

Eligibility Criteria

- Must be a domestic corporation or LLC.

- Limited to 100 shareholders.

- Shareholders must be U.S. individuals or certain trusts/estates.

- Only one class of stock is allowed.

Filing Deadline

- Must be filed:

- Within the timeline of Two-months and Fifteen- days of the commencement of the tax year.

- Or any time in the tax year before the intended effective date.

Why Make an Entity Classification Election?

In the U.S. tax system, many business entities — particularly LLCs and foreign businesses — have the flexibility to elect how they are classified for federal tax purposes. This flexibility, granted by the IRS through Form 8832 or Form 2553, empowers businesses to align their tax treatment with their operational and financial goals.

But why would a business choose to change its default classification? The reasons range from tax savings to structural benefits and investment readiness.

Here are some Major reasons business owners consider to make a classification election:

1. Reduce Overall Tax Liability

The most common reason for making an entity classification election is to reduce taxes through strategic structuring.

Examples

- A single-member LLC may elect to be taxed as an S Corporation to avoid high self-employment taxes on net profits.

- A multi-member LLC may elect C Corporation status to take advantage of the flat 21% corporate tax rate, especially when planning to retain earnings for growth rather than distribute them.

Key Benefit: Aligns your tax obligation with how the business operates financially.

2. Access to Fringe Benefits & Deductions

Certain tax classifications allow businesses to access additional deductions and fringe benefits that may not be available under default structures.

Examples

- C Corporations can deduct the cost of employee health insurance, life insurance, and even retirement plans more favourably than pass-through entities.

- Employees (including owner-employees) in a corporation may qualify for tax-free fringe benefits, subject to IRS limitations.

Key Benefit: Enhances total compensation strategy while reducing taxable income.

3. Better Investment and Financing Options

Electing corporate tax treatment can help businesses attract venture capital, institutional investors, or foreign investors, who may prefer investing in C Corporations due to stock issuance and structured governance.

Examples

- Tech startups often elect to be treated as C Corporations for easier equity structuring and compliance with investor expectations.

- Foreign-owned LLCs often elect corporate tax treatment to facilitate branch operations and avoid pass-through complexities.

Key Benefit: Facilitates external funding and long-term scalability.

4. Switch to Pass-Through Taxation

Alternatively, a C Corporation or LLC may elect to be treated as an S Corporation to avoid double taxation on distributed earnings.

- Under S Corp status, business income passes through to shareholders, who pay personal income tax without the corporation being taxed at the entity level.

- Only the salary part is meant to payroll taxes, whereas the rest business profits are not applicable to self-employment tax .

Key Benefit: Cuts down on taxation of profits at multiple levels.

5. Legal and Structural Flexibility

Entity elections allow businesses to maintain a legal structure under state law while modifying their tax structure federally.

- For example, an LLC can retain its operational flexibility and limited liability protection while electing S Corp or C Corp tax status.

Key Benefit: Enjoy legal advantages of LLCs with tax advantages of corporations.

6. Strategic Planning for International Operations

For foreign businesses operating in the U.S., entity classification elections provide essential tools for managing withholding taxes, branch profits taxes, and treaty benefits.

- A foreign company might elect U.S. corporate classification to access tax treaties and limit exposure to higher U.S. withholding rates.

- It helps establish a U.S. presence with more favorable tax treatment on Effectively Connected Income (ECI).

Key Benefit: Enhances cross-border tax efficiency and treaty compliance.

7. Avoid Inflexible Defaults

IRS default rules don’t always align with how your business functions.

- A single-member LLC is automatically treated as a disregarded entity, which could lead to complex personal tax filings if business operations are significant.

- Making a formal election can simplify accounting, clarify separation of business and personal finances, and legitimize the business in the eyes of partners, banks, and vendors.

Key Benefit: Gain control over how the IRS views and treats your entity.

Summary Table: Key Reasons to Elect Entity Classification

| Reason | Typical Election | Benefits |

| Lower total tax liability | LLC → S Corp or C Corp | Reduce self-employment or income tax |

| Access better fringe benefits | LLC → C Corp | Deduct insurance, perks, and bonuses |

| Attract external investors | LLC → C Corp | Equity options & investor readiness |

| Avoid double taxation | C Corp → S Corp | Pass-through taxation |

| Retain legal flexibility | LLC → S Corp or C Corp | Preserve LLC benefits with new tax rules |

| Reduce international tax burdens | Foreign entity → U.S. Corp | Treaty access, branch profits planning |

| Customize tax structure | Any eligible entity | Better control over federal tax obligations |

Final Considerations

While entity classification elections can yield significant advantages, they also come with legal implications, administrative requirements, and compliance responsibilities.

- Filing deadlines (75 days back or 12 months forward)

- Shareholder eligibility (for S Corps)

- State tax treatment may differ from federal elections

Choosing the Right Tax Classification: Making a Tax-Smart Business Decision

When starting or restructuring a business in the U.S., choosing the right tax classification is one of the most impactful decisions you’ll make. Your entity’s tax treatment determines not only how income is taxed, but also affects everything from profit distribution and compliance responsibilities to investor attractiveness and long-term growth strategies.

While many business owners focus on their legal structure (LLC, corporation, partnership), it’s equally important to understand that federal tax classification can be chosen separately by filing the appropriate forms with the IRS. This is where strategic planning becomes essential.

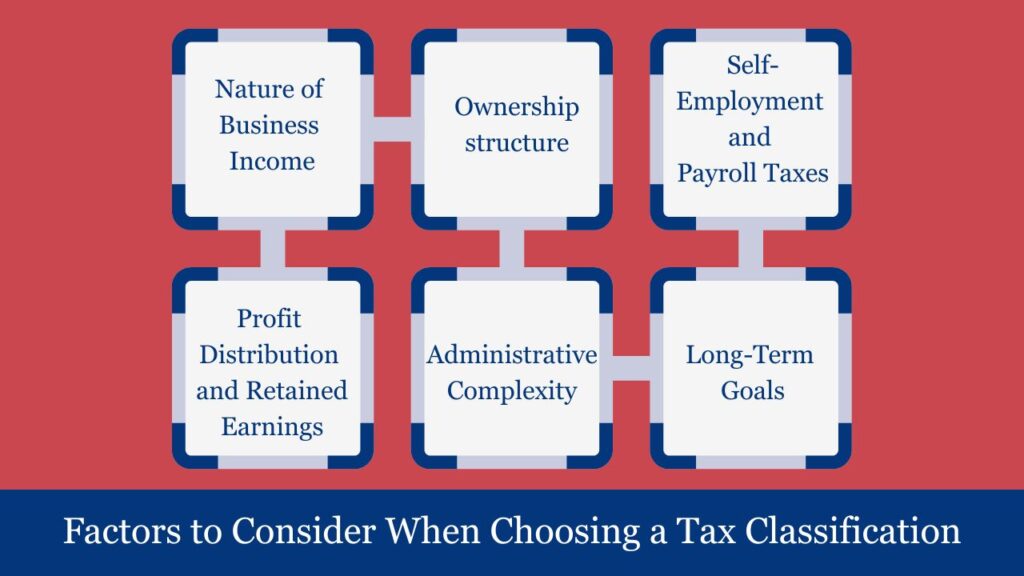

Primary Factors to Consider When Choosing a Tax Classification

1. Nature of Business Income

- Is the business generating high profits?

- Is income steady, seasonal, or unpredictable?

If the business is scaling quickly, considering an S Corp or C Corp election may provide tax savings and strategic advantages.

2. Ownership Structure

- Do you have one owner or multiple?

- Are there foreign investors or entities involved?

S Corporations are limited to 100 U.S. individual shareholders and allow only one class of stock. If your ownership includes entities, trusts, or non-resident aliens, then a C Corporation or partnership may be a better fit.

3. Self-Employment and Payroll Taxes

- Do you want to reduce the burden of self-employment taxes?

Sole proprietors and partners pay self-employment taxes (Social Security & Medicare) on all business income. An S Corporation structure can reduce this burden by allowing you to split income between salary (subject to payroll tax) and dividends (not subject to payroll tax).

4. Profit Distribution and Retained Earnings

- Do you want to reinvest profits or distribute them?

C Corporations can retain earnings within the business without immediate tax consequences to shareholders. This is helpful if you’re reinvesting in growth. However, distributed dividends are subject to double taxation (corporate and individual level).

Pass-through entities like partnerships and S Corps pass income directly to owners, which can be beneficial for distributing profits, but may complicate cash flow if income is taxed regardless of distribution.

5. Administrative Complexity

- Do you want a simple structure or are you ready to handle added compliance?

Sole proprietorships and partnerships have simpler compliance and fewer formalities. S Corporations and C Corporations involve more formalities: board meetings, payroll filings, officer designations, and separate business tax returns.

6. Long-Term Goals: Growth, Investment & Exit Strategy

- Are you planning to raise funds or liquidise the business?

C Corporations are preferred by investors and venture capitalists due to:

- Share structure flexibility

- Preferred stock options

- Ease of share transfer

They also qualify for Section 1202 Qualified Small Business Stock (QSBS) benefits — allowing potential tax exclusion on capital gains when selling.

Matching Tax Classification to Business Goals

| Business Goal | Ideal Classification | Reason |

| Simplicity for small operations | Sole Proprietorship / Partnership | Easy setup, minimal filings |

| Tax savings on self-employment taxes | S Corporation | Salary + dividend structure |

| Retaining profits for reinvestment | C Corporation | 21% flat tax rate, no distribution required |

| Planning to raise venture capital | C Corporation | Preferred by VCs, allows stock options |

| Access to fringe benefits | C Corporation | Maximizes deductions and employee benefits |

| Income pass-through without double tax | S Corporation / Partnership | Avoids corporate-level taxation |

Common Tax Classification Errors

Tax classification is a critical factor in determining how a business reports income, pays taxes, and complies with federal regulations. Despite its importance, many small businesses, startups, and even established entities make avoidable mistakes that can lead to IRS penalties, loss of benefits, and financial inefficiencies. Below are the most frequent tax classification errors, each explained in its own detailed paragraph.

1. Missing the Deadline to Elect Tax Classification

Mostly businesses commit the major mistakes by failing to file the appropriate tax classification election by due date. When an LLC is constructed, a default classification applies— single-member LLC is treated as a disregarded entity, and a multi-member LLC is considered as a partnership firm. However, if the business prefers to be treated as a C Corporation or S Corporation, it must file Form 8832 or Form 2553 within 75 days of formation (or in between 75 days of the starting of the tax year).. Failing to meet this deadline means losing the opportunity to benefit from lower corporate tax rates or S Corporation pass-through taxation, potentially resulting in a higher overall tax liability.

2. Electing S Corporation Status Without Meeting Eligibility Criteria

Another frequent issue is businesses electing to be taxed as an S Corporation without ensuring they meet the IRS’s strict eligibility rules. S corporations are only allowed to issue one class of stock, have a maximum of 100 stockholders, and must be citizens or residents of the United States. If a business fails to meet any of these criteria—such as by issuing preferred stock or accepting a foreign shareholder—its S Corporation status can be revoked retroactively, leading to unexpected double taxation and back taxes. This mistake can be financially devastating, especially for businesses that relied on S Corp status for tax savings.

3. Assuming Legal Entity Type Automatically Dictates Tax Status

A common misconception among business owners is that the legal form of their entity—whether LLC, partnership, or corporation—automatically determines how it is taxed. For an example, an LLC can considered to be treated as a corporation, and a foreign entity could be taken as a partnership. If no election is made, the IRS assigns a default classification, which may not align with the business’s goals. This can lead to mismatched tax filings, IRS confusion, or missed tax benefits simply because the entity did not actively elect the most beneficial classification.

4. Commingling Business and Personal Finances in Disregarded Entities

Owners of single-member LLCs treated as disregarded entities often make the mistake of mixing business and personal expenses in the same accounts. While the IRS allows disregarded entities to report income on the owner’s personal return, they still require accurate and separate financial records. Failing to maintain a clear boundary can not only trigger IRS audits but also risk piercing the corporate veil, eliminating the liability protection LLCs are designed to offer. This can expose the owner’s personal assets to legal claims, making bookkeeping and separate accounts a must.

5. Failing to Pay Reasonable Compensation in an S Corporation

Owners of S Corporations who work in their business are required by law to pay themselves a reasonable salary before taking shareholder distributions. One of the biggest errors made by small business owners is minimizing their own salary to reduce payroll taxes and instead withdrawing profits as tax-free distributions. This practice may seem financially smart in the short term but is a major red flag for IRS audits. If the IRS determines the salary is unreasonably low, it can reclassify distributions as wages and assess back payroll taxes, interest, and penalties. Business owners should benchmark compensation to industry standards and document it properly through payroll systems.

6. Foreign-Owned LLCs Ignoring Special IRS Filing Requirements

Foreign individuals or companies that own a single-member LLC in the U.S. often make the critical mistake of overlooking the unique filing obligations imposed by the IRS. Even if the LLC is treated as disregarded for tax purposes, still IRS mandates that the foreign owner to submit Form 5472, along with a pro forma form 1120, to disclose reportable transactions between the U.S. entity and its foreign owner. Failure to file this form correctly—and on time—can result in penalties starting at $25,000, with no income requirement threshold. This is one of the most overlooked and expensive classification errors made by foreign-owned businesses.

7. Not Reevaluating Tax Classification as the Business Evolves

Tax classifications are not meant to be “set and forget.” As a business grows, takes on new investors, expands into other states, or shifts its revenue model, the original tax classification may no longer be appropriate. Failing to reassess tax status periodically means the business could be overpaying taxes, missing deductions, or limiting its ability to attract funding. For example, a small LLC might benefit from electing S Corporation status once its profits exceed a certain level, while a startup raising venture capital may need to be a C Corporation. Businesses should make it a point to review their classification annually with a tax advisor.

Conclusion

Tax classification is not just a legal formality—it directly impacts how much tax you pay, how you report your income, and what compliance rules you must follow. Individuals and business owners should consult tax professionals to choose the most advantageous classification and maintain IRS compliance.

Frequently Asked Questions (FAQs)

1. What is a U.S. business’s tax classification?

Tax classification refers to how a business is categorized by the IRS for federal income tax purposes. This classification determines which tax forms the entity must file and how income, expenses, and profits are reported. Common classifications include sole proprietorships, partnerships, C corporations, S corporations, and disregarded entities.

2. Is it possible for an LLC to select its taxation?

Yes, an LLC can elect its tax classification. By default, a single-member LLC is treated as a disregarded entity, and a multi-member LLC is treated as a partnership. However, LLCs can elect to be taxed as a C Corporation by filing Form 8832 or as an S Corporation by filing Form 2553 with the IRS.

3. What sets apart a partnership from a disregarded entity?

A disregarded entity is a single-member LLC whose income and expenses are reported on the owner’s personal tax return (typically on Schedule C). A partnership is a multi-member entity that files Form 1065 and issues Schedule K-1s to its partners, who then report their share of income on their personal returns.

4. How do I change my entity’s tax classification with the IRS?

You must submit Form 8832 (Entity Classification Election) to the IRS in order to modify your tax classification. If you’re electing S Corporation status, use Form 2553. The IRS typically allows retroactive elections up to 75 days prior to the filing date, but certain limitations apply.

5. What happens if I don’t make a tax classification election?

If no election is made, the IRS assigns a default classification based on the entity structure. For instance, a multi-member LLC is treated as a partnership, but a single-member LLC is taxed as a sole proprietorship (disregarded entity). While default classifications are automatic, they may not be the most tax-efficient choice for every business.