What Is Schedule K1 Form 1065?- Best Review

Table of Contents

Unlocking The Detailed Guide On Schedule K1 Form 1065

Schedule K1 Form 1065 is an informational tax document that a partnership uses to report each partner’s share of income, deductions, credits, and other tax items. This form is an attachment to IRS Form 1065, which is filed annually by partnerships to report their overall financial activity.

The K-1 is not filed with the IRS by the partner; rather, it is issued to each partner, who uses it to report their portion of the partnership’s financial results on their own tax returns. The IRS receives copies of each K-1 along with Form 1065 to verify partner reporting.

Purpose of Schedule K1 Form 1065

Schedule K1 Form 1065 is a critical IRS document issued to each partner in a partnership, including LLCs treated as partnerships, to report their share of the entity’s income, deductions, credits, and other tax-related items. The purpose of the form is to ensure pass-through taxation, a foundational principle of partnership tax treatment under the U.S. Internal Revenue Code.

Unlike corporations, partnerships do not pay income tax at the entity level. Rather than being taxed at the entity level, all income, deductions, and tax items flow directly to each partner, who is responsible for reporting their proportional share on their individual or business tax return. The partnership itself files Form 1065 (U.S. Return of Partnership Income), while Schedule K-1 is the individualized summary provided to each partner.

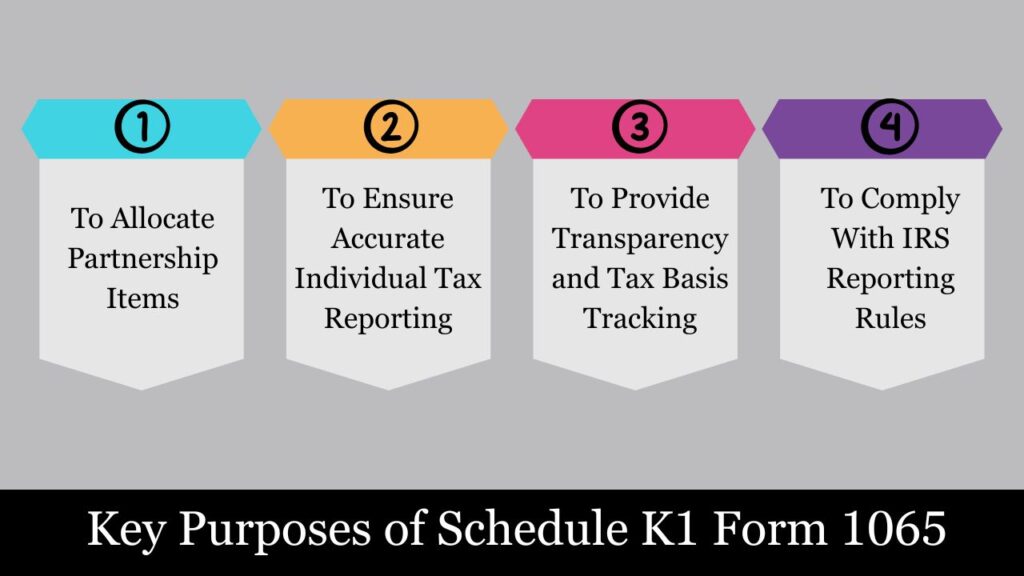

Key Purposes of Schedule K1 Form 1065:

1. To Allocate Partnership Items

Schedule K-1 outlines the specific allocation of income, deductions, credits, and other tax-related items assigned to each partner:

- Ordinary business income or loss

- Rental real estate and other rental income

- Guaranteed payments to partners

- Capital gains and losses

- Dividends and interest

- Foreign transactions

- Deductions such as Section 179 and charitable contributions

This breakdown reflects the partner’s ownership percentage and any special allocations defined in the partnership agreement.

2. To Ensure Accurate Individual Tax Reporting

Each partner uses the information from Schedule K-1 to:

- Report income and deductions on Form 1040 (Schedule E) for individuals

- Complete Form 1120S or 1120 for corporate partners

- Fulfill state-level filing obligations (if applicable)

3. To Provide Transparency and Tax Basis Tracking

The K-1 also provides essential data for tracking a partner’s:

- Tax basis in the partnership

- Distributions received during the year

- Loan balances (recourse and nonrecourse)

This information is necessary for determining whether losses are deductible and whether distributions are taxable or not.

4. To Comply With IRS Reporting Rules

The IRS uses Schedule K-1 to match a partnership’s reported income and deductions with each partner’s return. If a partner fails to report what’s listed on their K-1, it may trigger audits or penalties.

Who Receives a Schedule K1 Form 1065?

Schedule K-1 (Form 1065) is issued by partnerships and multi-member LLCs treated as partnerships for tax purposes. It is designed to report each partner’s share of the entity’s income, losses, deductions, credits, and distributions for a given tax year. The form is not filed with the IRS by the partner, but is used by the partner to complete their own tax return accurately and in accordance with federal tax laws.

Eligible Recipients of Schedule K1 Form 1065:

1. General Partners

They are directly engaged in managing the business and handling routine affairs of the partnership. They typically:

- Entitled to a portion of the partnership’s earnings and responsible for a share of its losses.

- May receive guaranteed payments (like a salary substitute)

- Assume full personal responsibility for the partnership’s debts and financial obligations.

Each general partner must receive a K-1 reflecting their share of business activity, regardless of whether any cash distribution was made during the year.

2. Limited Partners

Limited partners usually serve as passive investors and are not involved in the day-to-day management of the partnership. They are only liable up to the amount of capital they have contributed to the partnership.

They receive a Schedule K-1 because:

- They share in the partnership’s income and losses

- They may receive cash distributions

- Their return must reflect pass-through tax items

3. Members of Multi-Member LLCs (Treated as Partnerships)

LLCs with two or more members that have not elected corporate taxation are automatically treated as partnerships for federal tax purposes.

Each member:

- Is considered a partner in IRS terminology

- Receives a K-1 from Form 1065, showing their share of earnings and tax-relevant items

- Must report the K-1 data on their individual or corporate tax return, depending on entity structure

4. Corporations or Other Entities as Partners

In some partnerships, one or more partners may be corporations, trusts, estates, or even other partnerships. These entities also receive a K-1, and they:

- Use it to report the pass-through items on their own respective tax filings

- Often use Form 1120, Form 1041, or another appropriate form, depending on their type

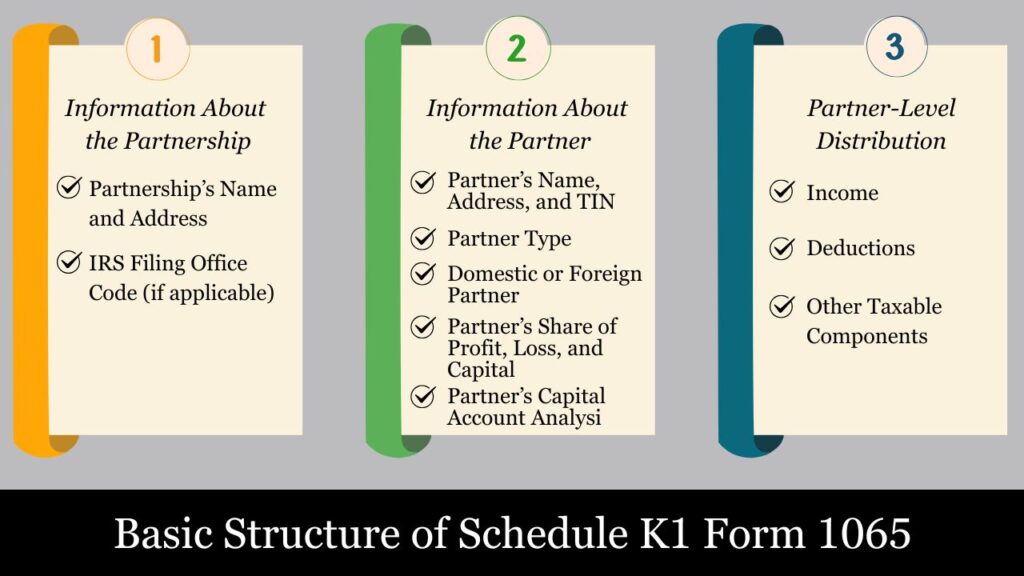

Structure of Schedule K1 Form 1065: A Line-by-Line Overview

Schedule K-1 (Form 1065) is divided into three major sections, each serving a unique purpose in helping the IRS and partners understand how the partnership’s income, deductions, credits, and other financial attributes are allocated. Each section of the form delivers key information that partners must transfer to their own individual or business tax filings.

Below is a detailed breakdown of the structure and purpose of each section:

Part I: Information About the Partnership

This section provides basic identifying details about the partnership entity that issued the K-1.

Key Fields Include:

- Partnership’s Name and Address – Legal entity name and principal business location.

- The partnership’s EIN serves as its federal tax ID number, enabling the IRS to track and identify the entity for reporting purposes.

- IRS Filing Office Code (if applicable).

- Indicates whether the partnership operates as a Publicly Traded Partnership (PTP), which may impact how income is reported and taxed.

Purpose

Establishes the origin of the K-1 and allows for proper cross-referencing with the partnership’s Form 1065 return.

Part II: Information About the Partner

This section identifies the recipient of the K-1 — the partner or member — and provides critical data about their relationship with the partnership.

Key Fields Include:

- Partner’s Name, Address, and TIN (Taxpayer Identification Number)

- Partner Type – Indicates whether the partner is an individual, corporation, partnership, trust, etc.

- Domestic or Foreign Partner – Determines certain withholding or reporting requirements.

- Partner’s Share of Profit, Loss, and Capital –

- Reported at the beginning and end of the year

- Can reflect ownership changes during the year

- Partner’s Capital Account Analysis –

- Summarizes capital activity over the tax year—from opening balance to income earned, funds added or withdrawn, and the resulting year-end capital.

- Capital is reported using a tax basis method

Purpose

Gives the IRS and partner a clear snapshot of ownership percentage, capital balance, and the basis for allocations made in Part III.

Part III: Partner-Level Distribution of Income, Deductions, and Other Taxable Components

This section contains the most comprehensive breakdown of the partner’s tax-related allocations. It itemizes the specific tax elements that are passed through to the individual partner.

Each box corresponds to a type of income, deduction, or tax-related item that must be reported elsewhere on the partner’s return.

Key Line Items Include:

| Box | Item | Description |

| 1 | Ordinary Business Income (Loss) | Net earnings from core partnership activity |

| 2 | Net Rental Real Estate Income (Loss) | Passive income from rental property |

| 3 | Other Net Rental Income (Loss) | Rental income not tied to real estate |

| 4 | Guaranteed Payments | Payments made to partners for services or capital |

| 5 | Interest Income | Pass-through interest earnings |

| 6a-c | Dividends (Ordinary, Qualified, Section 199A REIT) | All forms of dividend income |

| 7 | Royalties | Income from intellectual property or mineral rights |

| 8–9a | Net Short-Term and Long-Term Capital Gains | Gains/losses from securities and property sales |

| 10–13 | Deductions (Section 179, charitable contributions, investment interest, etc.) | Partner’s share of allowable deductions |

| 14–20 | Foreign transactions, AMT items, credits, basis adjustments, and other supplemental info | Required for specialized or international filings |

Each item may also include footnotes or statements to explain special allocations, limitations, or tax treatment (e.g., at-risk rules, passive activity rules, Section 704(c) adjustments).

Purpose

This section provides the line-by-line tax items the partner must report on their personal or business return. It integrates directly into Schedule E (Form 1040), Form 1116 (foreign tax credit), Form 4952 (investment interest), and others.

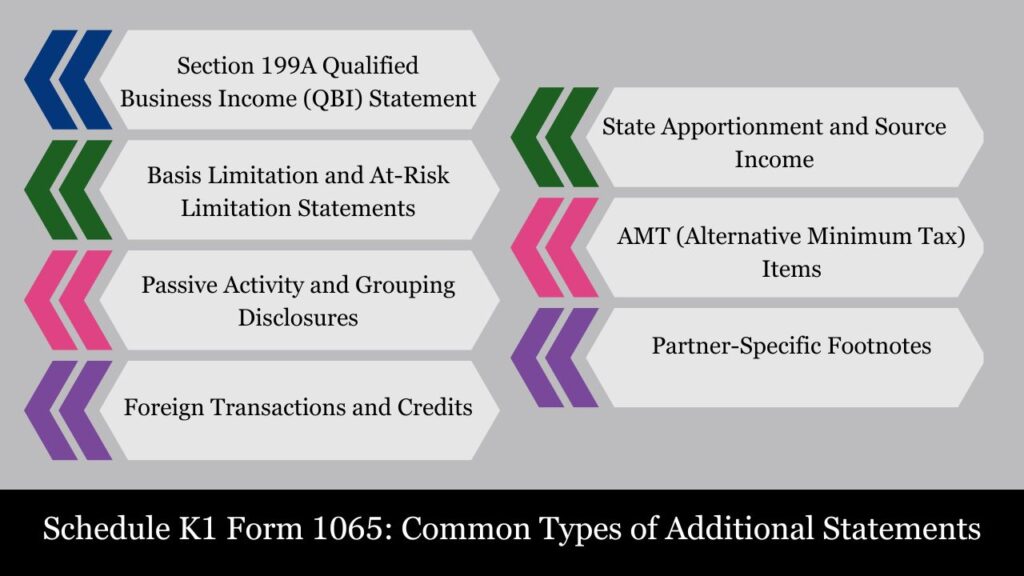

Common Types of Additional Statements

1. Section 199A Qualified Business Income (QBI) Statement

For pass-through businesses, the QBI deduction allows a 20% deduction of qualified business income. Partnerships must supply detailed information to help each partner determine:

- QBI-eligible income

- W-2 wages paid by the partnership

- Reflects the property’s cost basis immediately after acquisition, used for certain tax calculations like the QBI deduction.

Why it matters: This statement is essential for computing the QBI deduction on Form 8995 or 8995-A.

2. Basis Limitation and At-Risk Limitation Statements

These statements clarify the partner’s:

- Beginning and ending tax basis

- Debt allocations (recourse vs. nonrecourse)

- Changes due to contributions, distributions, or share of income/loss

- Amounts at-risk for purposes of Section 465 limitations

Why it matters: Basis and at-risk limits determine whether losses on the K-1 are deductible or suspended.

3. Passive Activity and Grouping Disclosures

Partnerships often disclose whether:

- The income relates to a passive activity

- The partner materially participates

- Activities have been grouped for tax reporting purposes (under Reg. §1.469-4)

Why it matters: Determines if income/loss is subject to the Passive Activity Loss (PAL) rules under Section 469.

4. Foreign Transactions and Credits

For partnerships involved in international operations or investments, they must disclose:

- Foreign source income

- Foreign taxes paid

- Type of income (general or passive)

- Applicable foreign country codes

Why it matters: Required for claiming a foreign tax credit on Form 1116.

5. State Apportionment and Source Income

If the partnership does business in multiple states, it may provide:

- A breakdown of income by state or locality

- Apportionment percentages used for state income tax reporting

Why it matters: Allows partners to properly file state tax returns and avoid over- or under-reporting income at the state level.

6. AMT (Alternative Minimum Tax) Items

Partners subject to the AMT may need:

- Adjustments to depreciation

- Preference items (e.g., tax-exempt interest from private activity bonds)

- Other adjustments required for Form 6251 (AMT)

Why it matters: These details help determine if the partner owes AMT tax in addition to regular tax.

7. Partner-Specific Footnotes

Sometimes, footnotes are used to:

- Clarify special allocations made under the partnership agreement

- Disclose debt guarantees or capital commitments

- Provide explanations for code references listed in Part III of the K-1 (e.g., Box 20 codes)

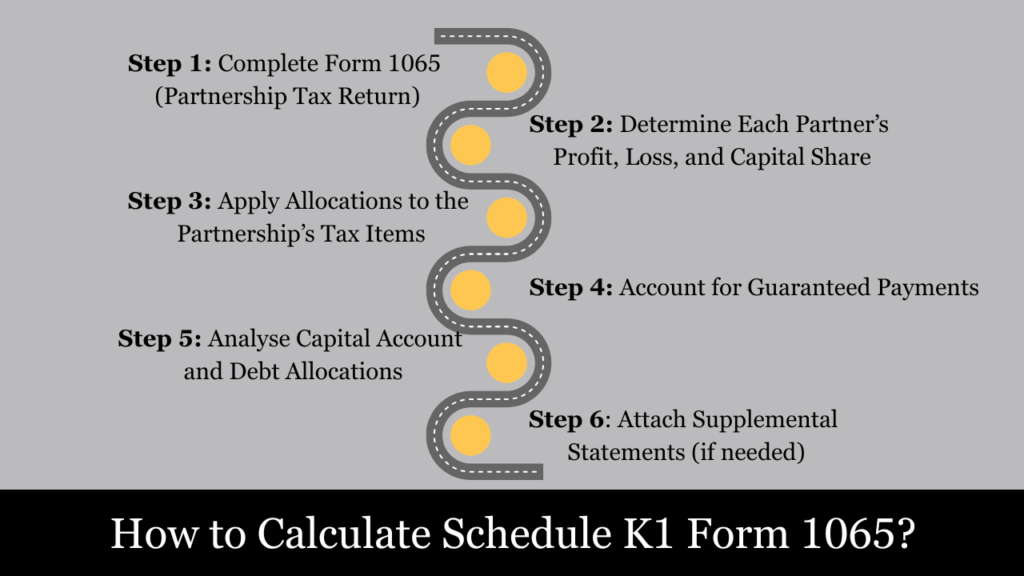

How to Calculate Schedule K1 Form 1065: A Step-by-Step Breakdown

Schedule K-1 is not something partners calculate themselves. Instead, it’s prepared by the partnership or LLC taxed as a partnership, based on the overall results reported on IRS Form 1065. The K-1 reflects each partner’s pro rata or specially allocated share of the partnership’s taxable items.

Here’s a step-by-step breakdown of how to calculate and prepare a Schedule K-1:

Step 1: Complete Form 1065 (Partnership Tax Return)

The partnership begins by preparing Form 1065, which reports the total:

- Gross receipts or sales

- Cost of goods sold

- Business expenses (wages, rent, depreciation, etc.)

- Net ordinary business income or loss

- Other items such as capital gains, dividend income, interest, credits, and deductions

Purpose: This form reflects the entity’s total financial activity for the year. The Schedule K portion of Form 1065 aggregates all tax-relevant items for allocation.

Step 2: Determine Each Partner’s Profit, Loss, and Capital Share

he allocation of each partner’s share is generally defined by the terms set forth in the partnership agreement. The agreement defines:

- Ownership percentages (may differ for profits, losses, and capital)

- Any special allocations (e.g., a 60/40 profit split despite 50/50 ownership)

- Treatment of guaranteed payments, capital contributions, and debt

Tip: Percentages used to calculate each K-1 don’t always match legal ownership — they follow tax allocation rules under Section 704(b).

Step 3: Apply Allocations to the Partnership’s Tax Items

Now that total income and partner percentages are known, the partnership allocates each line item from the Schedule K (of Form 1065) to the partners.

Example Allocation:

- Partnership net ordinary income: $100,000

- Partner A has a 60% profit interest

- Partner B has a 40% profit interest

Partner A’s K-1, Box 1 (Ordinary business income) = $60,000

Partner B’s K-1, Box 1 = $40,000

This process is repeated for all applicable boxes on Schedule K-1, including:

- Interest income

- Dividend income

- Capital gains/losses

- Section 179 deductions

- Charitable contributions

- Foreign tax credits

- AMT preference items

Step 4: Account for Guaranteed Payments

Guaranteed payments to partners are similar to salaries but are not based on profits. These payments are:

- Claimed as a deduction by the partnership and reported on Line 10 of Form 1065.

- Taxable to the receiving partner (reported in Box 4 of K-1)

Example: If Partner B receives a guaranteed payment of $15,000, that amount is added to their K-1 income and is subject to self-employment tax.

Step 5: Analyse Capital Account and Debt Allocations

Each K-1 must also include a capital account analysis, which reports:

- Beginning capital

- Contributions made

- Share of income/loss

- Withdrawals/distributions

- Ending capital

Partnerships are also required to distribute both recourse and nonrecourse liabilities among the partners in accordance with IRS rules.. These affect:

- Tax basis

- At-risk limits

- Deductibility of losses

Example: If the partnership took out a $100,000 loan, it must determine how much of that debt increases each partner’s basis.

Step 6: Attach Supplemental Statements (if needed)

If applicable, the partnership must include additional statements, such as:

- QBI (Section 199A) allocations

- Basis limitations

- Passive activity grouping

- Foreign tax detail

- State-specific income allocations

These aren’t calculated directly on the K-1 form but are necessary for the partner’s proper reporting.

Summary of K-1 Calculation Formula (Simplified):

For each line item:

Partner Allocation = Total Amount on Form 1065 Schedule K × Partner’s Allocation Percentage

Apply this formula to all income, deductions, credits, and other items required for Schedule K-1.

Example Scenario:

Facts:

- Two partners (A and B), each with 50% interest

- The partnership reports $120,000 in net business income, $20,000 in interest earnings, and $10,000 in contributions to charity.

- Partner A receives $10,000 guaranteed payment

Partner A’s K-1:

- Box 1: $60,000 (50% of $120K)

- Box 4: $10,000 (guaranteed payment)

- Box 5: $10,000 (50% of interest)

- Box 13: $5,000 charitable contributions

- Total share of taxable income: $85,000

Partner B’s K-1:

- Box 1: $60,000

- Box 5: $10,000

- Box 13: $5,000

- No guaranteed payment

Final Notes:

- Schedule K-1 calculations must follow the partnership agreement and the Internal Revenue Code (especially Sections 704, 705, and 752).

- Calculations can be complex when tiered partnerships, loss limitations, or special allocations are involved.

- Tax software or professional help is often used for accuracy and compliance.

Key Reporting Requirements for Partners (Schedule K1 Form 1065)

When a partner receives a Schedule K-1 from Form 1065, they are legally required to report the information on their own tax return—regardless of whether they received any actual cash distributions. The U.S. tax system treats partnership income as pass-through income, meaning it is taxable to the partner, not the partnership.

To comply with IRS requirements, partners must carefully report the items shown on the K-1 in the correct manner and on the correct tax forms. The following outlines the essential reporting responsibilities.

1. Report Income on Schedule E (Form 1040)

For individual partners, most K-1 income is reported on Schedule E, Part II, of Form 1040. This includes:

- Ordinary business income (Box 1)

- Rental real estate income (Box 2)

- Other rental income (Box 3)

- Guaranteed payments (Box 4)

Important Note: Even if no cash is received, all allocated income must still be reported.

2. Capital Gains and Losses: Filing Requirements Using Schedule D and Form 8949

If the K-1 includes:

- Short-term capital gains (Box 8)

- Long-term capital gains (Box 9a)

The partner must report these on Schedule D and, if applicable, Form 8949, detailing each transaction.

3. Handle Dividends, Interest, and Royalties on Proper Schedules

Partners must also report:

- Interest income (Box 5) – Reported on Schedule B

- Dividends (Box 6a-c) – Qualified and ordinary, also on Schedule B

- Royalty income (Box 7) – Typically flows to Schedule E

These are taxed similarly to if the partner received them directly.

4. Apply Loss Limitations (Basis, At-Risk, and Passive)

Partners must evaluate whether losses reported on the K-1 are currently deductible, based on:

- Tax basis limitation (IRC §704(d))

- At-risk limitation (IRC §465)

- Passive activity loss limitation (IRC §469)

If the partner lacks sufficient basis or does not materially participate, losses may be suspended and carried forward.

Common Forms Used:

- Form 6198 (At-Risk)

- Form 8582 (Passive Loss Limitations)

5. Track and Report Distributions

Partners must account for:

- Cash or property distributions (Box 19)

- If distributions exceed the partner’s basis, the excess is taxed as a capital gain

- Every distribution should be matched against the partner’s capital account and adjusted basis to ensure accurate reporting.

6. Qualified Business Income (QBI) Reporting

If the partnership is a qualified trade or business, partners will receive a QBI statement. Partners use this data to:

- Calculate the Section 199A deduction (up to 20% of QBI)

- Report on Form 8995 or 8995-A, depending on income thresholds and complexity

The K-1 itself does not provide the QBI deduction, only the relevant inputs.

7. Report Foreign Transactions and Credits

If foreign income or taxes are reported (e.g., Box 16), the partner may need to:

- File Form 1116 (Foreign Tax Credit)

- Comply with FBAR (FinCEN 114) or FATCA (Form 8938) if foreign assets are held

8. Apply AMT Adjustments

Certain partnership items may trigger Alternative Minimum Tax reporting, such as:

- Tax-exempt interest from private activity bonds

- Accelerated depreciation differences

These are reported on Form 6251, based on Box 17 items with code identifiers.

9. Report Self-Employment Income and Pay SE Tax

Income reported in Boxes 1 and 4—ordinary business income and guaranteed payments—is generally subject to self-employment tax. Individual partners must:

- Calculate this on Schedule SE (Form 1040)

- Include this liability with their total tax due

10. Maintain Accurate Basis Records

While the K-1 provides helpful basis info, the IRS holds the partner responsible for maintaining:

- Tax basis in the partnership

- Capital account reconciliations

- Adjustments from distributions, income, contributions, and debt allocations

If the partner disposes of their interest or receives large distributions, this basis info determines the taxability.

Summary of Key Forms and Where K-1 Data Flows:

| Form | Used For |

| Schedule E (Form 1040) | Partnership income & losses |

| Schedule D / Form 8949 | Capital gains and losses |

| Schedule B | Interest and dividends |

| Schedule SE | Self-employment tax |

| Form 1116 | Foreign tax credit |

| Form 8582 | Passive activity loss limitations |

| Form 8995 / 8995-A | QBI deduction |

| Form 6251 | Alternative Minimum Tax (AMT) |

| Form 6198 | At-risk loss limitations |

Filing Deadlines for Schedule K1 Form 1065

Schedule K1 Form 1065 is included as part of the partnership’s overall tax return and is not submitted as a standalone form to the IRS. Timely preparation and delivery of each partner’s K-1 is essential to ensure partners can file their own returns accurately and on time.

Let’s break down the key deadlines:

1. Partnership Filing Deadline – Form 1065 & Schedule K-1

For calendar-year partnerships, the filing deadline is:

Due by March 15 of the year after the tax year ends, unless it falls on a weekend or holiday—in which case the next business day applies.

- This deadline applies to filing Form 1065 with the IRS.

- It also serves as the deadline to furnish each partner with their Schedule K-1.

Example: For tax year 2024, the deadline to file Form 1065 and issue K-1s is March 17, 2025 (March 15 falls on a Saturday).

2. Extension of Time to File – Form 7004

If the partnership cannot meet the March 15 deadline, it may request an extension using:

Form 7004 – is used to request an automatic extension for filing various business income tax and information returns.

- Grants a 6-month extension for Form 1065 and Schedule K-1 filing.

- Extended deadline is typically:

For calendar-year partnerships, the extended filing deadline falls on September 15 of the same tax year.

Note: While the IRS grants an extension to file, there is no extension to provide the K-1s to partners unless the extension is filed. Partnerships should still aim to issue preliminary K-1 data early if partners need it for their returns.

3. Individual Tax Filing Deadline for Partners (Form 1040)

Using Schedule K-1 to Report Partnership Income on Your Tax Return

April 15 is the deadline for most individual taxpayers to file Form 1040.

If the partner doesn’t receive their K-1 by then:

- They may file for an extension using Form 4868, which provides until October 15 to file.

- However, estimated taxes owed are still due by April 15 to avoid penalties and interest.

4. Special Situations That May Affect Deadlines

- Fiscal-Year Partnerships: If the partnership operates on a fiscal year (e.g., July 1 – June 30), its Form 1065 and K-1s are due by the 15th day of the third month after the end of the fiscal year.

- Foreign Partnerships with U.S. Partners: Additional reporting and filing requirements may apply, including Forms 8865 or 5471, depending on ownership structure and foreign activity.

- Late Filing Penalties: Failure to file Form 1065 or issue K-1s on time can lead to an IRS penalty of $220 per partner per month, up to 12 months (IRC §6698).

Penalties for Non-Compliance with Schedule K-1 (Form 1065)

The IRS imposes strict rules and penalties to ensure partnerships properly file Form 1065 and timely furnish Schedule K-1s to each partner. These penalties are designed to encourage accurate and transparent reporting of pass-through income.

Non-compliance can occur in several forms — including late filing, failure to furnish K-1s, incomplete or inaccurate information, and intentional disregard. Let’s explore each category and its consequences:

1. Late Filing of Form 1065

If a partnership fails to file Form 1065 by the due date (including extensions), the IRS imposes a penalty per partner, per month.

Penalty Amount (2025 Tax Year):

$235 per partner, per month, up to 12 months

(Penalty is adjusted annually for inflation)

Example: If a partnership with 4 partners files 3 months late:

- Penalty = 4 × $235 × 3 = $2,820

2. Failure to Furnish Schedule K-1s to Partners

Each partner must receive a Schedule K-1 by the due date of the partnership return (usually March 15). If the K-1 is not furnished, the same penalty applies as for late Form 1065 filing.

- Penalty: $235 per K-1 not provided, per month (up to 12 months)

Note: Additional Penalties Apply Beyond Late Filing of Form 1065.

3. Filing Incomplete or Inaccurate Information

IRS Penalties for Inaccurate or Missing Schedule K-1 Information:

- Is missing required details (e.g., partner’s name, TIN)

- Contains incorrect allocations

- Is not prepared in accordance with the partnership agreement or tax law

Penalty for Incorrect Information:

- $310 per K-1 with incorrect or missing information

- Increased to $630 per K-1 if the IRS finds intentional disregard

4. Intentional Disregard of Filing Requirements

If a partnership willfully ignores its obligation to file Form 1065 or provide K-1s, the IRS can assess significantly higher penalties:

- Penalty can exceed $630 per return or K-1

- No cap on total penalty amount

- May include additional civil penalties or even criminal enforcement for fraud

5. State-Level Penalties (If Applicable)

States that require pass-through entity filings (e.g., California, New York, Illinois) may impose:

- Separate filing fees

- Penalties for late or missing K-1 equivalents

- Minimum franchise or entity-level taxes

Tip: State penalties can compound federal ones, especially in multi-state partnerships.

Conclusion

Schedule K-1 (Form 1065) is a cornerstone of the U.S. pass-through tax system, ensuring that each partner in a partnership accurately reports their share of income, deductions, credits, and other tax attributes. While the form itself may appear straightforward, its preparation and interpretation require a clear understanding of partnership agreements, IRS allocation rules, and individual partner tax situations.

Timely issuance of Schedule K-1s, along with accurate and complete reporting on individual or business returns, is essential for maintaining compliance and avoiding IRS penalties. Whether you’re a general partner, limited partner, or member of an LLC treated as a partnership, your responsibilities extend beyond simply receiving the form — they include correctly integrating its contents into your tax filing strategy.

By understanding the structure, deadlines, reporting requirements, and potential penalties associated with Schedule K-1, partners can make informed decisions, maximize tax efficiency, and stay aligned with federal and state tax laws.

Frequently Asked Questions (FAQs)

Do I need to report my K-1 if I didn’t receive any distributions?

Yes. Schedule K-1 reports taxable income, not just cash received. You are required to report all income shown on your K-1, even if you did not receive any money during the year.

When will I receive my K-1 from the partnership?

Partnerships are required to furnish Schedule K-1 to partners by March 15 of the year after the tax year ends, or the next business day if that date falls on a weekend or holiday. If the partnership files an extension, the extended deadline is September 15.

What happens if I don’t receive my K-1 before the April 15 tax deadline?

To extend the deadline for filing your individual tax return, you can submit Form 4868 to the IRS, you must still pay any estimated tax due by April 15 to avoid penalties and interest.

Are Schedule K-1 amounts subject to self-employment tax?

Yes, in most cases. Ordinary business income (Box 1) and guaranteed payments (Box 4) are generally subject to self-employment tax, unless the partner is a limited partner or passive investor.

Can I deduct losses shown on my K-1?

Maybe. Losses may be limited by:

-Your basis in the partnership

-The at-risk rules (Form 6198)

-The passive activity loss limitations (Form 8582)

Losses that are not currently deductible may usually be carried forward to offset income in future tax years..

What if there are errors on my K-1?

Contact the partnership immediately. If a correction is needed, the partnership must file an amended Form 1065 and issue a corrected Schedule K-1.

Do I need to attach my K-1 to my tax return?

Not usually. Individuals generally do not attach K-1s to Form 1040 when e-filing, but you must retain it for your records and use it to fill out related forms (e.g., Schedule E). However, corporate or fiduciary returns may require attachment depending on filing type.

What forms might I need along with Schedule K-1?

Depending on what’s reported on your K-1, you may need:

–Schedule E (for income/loss)

–Schedule SE (for self-employment tax)

–Form 1116 (foreign tax credit)

–Form 8949 & Schedule D (capital gains)

–Form 8995 or 8995-A (QBI deduction)

–Form 6198 (at-risk rules)

–Form 8582 (passive loss limitations)