New York Estimated Tax Payments: An Honest Review

Table of Contents

A Complete Synopsis On NY Estimated Tax Payments

If you reside in New York or have income from New York sources and anticipate owing $300 or more in state tax after accounting for withholding and credits, you’re typically. Obligated to submit estimated tax payments to the New York State Department of Taxation and Finance. These payments help ensure that you meet your state tax obligations throughout the year rather than paying a large lump sum at the time of filing.

Estimated taxes are especially important for self-employed individuals, freelancers, landlords, gig economy workers, and retirees with taxable pension or investment income. New York requires these payments to be made quarterly and provides a variety of methods to make the process convenient and efficient.

Who Must Make New York Estimated Tax Payments?

In New York, estimated tax payments aren’t required for all taxpayers. But if your income isn’t withheld or the withholding is insufficient, you may be legally required to make estimated tax payments. The state uses specific thresholds and conditions to determine whether you must make these quarterly prepayments. These rules primarily affect self-employed individuals, freelancers, investors, retirees, and others with non-wage income.

General Rule for Individuals

You must make estimated tax payments to New York State if both of the following conditions are met:

- You expect to owe at least $300 in New York State income tax after subtracting tax withheld and any refundable credits.

- You had a New York State income tax liability in the previous year, unless your total tax was zero and you were a full-year resident for that year.

This threshold applies to residents, part-year residents, and nonresidents with income sourced from New York (such as rental income, business income, or sale of New York property).

Types of Taxpayers Who Typically Must Pay Estimated Tax

1. Self-Employed Individuals & Freelancers

People earning income from sole proprietorships, gig work, or consulting services typically have no tax withheld from their payments. If they operate in or have clients in New York, they may owe estimated tax based on that income.

2. Landlords and Real Estate Investors

Rental income from properties located in New York, especially for out-of-state landlords, triggers a New York tax obligation. If the net rental income exceeds your deduction and credit thresholds, you may need to make quarterly payments.

3. Investors and High-Net-Worth Individuals

Capital gains, dividends, and interest are not subject to New York withholding. If you realize large investment gains—particularly from New York-based assets—you could be liable for estimated taxes.

4. Retirees

Although some pension income is exempt, IRA distributions, annuities, and retirement withdrawals are often taxable. Retirees living in New York—or receiving taxable income from New York sources—may need to make quarterly payments if no withholding is applied.

5. Unemployed Individuals with No Withholding

If you collect unemployment benefits that are not subject to adequate state tax withholding, and you don’t have other credits to offset it, you might cross the $300 threshold and need to pay estimated tax.

6. S Corporation Shareholders and Partners

If you’re a New York resident receiving flow-through income from an S corporation or partnership—even one operating outside the state—that income is generally taxable in New York and may require quarterly payments.

Special Note for Non-residents

Nonresidents must also make estimated tax payments if they receive New York-source income and meet the same $300 liability threshold. Common New York-source income for nonresidents includes:

- Rental income from NY real estate

- Income from NY-based businesses

- Capital gains from selling NY real property

Exceptions to the Rule

In most cases, you’re not required to make estimated tax payments if any of the following apply

- You expect your total New York tax liability to be less than $300

- You were a full-year resident last year and had no New York State income tax liability

- Your income is entirely from wages and adequate withholding is being made by your employer

- You qualify for withholding on other income sources, like pensions, which cover your tax liability

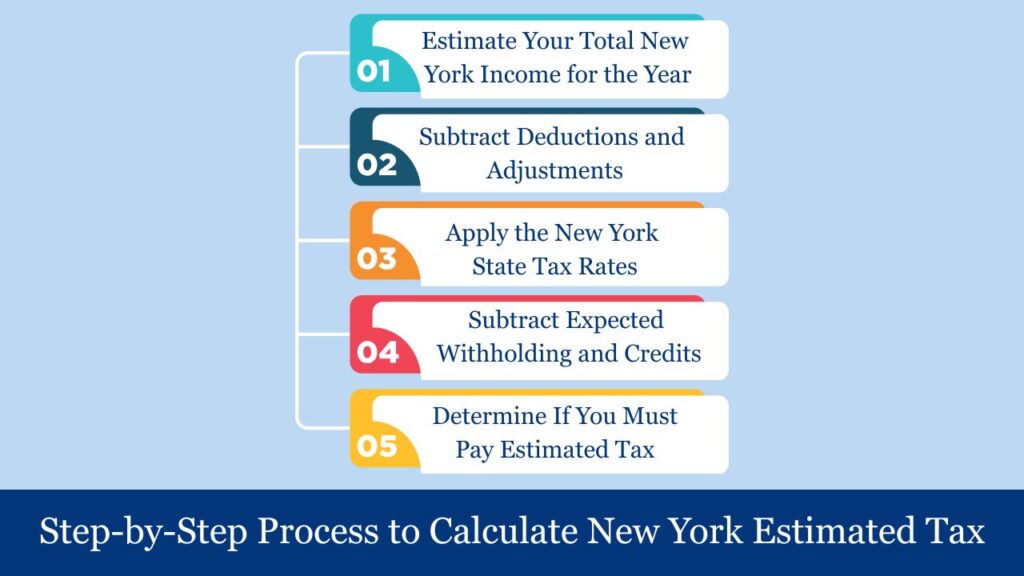

Step-by-Step Process to Calculate New York Estimated Tax

1. Estimate Your Total New York Income for the Year

Begin by projecting all income you expect to earn for the full tax year that is subject to New York State tax. This includes:

- Wages and salaries (if NY resident)

- Self-employment or business income

- Rental income from NY property

- Investment income (interest, dividends, capital gains)

- Retirement distributions (IRAs, pensions)

- Unemployment compensation

- Flow-through income from S corps or partnerships (if NY source)

For part-year residents or nonresidents, include only income that is New York-sourced.

2. Subtract Deductions and Adjustments

Next, reduce your income using applicable deductions:

- For the 2024 tax year, the standard deduction is $8,000 for single filers and $16,050 for those filing jointly as married.

- Itemized deductions (such as mortgage interest, property taxes, and medical expenses, if higher than the standard deduction)

- Adjustments may include contributions to accounts like a traditional IRA or a health savings account (HSA).

This calculation results in your New York adjusted gross income (AGI).

3. Apply the New York State Tax Rates

Use the New York income tax brackets for the current tax year to calculate your estimated liability. For 2024, rates range from 4% to 10.9%, depending on your income level and filing status.

Example

A single filer earning $80,000 in taxable income would pay approximately:

- 4% on the first $8,500

- 4.5% on income from $8,501 to $11,700

- 5.25% on income from $11,701 to $13,900

- 5.9% on income from $13,901 to $21,400

- 5.97% on income from $21,401 to $80,650 (with the remaining taxed accordingly)

Add each bracket’s result to calculate your total New York income tax liability.

4. Subtract Expected Withholding and Credits

Now subtract the amount of New York State tax you expect to be withheld during the year (e.g., from your job or pension). Also subtract:

- Available tax credits, such as the Empire State Child Credit, Real Property Tax Credit, or College Tuition Credit

- Any overpayments from the previous year that you applied toward this year’s liability

This results in your net tax due for the year.

5. Determine If You Must Pay Estimated Tax

If your net tax liability (after withholdings and credits) is $300 or more, you are required to make estimated payments. Divide the net liability into four equal quarterly payments unless you plan to use the annualized income method (helpful for seasonal earners).

Example Calculation

Let’s say you’re a single self-employed consultant living in New York:

- Estimated income: $85,000

- Standard deduction: $8,000

- Taxable income: $77,000

- Estimated NY tax (progressive rates): Approx. $4,150

- Expected withholding: $0

- Tax credits: $100 (e.g., household credit)

Net liability = $4,150 – $100 = $4,050

Since $4,050 exceeds $300, you must make estimated tax payments of $1,012.50 per quarter (April, June, September, January).

Optional: Use the Annualized Income Method

If your income varies throughout the year—such as a freelancer who earns more in certain months—you can file based on actual earnings per quarter using the annualized income installment method. This helps ensure you neither overpay nor underpay your estimated taxes during the early quarters

Use Form IT-2105-I and Form IT-2105.9 to apply this method or consult a tax advisor.

New York Estimated Tax Due Dates

If you’re required to make New York State estimated tax payments, it’s essential to understand the quarterly due dates to avoid penalties and interest. New York adopts a quarterly estimated tax schedule similar to the IRS, dividing the year into four payment periods. Each due date corresponds to a specific segment of the calendar year and is designed to ensure that taxes are paid as income is earned.

Standard Quarterly Schedule for Individuals

| Quarter | Income Period Covered | Estimated Tax Due Date |

| Q1 | January 1 – March 31 | April 15 (or next business day) |

| Q2 | April 1 – May 31 | June 17 |

| Q3 | June 1 – August 31 | September 16 |

| Q4 | September 1 – December 31 | January 15 (following year) |

Note: When a due date lands on a weekend or legal holiday, it is automatically extended to the following business day.

Why Due Dates Matter

Timely estimated payments help you:

- Avoid underpayment penalties and late fees

- Manage your cash flow by spreading tax payments throughout the year

- Stay compliant with New York State tax requirements

Missing or underpaying even one quarter could result in an underpayment penalty, unless you qualify for a safe harbor exception (e.g., paying 100% of prior year’s liability or 90% of the current year’s tax).

How to Make New York Estimated Tax Payments?

Paying New York State estimated taxes is essential if you earn income not subject to sufficient withholding—such as from self-employment, rental properties, investments, or pension distributions. New York offers several convenient methods to submit your quarterly estimated payments. Whether you prefer digital tools, paper vouchers, or using tax software, the state has options to fit your needs.

1. Paying Online Through the New York State Tax Website

The fastest, most secure, and highly recommended method to pay your New York estimated taxes is online via the New York State Department of Taxation and Finance website. Taxpayers can log in to their Individual Online Services account or use the quick payment option without logging in. Payments can be made using a bank account (ACH) for free or with a credit/debit card for a small processing fee. This method provides an instant confirmation and the flexibility to schedule future payments, making it ideal for those who want peace of mind and easy tracking.

2. Paying by Mail Using Form IT-2105

For individuals who prefer traditional methods, New York allows estimated tax payments by mail using Form IT-2105, the official estimated tax voucher. Taxpayers must print and complete the appropriate quarterly voucher and mail it along with a check or money order payable to “NYS Income Tax.” It’s crucial to write your Social Security Number, tax year, and “IT-2105” on the check to ensure proper processing. While slower than online payment, this method is useful for taxpayers who prefer maintaining physical records of their transactions.

3. Paying Through Tax Preparation Software

Many taxpayers opt to pay their New York estimated taxes using authorized tax preparation software such as TurboTax®, H&R Block®, or TaxAct®. These programs help calculate your estimated payments and allow you to electronically file Form IT-2105 directly through the platform. Additionally, most software supports electronic payments via direct bank withdrawal, making the process seamless for users who are already handling federal and state returns within the same system.

4. Setting Up Automatic Recurring Payments

Taxpayers can take advantage of New York’s Online Services portal to set up automatic recurring payments for their estimated taxes. This feature allows users to establish a fixed schedule for quarterly debits from their bank account, ensuring that payments are never missed. It’s particularly helpful for retirees, self-employed individuals, or anyone managing irregular income, as it reduces the need for manual tracking and last-minute payments each quarter.

5. Aligning Payments With Federal Estimated Tax Schedule

Although New York State and the IRS operate separate systems, it’s smart for individuals paying federal estimated taxes to synchronize their state estimated payments with the federal calendar. This not only simplifies recordkeeping but also makes it easier to plan cash flow. Paying New York estimated taxes alongside Form 1040-ES installments ensures you stay organized and avoid missing any critical deadlines across jurisdictions.

Penalties for Underpayment or Late Payment of New York Estimated Taxes

If you fail to make timely and sufficient New York estimated tax payments, the state may impose penalties and interest for underpayment or late payment. These penalties generally apply when your total estimated tax payments and withholding are less than 90% of your current year’s tax liability, or less than 100% (or 110% for higher-income taxpayers) of your prior year’s tax liability, whichever is lower. The underpayment penalty is calculated based on the amount you underpaid and the number of days the payment was late, using the state’s annualized interest rate.

Even if you pay the full amount owed at year-end, missing the required quarterly installments can still trigger penalties. To avoid this, it’s important to estimate accurately, pay on time, and adjust your payments if your income increases during the year.

Conclusion

Making accurate and timely New York estimated tax payments is essential for individuals with income not subject to regular withholding—such as freelancers, landlords, retirees, and investors. Understanding how to calculate your estimated liability, knowing when to pay, and choosing a convenient payment method can help you stay compliant and avoid costly penalties. Whether you prefer paying online, by mail, or through tax software, New York State offers flexible options to meet your needs. Consistently tracking your income and adjusting payments throughout the year ensures a smooth year-end tax filing experience.

FAQs – New York Estimated Tax Payments

Who needs to pay estimated taxes in New York?

Individuals expecting to owe $300 or more in New York State tax after accounting for withholding.

When are New York estimated taxes due?

Payments are due quarterly—on April 15, June 17, September 16, and January 15 (or the next business day if a due date falls on a weekend or holiday).

What form do I use to mail in a payment?

Use Form IT-2105, the Estimated Tax Payment Voucher, if mailing a check or money order to the New York State Tax Department.

Is there a penalty for underpayment?

Yes, If you underpay or miss a due date, New York may charge interest and penalties, even if you pay the total amount due when filing your return.