California Estimated Tax Payments: An Amazing Review In 2025

Table of Contents

California Estimated Tax Payments: A Complete Step By Step Guide

California Estimated tax payments are advance periodic payments made to the California Franchise Tax Board (FTB) to cover the state income tax on income that isn’t subject to withholding. These payments help taxpayers stay current with their tax liabilities throughout the year and avoid large balances due at tax time.

Unlike wages (where tax is withheld by an employer), many forms of income require taxpayers to proactively estimate and pay taxes quarterly. These include:

- Self-employment income (freelancers, consultants, gig workers)

- Rental income

- Investment earnings (interest, dividends, capital gains)

- Retirement distributions (IRAs, pensions)

- Trust and estate income

- Business income from partnerships, S corps, or sole proprietorships

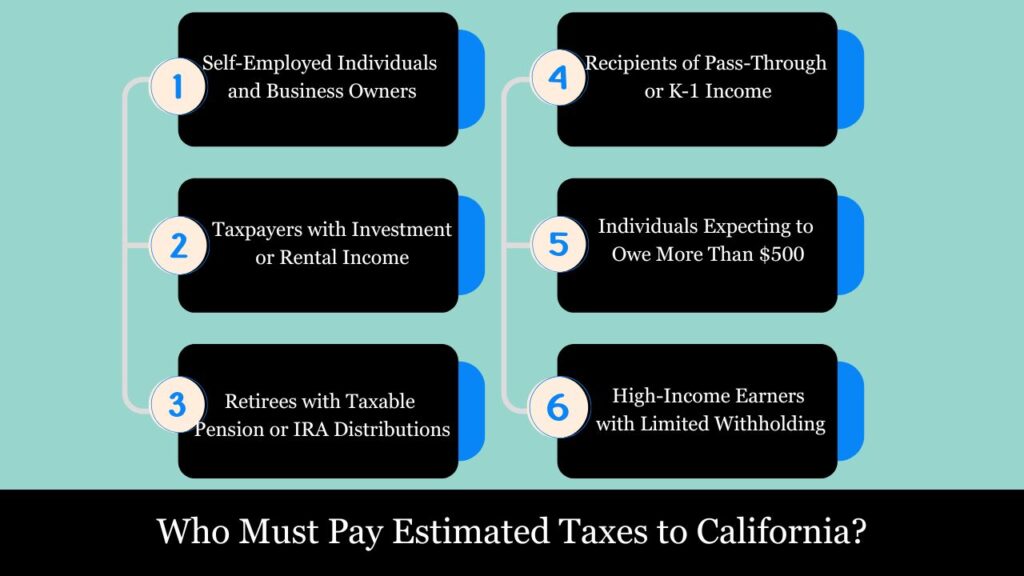

Who Must Pay Estimated Taxes to California?

Estimated taxes are prepayments made to the California Franchise Tax Board (FTB) to cover anticipated income tax liability throughout the year. The state requires certain taxpayers—especially those with non-wage income—to make these quarterly payments to avoid penalties and interest. Let’s break down who is obligated to pay estimated taxes in California:

1. Self-Employed Individuals and Business Owners

If you operate as a sole proprietor, independent contractor, freelancer, or run your own business, your income typically does not have tax automatically withheld. In such situations, you must estimate your tax liability and remit payments to the state on a quarterly basis.

Examples:

- Freelance designers and writers

- Uber drivers or delivery workers

- Consultants, photographers, or real estate agents

2. Taxpayers with Investment or Rental Income

If you earn dividends, interest, capital gains, or income from rental properties, and taxes aren’t withheld by a payer or management company, you may need to make estimated payments to California.

Examples:

- Earning interest from high-yield savings accounts or bonds

- Receiving dividends from stocks or mutual funds

- Selling real estate for profit

- Owning rental property in California

3. Retirees with Taxable Pension or IRA Distributions

Individuals receiving Social Security, pension distributions, or IRA withdrawals may owe estimated taxes if those payments don’t have sufficient withholding or are partially taxable in California.

4. Recipients of Pass-Through or K-1 Income

If you are a partner in a partnership, a member of an LLC, or an S corporation shareholder, and receive California-source income reported on a Schedule K-1, you may need to make estimated tax payments on your share of the entity’s profits.

5. Individuals Expecting to Owe More Than $500

California requires estimated tax payments when:

- You expect to owe $500 or more ($250 if married/RDP filing separately) in state income tax for the year after subtracting credits and withholding, and

- The combined amount of your tax withholdings and credits falls short of the required threshold:

- 90% of your current year’s total tax liability, or

- 100% of your prior year’s tax liability (or 110% if your adjusted gross income (AGI) was over $150,000—or $75,000 if married filing separately)

6. High-Income Earners with Limited Withholding

Even if you are a W-2 employee, you may be required to pay estimated taxes if:

- Your employer does not withhold enough California state tax, and

- You have side income, bonuses, or other untaxed income streams

Example:

A tech employee receiving a large year-end bonus or RSU (Restricted Stock Units) with insufficient withholding may face a shortfall, requiring estimated payments to avoid underpayment penalties.

Who Does Not Need to Pay Estimated Taxes?

In most cases, you’re not required to make estimated tax payments if certain conditions are met.:

- You had no California tax liability in the prior year,

- You maintained full-year residency in California.,

- You expect your withholding and refundable credits to cover 100% of your total tax liability, or

- Your non-wage income is minimal and will not result in taxes owed beyond the $500 threshold.

California Estimated Tax Payment Deadlines

Taxpayers who expect to owe California state income tax must pay estimated taxes in four quarterly installments throughout the tax year. These payments are due to the California Franchise Tax Board (FTB) and help taxpayers avoid penalties for underpayment.

Unlike the federal IRS schedule, California does not divide estimated tax payments into equal quarters. Instead, the state uses a special payment allocation formula.

Breakdown of Deadlines and Percentages

| Installment | Due Date | Percentage of Estimated Annual Tax | Notes |

| 1st Payment | April 15 | 30% of the year’s total liability | Covers the first quarter and a portion of the second quarter |

| 2nd Payment | June 15 | 40% (cumulative, not additional) | Must bring total paid up to 70% of total estimated tax |

| 3rd Payment | September 15 | 0% | California does not require a 3rd quarter payment |

| 4th Payment | January 15 of the following year | 30% | Final installment to bring total payments to 100% |

Example of Payment Timing (Tax Year 2025)

Let’s assume your estimated total California tax for 2025 is $10,000. Here’s when and how much you’d need to pay:

- April 15, 2025 → $3,000 (30%)

- June 15, 2025 → $4,000 (additional $1,000 to reach 70%)

- September 15, 2025 → No payment due

- January 15, 2026 → $3,000 (final 30%)

Penalty Warning: Late or Underpaid Installments

Failing to pay by the proper deadlines—or underpaying—can trigger penalties and interest. These are calculated based on the unpaid portion of each installment and accrue daily until full payment is made.

The FTB generally charges:

- 5% penalty per month on underpaid taxes (up to 25%)

- Daily interest at the current state rate

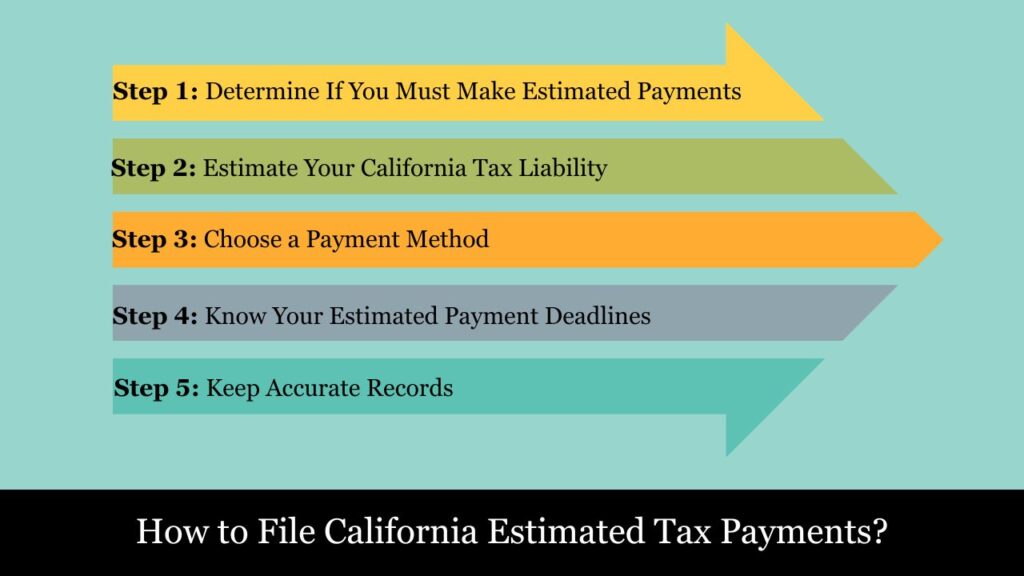

How to File California Estimated Tax Payments? – Complete and Descriptive Guide

If you’re a California resident or nonresident earning income sourced to California without adequate withholding, the Franchise Tax Board (FTB) requires you to make estimated tax payments throughout the year. These payments help taxpayers meet their tax obligations in a timely manner and avoid underpayment penalties.

This guide walks you through everything — from determining whether you must pay, calculating your payments, choosing how to file, deadlines, and recordkeeping best practices.

Step 1: Determine If You Must Make Estimated Payments

You are required to pay California estimated taxes if all of the following apply:

- You expect to owe at least $500 in tax for the year after subtracting withholding and credits ($250 if married/RDP filing separately).

- Your withholding and credits are expected to be less than 90% of your current year’s total tax liability, or 100% of your prior year’s total tax liability (110% if AGI > $150,000).

Common scenarios requiring estimated payments:

- Self-employed individuals with no tax withheld.

- Landlords receiving rental income.

- Investors receiving capital gains or dividends.

- Retirees with pensions or Social Security not subject to withholding.

Step 2: Estimate Your California Tax Liability

To accurately determine how much to pay each quarter:

- Estimate total gross income from all sources — wages, self-employment, investment income, rental income, etc.

- Subtract adjustments and either the standard deduction or itemized deductions.

- Use the California state tax rate schedule to calculate estimated tax.

- Subtract expected withholding and refundable credits.

- Divide your estimated tax into scheduled installment percentages.

You may use:

- Form 540-ES Worksheet (from FTB)

- FTB’s online Estimated Tax Calculator

- Professional tax software or services

Step 3: Choose a Payment Method

California offers several ways to file and pay estimated taxes:

Option 1: Pay Online Using FTB Web Pay (Most Efficient)

- Go to: https://www.ftb.ca.gov

- Select “Web Pay” for individuals or businesses.

- You have the option to make payments directly from your bank account.

- You may schedule future payments and print confirmations.

- No fees apply for Web Pay.

Option 2: Pay by Mail Using Form 540-ES

- Download and print the Form 540-ES payment vouchers.

- Enter your full name, Social Security Number, applicable tax year, and the amount you’re paying.

- Attach a check or money order made payable to Franchise Tax Board.

- Mail each voucher separately by the appropriate due date.

Mailing Address:

Franchise Tax BoardPOBox942867

Sacramento, CA94267-0008

Option 3: Through Tax Software or a Tax Professional

- Most commercial tax software allows for e-filing estimated payments.

- Your CPA, EA, or tax attorney can prepare and submit Form 540-ES electronically or by mail on your behalf.

Step 4: Know Your Estimated Payment Deadlines

California requires four installment payments each year:

| Installment | Due Date | Amount Due |

| 1st Installment | April 15 | 30% of total estimated tax |

| 2nd Installment | June 15 | 40% cumulative (additional 10%) |

| 3rd Installment | Not Required | California does not require this |

| 4th Installment | January 15 (next year) | Remaining 30% |

Important: Even though there’s no third payment, you must still ensure you meet the 90%/100% safe harbor rule cumulatively by year-end.

Step 5: Keep Accurate Records

Good documentation protects you in the event of an audit or IRS/FTB inquiry. Maintain copies of:

- All Form 540-ES payment vouchers and mailing receipts

- Web Pay confirmations (PDF or printed)

- Bank statements reflecting estimated payments

- Year-to-date calculations for tax liability

Optional: Apply Refunds to Future Estimated Taxes

If you overpay on your California income tax return and are due a refund, you can apply some or all of that refund toward next year’s estimated taxes. This election is made on Form 540, Line 98, or within your tax software.

Penalties for Not Filing or Underpaying

If you miss a deadline or underpay:

- Late payment penalty: 5% of unpaid tax per month, up to 25%.

- Underpayment penalty: Assessed if less than 90% of this year’s or 100% (110%) of last year’s tax is paid.

- Interest: Accrues daily on unpaid tax amounts.

Use Form 5805 (Underpayment of Estimated Tax by Individuals and Fiduciaries) to calculate and report penalties, if applicable.

Example: Filing and Paying Estimated Tax

Case:

Jane, a self-employed graphic designer in Los Angeles, expects to earn $120,000 in 2025. She projects a California tax liability of $6,500. Since she doesn’t have any withholding, she is required to make estimated payments.

She pays:

- $1,950 on April 15 (30%)

- $650 on June 15 (additional 10% to make 40% total)

- No third payment (skipped)

- $1,950 on January 15 (final 30%)

She uses FTB Web Pay and keeps her confirmation numbers for each transaction.

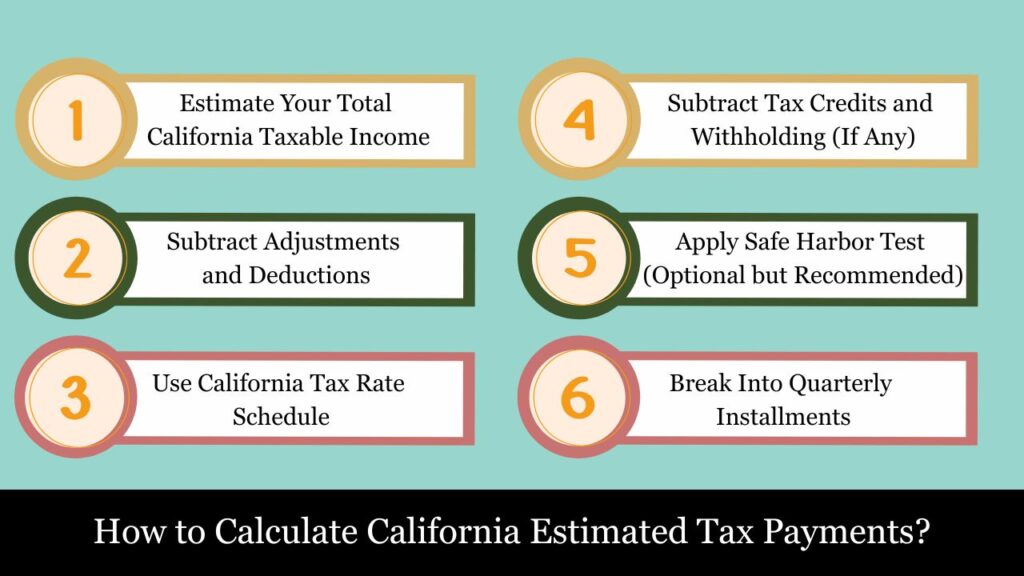

How to Calculate California Estimated Tax Payments?

If you earn income in California that isn’t subject to withholding (such as from self-employment, rental property, or investments), you’re expected to estimate your total tax for the year and pay it in installments. Follow these steps to determine your estimated tax payments correctly:

Step 1: Estimate Your Total California Taxable Income

Include all sources of income that are taxable in California, such as:

- Wages and salaries (if no or partial withholding)

- Self-employment income (Schedule C)

- Rental income (Schedule E)

- Dividends and interest

- Capital gains (sale of property or investments)

- Pensions and Social Security (CA doesn’t tax SS, but pensions may be taxable)

- Alimony received (if applicable under prior rules)

Example:

Jane expects the following income for 2025:

| Source | Amount |

| Freelance graphic design | $80,000 |

| Rental income | $20,000 |

| Investment dividends | $5,000 |

| Total Gross Income | $105,000 |

Step 2: Subtract Adjustments and Deductions

a. Adjustments to income may include:

- Student loan interest

- IRA contributions

- HSA contributions

- SEP/SIMPLE plan contributions

b. Then subtract:

- Standard deduction for 2025 (tentative):

- $5,363 for single or MFS

- $10,726 for MFJ, HOH, or QW

- Or itemized deductions, if greater (e.g., mortgage interest, property taxes, charitable gifts)

Example:

Jane claims a $5,363 standard deduction. Her adjusted gross income (AGI) is:

$105,000 – $5,363 = $99,637 taxable income

Step 3: Use California Tax Rate Schedule

Use the CA personal income tax brackets to calculate your estimated tax liability.

For 2025 (subject to adjustment), here’s a simplified version of CA tax brackets for single filers:

| Taxable Income Range | Tax Rate |

| Up to $10,099 | 1% |

| $10,100 – $23,942 | 2% |

| $23,943 – $37,788 | 4% |

| $37,789 – $52,455 | 6% |

| $52,456 – $66,295 | 8% |

| $66,296 – $338,639 | 9.3% |

| (Higher brackets not shown) | — |

Estimate: For simplicity, say Jane’s $99,637 results in a tax of $5,800 (using CA tax tables or software).

Step 4: Subtract Tax Credits and Withholding (If Any)

If you qualify for any California-specific credits (like the Earned Income Tax Credit, Young Child Tax Credit, or others), subtract them here.

Jane doesn’t qualify for any credits and has no withholding, so:

Estimated Tax Owed: $5,800

Step 5: Apply Safe Harbor Test (Optional but Recommended)

If Jane’s 2024 tax liability was $5,400, she can pay either:

- 90% of current year’s tax = $5,220

- 100% of prior year’s tax = $5,400

- (110% if her AGI last year was over $150,000)

She chooses to pay $5,400 to meet the safe harbor and avoid underpayment penalties.

Step 6: Break Into Quarterly Installments

California requires:

| Installment | Due Date | Amount (% of total) |

| Q1 | April 15 | 30% of estimated tax |

| Q2 | June 15 | 10% (to total 40%) |

| Q3 | — (Skipped) | — |

| Q4 | Jan 15 (next) | Final 30% |

For $5,400 total:

- Q1 = $1,620

- Q2 = $540

- Q3 = Skipped

- Q4 = $1,620

Example Summary

Jane expects to owe $5,400 in California state income tax. Her estimated payments will be:

- $1,620 by April 15

- $540 by June 15

- (No September payment)

- $1,620 by January 15 (next year)

She pays using the FTB Web Pay system to avoid delays and keeps electronic confirmations.

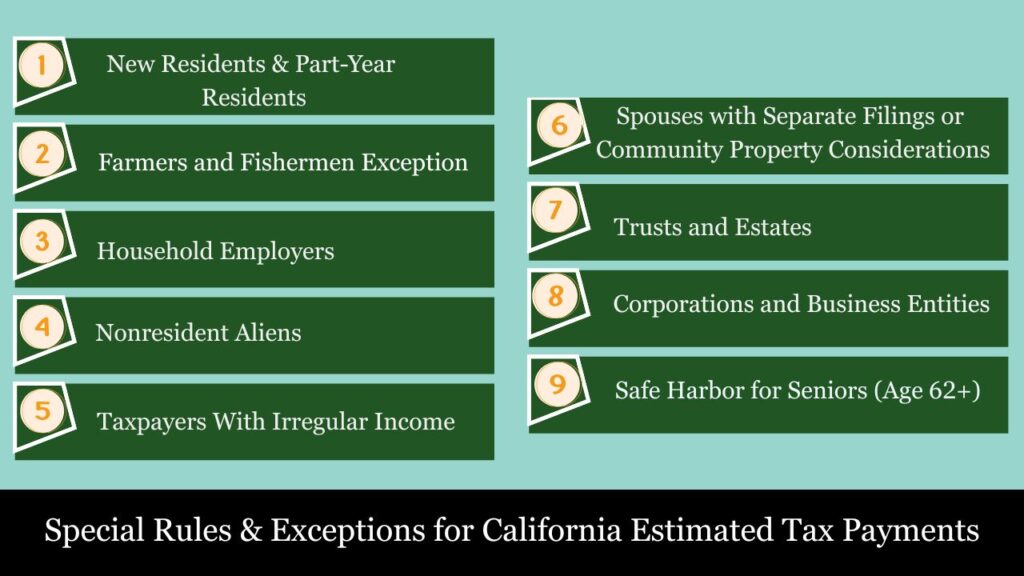

Special Rules & Exceptions for California Estimated Tax Payments

While most California taxpayers must follow the standard rules for calculating and submitting estimated taxes, several exceptions and special circumstances apply depending on income type, filing status, residency, and other factors.

1. New Residents & Part-Year Residents

If you moved into or out of California during the year:

- Only income earned while a resident of California is subject to California income tax.

- Your estimated tax payments should be proportionate to the income you earn from California sources.

- Use Schedule CA (540NR) to allocate your income.

2. Farmers and Fishermen Exception

If two-thirds or more of your total gross income comes from farming or fishing activities:

- You are only required to make one estimated payment.

- You must submit this payment by January 15 of the next calendar year.

- Alternatively, you can avoid making estimated payments if you file your full tax return by March 1 and pay all taxes due at that time.

3. Household Employers

If you employ household workers (e.g., nannies or housekeepers):

- The wages you pay are subject to California payroll tax, but not subject to estimated income tax payments.

- However, if you operate a home business that employs others, estimated taxes may apply to your business income.

4. Nonresident Aliens

If you’re a nonresident alien with California-source income:

- You must pay estimated taxes on income earned from California sources (like rental property or business income in the state).

- You must file Form 540NR and follow California’s nonresident tax rules.

5. Taxpayers With Irregular Income

If your income fluctuates (e.g., freelancers, gig workers, consultants):

- You can annualize your income to calculate more accurate quarterly estimated payments.

- Use Form 5805 and its Annualized Income Installment Method to prevent underpayment penalties caused by fluctuating income levels.

6. Spouses with Separate Filings or Community Property Considerations

- In community property states like California, each spouse must report 50% of community income, unless legally separated or with separate property agreements.

- Special rules apply when spouses file separately but share community income, affecting how estimated tax should be calculated and paid.

7. Trusts and Estates

- Fiduciaries of trusts or estates must make estimated payments if the total tax liability exceeds $500.

- Use Form 541-ES to make estimated tax payments for fiduciary income.

8. Corporations and Business Entities

- Corporations must make estimated tax payments if their expected tax liability is $500 or more.

- These payments are made using Form 100-ES.

- Due dates differ slightly: corporations follow a 15th-day-after-quarter model (e.g., 4th month = April 15).

9. Safe Harbor for Seniors (Age 62+)

California does not offer special estimated tax exemptions for seniors, but:

- If your income is primarily from Social Security (not taxed in CA) and you owe little or no tax, estimated payments might not be required.

- Still, seniors with significant pension or investment income may be required to pay estimates.

Conclusion: California Estimated Tax Payments

California’s estimated tax system is designed to ensure taxpayers meet their income tax obligations throughout the year—especially those with income not subject to withholding. While the standard rules apply broadly, many exceptions and special provisions exist for certain taxpayers like farmers, new residents, nonresident aliens, and those with fluctuating income.

To stay compliant and avoid penalties:

- Assess your income sources early.

- Use safe harbor rules to avoid underpayment charges.

- File the correct forms (e.g., 540-ES, 5805, 541-ES) based on your filing status and entity type.

- Adjust your quarterly payments if your income significantly changes.

Ultimately, proactive planning, accurate calculations, and timely payments are key to managing your California estimated taxes effectively.

Frequently Asked Questions (FAQs)

What form do individuals use to pay California estimated taxes?

Use Form 540-ES to submit estimated payments for personal income tax. You can file it online through the Franchise Tax Board (FTB) website, by mail, or via your tax preparer.

How do corporations and trusts pay estimated taxes in California?

–Corporations use Form 100-ES

–Trusts and estates use Form 541-ES

Can I pay California estimated tax online?

Yes. Payments can be made online using the FTB Web Pay system, bank transfers, or via credit/debit cards (a convenience fee may apply).

What happens if I miss an estimated tax payment?

Missing a payment can lead to an underpayment penalty, calculated on the unpaid amount and the time it was late. Penalties can be avoided by meeting safe harbor thresholds.

Can I adjust my estimated payments if my income changes?

Yes. You can increase or decrease your estimated payments throughout the year if your income or deductions change significantly.

Is there a “safe harbor” rule in California to avoid penalties?

Yes. To avoid penalties, pay either:

-100% of your prior year’s tax, or

-90% of your current year’s tax

(110% if your prior year’s –AGI was over $150,000 or $75,000 if MFS)

What if I move to California mid-year?

If you become a California resident partway through the year, you may still owe estimated taxes based on your California-source income after becoming a resident.

How do I calculate my estimated tax liability accurately?

Use Form 540-ES Worksheet, or calculate based on:

-Expected income

-Tax credits

-Deductions

-Withholding

Tax software and CPAs can help if you have variable or complex income sources.