Creditable Withholding Tax Made Simple Don’t Miss Out In 2025

Table of Contents

Creditable Withholding Tax: The Smart Way to Reduce Your Tax Bill

Creditable withholding tax refers to a tax mechanism where a portion of a taxpayer’s income is withheld at the source by a third party—typically the payer of the income—and remitted directly to the government as an advance payment toward the taxpayer’s eventual income tax liability. Unlike final withholding tax, which is conclusive and requires no further filing on the recipient’s part, creditable withholding tax is provisional and can be claimed as a tax credit when filing the annual income tax return.

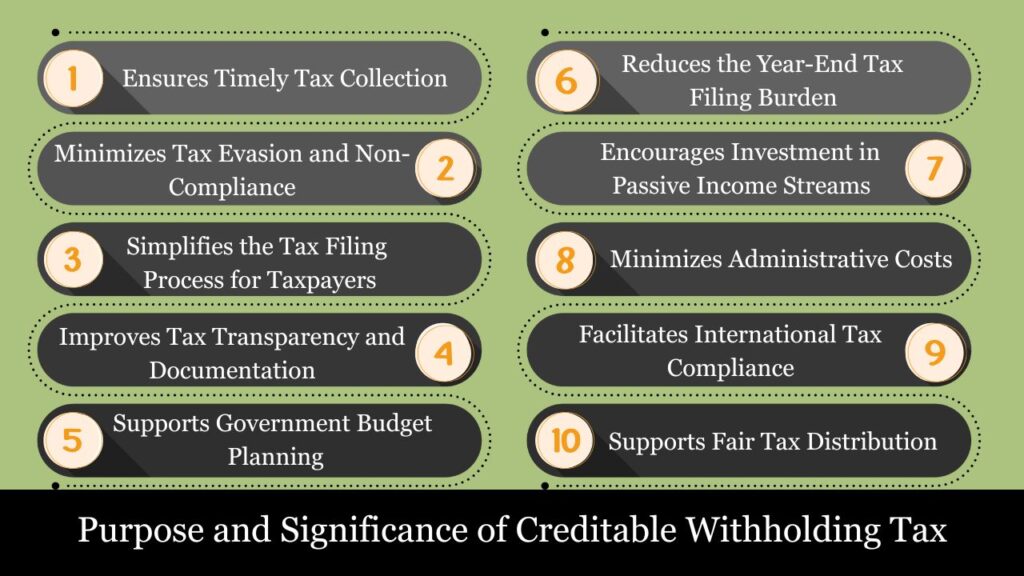

Purpose and Significance of Creditable Withholding Tax

Creditable withholding tax serves multiple vital functions within a tax system, benefiting both governments and taxpayers. It ensures the timely collection of taxes, improves compliance, and simplifies the overall tax process. Below is a detailed breakdown of its purpose and significance:

1. Ensures Timely Tax Collection

Creditable withholding tax allows governments to collect tax revenue throughout the year rather than waiting until the end of the fiscal year. This mechanism ensures a steady cash flow for public expenditure and government operations. By withholding taxes as income is earned, the government secures early access to the funds it needs to support public services, infrastructure, and social programs.

2. Minimizes Tax Evasion and Non-Compliance

By requiring income payers (such as employers, financial institutions, or business partners) to withhold taxes at the source, creditable withholding tax reduces the opportunity for tax evasion. This system ensures that taxes are collected before the taxpayer has the chance to potentially underreport income or fail to pay the appropriate amount. It helps enforce tax compliance across a broad range of income sources.

3. Simplifies the Tax Filing Process for Taxpayers

Instead of requiring individuals or entities to pay their full tax liability at the end of the year, the withholding tax provides a “prepayment” system. Taxpayers only need to file their tax returns, and they can claim credit for the tax already paid through withholding. This not only reduces the tax burden at filing time but can also result in a refund if more tax was withheld than necessary.

4. Improves Tax Transparency and Documentation

Creditable withholding tax promotes clear and transparent reporting of income and taxes paid. The withholding agents are required to issue official certificates (such as Form 1099 or equivalent) to income recipients, detailing the amount withheld and the total taxable income. These documents serve as proof of the tax paid, simplifying the reporting process and reducing the risk of errors.

5. Supports Government Budget Planning

For the government, a steady and predictable flow of revenue is crucial for budgeting and fiscal planning. Withholding taxes provide a more stable tax revenue stream compared to relying solely on year-end income tax payments. This is particularly important for governments in countries with large informal or freelance sectors where accurate income reporting can be challenging.

6. Reduces the Year-End Tax Filing Burden

Because taxes are withheld and credited throughout the year, taxpayers don’t have to face a large tax bill at year-end. This helps avoid situations where taxpayers are required to pay a lump sum of taxes, reducing financial strain. In turn, it makes tax filing simpler and more predictable for taxpayers, particularly in professions where income varies or is earned sporadically (e.g., freelancers or contract workers).

7. Encourages Investment in Passive Income Streams

In many cases, creditable withholding tax applies to passive income sources, such as rental income, interest, dividends, and royalties. By simplifying the tax process and reducing upfront costs, withholding taxes can make investing in these income streams more appealing to investors. This, in turn, can help stimulate capital flow into industries like real estate, energy, and financial services.

8. Minimizes Administrative Costs

For tax authorities, collecting taxes via withholding reduces the need for extensive auditing and enforcement of tax compliance. The burden of tax collection is shifted to withholding agents—such as employers or financial institutions—who are already handling transactions. This minimizes the administrative cost of pursuing underreporting or tax evasion.

9. Facilitates International Tax Compliance

In the case of cross-border investments or income earned by foreign nationals, creditable withholding taxes help ensure that taxes are collected on income derived from foreign sources. Many international tax treaties allow for withholding tax to be credited against the taxpayer’s home country tax liability, ensuring double taxation is avoided. This system simplifies the compliance process for individuals and businesses involved in international trade or investments.

10. Supports Fair Tax Distribution

Creditable withholding ensures that all taxpayers, whether employed or self-employed, are paying taxes based on their income. This system helps distribute the tax burden fairly across different segments of the population, ensuring that individuals or entities earning income in various forms contribute to government revenue.

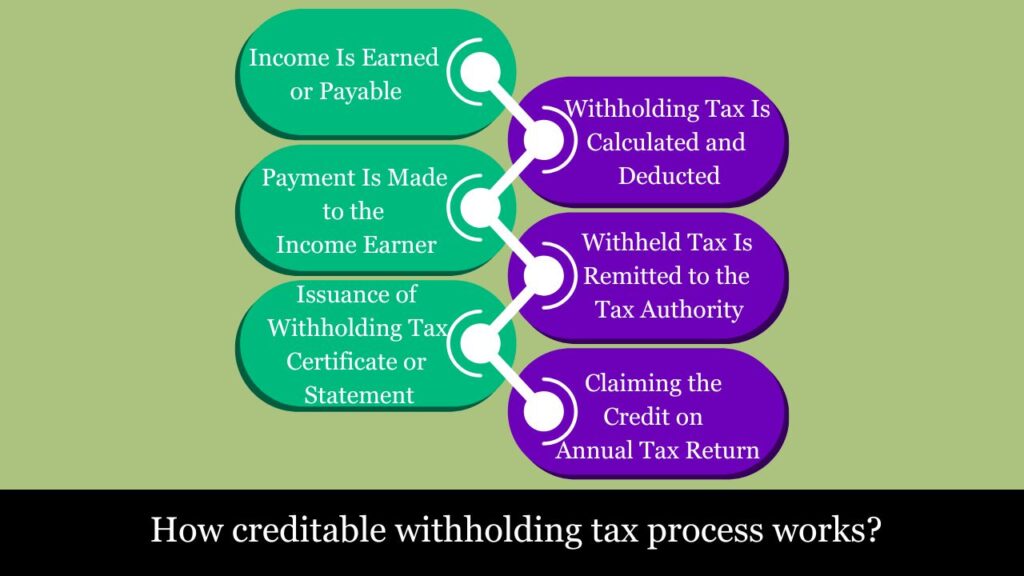

How Creditable Withholding Tax Works?

Creditable withholding tax functions as a proactive and structured tax collection method, designed to deduct a portion of tax liability at the source of income—before it even reaches the taxpayer. This system is widely used by tax authorities to streamline revenue collection, reduce tax evasion, and ensure timely remittance of taxes.

Here’s a step-by-step breakdown of how the creditable withholding tax process works:

1. Income Is Earned or Payable

A person or business provides goods, performs a service, or earns income through rent, commissions, royalties, professional work, or dividends. This income becomes subject to withholding under local tax laws and regulations.

Example:

A freelance consultant earns $20,000 from a corporate client for services rendered.

2. Withholding Tax Is Calculated and Deducted

Prior to making a payment, the withholding agent determines the applicable tax amount—usually a set percentage tied to the nature of the income. This percentage varies by country and type of income.

Example:

The applicable withholding rate is 10%. Therefore, $2,000 is withheld from the $20,000 payment.

3. Payment Is Made to the Income Earner

he recipient is paid the net amount, which is the total income after deducting the withholding tax. The withheld portion is not lost—it is a prepaid tax on behalf of the taxpayer, which they can later credit against their annual tax return.

Example:

The freelancer receives $18,000, and $2,000 is withheld and paid to the tax authority.

4. Withheld Tax Is Remitted to the Tax Authority

t is the withholding agent’s duty to submit the deducted tax to the relevant tax authority within the specified time frame. They usually file a withholding return/report indicating the amount withheld, income recipient details, and the nature of the income.

Example:

The corporate client deposits $2,000 with the national tax department, referencing the freelancer’s taxpayer identification number (TIN).

5. Issuance of Withholding Tax Certificate or Statement

After remitting the withheld tax, the payer provides the income earner with a withholding tax certificate (such as Form 1099 in the U.S. or BIR Form 2307 in the Philippines). This document acts as evidence of the tax already paid and is essential for claiming the credit.

Example:

The freelancer receives a certificate showing that $2,000 was withheld and submitted to the government on their behalf.

6. Claiming the Credit on Annual Tax Return

When the income recipient files their annual income tax return, they compute their total tax liability for the year. The amount of tax that was previously withheld is then credited against this liability.

- If the amount of tax withheld is insufficient to cover the total tax due, the taxpayer must pay the difference.

- If the total withheld tax is more than the liability → the taxpayer may request a tax refund or carryforward.

Example:

If the freelancer’s total tax due for the year is $5,000 and $2,000 has already been withheld, they only owe an additional $3,000.

How to Calculate Creditable Withholding Tax?: Step-by-Step Calculation

Step 1: Identify the Gross Amount of Income

Determine the total amount to be paid before tax. This is called the gross income and is the base amount on which withholding tax will be applied.

- Examples: Professional fees, rental income, commissions, contractor payments.

Step 2: Determine the Applicable Withholding Tax Rate

This rate depends on:

- Type of income (e.g., professional services, royalties, rent),

- Residency status of the payee (resident vs non-resident),

- Tax treaties (for international cases), and

- Local tax laws (e.g., IRS in the U.S., BIR in the Philippines, CBDT in India).

Examples of rates:

- Professional fees: 10%

- Rent: 5%

- Commission: 10%–15%

- Royalties: 10%–20%

Always refer to the latest tax authority guidelines or official withholding tables.

Step 3: Multiply Gross Income by the Withholding Rate

Creditable Withholding Tax = Gross Income × Withholding Tax Rate

Step 4: Subtract Withholding Tax from Gross Income

Net Payable to Recipient = Gross Income − Withholding Tax

Full Calculation Example

Scenario:

- A freelance graphic designer in India earns ₹100,000 from a corporate client.

- The applicable withholding tax (TDS) rate on professional fees is 10%.

Calculation:

- Gross Income: ₹100,000

- Withholding Rate: 10%

- Withholding Tax: ₹100,000 × 10% = ₹10,000

- Net Payment to Freelancer: ₹100,000 – ₹10,000 = ₹90,000

So, the freelancer receives ₹90,000, and the payer remits ₹10,000 to the Income Tax Department under the freelancer’s PAN.

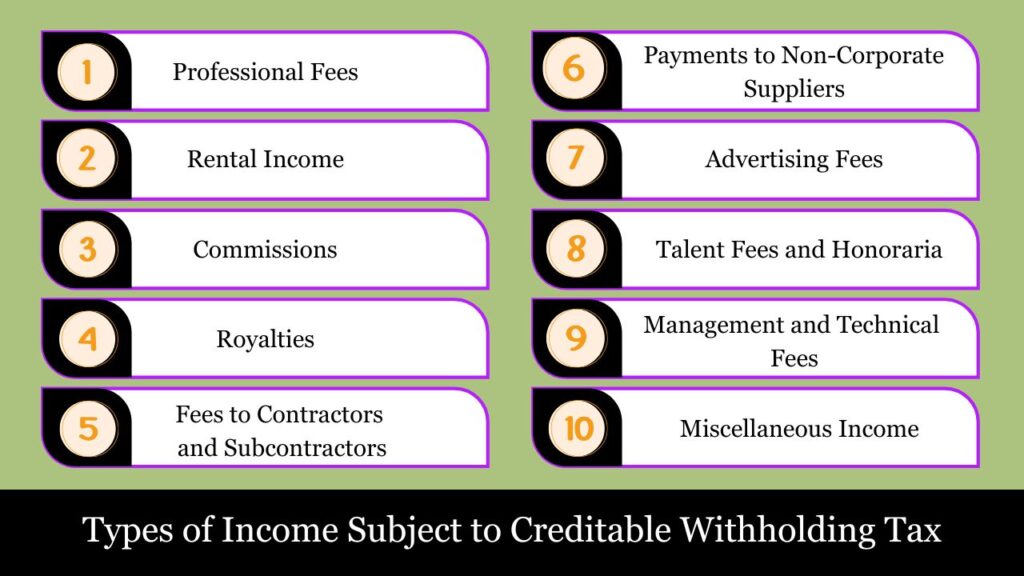

Types of Income Subject to Creditable Withholding Tax

Creditable withholding tax (CWT) typically applies to various forms of earned and passive income where a portion of the payment is withheld at source and later credited against the payee’s annual tax liability. It is most commonly applied to income types that are non-salaried, irregular, or involve third-party payments.

The following are the primary types of income typically subject to Creditable Withholding Tax (CWT):

1. Professional Fees

Payments made to independent professionals or freelancers—such as consultants, lawyers, architects, engineers, doctors, accountants, and IT specialists—are commonly subject to creditable withholding tax.

Example:

A company hires a consultant and pays ₹100,000. It withholds 10% (₹10,000) as tax and pays the remaining ₹90,000 to the consultant.

2. Rental Income

Rental payments for real property (buildings, land, office spaces) or personal property (equipment, vehicles) are often subject to CWT. The withholding is typically done by corporate tenants, government agencies, or large entities leasing the property.

Example:

A corporation pays $5,000 monthly rent and withholds 5% ($250) from the payment to comply with withholding tax rules.

3. Commissions

Income earned through brokerage or agency arrangements, such as insurance agents, marketing brokers, real estate agents, and advertising intermediaries, is subject to CWT.

Example:

An insurance broker receives $10,000 in commissions. The company withholds 10% ($1,000) and pays $9,000.

4. Royalties

Payments for the use of intellectual property—such as copyrights, patents, trademarks, formulas, software licenses, or publishing rights—are often subject to creditable withholding tax.

Example:

A publishing house pays ₹500,000 to an author for royalties, withholding ₹50,000 (10%) as tax.

5. Fees to Contractors and Subcontractors

Entities that pay for contractual services involving construction, manufacturing, fabrication, or other projects may need to withhold a portion of the payment.

Example:

A builder hires a plumbing subcontractor for ₹200,000 and withholds 2% (₹4,000) as creditable tax.

6. Payments to Non-Corporate Suppliers

Payments made to sole proprietors, partnerships, or individuals who supply goods or services—not through employment—are often subject to withholding tax.

Example:

An office procures computer hardware from a registered individual supplier for $50,000 and withholds $2,500 (5%).

7. Advertising Fees

Media and advertising firms often receive income subject to withholding tax, especially in broadcast, print, and online marketing.

Example:

A media agency bills $100,000 for an advertising campaign. The client withholds 1.5% ($1,500).

8. Talent Fees and Honoraria

Payments to performers, speakers, writers, moderators, influencers, and artists are also commonly withheld at source.

Example:

An author receives ₹75,000 for a guest lecture and the institution withholds ₹7,500 (10%).

9. Management and Technical Fees

Professional services rendered by corporate or individual consultants in areas like IT support, HR, accounting, or business advisory are often covered under CWT rules.

Example:

A consulting firm charges $20,000 for business process reengineering, and the client withholds 5%.

10. Miscellaneous Income

Other forms of income like:

- Prizes and awards

- Training and seminar fees

- Franchise fees

- Non-employee director’s fees

may be subject to CWT depending on local tax laws.

Example of Creditable Withholding Tax in Action

Let’s say a freelance IT consultant earns $50,000 from a corporate client in a year. The client is required to withhold 10% ($5,000) and deposit it with the tax authority. The consultant receives $45,000 along with a withholding certificate for $5,000.

At the end of the tax year:

- The consultant calculates their total tax liability (say $8,000).

- Since $5,000 has already been withheld and credited, they only need to pay the remaining $3,000.

- If their total tax liability had been $4,500 instead, they would be eligible for a $500 refund.

Penalties for Creditable Withholding Tax Non-Compliance

Failure to comply with creditable withholding tax requirements can lead to severe financial and legal consequences for both the withholding agent (payer) and, in some cases, the income recipient (payee). Tax authorities impose these penalties to enforce timely remittance, proper documentation, and accurate reporting.

1. Failure to Withhold Tax

If a payer fails to withhold the required tax amount from a transaction subject to CWT:

- The payer becomes liable for the full amount of the tax not withheld.

- Interest and surcharges may be added to the unpaid withholding amount.

- The recipient may still claim the full payment and may also face issues during filing.

Example:

If a company pays ₹100,000 for a professional service and does not withhold ₹10,000 (10%), the tax authority may demand the unpaid ₹10,000 plus interest and penalties from the company.

2. Failure to Remit Withheld Taxes on Time

Withholding tax must be remitted to the tax authority within the prescribed deadline (monthly, quarterly, etc.).

Penalties may include:

- Late remittance penalties: Often a fixed percentage (e.g., 1.5% per month) of the tax due.

- Interest on unpaid amount: Compounded monthly, based on statutory interest rates.

- Surcharges: Up to 25% to 50% of the tax due, depending on the jurisdiction.

3. Failure to Issue Withholding Tax Certificates

Payers must issue certificates of tax withheld (e.g., Form 2307, Form 16A, Form 1099) to payees.

Non-issuance may result in:

- Penalties per certificate not issued (varies by country; may be a flat fine per failure).

- Difficulty for the payee to claim tax credits or refunds.

- Audit exposure or penalties for obstructing tax credit claims.

4. Incorrect Withholding or Reporting

- Applying the wrong tax rate (e.g., withholding 5% instead of 10%) may lead to deficiency assessments.

- Incorrect reporting on tax forms can result in:

- Tax adjustments,

- Administrative penalties, and

- Reputational risk for corporations or firms under audit.

5. Fraud or Willful Misrepresentation

In cases of intentional failure to withhold, report, or remit:

- Authorities may impose criminal charges, including:

- Tax fraud

- Evasion

- Obstruction of tax collection

- Penalties may include:

- Hefty fines,

- Imprisonment, and

- Business license revocation.

Conclusion

Creditable withholding tax plays a critical role in modern tax administration. It ensures timely collection, enforces transparency, and offers taxpayers the benefit of prepayment toward their total tax bill. Proper documentation, timely reporting, and accurate reconciliation during annual filing are essential to making the most of this system—especially for freelancers, contractors, landlords, and businesses operating with multiple income streams.

Frequently Asked Questions (FAQs)

What is Creditable Withholding Tax (CWT)?

It’s a tax withheld at source and credited against the recipient’s annual income tax. It’s not the final tax.

Who withholds CWT?

Registered businesses, government agencies, and other entities paying income subject to withholding.

Which categories of income are generally subject to Creditable Withholding Tax?

Professional fees, rent, commissions, royalties, contractor payments, and similar non-salary income.

Is CWT refundable?

Yes, if the tax withheld exceeds the final tax due. he withheld amount can be claimed as a tax credit when filing the annual income tax return.

Is the recipient required to file an income tax return?

Yes. Income subject to CWT must be reported, and the tax withheld credited.

What proof is needed to claim CWT?

The official withholding tax certificate (e.g., Form 2307, Form 16A, Form 1099) issued by the payer.

When must withheld taxes be remitted?

Usually monthly or quarterly, depending on local tax rules.

What happens if CWT is not withheld?

The payer may be held responsible for the unpaid tax, along with any applicable interest and penalties.

Is CWT the same as Final Withholding Tax?

No. CWT is creditable; final tax is conclusive and does not require further reporting.

How long should CWT records be kept?

At least 3–7 years, depending on your country’s retention rules.