The 72(t) Rule: Best Smart Way to Use Your IRA Early

Table of Contents

Unlocking Early Retirement: What You Need to Know About the 72(t) Rule

The 72(t) rule, as outlined in Internal Revenue Code §72(t), governs early withdrawals from retirement accounts. Ordinarily, distributions taken before reaching age 59½ from accounts such as Traditional IRAs, SEP IRAs, SIMPLE IRAs, or employer-sponsored plans like 401(k)s are subject to both:

- Ordinary income tax, and

- An additional 10% early withdrawal penalty.

However, Section 72(t) provides specific exceptions to the early withdrawal penalty, one of the most commonly used being the Substantially Equal Periodic Payments (SEPP) exception.

Primary Objective of the 72(t) Rule

The rule exists to discourage early depletion of retirement savings but acknowledges that life events may require individuals to access their funds earlier. Thus, §72(t) offers structured options for penalty-free withdrawals under strict compliance—ensuring funds are not misused, but still accessible when necessary. This is especially useful for:

- Early retirees

- Individuals facing long-term unemployment or hardship

- Those looking for penalty-free early access due to life changes

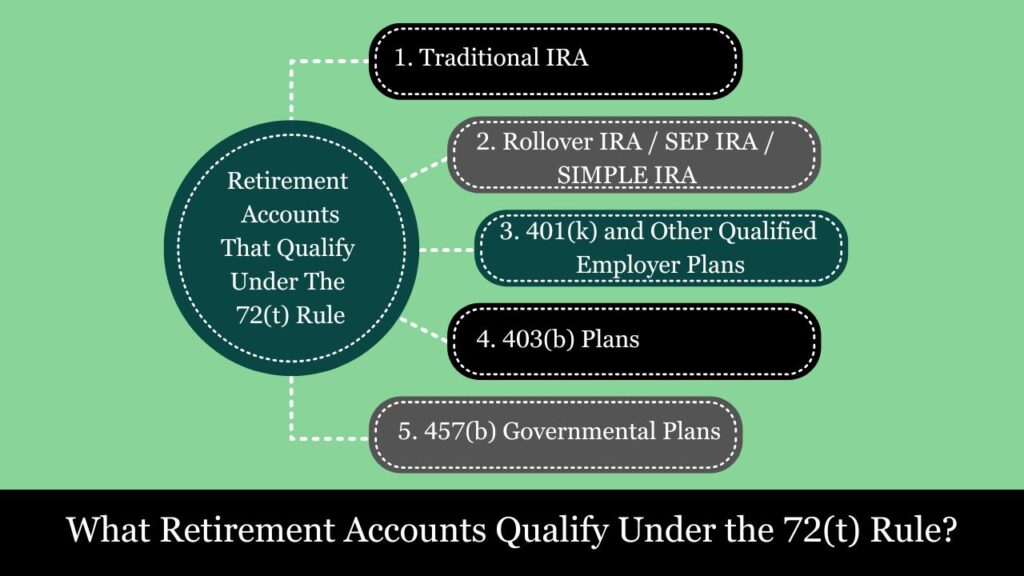

What Retirement Accounts Qualify Under the 72(t) Rule?

The 72(t) rule applies to IRS-defined tax-deferred retirement accounts and permits early withdrawals before age 59½ without the standard 10% early withdrawal penalty, provided that the withdrawal meets certain conditions, such as being part of a Substantially Equal Periodic Payment (SEPP) plan.

Below is a detailed list of qualified accounts and their eligibility under 72(t):

1. Traditional IRA

- Eligible under 72(t) for penalty-free withdrawals.

- Withdrawals are always subject to ordinary income tax, but not the 10% penalty if done through SEPP or other 72(t) exceptions.

- Commonly used for SEPP planning due to its simplicity and individual ownership.

2. Rollover IRA / SEP IRA / SIMPLE IRA

- Rollover IRA: Fully eligible for SEPP if funds were rolled over from a qualified plan like a 401(k).

- SEP IRA (Simplified Employee Pension): Eligible under 72(t).

- SIMPLE IRA: Also eligible, but subject to a special rule—withdrawals made within two years of the first contribution incur a 25% penalty, not the standard 10%. After 2 years, 72(t) rules apply normally.

3. 401(k) and Other Qualified Employer Plans

- Eligible under 72(t), but with a condition:

- The account holder must separate from service (i.e., retire, quit, or be terminated) before starting withdrawals.

- Employer plans must allow periodic withdrawals under the plan’s distribution rules—not all 401(k) plans permit this.

- If allowed, SEPP plans from a 401(k) must follow the same strict guidelines as IRAs.

Important: If you’re still employed with the company where the 401(k) resides, 72(t) withdrawals usually aren’t allowed unless the plan explicitly permits in-service withdrawals.

4. 403(b) Plans

- Eligible for penalty-free distributions under 72(t) if separated from employment.

- Similar to 401(k) plans, employer participation and plan rules govern access.

5. 457(b) Governmental Plans

- Generally not subject to the 10% early withdrawal penalty at all if separated from service.

- As such, 72(t) does not need to be used.

- Non-governmental 457(b) plans, however, have stricter distribution rules and are not typically eligible for 72(t) treatment.

Non-Qualifying Accounts

Certain types of accounts are not eligible for 72(t) treatment:

- Roth IRA contributions: Can be withdrawn anytime tax- and penalty-free, so 72(t) does not apply.

- Roth IRA earnings: Only eligible under 72(t) if part of a qualified distribution; otherwise subject to a 10% penalty on earnings.

- Health Savings Accounts (HSAs): Not covered by 72(t).

- Coverdell ESAs / 529 Plans: For education purposes only—72(t) does not apply.

- Non-retirement brokerage accounts: These are not tax-advantaged retirement plans and are not covered under §72(t).

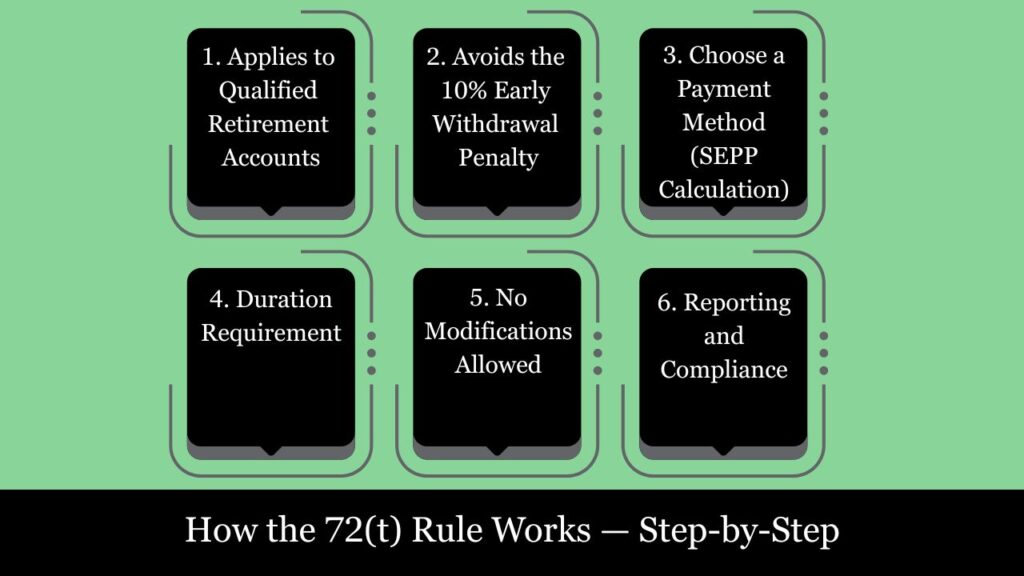

How the 72(t) Rule Works — Step-by-Step

1. Applies to Qualified Retirement Accounts

The 72(t) rule can be used with:

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- 401(k) plans (only after separation from service)

Roth IRAs are not typically subject to 72(t), as contributions are already made with after-tax dollars and can usually be withdrawn tax-free.

2. Avoids the 10% Early Withdrawal Penalty

Normally, withdrawing from your retirement account before age 59½ results in:

- Ordinary income tax

- Plus a 10% additional penalty

Under 72(t), if you take substantially equal periodic payments (SEPPs), the 10% penalty is waived, although regular income tax still applies.

3. Choose a Payment Method (SEPP Calculation)

To qualify under the 72(t) rule, the IRS requires you to take structured, regular withdrawals using one of three approved methods:

| Method | Description | Payment Type |

| RMD Method | Based on IRS life expectancy tables | Varies each year |

| Fixed Amortization | Uses an amortization formula with IRS-approved interest | Fixed annual amount |

| Fixed Annuitization | Uses an annuity factor and IRS rate | Fixed annual amount |

You must calculate the annual payment amount and take it consistently each year based on your chosen method.

4. Duration Requirement

Once started, you must continue the SEPP for the longer of:

- 5 years, or

- Until you turn age 59½

Example:

If you begin at age 50, you must continue payments for 9½ years (until 59½).

If you start at 58, you must continue until age 63.

5. No Modifications Allowed

Once the SEPP plan starts:

- You cannot change the method or payment amount (except a one-time change to the RMD method)

- You cannot take extra withdrawals or miss a scheduled payment

Any modification triggers retroactive penalties:

- The IRS will reapply the 10% penalty to all prior distributions

- Plus interest on that penalty amount

6. Reporting and Compliance

- Distributions are reported on Form 1099-R

- If the provider doesn’t mark them with Code 2 (exception), you must file Form 5329 and manually claim the exception under Code 2 for SEPP

Key Exception: Substantially Equal Periodic Payments (SEPP)

The Substantially Equal Periodic Payments (SEPP) exception is one of the most important provisions under IRC Section 72(t), allowing individuals to withdraw funds from certain retirement accounts before age 59½ without paying the standard 10% early withdrawal penalty.

What Is SEPP?

SEPP consists of predetermined retirement distributions that are obligated to be

- Substantially equal in amount each year

- Made at least once per year

- Must continue for at least 5 years or until the account holder turns 59½, whichever occurs later

This exception was designed to give early retirees or those in financial need a structured method to access their retirement savings without incurring a penalty.

SEPP Calculation Methods

Eligibility requires that withdrawals be calculated using an IRS-approved method:

- Required Minimum Distribution (RMD) Method:

- Uses IRS life expectancy tables.

- Payment amount changes annually.

- Results in the lowest annual payout.

- Easiest to calculate and maintain.

- Fixed Amortization Method:

- Calculates a fixed annual payout based on:

- Life expectancy

- A reasonable interest rate (defined by IRS guidelines)

- Amount remains the same each year.

- Calculates a fixed annual payout based on:

- Fixed Annuitization Method:

- Uses an annuity factor derived from mortality tables and interest rates.

- Like amortization, produces a fixed annual amount.

You must choose one method at the start and stick with it. You may only change once (from amortization or annuitization to RMD) if desired.

Duration Requirements

- To comply with SEPP rules, payments must be made for at least five years or until the account holder reaches 59½, whichever is longer.

- Example:

- If you start SEPP at age 50, you must continue for 9½ years (until age 59½).

- If you start at age 58, you must continue until age 63 (minimum 5 years).

Modifications and Penalties

Modifying or stopping the SEPP plan too early (except due to death or disability) results in retroactive penalties:

- The IRS may impose the 10% early withdrawal penalty on all prior SEPP distributions if requirements are not met.

- Interest on those penalties may also be added.

- Common disqualifying modifications include:

- Changing the distribution method (beyond the one-time allowed switch)

- Withdrawing more or less than the calculated SEPP

- Taking extra distributions outside of the SEPP schedule

Reporting SEPP

- Form 5329 must be filed and Box 7 of Form 1099-R must show Code 2 to indicate a 72(t) exception.

- Your plan administrator may not include the exception code automatically—you may need to file Form 5329 manually.

Strategic Use of SEPP

SEPP is commonly used in scenarios such as:

- Early retirement before age 59½

- Bridge income while waiting for Social Security or pensions

- Debt payoff or financial emergency requiring penalty-free access to retirement funds

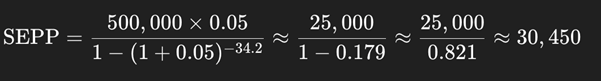

Example Scenario:

- Name: John

- Age: 50 (at the start of SEPP)

- Account Type: Traditional IRA

- IRA Balance: $500,000

- Interest Rate Assumed: 5% (fixed for calculation)

- Chosen Method: Amortization Method

- According to the IRS Single Life Table, the life expectancy is 34.2 years

Step-by-Step Calculation Using Amortization Method:

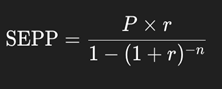

The amortization method calculates a fixed annual payment using the formula for a standard amortizing loan (similar to a mortgage):

Where:

- P=500,000

- r =5% annual interest = 0.05

- n = 34.2 years (IRS life expectancy)

So, John must withdraw $30,450 annually from his IRA starting at age 50, and continue these withdrawals for at least 9.5 years—until age 59½.

Rules John Must Follow:

- He cannot modify the amount or stop SEPP early.

- If he stops before age 59½, he’ll owe the 10% early withdrawal penalty retroactively on every withdrawal taken.

- He must keep documentation showing he followed the 72(t) rules each year.

72(t) Rule Updates for 2025

As of 2025, the IRS has made several updates related to the 72(t) rule and Substantially Equal Periodic Payments (SEPPs), especially regarding interest rate calculations, tables, and compliance monitoring. Below is a summary of notable 2025 updates:

1. Higher Interest Rate Cap (Applicable for SEPP Calculations)

- SEPP calculations may use an interest rate up to 120% of the applicable federal mid-term rate, as allowed by the IRS.

- In 2025, due to increased AFRs (driven by inflation and Federal Reserve policy), the maximum interest rate allowable for SEPP calculations has increased to over 5.2% in some months.

- This permits larger annual SEPP withdrawals compared to earlier years.

2. Updated Life Expectancy Tables (Post-2022 Still in Use)

- The life expectancy tables used in SEPP calculations were revised in 2022 for longer life expectancies and are still in effect for 2025.

- These tables slightly reduce the annual SEPP amount, as distributions are stretched over a longer assumed life.

3. IRS Clarifications on Modifications

- In 2025, the IRS re-emphasized guidance on when a SEPP plan is considered “modified” (which would trigger retroactive penalties).

- Any change in payment frequency, method, or amount without IRS approval — even due to miscalculation — may lead to disqualification.

4. Digital Monitoring Enhancements

- The IRS has upgraded its audit algorithms in 2025 to better track early withdrawals using SEPP.

- Taxpayers are encouraged to maintain clear documentation and may be required to provide calculation proof during audits.

5. Rollover Restrictions Remain Strict

- While receiving SEPP payments, participants are prohibited from rolling over the IRA.

- Violating this rule will terminate the SEPP schedule, triggering all deferred penalties retroactively.

6. Penalty Rate Remains at 10%

- The early distribution penalty remains unchanged at 10%, unless the SEPP schedule is followed correctly or other exceptions apply.

Conclusion

The 72(t) Rule, especially through Substantially Equal Periodic Payments (SEPP), offers a powerful but complex path to penalty-free early retirement withdrawals. While it enables financial flexibility, it carries stringent rules and heavy consequences for mistakes. For those considering SEPP, it is strongly advised to work with a financial planner or tax professional to build and maintain a compliant plan.

Frequently Asked Questions (FAQs)

What is the 72(t) rule?

The 72(t) rule allows penalty-free early withdrawals from retirement accounts like IRAs and 401(k)s before age 59½, if taken as a series of Substantially Equal Periodic Payments (SEPP).

What accounts qualify for 72(t) withdrawals?

Traditional IRAs, Roth IRAs (basis only), 401(k)s (if separated from service), and other qualified retirement plans.

How long must I continue SEPP withdrawals?

The commitment must last at least five years or until you reach age 59½—whichever period is longer.

What happens if I stop the SEPP plan early?

You may owe retroactive 10% early withdrawal penalties and interest on all previously taken distributions.

Are there different calculation methods for SEPP?

Yes. There are three IRS-approved methods available for use:

–Required Minimum Distribution (RMD)

–Fixed Amortization

–Fixed Annuitization

What’s new with the 72(t) rule in 2025?

The IRS-approved interest rate (mid-term AFR) used for calculations has increased, which may increase allowable SEPP amounts. Compliance scrutiny has also tightened.

Can I roll over funds while taking SEPP?

No. Rolling over funds or changing account balances generally invalidates the SEPP and may trigger penalties.

Can I modify the SEPP plan later?

No. Modifications aren’t allowed once the plan starts, except for a single switch to the RMD method.

Is the 72(t) rule the same for Roth IRAs?

Roth IRAs can use 72(t) only on earnings, since contributions can always be withdrawn tax- and penalty-free.

Should I consult a tax advisor before starting a SEPP plan?

Yes. Strict regulations and costly errors make it essential to work with a knowledgeable tax or financial professional.